|

Financial

Management MGT201

VU

Lesson

10

PROJECT

CASH FLOWS, PROJECT TIMING,

COMPARING PROJECTS, AND

MODIFIED

INTERNAL

RATE OF RETURN (MIRR)

Learning

Objectives

After

completing this lecture, you

would be able to understand

�

Cash

flows relevant to NPV and

IRR

�

Project

timing on the cash flows

relationship

�

Steps

involved in preparing pro

forma cash flow

statement

�

Project

options

�

Problems

with IRR

�

Modified

Internal Rate of

Return

�

Problems of

comparison among projects of unequal

life

Today,

we are going to talk about

project cash flows, along

with the concepts of net present

value

(NPV)

and internal rate of return

(IRR), as they relate to the

project cash flows. NPV

and IRR are

important

and widely used techniques of

evaluating investment in real

assets. Before going into

details

of

these techniques, one must have a clear

understanding of what these

real assets are.

Real

assets projects may also

include entire businesses.

Investors have the option of investing

in

running

businesses, which are also a

collection of assets. The

way a project can be

evaluated using the

IRR

and NPV techniques, the cash

flows being generated from a

business can also be

evaluated in the

same

manner.

The

actual NPV and IRR for

real assets are not

very easy to calculate despite having an

easy

formula,

because the inputs used in the

formula are only estimates.

Cash flows, the basic input

is based

on

forecasts, hence majority of

errors that may take place

in calculating the actual NPV or IRR of

any

project

may be because of forecasting errors.

The next important challenge

is to assess or forecast the

anticipated

life of the business, which

could only be based on an

educated guess. Although,

you might

have

studied in financial accounting

about the perpetual concern, however, in

reality businesses have

finite

life. Another important

input is the discount rate. Picking the

right discount rate is not an

easy task

either.

However, we will talk more

about discount rates when we

would discuss the concept of

risk. All

these

factors combined together make

the calculation of NPV very

difficult.

Let

us begin with a relatively

simple formula for

calculating net incremental after

tax cash flows.

Net

incremental after tax cash

flows = net operating income +

depreciation +

Tax

savings from depreciation + net working

capital + other cash

flows

�

Net

operating income is obtained from the

income statement

�

Depreciation

is added back since it is a non-cash

expense

�

Net

working capital requirements for the

project as estimated are

also added

�

Other

cash flows which are

associated with NPV

Other

Cash flows relevant to the NPV of

the project

Broadly

speaking, these other cash

flows can be categorized into three

types

1.

Opportunity costs relevant to

the cash flows of the

project

Suppose

you are to invest in a new

project, a small production

unit with 4 weaving looms.

You

would

also need to have a piece of land where

the machinery would be installed.

Suppose

further,

that you already have that

piece of land. While calculating the

NPV for the project,

you

would

have to include the value of the land

that you are using.

Although you are not

buying that

land,

but that land has a

certain market value. You

could have sold that land at

the market price

and

by not doing so you are

incurring an opportunity

cost.

2.

Cash flows associated with

externalities

Externalities

in financial terms may be

defined as incidental cash

flows that arise because of

the

effect

of new project on the existing or

running business. For

instance, if a company adds a

new

product

to its produce line, the launching of the

new product can adversely

affect the sales

revenue

of the existing product line.

This phenomenon of competition among the

brands of the

same

company is also known as cannibalization.

When an entrepreneur is embarking on a

new

project,

he might either hurt or

increase the sales of the existing

products and that is an

externality.

While calculating the net incremental

after tax cash flows, the

incremental effect of

these

externalities, whether negative or

positive should be included in the

calculation.

50

Financial

Management MGT201

VU

3.

Sunk costs:

Sunk

costs need to be excluded

while calculating the incremental

cash flows. Sunk

costs

are the costs that have

already incurred in the past.

Whether you decide to invest

your

money

in the new project or not, the sunken

costs cannot be recovered. For instance,

if a

company

has purchased an import/export license

and a few years after the company

decides to

export

a certain commodity, the cost

incurred to purchase the license would

not be included in

the

cash flows. Whether the company

decides to undertake the new

export project or not,

the

license

fee cannot be recovered.

Timing

of the projects:

The

next important issue that we

need to look at is the different times in

which project or

business

cash flows have incurred.

Broadly speaking, there are three

phases.

1.

Initiation of the project, the time of

investment

2.

Life of the project

3.

Termination of the project

Time

of investment:

Time

of business refers to the initiation time

when the initial cash

outflow occurs. In addition

to

the

investment in the fixed assets,

you may also have net

working capital requirements or

mobilization

requirements

to get the project started. You can add

these two types of initial

cash outflows since

they

are

occurring at the same point in

time. You might also have to

subtract any tax paid on the

sale of old

assets

to get a net figure for the initial

cash outlay. As we discussed

earlier, we need to invest in

new

assets

if the old assets become

less productive. These old

assets, despite losing their

productivity have

some

market value at which they

can be disposed off. If the

market value of the project is

higher than its

book

value, the company earns as gain on the

sale of the asset, which may

be taxable1.

Life

of the project:

This

second phase encompasses a

major duration since it is

concerned with the cash

flows that

occur

during the life of the project.

The relevant cash flows

for the period would be the

operating cash

flows,

in the form of cash receipts

from sales revenue and other

income, as well as cash

expenses or

payments

in the form of operating, marketing and

administrative costs. It is important to

keep in mind

that

all these revenues and costs

would be seen on a cash

basis. We would also need to

take into account

if

there are any tax savings

that are coming about

because of showing increased

depreciation. The

change

in depreciation takes place as the

new assets are included in

the business and these new

assets

are

usually depreciated at an accelerated

rate in comparison to the old replaced

assets, which were

being

depreciated

at a low rate in the final year of

their useful life. The

amount of depreciation could

also

increase

if the new asset has a

high price, the amount of depreciation

charged to the asset would

also be

high.

Since depreciation is a non-cash expense,

it has to be added back to the net profit

to get the cash

flows.

If the new asset has replaced an

old one, the difference between the

depreciation of the two

would

be added to the cash

flows.

Termination

of the project:

Termination

of the project refers to the period when

the project life ends. At

this time, we need

to

take into account the

salvage value of the project

assets, the price at which the

assets can be sold

out.

Selling

an asset results in a cash

inflow--represented by salvage value. In

addition, you would

also

recover

the working capital that you

have invested in the business at the

beginning. This would

be

another

cash flow because of

liquidating accounts receivable

and other accrued

assets.

Steps

involved in preparing estimated

cash flow statement:

Cash

flow statement is a consolidated

statement of changes in financial

position. Following are

the

steps

involved in preparing a cash

flow statement.

�

Net Operating Income

(from Performa P/L)

�

Add back Depreciation (non-cash

expense)

�

Add Additional Net

Working Capital

Required

�

Subtract Additional Investments in Fixed

Assets

�

Add Any Tax Savings from

Change in Depreciation

�

Add Any Cash from Sale

of Assets at Salvage Value

1

In

certain countries, like

Pakistan, capital gains are

not taxed at all

51

Financial

Management MGT201

VU

�

Add

Any Tax Savings from Gain on

Sale of Assets

The

following example would help

you in understanding the composition of a

cash flow statement

based

on the pro forma profit &

loss account.

PRO FORMA (FORECASTED)

CASH

FLOW

A

SAMPLE YEAR IN PROJECT'S

LIFE

Amount

in Rupees

Net

Operating Income (from Pro

forma P/L):

1,000

Cost

Savings (2000) + Revenues (1000)

Expenses

(2000)

Add

back Depreciation (non-cash

expense):

100

Add

Additional Net Working

Capital Required

200

Subtract

Additional Investments in Fixed

Assets

(500)

Add

Any Tax Savings from Change in

Depreciation

50

Add

Any Cash from Sale of Assets

at Salvage Value

100

Add

Any Tax Savings from Gain on

Sale of Assets

50

NET

CASH FLOWS

1000

Explanation:

The

main items we need for

preparing is the net operating income,

which is an estimated

income

as it has been obtained from

the pro forma income

statement. The net operating

income is

calculated

by adding revenues to cost savings minus

expenses, which in our

example is Rs.1000. The

next

item used in preparing a

cash flow statement is the

depreciation. Depreciation is added back

to the

net

operating income, as it is a non-cash

expense. Assume the depreciation to be at

Rs.100, which would

be

added to the net operating income.

Another thing that we need

to add to the net operating profit is

the

additional

working capital requirements, which in

our example is assumed Rs

200.

We

would also need to subtract

any additional investment in

fixed assets. Investments in

fixed

assets

result in cash outflows,

which need to be subtracted to get net

cash flows. We would also

add any

tax

savings that come about

because of changes in depreciation.

When you show more

depreciation,

your

taxable income reduces and

as a result, you have to pay

lesser taxes. Depreciation is a

non-cash

expense

but tax is paid in cash

form. By paying less tax,

the business is in fact saving

tax by applying a

high

depreciation rate. You would also

add any cash flow

resulting from the sales of

assets. Assets that

are

sold at salvage value represent

cash inflows. Any tax advantage on the

gain would also be

added.

Based

on these additions and subtractions, we

arrive at the net cash flow

figure as shown in the example.

Management

overestimates the cash flows.

They portray a very

optimistic picture of the cash

flows and

the

NPV, which is also known as

an upward bias in NPV

calculations. This is one of the ways

of

window-dressing.

Project

Options:

Some

of the companies in certain situations

accept projects with negative

NPV, or NPV less

than

zero. Although, the mathematical details

would be discussed in the later lectures,

we need to

understand

why companies do

that.

Companies

invest in projects with negative

NPV because there is a hidden

value in each project.

This

hidden

value is an opportunity, which is

known as an option. These

opportunities and options

carry

some

value. For instance, there

are a number multinational companies

investing in China these

days,

even

though, the net present value of there

projects might be significantly lower

than zero. It is

because

they

are sacrificing short and medium

term cash flows for a

long-term market share. They

see China as

a

potential market owing to

its huge market size, and

for long-term benefits, they

are willing to invest

in

projects

with negative net present

value.

The

same concept is true for

technology industry. We can

take the example of Amazon.com,

a

web

based company where the CEO and the

managers are willing to

invest even if the net present

value

is

negative. The management

believes that the growth of the

market is such that the

negative net present

value

would be compensated in future by

heavy downpour of positive

cash flows later in the life

of the

project.

You must keep in mind that

these options are hidden

and might not be very

visible to you.

When

we talk about the option to abandon a

project, the abandonment too has a

value. For instance,

if

you

find that one of the projects has

started losing money, you

would have the option to end the

project

52

Financial

Management MGT201

VU

and

thereby cutting the losses.

This is the abandonment value of the

project. In contrast, for

larger

project

the abandonment option might be very

difficult to exercise. When we make

decision of investing

cash

in a project, we bear the

opportunity cost of not

investing the cash in another project and

thereby

losing

option. Locking up your

money & time in a bad project

today can reduce your

Option Value to

invest

in better opportunities in

future

Problems

with IRR:

Let

us now discuss some problems

with the calculations of IRR.

The problems with

calculation

of

IRR come about when the

project's useful life is for

more than two years. Another

problem arises

when

there are non-normal cash

flows or one or more net cash

outflow at some point in

future (in

addition

to the initial investment outflow).

This creates multiple real

roots (or more than one IRR's)

that

bring

the NPV of the project equal to

zero.

Let

us take a simple example for

explanation of the concept. For instance,

you have made an

initial

investment

(outflow) of Rs.100, the Net Cash

Receipts (inflow) at the end of Year 1 is

of Rs.500, and

net

loss (outflow) at end of Year 2 is of

Rs.500. The cash flow

pattern can be explained in the

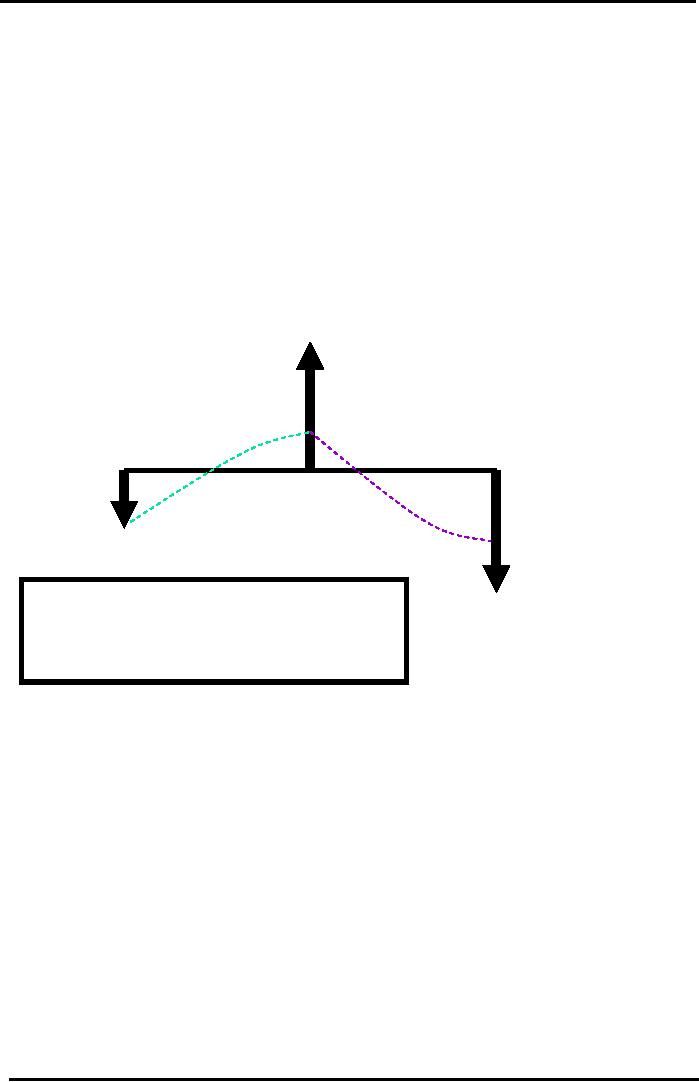

diagram

below.

CF

1 = +Rs.500

Sign

Change #1

Yr

0

Yr

1

Yr

2

Sign

Change #2

Io

= - Rs.100

Note:

More

than 1 Sign Change in

CF

2 = -Rs.500

Direction

of Cash Flow Arrows

suggests

Multiple

IRR's

In

the above diagram, we have a cash

outflow

of Rs.100 represented by a

downward

arrow in the year 0. The

upward arrow represents cash

inflow of Rs.500 in the year 1, and

the

last

downward arrow in the second

year represents another cash

outflow of Rs.500. The IRR of

the

project

can be calculated as under

IRR

Equation:

NPV

= 0 = -100 + 500/ (1+IRR) -

500/(1+IRR)2

Solve

by Iteration (or Trial &

Error):

IRR

= 38% and 260%

approx!

Solving

the equation, we come up with

two values of IRR. Which of the

two values is correct? The

best

way

to deal with this situation

is to leave both the found of

rates and use another important

tool for the

calculation

of the IRR known as Modified

Internal Rate of

Return.

Modified

Internal Rate of Return:

The

logic used in this technique

is to separate the cash inflows

and outflows for each

year and

use

a market discount rate "k"

(or the cost of capital).

Plotting the cash inflows and

outflows on a

diagram,

we would keep them separate instead of

finding the net cash flow.

The next step is to

discount

all

the future cash outflows and

discount them to the present. The

third step is to compound

the

company's

cash inflows to the future

end period, which represents

the end of the life of the project.

The

idea

of compounding the cash inflows is on the

assumption that they are reinvested at

the cost of capital.

53

Financial

Management MGT201

VU

After

doing the compounding and discounting of

cash flow, we use a rate at

which the future value

of

cash

inflows is equal to the present

value of cash outflows. The

rate at which the two equate is

known as

the

Modified Internal Rate of

Return. The formula for the

MIRR is given as

under.

Find

the Modified IRR (MIRR)

using:

(1+MIRR)

n =

Future Value of All Cash

Inflows....

Present

Value of All Cash

Outflows

n

CF

in * (1+k) n-t

(1+MIRR)

=

CF

out / (1+k) t

Now

the question arises as to why

are we using two different

interest or discount rates in the

equation.

One of the interest rate is the

MIRR and the other is the discount rate

used in the NPV

calculation

(opportunity cost of

capital).

Life

of the project:

In

our previous example, where we

compared a saving certificate to a

bank deposit, the lives

of

the

two investments were not of the same

duration. The net present

value of the two projects is

not

comparable

due to the difference in life spans.

There are two approaches

used to make two projects

with

different

life spans comparable.

Common

Life Approach:

In

order to make the two

investment opportunities we equate the

life of the two projects. We

would

repeat the cash flow pattern

of each project over a

horizon that matches the

least common

multiple

of the lives of the two projects. For

instance, if there are two projects, and

the life of first

project

is one year and that of the second is

two years, the least common

multiple would be two and

the

cash

flow pattern of the project

would be repeated for the

next year, in order to make

the two projects

comparable.

Similarly, if first project

has a life of two years

and second project has a

life of three years,

the

least common multiple would be

six. In that case, the cash

flows of the first project

would be

repeated

thrice and that of the second

project would be repeated

twice. Having equated the

lives of the

project

the net present value of both the

projects can be calculated and

compared.

Equivalent

Annual Annuity

Approach:

The

other approach is to calculate the NPVs of the

projects and multiply the result

with the

annuity

factor. This method converts the projects of

different lives into annuity

of the same duration in

time.

Inflation

consideration

�

Use Inflation Discount

Factor: Multiply each future

cash flow term in the NPV

equation by

the

Inflation Discount Factor: 1 /

(1+g) t. Where g = %

inflation per year and t = number of

years.

54

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios