|

Financial

Management MGT201

VU

Lesson

15

BONDS

VALUATION AND YIELD ON BONDS

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Bond

Valuation

�

Yield

of Bonds

In

previous lecture, we studied

are bonds are long term

debt instruments. Like Stock

bonds are also

direct

claim securities which means

that the value of these

bonds is determined by the future

cash flows

that

bond holders will receive.

These cash flows are of

two basic types

1.

Cash inflow: in the form of

coupon receipt with regular

interval over the life of the

bond

2.

Other cash flow is the par

value of the bond which you

will receive at the maturity

date of the

bond.

Present

Value formula for the

bond:

n

PV= ∑ CFt

/

(1+rD)t

=CF1/(1+rD)+CFn/(1+rD)2

+..+CFn/

(1+rD)

n

+PAR/

(1+rD)

n

t

=1

NPV

= Intrinsic Value of Bond or

Fair Price (in rupees) paid

to invest in the bond. It is the Expected

or

Theoretical

Value and needs to be

compared to the Market Price. It is

different from the Par (or

Face)

Value

which is printed on the Bond

paper.

rD

= Bondholder's (or Investor's)

Required Rate of Return for

investing in Bond (Debt).

DIFFERENT

from

the Coupon Rate and the Market /

Macroeconomic Interest Rate!

There

are basically 2 kinds of Cash

Flows:

(1)

Annuity from Fixed Regular

Coupon Receipts (CF= Coupon

Rate x Par Value) and

(2)

Single Cash Flow from

Par Value (or Initial

Investment) Returned to the Investor on

maturity.

In

this equation

rD:

It

represents the required rate of

return. It is the return which is

required by the investor based

on

his

opportunity cost. In case of Pakistan,

the investor required a higher

return on bond then the rate

of

markup

offered by the PLS account in

bank. It is different from the

Coupon Rate and the Market

/

Macroeconomic

Interest Rate.

Coupon

or CF:

It

is a fixed rate and it is equal to

(CF=

Coupon Rate x Par

Value)

Par

value of the bond is fixed

but the market price varies

with the change in the supply

and demand,

perception

of investor for that

bond.

Example:

Defense

Savings Certificates: Suppose that

you invest in a Defense Savings

Certificate whose Par

Value

is Rs 100,000. The Bond

Issuer is the Government of Pakistan. The

Certificate has small

detachable

coupons. You (as the Bondholder or

Investor) can present one

Coupon at the end of

every

month and receive Rs 1,000

cash. After 1 year, you

will be repaid your

Principal Investment

(or

Par Value) of Rs 100,000.

Assume your Required Return

(rD) is 10% pa. What is the

Present

Value

of this Investment to

you?

In

the previous lectures, we have solved

simple version of similar

example we solved a

problem

similar

to this where we had to calculate the NPV

of the Defense Savings Certificate with 1

Annual

Coupon

payment after 1 year.

We

arrived at the following approximate

answer:

NPV

=

-Io

+

CF1

/ (1+ i) +

CFI1

/ (1+ i)

=

-100,000 + 12,000/(1+0.10) +

100,000/(1+0.10)

=

-100,000 +

10,909

+

90,909

=

1,818

(NOTE:

PV = NPV + Io = 10,909 + 90,909 =

101,818)

But

this is not the correct exact answer to

our present example because

it ignores monthly compounding.

Accurate

Solution - Monthly

Compounding:

The

Accurate solution to the Savings

Certificate Example with

Monthly Coupons requires us to

use

a monthly cash flow diagram

and do monthly discounting. There is an

Annuity Stream of 12

70

Financial

Management MGT201

VU

Coupons

(Cash Inflows) of Rs 1,000

each at the end of every

month. There is a final Cash

Inflow worth

the

Par Value of Rs 100,000 at the end of the

12th month.

The

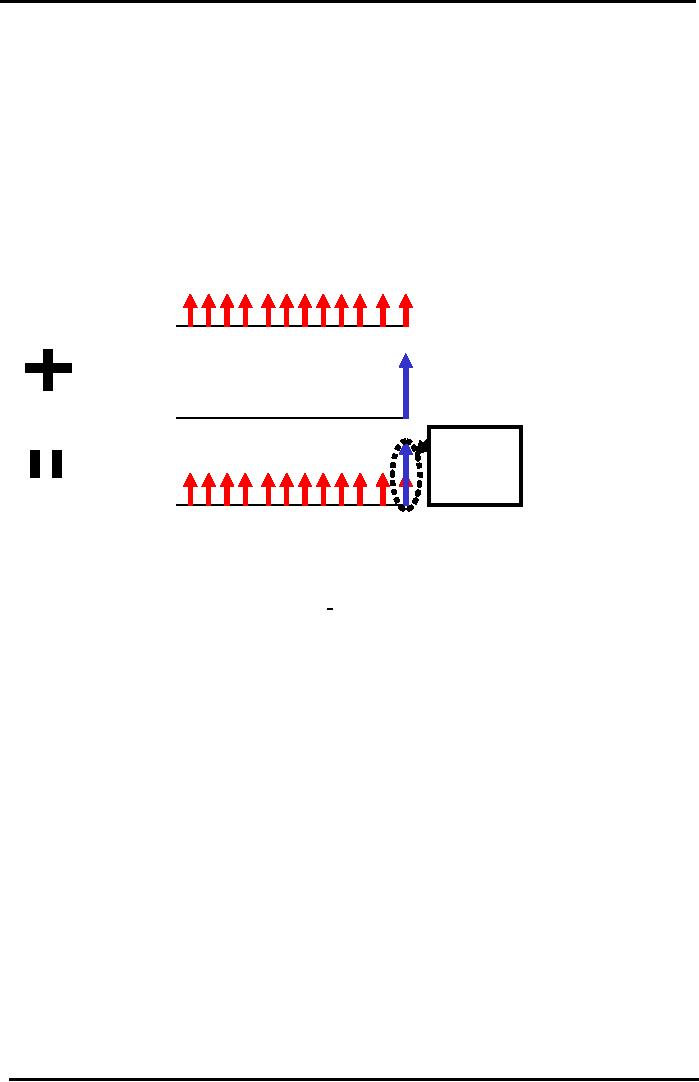

Cash Flow Diagram for Bonds

is a Combination of 2 Flows: (1) an

Annuity Stream (of

Coupon

Receipts) every month for 12

months and (2) One Par

Receipt at the end of the 12th

month.

You

can draw their individual

Cash Flow Diagrams and then add them up

later. You can compute

their

PV's

separately and then add them up

later.

Cash

flows from coupons

represents by the upward pointing arrows

which represents cash

inflows.

In

combine diagram, at the end of the

year there are two upward

pointing arrows. One

for

coupon

rate and the other is for the

payment of par value of

bond.

Bond

Cash Flow Diagram

Savings

Certificate Example

Rs

1,000

Coupon

Annuity:

(Monthly)

Time

(Months)

12

01

2

6

Rs

100,000

Par

Receipt :

0

12

(at

Maturity)

2

Cash Flow

Arrows

at

SAME

point in

time

can be

Combined

added.

Time

(Months)

12

Cash

Flow

01

2

6

Diagram

Calculate

the PV of Coupons from the FV Formula for

Annuities (with multiple

compounding

within

1 year):

FV

= CCF (1 + rD/m )nxm -

1/rD/m

Use

Monthly Basis for this

example. n = 1 year m = 12

months

CCF

= Constant Cash Flow = Rs 1,000 =

Monthly Coupon

rD

= Annual Nominal Required

Rate of Return for

investment in Bond (Debt) =

10% pa.

Periodic

Monthly Required Rate of

Return is rD/m = 10/12 =

0.833 % = 0.00833 p.m.

m

= 12 months

Coupon

Annuity Cash Flow

Receipts

FV

= 1,000 x [(1.00833)12- 1] /0.00833 =

+Rs 12,566 (at the end of 1

year)

PV

(Coupons Annuity) = FV / (1 + rD/m)

nxm

=

12,566 / (1.00833)12 = +Rs

11,374

Final

Par Value Cash Flow

Receipt

FV

=

100,000 (at the end of 1

year)

PV

(Par) =

100,000 / (1.00833)12 = +Rs

90,522

PV

= PV (Coupons

Annuity) + PV (Par) = 11,374 +

90,522

=

+ Rs 101,896 (Final

Answer)

So

this Certificate is worth Rs

101,896 to you today. It is

worth more than the Market Price

(Rs

100,000).

So it is a good investment.

NOTE:

Our answer is slightly

higher than what we got

when we used Annual

compounding (Rs

101,818).when

we consider multiple compounding the

present value of the bond

increases. Its NPV is

greater

than zero so on the basis of

our capital budgeting techniques

you should invest in that

project.

Now,

we consider over all rate of return on a

bond. We have studied expected price of

the bond. These

two

are complimentary. When

bonds trader talk about he

overall return on a particular

bond they

referred

to yield to maturity.

71

Financial

Management MGT201

VU

Bond

Yield to Maturity

(YTM):

We

can calculate the Value of our

Investment in Bonds. But how

can we compute its Rate

of

Return?

Both are important whether

you are talking about

Investment in Real Assets or

Securities.

The

most common way to compare the

Overall Rate of Return of

different Bonds is to compare

their

YTM's.

In

capital budgeting, you can

calculate IRR using the NPV

equation. Similarly, you can

calculate it

by

setting the PV Equation for

Bond Valuation equal to the

Present Market Price and

solve for "rD".

Use

Trial and Error or

Iteration. The value of "rD"

that gives PV = Market Price is the YTM

for that

Bond.

PV

=

Bond Market Price =

CFt

/

(1+rD)t

CF1/

(1+rD)

+CF2/(1+rD)2+...+CFn/(1+rD)n+

PAR/(1+rD)n

All

variables are known (ie.

CF, PAR, and n) EXCEPT

rD

.Set

PV equal to the Actual Present

Market

Price

of Bond and solve for

rD

YTM

= rD

Bond

YTM Example:

Term

Finance Certificate (TFC): The

TFC (a kind of Bond) of

Company ABC is traded in the

Karachi

Stock Exchange for Rs 900.

The Par Value of the TFC is

Rs 1,000. The Coupon Rate is

fixed

at

15% pa. Coupons are paid

annually. The TFC will

Mature after exactly 2 Years

(it is a 5 Year Bond

issued

3 Years ago). What is the

Overall Expected Rate of Return

(ie. YTM) offered by this

TFC?

Market

Price (Rs 900) is LESS than

its Par Value (Rs

1,000). This Bond is selling

at a Discount. Why?

Possibly

Interest Rate Risk. Market

Interest Rate rises above

TFC's Fixed Coupon Rate so

Market Price

of

the TFC falls below Par.

Note: when Market Interest

Rates rise, Required Rate of

Return (rD) for

Investors

rises. But, Coupon Rate

fixed by Bond Issuer at time

of issue.

The

Expected (or Promised) Rate of Return

for Investors is the Yield to

Maturity (or YTM).

Compute

the Overall Return (or YTM)

for the TFC using the Old

IRR-like Approach:

PV

= Market Price = Rs 900

Par

Value =Rs 1,000. Receive

this after 2 Years

(remaining life)

Annual

Coupons =Coupon Rate x Par

=15%x1, 000 = Rs 150

rD

=

Minimum Return Required by the

Investors investing in

The

Bond Market = YTM.

This

is unknown in the equation.

PV

= 900 = 150 / (1+ rD) +

150 / (1+rD)2

+

1,000 / (1+rD)2

900

= 150 / (1+ rD) +

1,150 / (1+rD)2

. Use

Trial & Error

rD

> 15%:

Try

rD = 20%: PV = 924 (close)

Try

rD = 21%: PV = 909 (closer)

YTM

= 21.7%: (Gives

PV=Rs 900)

YTM:

YTM is the expected rate of return for

which the bond holder holds

the bond until maturity but

if

the

bond holder before maturity

is called by the issuer or if the holder

of the bond decides to sell

the

bond

before maturity then your

answer will change .all the

calculation will remain the

same only par

value

is replaced as

n

PV=∑ CFt /

(1+rD)t

=CF1/(1+rD)+CF2/(1+rD)2+...+CFn/(1+rD)n+CALL/(1+rD)n

t=1

Where

CALL = PAR Value + 1 Year's

Worth of Coupon

Receipts

YTM

=Total or Overall Yield = Interest

Yield + Capital Gains

Yield

TFC

Example Total Yield = YTM =

+21.7%

Interest

Yield or Current Yield = Coupon /

Market Price

TFC

Example Interest Yield = Rs

150 / Rs 900 = +16.7%

pa

Capital

Gains Yield = YTM - Interest

Yield

TFC

Example Capital Gains Yield

= 21.7% - 16.7% = +5 %

n

=

Maturity or Life of Bond (in

years)

FV=CCF[(1+rD/m)n*m-1]/rD/m

N=1

year ,m= no. of intervals in

a year =12

CCF=constant

cash flow =1000=monthly

copoun .we can plug the

values in this formula to know

what

the

future value of annuity is

going to be ?take a look at the copoun

annuity :

72

Financial

Management MGT201

VU

FV=1000[(1-0.00833)12-1]/0.0083=+12566

at the end of one year what

is the present value of

this

copoun

annuity

PV=FV/(1+rD/m

)n*m

=12566(1.00833)12

=+11374

This

is the present value of cash

flow from coupon. Now we

need to calculate the present

value of face

value

at maturity suppose face

value =100,000 then

PV(PAR)=100,000/(1.00833)12

=+90,522

Now,

we combine the present value of

coupon interest and present

value of par both

i.e.=11374+90522=

Rs.101896.

When

we compare the answer with

annual cash flows where

coupon was not

compounded

monthly

.it is grater because monthly

compounding increase future

cash flows as well as the

present

value

.2nd thing is that this

NPV is grater than the initial

investment which is Rs.100,000so, we

should

under

take this project because

the NPV is grater .now, the next

area is the rate of return

so, the

important

thing in this regard is yield to

maturity .this is abbreviated as

YTM.it is easy to understand

because

we have discussed IRR in capital

budgeting .where we set NPV=0 and

calculated for r .here

market

price is the YTM of the bond and

then solving for the

variable rD=required

rate of return .so,

let's

try to understand YTM using a very

simple example ,the example

that we will pick out is

that of

term

finance certificate or TFC

which is by the stock exchanges of Pakistan

for Rs.900.let's assume

that

its

par value is Rs.1000fixed or coupon

interest rate is 15 p.a. and it is paid annually

,total life of the

TFC

is 5 years 3 years have already

passed and it will mature 2

years from now what

will be over all

expected

rate of return .So, let's

see the equation if we compute the over

all yield here we can

equate

PV=market

value is the YTM for the bond the

PV=900 which is market price

PAR=1000.

Annual

coupon rate =coupon rate *par

=15/100*1000=150

rD=minimum return required by

the investor in the bond market =YTM it

is unknown ?

PV=

900=150/(1+rD )+150/

(1+rD)2+1000/(1+rD)2

we

also know that the value of

rD should be more than 15%

you will try different

values for example if

you

try 20% you will

come up with PV=24

(close),try rD=21.7% PV=900

so,

YTM

=21.7% =900

Therefore

21.7% is the yield to maturity

for this TFC because

rD=YTM .YTM is the expected

rate

of return for which the bond

holder holds the bond until

maturity but if the bond

holder before

maturity

is called by the issuer or if the holder

of the bond decides to sell the

bond before maturity

then

your

answer will change .all the

calculation will remain the

same only par value is replaced as

call value

so,

Call=par

value +I, year copoun

receipts

Another

thing to keep in mind is that YTM

has two components first

is

YTM=interest

yield on bond +capital gain

yield on bond from his

example

YTM=

21.7% so,let's calculate the interest

yield

INTEREST

YIELD =annual copoun interest /market

price

=150/900

=16.7% so,

CAPITAL

YIELD =YTM INTEREST YIELD

=21.7%-16.7%=5%

73

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios