|

Financial

Management MGT201

VU

Lesson

16

INTRODUCTION

TO STOCKS AND STOCK VALUATION

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Introduction

to Stocks

�

Stock

Valuation

In

previous lectures, we have discussed

about one kind of direct

claim security which is

bonds.

Bonds

are long term debt

instruments. Now, we will take in

detail about another kind of

security which

is

known as Stocks or

Shares.

Stocks:

These

are equity paper representing ownership.

Shareholders are part owners of the

company. If

you

look at the balance sheet

when the company issues shares to

raise money such shares

should be

shown

on the liability side of the balance

sheet of the company. Shareholders are

called owners of the

company

these are shown under the

equity section .However, the shares

that are purchased by

the

company

are shown on the asset side of the

company under the head of marketable

securities .Generally,

when

we are talking about the

issuance of the shares we refer to

shares as liability. Basically, the

share

is

a legal contractual piece of paper it

shows the name of the company. It

shows the par or face value

of

the

share and it also assures

that the shareholder is the part owner of

the company.

Remember

that Shares

are distinguished from the

bonds because shares

represent the

ownership

whereas the bond is a debt

instrument. Another thing

about the shares is to remember

that par

value

is the value when they are

issued the market value of the

shares changes with

investor's

perception

about the company's future

and supply and demand

situation. So, do not

confuse the par

value

with the Market value of the

shares .par value is printed on

that share certificate. As we

have

studied

that Value of Direct

Claim Security

is directly tied to the value of the

underlying Real Asset.

Why

raise money through Equity

(i.e. Shares or Stocks) rather

than Debt (i.e. Bonds or

Loan)?

What

are the advantages of raising

money through equity?

Equity

financing gives the flexibility

that you do not have to made

regular payments. In case of debt

or

bond

you have under taken a promise to

pay a fixed rate of return

.but in case of shares o

fixed rate of

interest

is paid only dividend is

paid on net income according to the

decisions of the board of directors

and

management. You have no obligations to

pay fixed dividend to common

shareholders. But, if the

Company

raises money using Bonds,

then it will have to pay a

fixed amount of interest (or

mark-up)

regularly

for 2 Years. If the Company

does NOT pay on time,

you are declared Defaulter and

your

business

can be closed and the Lenders

(Bondholders) can sell the

company's assets to recover

their

money.

The

value of direct claim

security because derived

from underlying real asset.

It can be thought

of

as a piece of paper that generates a

certain cash flow over the

period of time. Share

certificate is a

piece

of paper that represents

some other real assets and

it generates future cash

flows.

1.

Dividend you are received as

shareholder.

2.

Capital gain

For

example, if there is a textile company

which need to raise the amount of

Rs1 million to

invest

in looms. Company can raise

this amount either by equity or

bonds.

In

case the company decides to raise it

through equity. Then it

issues the share certificate

amounting to

Rs

1 million and sells them to various

interested investors and receives the capital in the

form of equity.

Why

do these share certificates

carry value?

This

investment for the share holders

will generate the cash flow

in form of income and the

cash

flows

in the form of capital gains .These

cash flows are generated

through the under lying

real

assets

.what are these real

assets .the real assets in

this example are the textile

weaving looms and fabric

prepared

by these looms. The cash

flows are generated from the

sale of this fabric. From

these cash

flows

the company is paying dividend (See

diagram)

74

Financial

Management MGT201

VU

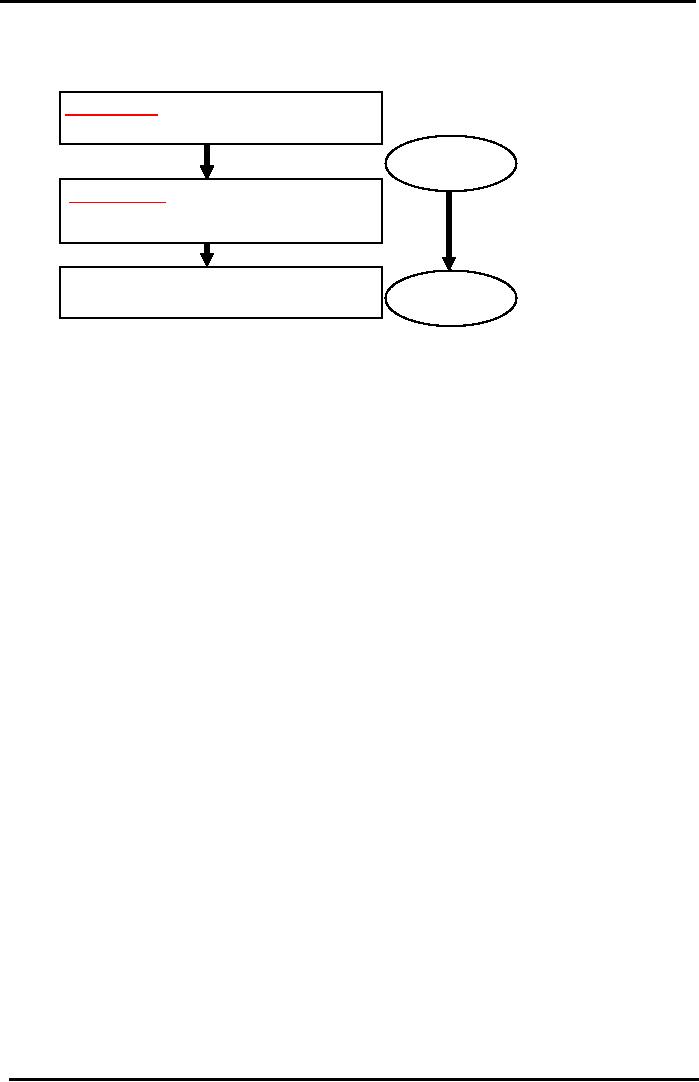

Share

Value & Cash

Flows

from

Underlying Real Assets

COMPANY'S

REAL

WORKING ASSETS

that

has issued the Share

ie: Weaving Looms

Capital

Budgeting

NPV

Criteria

COMPANY'S

OPERATING

CASH FLOWS

&

INCOME ie. Revenue from

sale of Fabric

(Company

Value)

DIVIDEND

& CAPITAL GAIN CASHFLOWS

Securities

Valuation

i.e.

Cash pay out to Shareholders

(Share Value)

or

Share Pricing

Share

Concept:

A

Limited Company can raise

money by Issuing (or

selling) Equity in the form of

Shares. In

Pakistan,

the Par Value (or Face

Value) of each share is

generally Rs 10. But by in

large public listed

companies'

issues shares with par value

of Rs.10each .keep in mind that par

value of the share is

value

when

it was issued when it has

gone into market it has

different value. The Life of

a Share is considered

Perpetual

(or never-ending "going

concern") unless of course the company

closes down or goes

bankrupt.

As

the financial health (cash

flows and income) of the company changes

with time, the Market

Value

(or Price) of the Share changes

(even though it's Par

Value is fixed). Market

Prices also change

depending

on the Supply-Demand for the share and

also speculation or satta.

Shares

of Listed Public Limited Companies

are traded in the Stock Exchange like

KSE (Karachi

Stock

Exchange), LSE (Lahore), ISE

(Islamabad). You can buy /

sell shares over the phone

&/or

computer

through your Broker whose

agents / Jobbers are trading

at the exchange. You make payments

to

your Broker through a

Brokerage Account at one of the banks in

the Stock Exchange or through

cash

soon

after the trade is made.

Shares

of Private Limited Companies

(which are not listed)

can also be bought and

sold

privately

and the Corporate Law Authority and

Registrar Joint Stock Companies

need to be informed.

Types

of Equity:

There

are two types of

equity

1.

Common Stock

2.

Preferred Stock

Common

Stock:

It

is the most common kind of equity as

compared to preferred stock. Common Shareholders

are

Owners

who have Voting Rights in

management decisions. Common Shareholders are owners

who

receive

a Dividend (share of the Profit or

Net Income proportionate to

their shareholding) which

varies

depending

on the Net Income for that

year and the decision of the Board of

Directors regarding

how

much

to Retain and Reinvest. Cash

flows associated with common

shares will be used to calculate

the

expected

price of share then we

compare it market value of stock.

There are 2 kinds of cash

flow

associated

with the stocks

1.

Dividend you received as shareholder: In

case of common stocks, these

are unpredictable

and

changing as to bond valuation where the

coupon receipts are generally

constant and

regular

in time interval. Therefore we

can use annuity formula.

But when we are

talking

about

common shares dividends are

not fixed. That's make the

valuation of common stock

different

from bond valuation

2.

Capital gains

Preferred

Stock:

This

kind of Equity is rare. Preferred Shareholders get a

preference (or priority) over

the

Common

Shareholders in recovering their money if

the company goes bankrupt.

Although

Preferred

Shareholders are owners, they may

not get voting rights. It is

also known as Hybrid

75

Financial

Management MGT201

VU

Equity.

As it is a Mix of Bond and Share. Preferred

Shareholders receive a Fixed

Regular

Dividend

(similar to the Coupon for a

Bondholder).

Share

Price Valuation - Preferred

Stock:

Perpetual

Investment with Fixed Regular

Dividends:

Perpetual

Investment means you are

considering buying this

Stock and keeping it

forever!

PV

= Po* = DIV 1 / r PE

Where

r PE = Minimum Required Rate of

Return on Preferred Stock Equity

for the individual

investor,

PV

= Present Market Value (or

Estimated Present Price) which depends on

DIV 1 = Forecasted Future

Dividend

in the next period (ie. Year

1 and all other years

since DIV 1=DIV2= DIV3=...)

Basically, it

is

a Perpetuity Formula.

Finite

Investment:

Finite

Investment means you plan to

buy this Stock and

then sell it in a few days

or years (n). Formula

similar

to Bond.

PV

= Po* =

DIVt

/ (1+ rPE) t + Pn /

(1+

rPE) n .

t=year.

Sum from t = 1 to n. Pn = Final

Expected Selling Price

PV

(Share Price) = Dividend Value + Capital

Gain /Loss.

The

Dividend Value derived from

Dividend Cash Stream and

Capital Gain /Loss from

Difference

between

Buying & Selling Price.

Example:

Company

ABC Preferred Stock is traded in the

Lahore Stock Exchange and

has a Market Price of

Rs

13. The Company has

fixed the Dividend to be Rs 2 per share.

The Par Value of each

share is

Rs

10. You expect the Price to be Rs 13 after 2

years. As the investor, you expect a

Minimum

Required

Return of 10% because you

can earn that much

from a bank deposit account

almost risk

free.

BUT, Stocks are generally

more risky investments than bank

deposits SO you will only

invest

in

risky stock IF the expected return is

higher than 10% - lets say

15%. Calculate the Fair

(or

Expected)

Price of the Preferred Stock.

NOTE:

We will discuss RISK in detail

later in course

Perpetual

Investment in Preferred Stock

PV

= DIV 1 / r PE = Rs 2 /

15% = 2 / 0.15 = Rs

13.33

The

Fair (or Intrinsic Value) of

the Share to You is Rs 13.33. The

Market Value is Rs 13. So,

the Share

is

worth more to You than its

price in the market. It is undervalued

and you will gain value by

buying it.

Finite

Investment in Preferred Stock:

PV

=

DIVt

/ (1+ rPE) t + Pn /

(1+

rPE) n. n = 2

years

=

2 / (1.15) + 2 / (1.15)2

+ 13 /

(1.15)2

=

Rs

13.08

In

this example, Perpetual Investment in

Preferred Stock is worth more than

Finite Investment in

Preferred

Stock because Present Value

of the Infinite Stream of Rs 2 Dividends

is more than the

Present

Value

of the expected future Selling Price (Rs

13).

Share

Price Valuation - Common

Stock

Finite

(Limited Life) Investment in Common

Stock

It

is more common. Need to account for

Cash Flows from Variable

Dividends and Estimated

Selling

Price (Pn).

Note

that Pn depends on DIVn+1. Price at

any point in time will

always depend on Dividend in the

following

year! Formula is similar to

Bond Valuation

Equation.

Perpetual

Investment in Common Stock:

PV

= DIV1/(1+rCE)

+DIV2/(1+rCE)2

+..+

DIVn/(1+rCE)n

+

Pn/(1+rCE)n

PV

= Po* = Expected or Fair Price = Present

Value of Share, DIV1=

Forecasted Future Dividend

at

end

of Year 1, DIV 2 = Expected Future

Dividend at end of Year 2, ..., Pn = Expected

Future Selling

Price,

rCE = Minimum Required Rate

of Return for Investment in the Common

Stock for you

(the

investor).

Note that Dividends are

uncertain and n = infinity

PV

(Share Price) = Dividend Value + Capital

Gain.

Dividend

Value is derived from

Dividend Cash Stream and

Capital Gain / Loss from

Difference

between

Buying & Selling Price.

Perpetual

Investment in Common Stock:

It

is an idealized Case. The

Final Cash Flow term

(containing Pn) in the equation takes

place at

Year

n = infinity The last term (containing

Pn) has a Present Value almost

equal to Zero because

the

76

Financial

Management MGT201

VU

Discount

Factor (1+rE)n in the

denominator becomes very

large when n=infinity. So,

you can ignore

the

Last Cash Flow terms

taking place at Year n.

Simplified

Formula (Pn term

removed from the equation

for large investment

durations i.e. n =

infinity):

PV

= DIV1/ (1+rE) +

DIV2/ (1+rE)

2

+ ...

DIVn/(1+rE)n

=

DIVt

/ (1+ rE) t. t =

year. Sum from t =1 to

n

This

Equation is still impractical

because need to forecast

Dividends for every year

forever!!

Example:

The

Common Stock of Company ABC

is being traded in the Islamabad Stock

Market. Its

Market

Price is Rs.13. You study Company

ABC's Annual Report, Balance

Sheet, Income Statement,

and

Cash Flow Statement and you

forecast the future Dividends to be Rs 2

in the first year and Rs 4 in

the

second year. You forecast the

Market Price to be Rs 13 after 2 years.

The Par Value of each

share is

Rs

10. The Risk Free

Return is 10% pa. Your

expected Minimum Required Return

from the high-risk

Common

Stock of ABC is 20%.

Calculate

the Fair (or Expected) Price of the

Common Stock

Common

Stock Valuation (Risky

Investment: rCE=

20%)

1st year will be Rs.2 and

dividend in 2nd

year

will be Rs.4 assume risk

free rate of return is 10%

and high

rate

of return to be required is 20%again

this 20% is higher than

10% in a country .and this

20%

minimum

required rate of return is higher

than the preferred stock required by

that company is

15

% .this is because common stock is considered more

risky than preferred stock and

bank deposit in a

country

.let's calculate the value of common stock

for company ABC we will use

our old present

value

formula

for finite investment

:

PV=2/12+4/(1.2)2+1.3/(1.2)2

Finite

Investment for 2 Years: PV =

2/1.2

+ 4 /

(1.2)2

+ 13 /

(1.2)2

= Rs

13.47

This

is estimated price for

2nd year investment based on

forecasted dividend let's

see the long term

investment

use present value formula

about which we talked

earlier on

Perpetual

Investment: PV =??

We

can not determine it because

we don't have Dividend forecast

data for every year

forever!! We need

to

use Models for approximating

future Dividends Cash Flow

Stream:

Zero

Growth Model

Constant

Growth Model

We

will discuss about these in

the next lecture.

77

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios