|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

6

MORE

ABOUT PREPARATION OF FINANCIAL

STATEMENTS

Conversion

Cost

Most

of the times during solving

the problems direct labor cot

and factory overhead costs

are not

given,

instead an amount named as

conversion cost appears in

the question. Conversion cost

is

combination

of these two costs i.e.

Conversion Cost = Direct

labor + Factory overhead

cost.

These

are the two costs

which converts the raw

material into the finished

goods therefore these

are

named

as conversion cost.

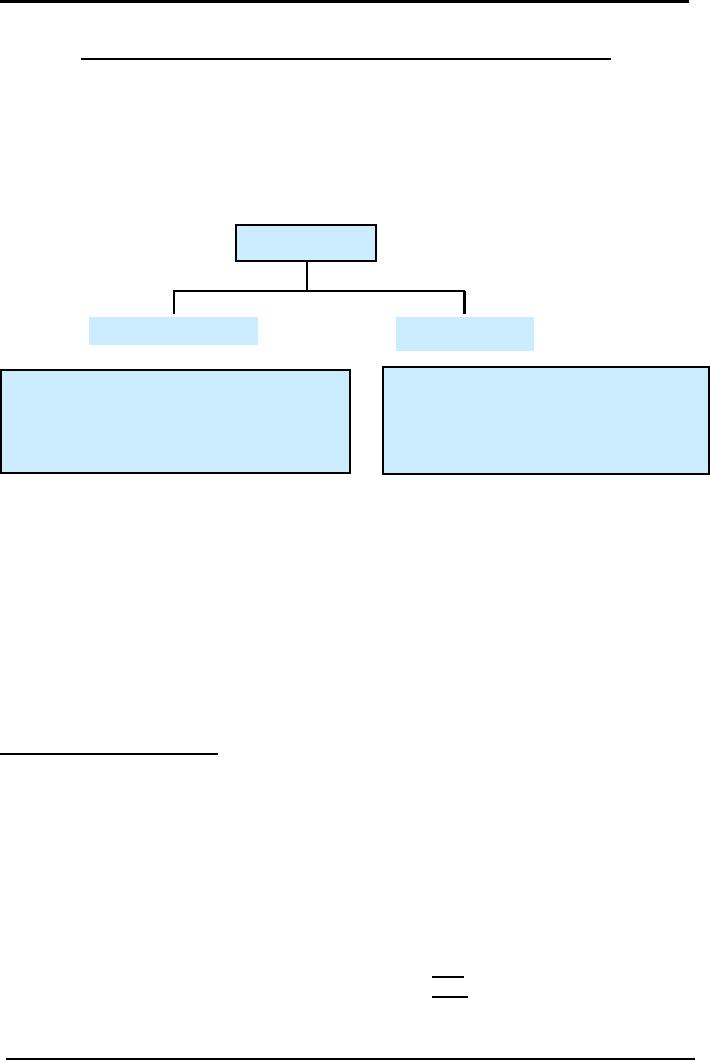

Production

Cost

Direct

Material Cost

Conversion

cost

It

consists of both direct

labor cost

It

represents heavy proportion in

product

and

FOH cost. It is used to

convert

cost.

The management should

be

the

direct material cost into

finished

vigilant

about the control of

material cost.

goods.

Valuation

of Closing Finish Goods

inventory

Another

problem that students often

face while solving questions

of cost of goods sold is

non

availability

of cost of finished goods

inventory.

Cost

of finished goods inventory is

calculated by multiplying units of

finished goods

inventory

with

the cost per unit. So to

calculate cost of closing finished

goods inventory following

formula is

used:

Closing

finished goods units x cost

per unit

Some

times cost per unit is

not given in the question, the question

becomes more complex. In

this

situation

some information will be given

that can be used to find

out the cost per

unit.

Cost

per unit is calculated

through the following

formula:

Cost

of goods manufactured = cost

per unit

Number

of units manufactured

This

is also known as per unit

manufacturing cost. There

are two components to this

formula

which

need to be determined before its application.

1.

Cost of goods

manufactured

2.

Number of units

manufactured

Cost

of goods manufactured is calculated in

the way as we have already

discussed. Where as

number

of units manufactured will be obtained

through the following

working:

Units

sold

****

Add

Units closing finished goods

inventory

****

Less

Units opening finished goods

inventory

****

Units

manufactured

****

This

can also be understood

through the following

algebraic manner:

36

Cost

& Management Accounting

(MGT-402)

VU

Opening

finished goods units + Units

produced

Closing finished goods units = Units

sold

Units

produced =

Units sold + Closing finished goods

units - Opening finished goods

units

PRACTICE

QUESTIONS

Q.

1

The

information relating to cost department

of BETA Corporation is as

follows

Inventory

Jan

1

Dec

31

Material

34,000

49,000

Work

in process

82,000

42,000

Finish

goods

48,000

?

Finish

goods inventory

Jan

1

300

units

Dec

31

420

units

Sold

during the year

3,380

units at Rs. 220 per

unit.

Rupees

Material

Purchased

360,000

Conversion

cost

214,400

Freight

In

8,600

Purchase

discount

8,000

Opening

material inventory

34,000

Closing

material inventory

49,000

Prepare

Cost of Goods Sold Statement

from the above

information

Solution

Rupees

Direct

material opening inventory

34,000

Add

Net purchases

Material

Purchased

360,000

Add

Freight Inward

8,600

Less

Purchase discount

8,000

360,600

Material

available for use

394,600

Less

raw material closing stock

49,000

Direct

Material consumed

345,600

Add

Conversion cost

214,400

Total

factory cost

560,000

Add

Opening Work in process

inventory

82,000

Cost

of goods to be manufactured

642,000

Less

Closing Work in process

42,000

Cost

of goods manufactured

600,000

Cost

of Goods Sold

Cost

of goods manufactured

600,000

Add

Opening finished goods

inventory

48,000

Cost

of goods to be sold

648,000

Less

Closing finish goods

(working)

63,000

Cost

of goods sold

585,000

(working)

37

Cost

& Management Accounting

(MGT-402)

VU

Units

sold

3,880

Add

Units

closing finished goods

inventory

300

Less

Units

opening finished goods

inventory

420

Units

manufactured

4,000

This

can also be understood

through the following

algebraic manner:

Opening

finished goods units + Units

produced

Closing finished goods units =

Units sold

300

+ X 420 = 3880

Units

produced =

Units sold + Closing finished goods

units - Opening finished goods

units

X

=

3,880 + 420 300 =

4,000

Cost

per unit

=

Cost

of goods manufactured

Number

of units manufactured

=

600,000

4,000

=

150

Value

of Closing Finish Goods

Inventory

Closing

finish goods = Closing finish

goods units X

Cost

Per unit

=

420 x 150

=

63,000

ASSIGNMENT

QUESTIONS

Q.

1

Following

is the information pertaining to

the production cost of

Revolving Chair Company

for

the

year ending on March 31

2006;

Direct

material consumed

440,000

Direct

labor

290,000

Indirect

labor

46,000

Light

and power

4,260

Depreciation

4,700

Repairs

to machinery

5,800

Other

factory expenses

29,000

Work

in process inventory; April 1,

2005

41,200

Finished

goods inventory; April 1,

2005

34,300

Work

in process inventory; March

31, 2006

42,500

Finished

goods inventory; March 31,

2006

31,500

During

the year 18,000 units

were completed.

Factory

overhead cost is applied @

30% of the direct labor

cost.

Required:

1.

Cost of goods manufactured

statement

2.

Cost of goods sold statement identifying

at normal and at

actual

3.

Cost per unit

4.

Amount of over or under

applied factory overhead

cost

38

Cost

& Management Accounting

(MGT-402)

VU

Q.

2

Records

of Younas Fans show the

following information for

the first quarter of the

year 2006:

Direct

material purchased

1,946,700

Direct

labor

2,125,800

Factory

overhead (40% variable and

60% fixed)

764,000

Marketing

expenses (80% fixed)

516,000

Administrative

expense (100% fixed)

461,000

Sales

(12,400 Fans)

6,634,000

Inventory

opening

Finished

goods (100 fans)

43,000

Direct

material

268,000

Inventory

closing

Finished

goods (200 fans)

not

known

Direct

material

167,000

There

was no opening and closing work in

process inventory.

Required:

1.

Number

of units manufactured during

the quarter

2.

Cost

of goods manufactured statement for

the quarter

3.

Value

of closing finished goods

inventory

4.

Income

statement for the

quarter

5.

Gross

profit per unit

6.

Net

profit per unit

7.

Gross

profit to sales ratio

8.

Cost

of goods sold to sales

ratio

9.

Fixed

production cost per

unit

10.

Variable

production cost per

unit

11.

Fixed

expenses per unit

sold

12.

Variable

expenses per unit

sold

39

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS