|

Financial

Management MGT201

VU

Lesson

02

OBJECTIVES

OF FINANCIAL MANAGEMENT, FINANCIAL

ASSETS AND FINANCIAL

MARKETS

Learning

objectives:

After

going through this lecture,

you would be able to have a

better understanding of the

following

concepts.

�

Objectives

of financial management as compared to

Economics and Financial

Accounting

�

Real

and Financial assets

�

Different

types and characteristics of financial

assets and the similarities

and

differences

among them

�

How

these financial assets are

reported in the balance sheet of a

company

�

Concept of

Value and different kinds of

Value

�

Types

of financial and real assets

markets

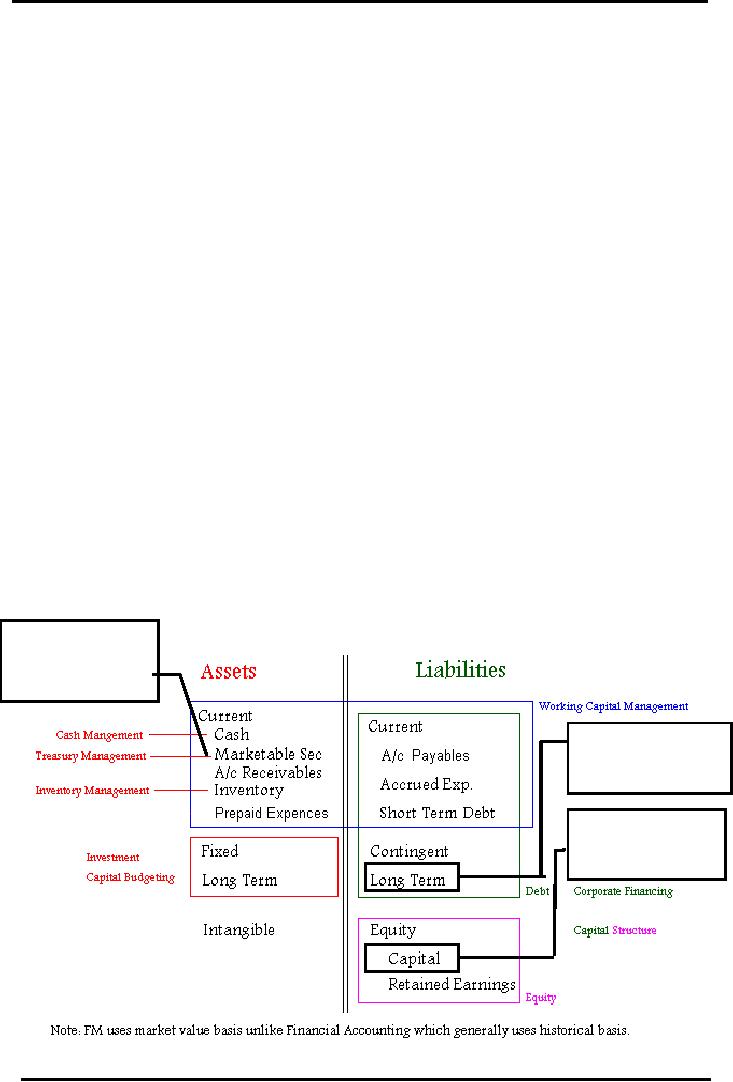

While

studying the course of financial

management, we will study, in

detail, two important areas

of

financial

management, known as:

1.

Investments & Capital

budgeting

2.

Corporate financing.

Concepts

such as interest, time value of

money, cash flows, risk

& return, cost of

capital,

leverage,

financing would be thoroughly

discussed. In the later lectures, we will

talk about some

specialized

areas of finance like

international finance & working

capital finance.

In

the previous lecture, we had

discussed the overall organizational

hierarchy, and the hierarchy

of

the finance department the people responsible

for the financial management

functions. Furthermore,

the

different types of business legal

entities and their salient

characteristics were also

discussed.

In

this lecture, we would

discuss the differences that

exist among Financial

Management,

Economics

& Financial Accounting

disciplines.

�

Objective

of Economics:

The

objective of economics, as a subject, is

profit maximization; however, the

scope of

economic

profit maximization is vast

and loosely defined. In

economics, we can talk

about

profit

maximization for an individual, the

whole society, or a particular

class or group. We

can

also talk about profit

maximization for the whole

world in global terms. In

social

economics,

we may study the social profit

maximization for the societies,

whereas, in

capitalistic

economics we may study

individual or company's

profit.

�

Objective

of Financial Management

(FM)

In

comparison, financial management is more focused.

The objective of

financial

management,

specifically, is to maximize the

shareholders wealth in the present

terms.

Financial

practitioners usually use the

discounting and the net present value

techniques

while

calculating the increase in the wealth of

shareholders.

�

Objective

of Financial Accounting

(FA):

The

objective of financial accounting is to

collect accurate, systematic,

and timely

financial

data and other financial

information, and to compile and

consolidate it in an organized

and

systematic way, according to the

principles and rules of accounting, for

reporting purpose.

The

financial managers use these

reports to assess the financial position

of the company through

various

financial management tools and

then the financial position

can be compared to,

or

benchmarked

against, the industry norms. The

four different financial

statements used for

the

purpose

of reporting and analysis are

1.

Balance Sheet

2.

P/L or Income

Statement

3.

Cash Flow Statement

4.

Statement of Retained Earnings (or

Shareholders' Equity Statement)

In

financial accounting, assets

are recorded on the basis of historical

costs in the balance

sheet,

i.e.,

the assets are recorded at their

original purchase price. Of

course, the depreciation on the asset

is

duly

subtracted from its original

value as the asset remains in

use of the business.

However,

in financial management, book

value is seldom used and financial

managers consider

the

market value and the

intrinsic value of

assets.

8

Financial

Management MGT201

VU

Market

value may

be defined as the value currently

prevailing in the market or the value

at

which

the sellers are ready to

sell, and buyers are ready

to buy a particular

asset.

Intrinsic

value or the

fair

value is

calculated by summing up the discounted future

cash flows.

In

Financial accounting, we followed the

principle of accrual accounting in which

expenses &

incomes

are rerecorded when they

incur. In Financial management, we

will primarily be interested in

cash

& cash flows. In Financial

management, we will use cash

as primary source for

calculating value,

although

the accrual data would also be

useful for analyzing a

firm's financial

position.

Before

getting into details, it is

important to understand a few concepts

that would be

frequently

used

throughout the course.

Real

Assets:

Real

assets are tangible assets

that have physical characteristics. For

instance, land,

house,

equipment,

car, wheat, fruits, cotton, computers,

etc., are different kinds of

real assets.

Securities:

Security,

also known as a financial

asset, is a piece of paper representing a claim on an

asset.

Securities

can be classified into two

categories.

�

Direct

Securities: Direct

securities include stocks and

bonds. While valuing

direct

securities we take into account the

cash flows generated by

the

underlying

assets.

Discounted

Cash Flow (DCF) technique is

often used to determine the

value of

a

stock or bond.

�

Indirect

Securities:

Indirect securities include derivatives,

Futures and Options.

The

securities do not generate any

cash flow; however, its

value depends on the

value

of the underlying asset.

While

in this course, direct securities

would be discussed at length, the

indirect securities would

only

be skimmed through in the later

chapters.

Bonds:

Bonds

represent debt. The

important features of bonds

are given as under.

�

Internationally, bonds are the

most common way for

companies to raise

funds.

�

A bond is a long-term debt contract

(on paper) issued by the borrower (Issuer

of the Bond i.e., a

company

that wishes to raise funds)

to the lenders (bondholders or Investors

which may include

banks,

financial institutions, and private

investors).

�

Bonds issued by a company are

usually shown on the liabilities side of

the Balance Sheet.

�

A Bond requires the borrower to pay

a pre-determined amount of interest regularly to the

lender

(bondholder).

The interest rate or the rate of return on a

bond can be Fixed or

Floating. If an

investor

purchases a bond which is

offering a rate of 10 % for the life of

the bond, the rate

would

be fixed at 10 percent. However, if the interest rate

on the bond is tied to the

market

interest

rates, the rate of interest would be

floating. The floating rate

implies that the interest

rate

would fluctuate with any

change in the market interest

rate.

Types

of Bonds:

�

Debentures: Unsecured no asset

backing

�

Mortgage Bond:

Secured

by real property i.e. Land,

house

�

Others:

Eurobond,

Zeros, Junk, etc.

The

details on these different types of

bonds would be discussed in

later lectures.

Stocks

(or Shares):

Stocks

(or Shares) are paper

certificates representing ownership in a

business. Therefore, if a

company

has issued 1 million shares

and an investor owns 1 share

only, he is a part owner

(or

shareholder)

of the company. Stocks or shares

are represented in the equity section of

the balance

sheet.

A stock certificate is perpetuity, i.e.,

it lasts as long as the company does.

Shareholders have a

residual

claim (last claim) on

whatever net income (or profit)

and assets are left

over after the

bondholders

have been fully paid off. It

is the most common source of raising

funds under Islamic

Shariah.

Shares are traded in Stock

market e.g. Karachi Stock Exchange

(KSE), Lahore Stock

Exchange

(LSE) & Islamabad Stock Exchange

(ISE).

Difference

between Shares &

Bonds:

The

main difference between shares

and bonds is that shares

are representation of ownership in

a

company while bonds are not

representative of ownership.

9

Financial

Management MGT201

VU

The

second difference is that

shares last as long as the company lasts

where as bonds have

limited

life.

Another

difference is that the return on a

bond is predetermined, i.e., the

investor knows in

advance

how much return he would get

from a bond. However, a

stockholder cannot be certain

about

the return on a stock investment, since

the dividends may or may not

be paid in a certain

year

or

the percentage of dividends announced may

vary.

Types

of Stocks (or Shares):

Common

Stock:

Common

shareholders receive dividends, or

portion of the net income which

the

management

decides, NOT to reinvest

into the company in the form of retained

earnings.

Dividends

are paid in proportion to the number of

shares the stockholders own and

are

announced

by the board of directors, who

may opt not to announce a

dividend in a particular

year.

Common Stockholders have voting rights to elect the

board of directors.

Preferred

Stock:

It

is the stock with a predetermined or

fixed dividend. In case, the

board of directors announces

dividends,

the preferred stockholders would have a

priority claim on them, i.e.,

they would be paid

dividends

before any dividends are

paid to the common stockholders. However, if the

board opts to

retain

earnings, the preferred stock would not

yield a dividend, and thus

cash flows from a

preferred

dividend

are not as certain as income

of the bondholders.

Dividends

are paid out of net income. Shareholders

get a part of the net profit of the

company

during

the year, proportional to their

shareholdings, and it is for the management to decide

how much of

the

profit is to be distributed among the

shareholders.

Now,

we will see how these

shares and bonds will appear

on the face of a balance sheet. We

will have

to

look at these shares and

bonds from two aspects,

the shares and bonds

that the company issues

and

the

shares and bonds that

company invest in. The

shares and bonds that a

company purchases as an

investment

will come on the asset side

under the section of marketable securities.

These shares and

bonds

have been purchased by the company to

generate extra income. On the

other hand, those

shares

and

bonds that the company issues to

raise funds will appear on

the liability side.

If

the company has issued bonds,

they will be classified as

liability. But if the company has

issued

equity

shares, they will appear

under the section of common equity on

liability side in the balance

sheet.

Where

do bonds & stocks appear on the

Balance Sheet?

Stocks

&

Bonds

Purchased

as

Investment

Own

Bonds

issued

by

company to

raise

cash

Own

Stock

issued

by

company to

raise

cash

10

Financial

Management MGT201

VU

Finally,

let's talk about the most

important concept that we

will keep on repeating

throughout

the

course; the concept of `value'. In

financial terms, there are

different types of values, which are

given

as

under.

Value

�

Book

Value:

Book

Value is the value of an asset as shown

on the Balance Sheet. It is based

on

historical

cost (or purchase price) and

accumulated depreciation.

�

Market

Value:

Market

value of an asset is as quoted in the

market, which basically

depends on the

supply

& demand of the asset and the

negotiations between buyers & sellers.

�

Liquidation

Value:

The

liquidation value is the value of an

asset in a particular situation, where

the

company

is in the process of wrapping up the

business and its assets

are valued and

sold

individually.

�

Fair

Value or Intrinsic

Value:

The

most important value concept

in this course is of fair

value or the intrinsic

value. In

order

to find the intrinsic value of an

asset, the present value of the

working assets'

future

cash flows is calculated and summed

up. If the intrinsic value of an

asset is less

than

its market value, the asset

among investors is perceived as

"undervalued".

Financial

Markets

�

Capital

Markets:

These

are the markets for the

long term debt & corporate stocks.

The maturity of debt

should

be more than one year to qualify it as a

capital market

instrument.

Stock

Exchange:

A

stock exchange is a place where the listed

shares, Term finance

certificates (TFC)

and

national investment trust units

(NIT) are exchanged and traded between buyers

and

sellers.

Long

term bonds:

Long

term government & corporate bonds are

also traded in capital markets.

�

Money

Markets

Money

market generally is a market where there

is buying and selling of short term

liquid

debt

instruments. (Short term means one year

or less).Liquid means something which

is

easily

en-cashable; an instrument that

can be easily exchanged for

cash.

Short

term Bonds

Government

of Pakistan: Federal Investment Bonds (FIB),

Treasury-Bills (T-

o

Bills)

Private

Sector: Corporate Bonds,

Debentures

o

Call

Money, Inter-bank short-term and

overnight lending &

borrowing

Loans,

Leases, Insurance policies, Certificate

of Deposits (CD's)

Badlah

(money lending against shares), Road-side

money lenders

�

Real

Assets or Physical Asset

Markets

Cotton

Exchange, Gold Market, Kapra

(Cloth) Market

o

Property

(land, house, apartment,

warehouse)

o

Property

(land, house, apartment,

warehouse)

o

Computer

hardware, Used Cars, Wheat, Sugar,

Vegetables, etc.

o

11

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios