|

Financial

Management MGT201

VU

Lesson

18

COMMON

STOCKS RATE OF RETURN AND EPS

PRICING MODEL

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Common

Stocks Rate of Return

�

EPS

Pricing Model

In

this lecture, we will

continue our discussion on

share price valuation and we

discuss the common

stock

valuation in case of long term or

perpetual investment.

First,

we review what we have studied in the

previous lecture. We have discussed 2

approaches of

perpetual

common stock valuation.

1.

Zero growth :

In

this we assume zero growth

in dividends and our formula

is

Po*=DIV1

/ rCE (Po* is being

estimated).

2.

Constant growth rate:

In

this we assume that dividend

is growing at constant growth rate

(inflationary rate).we

can

also use accounting data to

calculate `g'.

g=

plowback ratio x

ROE.

In

this particular case of

constant growth model the

formula for estimation of

fair price is

Po*=

DI V1/ (rCE -g)

Now,

we have studied about estimating the

fair price of the common shares

under a very long

term

investment but it is equally

important to know the Required rate of

Return (ROR).

In

capital budgeting criterion, we have

mentioned that we have to look

both NPV as well as IRR.NPV

is

the

price or value of the asset or

security and IRR is the

measure of the rate of return of a

particular asset

or

project. So, we have to compute both

NPV and IRR. Similarly, for

the case of direct claim

securities

like

share we can use the same

equation and we can

rearrange them for the required rate of

return which

is

equal to rCE

The

Estimated Required Rate of Return

for Investment in Common Equity

(rCE) can

be

calculated

by re-arranging the same

equation:

Dividends

Pricing Models:

Zero

Growth:

Po*=DIV1

/ rCE

(Po*

is being estimated)

rCE*=

DIV1 / Po (rCE* is being

estimated)

Similarly,

Constant

Growth: Po*=

DI V1/ (rCE

-g)

rCE*=

( DIV 1 / Po) +

g

Div

Yield

Cap.Gain

Yield

This

particular formula the way it is

mentioned above is known as Gordon's

formula and we

use

this formula to calculate the required

rate of return.

Gordon's

Formula: Estimated

Fair Present Price (or

Present Value) of Share

calculated using

Forecasted

Future Cash Flows of

Dividend Payouts to Shareholders and

their growth

rCE*=

(DIV 1 / Po) + g

In

this the first part

(DIV

1 / Po) is the dividend yield

g

is the Capital gain

yield.

The

reason we use these terms is

that basically (DIV 1 / Po) is the

fraction of the present

price

which

represents by the dividends.

g

the capital gain yields is

simply the lumped measure of expected

increase in dividend that

you expect

in

the dividend over the life of the

asset.

Now,

if you see the formulas of stock

valuation that we have discussed up

till now. These

formulas

have used forecasted dividends and

that is why we called these

formula dividend

yield

approach

to find the price. We have use

dividends as a direct measure of

cash flows that a stock

holder

receives

from the security.

We

mentioned that we will calculate

value of an asset or security

based on cash flows it

will

generates

in the future. Any working asset

can be valued based on its

future cash flows.

So

we began valuing shares

based on dividend income

that a share holder's

receives. There is

another

approach for valuing

shares.

81

Financial

Management MGT201

VU

Earnings

per Share (EPS) Pricing

Model:

In

this our perspective is not the

direct cash flows generated

by the shares rather we value

the

shares

based on cash flows that

are generated by the company whose

share we are taking. In

other

words,

Estimated Fair Present Price of Share

calculated based on Forecasted Future

Cash Flows of

Company's

Earnings and growth from Ploughed

Back Reinvestments (from Retained

Earnings). We can

do

that because it is mentioned

earlier that for direct

claim securities like bond and

stocks the value of

security

can be calculated from the

cash flows of underlying

assets. For share the

underlying assets are

the

assets of the company and the

cash flows generated by the

assets of the company.

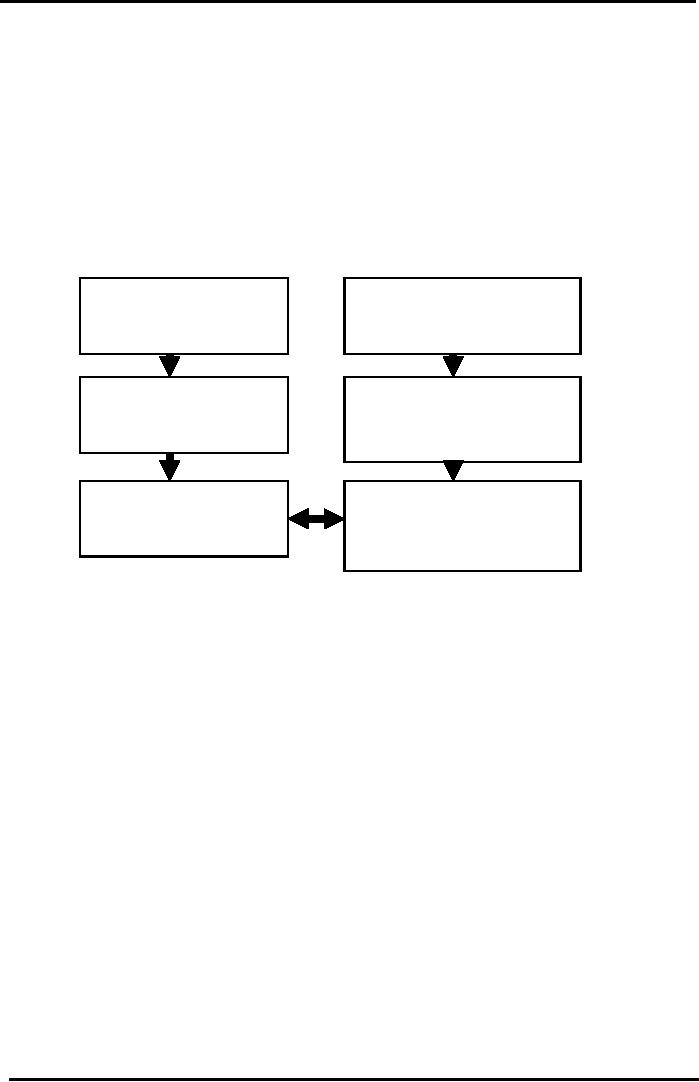

COMMON

STOCK PRICING APPROACHES

DIVIDEND

PRICING

E.P.S

PRICING

Stock

(Paper,

Direct Claim

Real

Assets & Future

Security)

issued by Company

Investments

in Projects of

ABC

Company

ABC

Forecasted

Earnings & Sales

Forecasted

Dividends

Revenue

(Cash

Flows generated by

(Cash

Flows generated by

real

business operations)

Stocks)

Present

Value of Company

Present

Value of a Stock

ABC

(with certain number of

of

Company ABC

Common

Shares Outstanding)

That

is the logic behind the EPS approach.

Now, let's see the EPS

approach to calculate the price of the

share.

EPS

Approach:

In

EPS approach, we estimate the price of

common stock under very long term

investment.

EPS

Stock Price Estimation

Formula

PV

= Po* = EPS 1 / rCE +

PVGO

Po

=

Estimated Present Fair Price,

EPS

1 =

Forecasted Earnings per Share in the

next year (i.e. Year

1),

rCE

=

Required Rate of Return on

Investment in Common Stock

Equity.

PVGO

=

Present Value of Growth

Opportunities. It means the Present

Value of Potential

Growth

in Business from Reinvestments in New

Positive NPV Projects and

Investments. PVGO is

perpetuity

formula.

The

formula is

PVGO

= NPV 1 / (rCE - g) = [-Io +

(C/rCE)] / (rCE

-g)

In

this PVGO Model: Constant

Growth "g". It is the growth in

NPV of new Reinvestment Projects

(or

Investment).g=

plowback x ROE

Perpetual

Net Cash Flows (C)

from each Project (or

reinvestment).

Io

= Value of Reinvestment (Not

paid to share

holders)

=

Pb x EPS

Where

Pb= Plough back = 1 Payout

ratio

Payout

ration = (DIV/EPS) and

EPS

Earnings per Share= (NI - DIV) / #

Shares of Common Stock

Outstanding

Where

NI = Net Income from P/L

Statement and DIV = Dividend, RE1=

REo+ NI1+ DIV1

ROE

= Net income /# Shares of Common

Stock Outstanding.

Now

when we look at the detailed method of

calculating the NPV you will

see that

82

Financial

Management MGT201

VU

NPV

1 = [-Io + (C/rCE)] / (rCE

-g)

If

we compare it with the traditional

NPV formula

-Io

= Value of initial

investment

(C/rCE)

= present value formula for

perpetuities where you assume

that you are generating the

net cash

inflow

of C every year.

C

= Forecasted Net Cash Inflow

from Reinvestment = Io x

ROE

Where

ROE = Return on Equity = NI / Book

Equity of Common Stock

Outstanding

In

the EPS approach, in calculating the fair

price of the common stock our conceptual

logic was

we

calculate the value of the piece of paper

based upon the cash flows

the real company generated. We

do

this because the value of

direct claim securities can be calculated

form the underlying

assets.

In

EPS approach, we talk abut the company

and the cash flows that the

company generates but in the

case

of dividends approach , we are talking

about the cash flows

directly generated from the piece

of

paper(i.e.

dividends).

The

PVGO in EPS approach formula is

different from `g'.

`g'

it is the growth rate in dividends

PVGO

is potential growth in the value of the

business from the future investments in

new projects. The

basic

model we used to estimate

this present value of the company

which is coming from

investment in

the

future projects with +ve NPV

is that we assume that the company

saves their part of the net

income

in

the form of retained earning

every year. So, in this

particular model we are

assuming that these

retained

earning is invested in projects that

will yield +ve NPV

each year and the cash

flows are

constant.

It also assumes that NPV

from investment that a company

makes in new projects grows at

constant

growth rate `g'

perpetually.

Example:

The

Common Stock of Company ABC is

trading in the Islamabad Stock Exchange at a

market

price

of Rs 105. You are considering

investing in it so you study the

company's Annual

Report,

Financial

Statements, and make some

forecasts. The Data is as

follows:

Forecasted

Dividend Next Year = Rs

10

Expected

Dividend Growth = 10%

pa

Forecasted

Earnings per Share = Rs 12

Your

Required Return on Investment in

ABC Common Stock = 20%

pa.

Compute

the Estimated Present Fair Price of

Company ABC's Common

Stock.

Dividend

Pricing (Gordon's)

Approach:

PV

= Po* = DIV1 / (rCE - g)

=

10 /

(20%-10%) = 10/0.10

=

Rs 100 (Estimated Fair Price is less

than Market Price of Rs 110 so

share is

overvalued

in the

Market)

Earnings

Per Share (EPS) Pricing

Model

PV

= Po* = EPS 1/ rCE +

PVGO

EPS

1 / rCE = 12 /

0.20 = Rs 60

PVGO

= NPV1 / (rCE -g) = [-Io+(c/

rCE)] / (rCE -g)

=

[-(PbxEPS) + (IoxROE/ rCE)] /

(rCE -g)

=

[-(1/6 x 12) + (2 x 6/10 /

0.20)] / (0.20 -

0.10)

=

[-2 + 6] / 0.10 = Rs 40

Pb

= 1 - Payout = 1 - DIV / EPS = 1 - 10/12

= 1/6

g

= Pb x ROE = 10% = 1/10 So ROE =

6/10

PV

= Rs 60 + Rs 40 = Rs 100 (Same

as Dividend Approach).

EPS

Approach shows that 40%

(i.e. Rs 40 out of Rs 100) of the

Value is Growth Based (i.e.

PVGO)

Growth

Stock:

It

is growth share where the

value of the share is determined by the

potential of this company to

grow

its business as oppose to company

which have low growth

rate.

Particularly,

for IT internet companies where we expect

a high rate of growth for he

business the PVGO

term

is large percent of the price of the

share.

83

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios