|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

7

MATERIAL

Material

means the inventory that is

used as input for production

of finished output or rendering

of

services or for office use

and packaging.

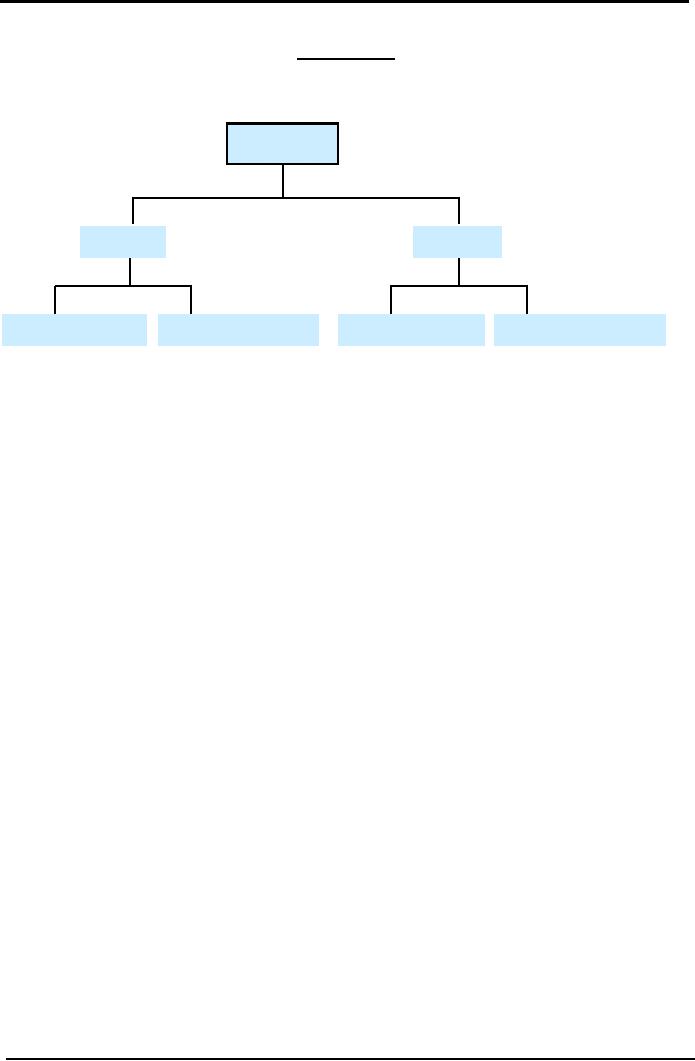

Categories

Material

Supplies

Direct

Material

Indirect

Material

Office

Supplies

Shipping

Supplies

Categories

of Material & Supplies

1.

Direct Material

2.

Indirect Material

3.

Office Supplies

4.

Shipping Supplies

Direct

Material costs

are those cost of material that

are traceable in full in the

cost of a

product

or services. For example:

cost of wood in production of

table.

Indirect

Material/Factory Supplies is the

cost that is incurred in

producing product but

which

can not traced in full in

the cost unit. For

example: polishing material in production

of

furniture.

Office

Supplies: This

is the cost of those items/goods

which are used in the

offices for

administration

purposes. For example: stationery

items.

Shipping

Supplies: This

is the cost of the material

which is used in packaging of

the finished

product.

Accrual

Concept/Matching Concept

All

of the cost of material and

supplies purchased is not

charged to the production.

Only that

much

cost is charged which

matches the revenue earned in

the period. This concept of

accounting

is

known as accrual concept.

Following

the accrual concept will

leave a stock of unused/unconsumed

supplies and unsold

finished

in the stores or

warehouses.

Inventory

Inventory

is an asset that is

held:

�

as material

and supplies; or

�

in

the production process as

semi finished goods;

or

�

as

finished goods.

Inventory

Maintenance Systems

1.

Periodic Inventory System:

2.

Perpetual Inventory System: `

40

Cost

& Management Accounting

(MGT-402)

VU

Perpetual

Inventory System

Under

this system, a complete and

continuous record of movement of each

inventory item is

maintained.

Perpetual records are useful

in preparing monthly quarterly or other

financial

statement.

Record used is normally a "store

ledger card" specifying quantity

wise receipt, issue

and

balance

together with values in

chronological sequence.

Advantages:

1)

It

protects materials from theft or

loss.

2)

It

helps in reducing wastages and

spoilages.

3)

Inventory

levels can be fixed and

observed.

4)

It

serves as a moral

check.

5)

It

helps in highlighting slow

moving and obsolete

inventory.

6)

It

helps in frequent physical

counting.

Disadvantages:

1)

It

is very complex.

2)

It

is costly.

3)

Complex

calculations are required.

4)

Sufficient

technical knowledge is required.

Periodic

inventory System or Physical

system

Under

this system, the value of

inventory is determined at the end of

the year through a

physical

count

of inventory in store/warehouse. It does

not maintain a continuous record of

movement of

each

inventory item.

Advantages

1)

It

is very simple.

2)

It

is very cheap.

3)

No

calculations required.

4)

No

technical knowledge required.

Disadvantages

1)

It

does not protect materials

from theft or loss.

2)

No

help in reducing wastages and

spoilages.

3)

Inventory

levels cannot be fixed and

observed.

4)

It

does not help in

highlighting slow moving and

obsolete inventory.

5)

No

help in frequent physical

counting.

Inventory

costing methods

1.

First In First Out

(FIFO)

2.

Last In First Out (LIFO)

3.

Weighted Average (W.Avg)

First

in First out

(FIFO):

This

method assumes that the

goods firstly received in

the stores or produced firstly

are the

first

ones to be delivered to the

requisitioning department.

For

example a bakery produces

200 loaves of bread on

1st of January at a cost of

Re.1 each, and

200

more on 2nd. at Rs. 1.25 each.

FIFO states that if the

bakery sold 100 loaves on 3rd.,

the

cost of consumption is Re.1

per loaf (recorded on the

income statement) because that

was

the

cost of each of the first

loaves in inventory. The 100

at Re. 1 and 200at Rs.1.25

loaves

would

be allocated to ending inventory (appears

on the balance

sheet).

41

Cost

& Management Accounting

(MGT-402)

VU

Features

�

FIFO

gives us a better indication of

the value of ending inventory (on

the balance

sheet)

�

It

also increases net income

because inventory that might

be several years old is used

to

value

the cost of goods

sold.

�

Increasing

net income sounds good, but

do remember that it also has

the potential to

increase

the amount of taxes that a

company must pay.

Advantages:

1)

It

is the method that most

people feel logically as correct

since it assumes that the

stock

issues

are made in the order in

which they are

received.

2)

Issue

prices are based on the

prices actually paid for

the stock.

3)

It

is an acceptable method for

the purposes of financial

reporting.

Disadvantages:

1)

FIFO

complicates stock records as issues

have to be analyzed by

delivery.

2)

Issues

from stock are not recorded

at the most recent prices

paid. This could

influence

costing

of work done and may

ultimately affect the

revenue.

Last

In First Out

(LIFO):

This

method assumes that the

goods received most recently

in the stores or produced

recently

are

the first ones to be delivered to

the requisitioning department.

The

older inventory, therefore,

is left over at

the end of the

accounting

period.

For

the 200 loaves sold on

3rd.

January, the same bakery

would assign Rs. 1.25

per loaf to cost

of

consumption while the remaining

200 at Re.1 and 100 at

Rs.1.25 loaves would be used

to

calculate

the value of inventory at the

end of the period.

Features

�

LIFO is

not a good indicator of ending

inventory value because the

left over inventory

might

be extremely old and,

perhaps, obsolete.

�

LIFO results

in a valuation that is much

lower than today's prices.

LIFO results in

lower

net income because cost of

goods sold is higher.

Weighted

Average Method (W.Avg):

This

method recalculates the

average cost of inventory

held each time a new

delivery is

received.

Issues are then recorded at

this weighted average

price.

It

takes the weighted average of

all units available for

sale during the accounting

period. The

formula

to calculate the weighted average

rate is:

Total

Cost = weighted average rate per

unit

Total

Units

Weighted

Average cost is used to determine

the value of cost of consumption

and ending

inventory.

In

our bakery example, the

weighted average cost for

inventory would be Rs. 1.125

per unit,

calculated

as [(200

x Rs. 1) + (200 x Rs.

1.25)]

400

Features

�

Weighted

Average cost produces results

that fall somewhere between

FIFO and LIFO.

42

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Q.

1

Periodic

System

Date

Units

Total

1

Jan

100

@

10

Rs.

1,000

5

Jan

100

@

11

1,100

10

Jan

150

@

12

1,600

During

the period 300 unit were

sold

Required:

Calculate cost of inventory

under each of the costing

methods.

Solution

Cost

of inventory:

As

per FIFO

50

@ 12

=

600

As

per LIFO

50

@ 10

=

500

As

per W.Avg 50 @ 10.5714 =

529

Q.

2

Perpetual

System

100

units of material "M" costing Rs. 8.00

per unit were in stores on

January 1, 2006.

Following

are

the receipts and issues

during January.

Jan.

1

Received

100

units @ 8.50

Jan.

5

Issued

100

units

Jan.

8

Received

200

units @ Rs. 8.85

Jan.

15

Received

100

units @ Rs. 9.25

Jan

25.

Issued

220

units

Jan.

31

Issued

80

units

Required:

Prepare

Materials Ledger card based

on the above information using

each of the

following

methods:

IFO

Method

F

LIFO

Method

Weighted

Average cost Method

43

Cost

& Management Accounting

(MGT-402)

VU

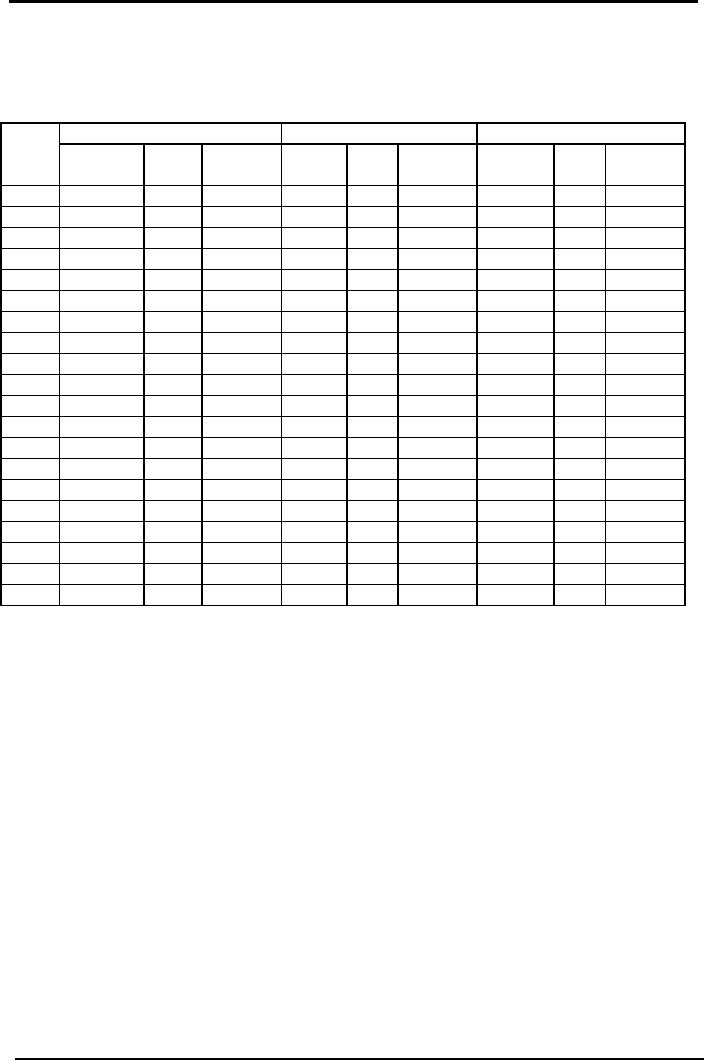

Solution

Materials

Ledger Card

FIFO

Material

M

Received

Issued

Balance

Date

Units

Units

Amount Unit

Unit

Amount Units

Unit

Amount

Cost

Cost

Cost

19xx

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Jan

1

100

8.00

800

Jan

1

100

8.50

850

100

8.00

800

100

8.50

850

Jan

5

100

8.00

800

100

8.50

850

Jan.8

200

8.85

1,770

100

8.50

850

200

8.85

1,770

Jan15

100

9.25

925

100

8.50

850

200

8.85

1,770

100

9.25

925

Jan25

100

8.50

850

80

8.85

708

120

8.85

1062

100

9.25

925

Jan31

80

8.85

708

100

9.25

925

44

Cost

& Management Accounting

(MGT-402)

VU

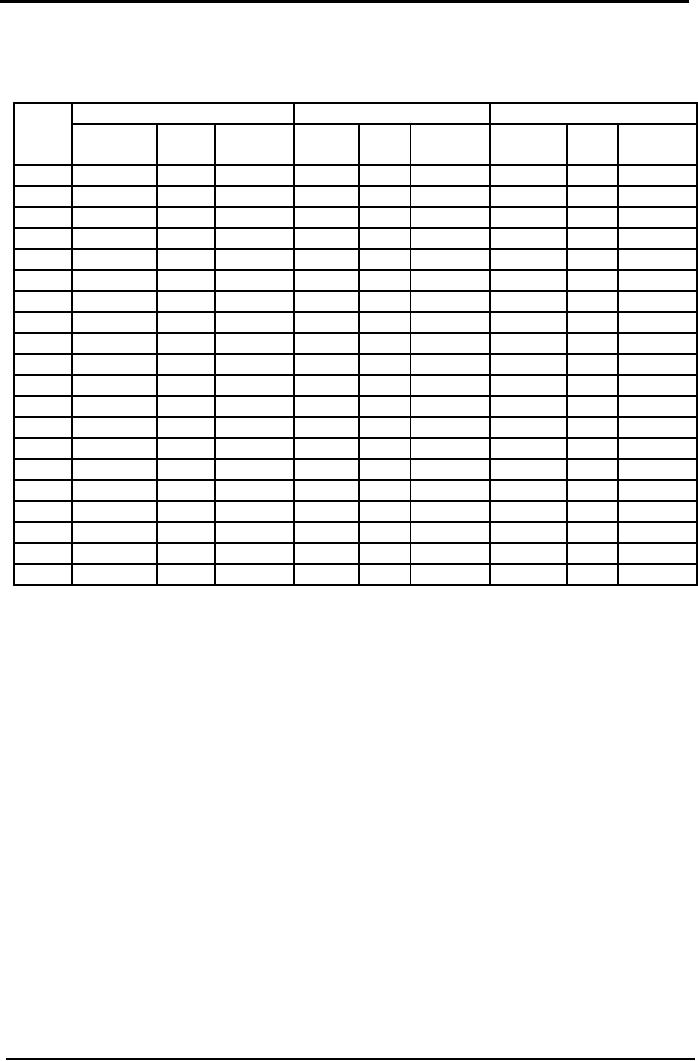

Materials

Ledger Card

FIFO

Material

M

Received

Issued

Balance

Date

Units

Units

Amount Unit

Unit

Amount Units

Unit

Amount

Cost

Cost

Cost

19xx

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Jan

1

100

8.00

800

Jan

1

100

8.50

850

100

8.00

800

100

8.50

850

Jan

5

100

8.50

850

100

8.00

800

Jan.8

200

8.85

1,770

100

8.00

800

200

8.85

1,770

Jan15

100

9.25

925

100

8.00

800

200

8.85

1,770

100

9.25

925

Jan25

100

9.25

925

100

8.00

800

120

8.85

1062

80

8.85

708

Jan31

80

8.85

708

100

8.00

800

45

Cost

& Management Accounting

(MGT-402)

VU

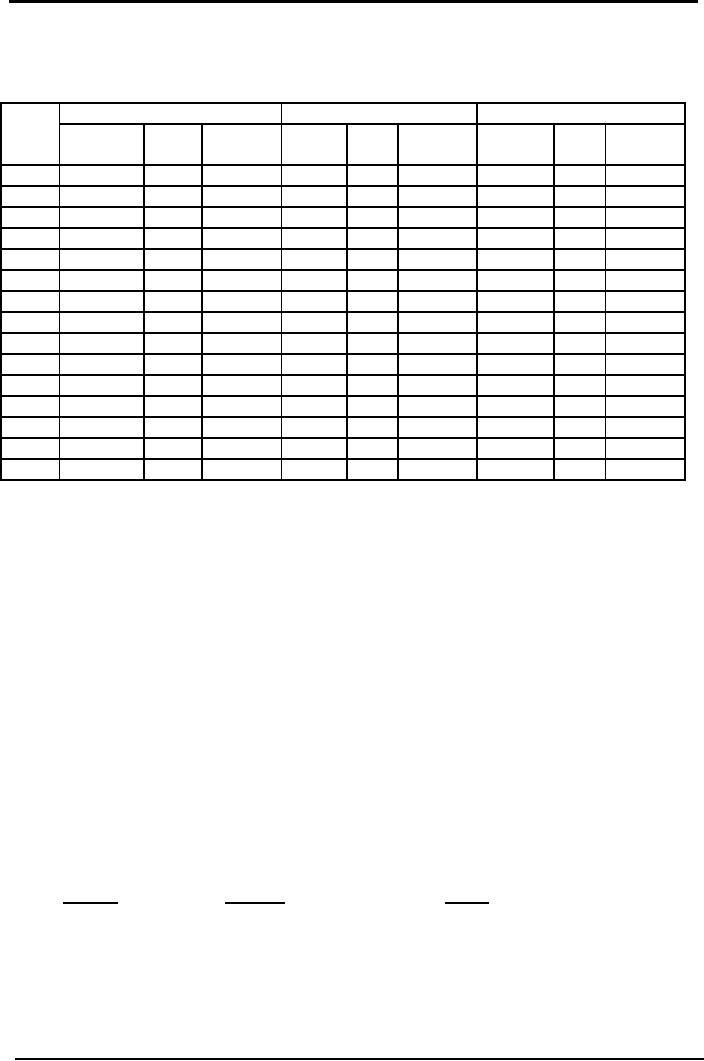

Materials

Ledger Card

Weighted

Average

Material

M

Received

Issued

Balance

Date

Units

Units

Amount Unit

Unit

Amount Units

Unit

Amount

Cost

Cost

Cost

19xx

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Jan

1

100

8.00

800

Jan

1

100

8.50

850

200

8.00

1,650

Jan

5

100

8.25

825

100

8.25

825

Jan.8

200

8.85

1,770

300

8.65

2595

Jan15

100

9.25

925

400

8.80

3520

Jan25

220

8.80

1,936

180

8.80

1584

Jan31

80

8.80

704

100

8.80

880

A

comparison, based on above illustration,

of cost of materials issued

and cost of ending

inventory

obtained

under the three methods is

presented below:

FIFO

Average

Cost

LIFO

Cost

of materials issued

Rs.

3,420

Rs.

3,465

Rs.

3,545

Ending

inventory

925

880

800

It

is clear that FIFO gives

the lowest cost of materials

issued and the highest cost

of ending

inventory,

consequently the highest gross

profit. On the other hand

LIFO gives the highest cost

of

issues

and lowest cost ending

inventory, consequently the

lowest gross profit.

Whereas, the cost

and

as a result the gross

profit, calculated under

average cost method are in

between FIFO and

LIFO.

The illustration demonstrates a period of

rising prices. In a period of falling

prices,

naturally,

the results would have been

reverse.

ASSIGNMENT

QUESTIONS

Q.

1

Jamshed

& company is a manufacturing concern.

Following is the receipts &

issues record for the

month

of January, 2006

Receipts

Issues

Date

Jan

1

Opening

Balance 50 @ 40

Jan

8

200

units @ Rs. 50/unit

Jan

11

60

units

Jan

13

150

units @ Rs. 60/unit

Jan

18

100

units @ Rs. 75/unit

Jan

20

150

units

46

Cost

& Management Accounting

(MGT-402)

VU

Prepare

Inventory sheets

under:

FIFO

Method

LIFO

Method

Weighted

Average cost Method

Q.

2

Assuming

nil opening stocks prepare

store ledger cards and

calculate the value of the

closing

stock

from the data provided

below using each of the

following methods:

�

FIFO

�

LIFO

�

W.Avg

Receipts

Date

Units

Rate

October

1

100

12.50

October

8

85

15.00

October

16

95

11.95

October

20

115

13.00

Issues

October

55

October

65

October

50

October

25

October

115

Q.

3

Following

transaction appeared in the books of

accounts of a trading concern.

PURCHASE

Month

Quantity

(Units)

Cost

per unit (Rs)

Jan

100

41

Feb

200

50

April

400

51.87

SALES

Month

Quantity

(Units)

Cost

per unit (Rs)

March

250

64

May

350

70

June

100

There

was an opening balance of 100

units for Rs 3,900.

From

the information given above,

for the six month ended

June 30, show the

store ledger

records

including the closing stock balance

and stock evaluation by using weighted

average and

FIFO

methods of costing under periodic and perpetual

system of accounting.

47

Cost

& Management Accounting

(MGT-402)

VU

Q.

4

Receipts

1-12-1993

80kg @ Rs. 5 per kg

10-12-1993

80 kg @ Rs. 6 per kg

Issued

2-12-1993

60 kg

11-12-1993

60 kg

What

is the value of 40 units of closing stock

under each of the methods?

Using the

periodic

and perpetual accounting

system.

FIFO

Rs.__________

LIFO

Rs.__________

Weighted

average price

Rs.__________

MULTIPLE

CHOICE QUESTIONS

1)

In most of the industries, the

most important element of cost

is

a)

Material

b)

Labor

c)

Overheads

d)

Prime cost

2)

According to which of the

following method of pricing,

issue; are close to current

economic

values?

a)

Last in first out

price

b)

First in first out

price

c)

Highest in first out

price

d)

Weighted average price

3)

In which of the following of

pricing, costs lag behind

the current economic

values?

a)

Last in first out

price

b)

First in first out

price

c)

Replacement price

d)

Weighted average price

4)

Which of the following items

of cost should not be

treated as direct material?

a)

Electricity representing 90% of the

total cost

b)

Stand paper used in

production

c)

Thread used in stitching

garments

d)

All of the above

5)

When prices fluctuate

widely, the method that

will smooth out the

effect of fluctuation is

a)

Simple average

b)

Weighted average

c)

FIFO

d)

LIFO

Data

for MCQ No. 6 to

9

Given-opening

stock on 1-1-1994

-200

kg @ Rs. 4 per kg.

�

Purchase

on 4-1-1994

-

300 kg @ Rs. 5 per kg

�

Issued

on 8-1-1994

-

350 kg

�

Market

price on8-1-1994 = Rs. 5 per

kg

�

On

the basis of above

information, select the

correct answer in each of

the following:

6)

At what amount materials

issued on 8-1-1994 will be

charged if FIFO method is

used?

48

Cost

& Management Accounting

(MGT-402)

VU

a)

1,100

b)

1,550

c)

1,700

d)

1,750

7)

At what amount materials

issued will be charged if LIFO

method is used?

a)

1,550

b)

1,575

c)

1,700

d)

1,750

8)

At what amount materials,

issued will be charged if

simple average price is

used?

a)

1,550

b)

1,575

c)

1,610

d)

1,700

9)

What amount materials issued

will be charged if weighted average

price is used?

a)

1,575

b)

1,610

c)

1,625

d)

None of these

49

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS