|

DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS |

| << DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS |

Cost

& Management Accounting

(MGT-402)

VU

MAKE

OR BUY DECISIONS

Introduction

In a

make or buy situation with

no limiting factors, the relevant

costs for the decision

are the

differential

costs between the two

options.

A

make or buy problem involves

a decision by an organization about

whether it should make

a

product/carry

out an activity with its own

internal resources, or whether it

should pay another

organization

to make the production/carry

out the activity. Examples of

make or buy decisions

would

be as follows.

a.

Whether a company should

manufacture its own components, or

buy the components

from

an outside supplier.

b.

Whether a construction company

should do some work with its

own employees, or

whether

it should subcontract the

work to another

company.

It

an organization has the

freedom of choice about

whether to make internally or

buy externally

and

has no scarce resources that

put a restriction on what it

can do itself, the relevant

costs for

the

decision will be the

differential costs between

the two options.

Example:

Make or Buy

Buster

Ltd makes four components,

W, X, Y and Z, for which

costs in the forthcoming

year are

expected

to be as follows.

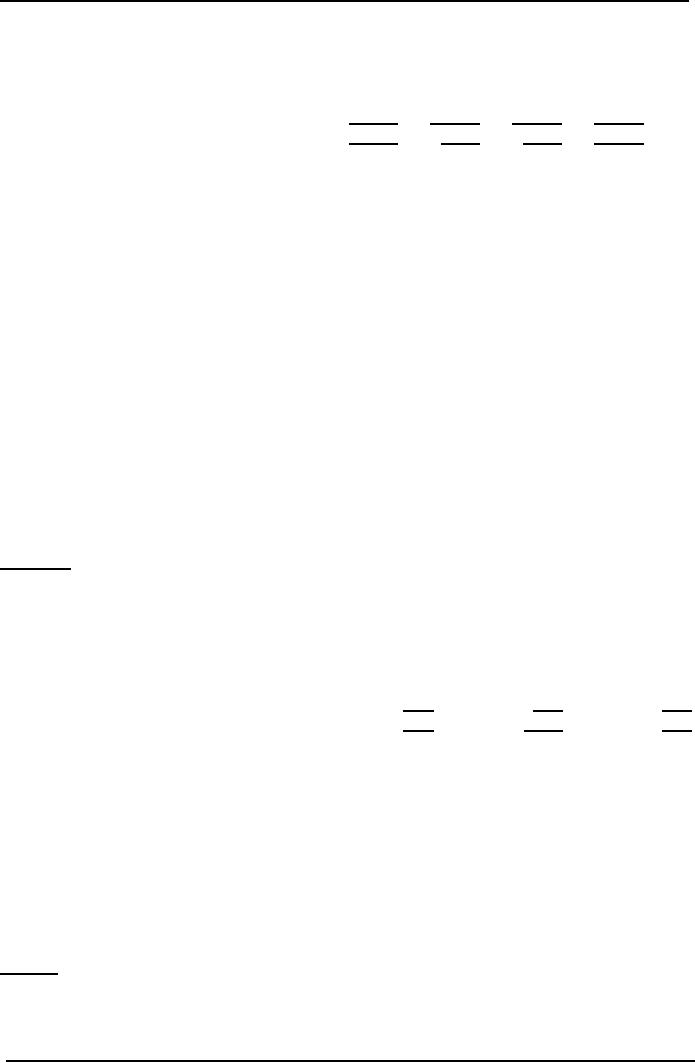

W

X

Y

Z

Production

(units)

1,000

2,000

4,000

3,000

Unit

marginal costs

Rs.

Rs.

Rs.

Rs.

Direct

materials

4

5

2

4

Direct

labor

8

9

4

6

Variable

production overheads

2

3

1

2

14

17

7

12

Directly

attributable fixed cost per

annum and committed fixed

costs are as follows:

Rs.

Incurred

as a direct consequence of making W

1,000

Incurred

as a direct consequence of making X

5,000

Incurred

as a direct consequence of making Y

6,000

Incurred

as a direct consequence of making Z

8,000

Other

fixed costs

(committed)

30,000

50,000

A

subcontractor has offered to

supply units of W, X, Y and Z

for Rs. 12, Rs.

21, Rs. 10, and

Rs. 14

respectively.

Required:

Decide

whether Buster Ltd should

make or buy the

components.

Solution:

a.

The

relevant cots are the

differential costs between making

and buying, and they

consist

of

difference in unit variable costs

plus differences in directly attributable

fixed costs.

Subcontracting

will result in some fixed

cost savings.

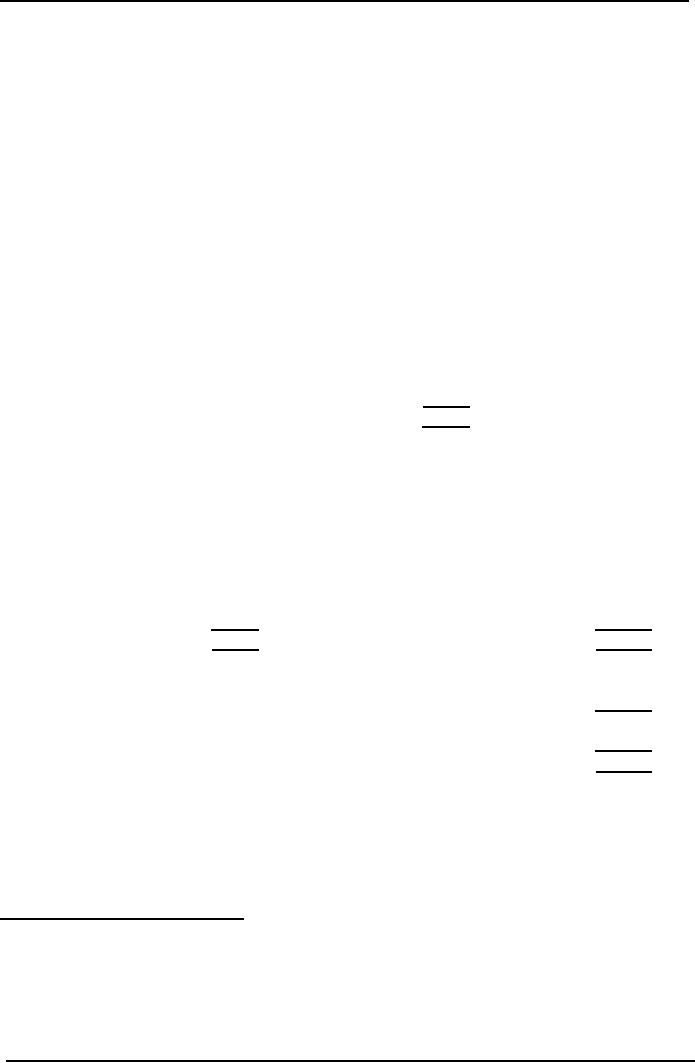

W

X

Y

Z

Rs.

Rs.

Rs.

Rs.

Unit

variable cost of making

14

17

7

12

Unit

variable cost of

buying

12

21

10

14

(2)

4

3

2

W

X

Y

Z

243

Cost

& Management Accounting

(MGT-402)

VU

Annual

requirements (units)

1,000

2,000

4,000

3,000

Rs.

Rs.

Rs.

Rs.

Extra

variable cost of buying (per

annum)

(2,000)

8,000

12,000

6,000

Fixed

costs saved by buying

(1,000)

(5,000)

(6,000)

(8,000)

Extra

total cost of buying

(3,000)

3,000

6,000

(2,000)

b.

The

company would save Rs.

3,000 pa by subcontracting component W

(where the purchase

cost

would be less than the

marginal cost per unit to

make internally) and would

save Rs.

2,000

pa by subcontracting component Z (because

of the savings in fixed

costs of Rs. 8,000).

c.

In

this example, relevant costs

are the variable cots

in-house manufacture the

variable costs

of

subcontracted units, and the

saving in fixed

costs.

Other

factors to consider in the make or

buy decision.

a.

If

components W and Z are subcontracted,

how will the company

most profitably use

the

spare

capacity? Would the company's

workforce resent the loss of

work to an outside

subcontractor?

b.

Would

the subcontractor be reliable

with delivery times, and

would he supply

components

of

the same quality as those

manufactured internally?

c.

Does

the company wish to be

flexible and maintain better

control over operations by

making

everything itself?

d.

Are

the estimates of fixed cost

savings reliable? In the

case of Product W, buying is

clearly

cheaper

than making in-house. In the

case of product Z, the

decision to buy rather

than

make

would only be financially beneficial if

the fixed cost savings of

Rs. 8,000 could

really

be

`delivered' by management.

Question

B

Limited makes three

components S, T and W. The

following costs have been

recorded.

Components

S Component T Component W

Units

Cost

Unit

Cost

Unit

Cost

Rs.

Rs.

Rs.

Variable

Cost

2.50

8.00

5.00

Fixed

Cost

2.00

8.30

3.75

Total

Cost

4.50

16.30

8.75

Another

company has offered to

supply the components to BB

Limited at the

following

prices

Components

S Component T Component W

Price

each

Rs.

4

Rs.

7

Rs.

5.50

Which

component(s), if any, should BB

Limited consider buying

in?

A

Buy

in all three

components

B

Do

not buy any

C

Buy

in S and W

D

Buy in T only

Answer

BB

Limited should buy the

component if the variable

cost of making the component is

more than

the

variable cost of buying the

component.

244

Cost

& Management Accounting

(MGT-402)

VU

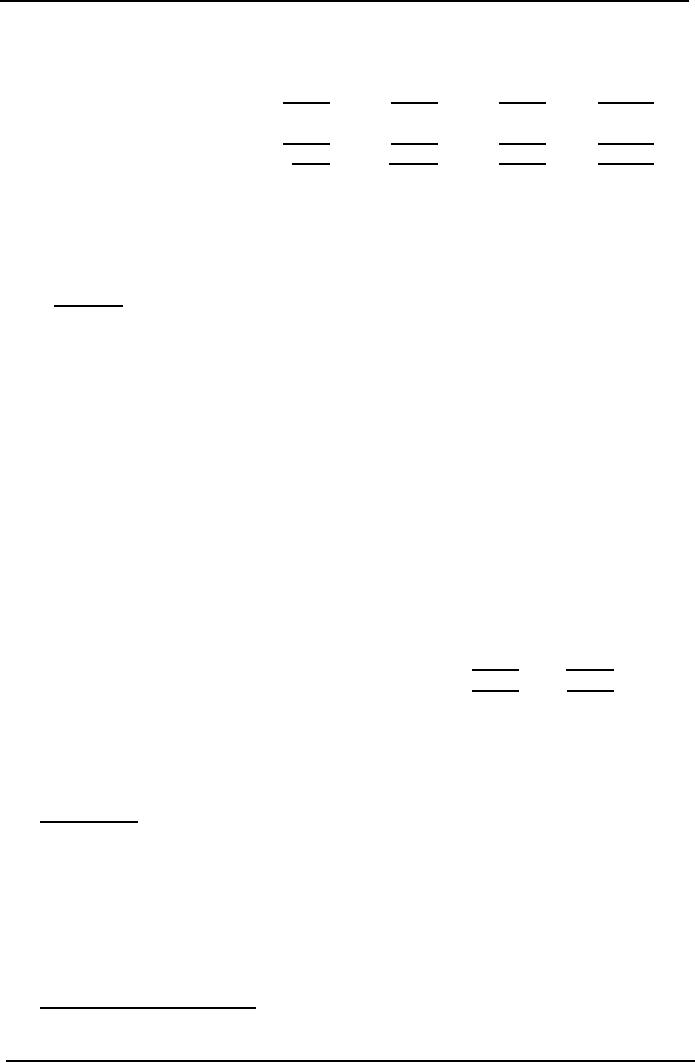

Components

S Component T Component W

Rs.

Rs.

Rs.

Variable

Cost of Making

2.50

8.00

5.00

Variable

Cost of Buying

4.00

7.00

5.50

(1.50)

1.00

(0.50)

The

variable cost of making component T is

greater than the variable

cost of buying it.

BB

Ltd should consider buying

in component T only.

The

correct answer is D.

Make

or Buy Decisions and Limiting

Factors

In

a situation where a company must

subcontract work to make up a

shortfall in its won

production

capability, its total costs are

minimized if those components/products

subcontracted

are

those with the lowest extra

variable cost of buying per

unit of limiting factor

saved by buying.

Example:

Make or Buy and Limiting

Factors

Green

Ltd manufactures two components,

the Alpha and Beta, using

the same machines for

each.

The

budget for the next year

calls for the production

and assembly of 4,000 of

each component.

The

variable production cost per

unit of the final product,

the gamma, is as

follows.

Machine

Variable

hours

cost

Rs.

1

unit of Alpha

3

20

1

unit of Beta

2

36

Assembly

20

76

Only

16,000 hours of machine time

will be available during the

year, and a sub-contactor

has

quoted

the following unit prices

for supplying components;

Alpha Rs. 29, Beta

Rs. 40. Advise

Green

Ltd.

Solution:

a.

There

is a shortfall in machine hours

available, and some products

must be sub-

contracted.

Product

Units

Machine

hours

Alpha

4,000

12,000

Beta

4,000

8,000

Required

20,000

Available

16,000

Shortfall

4,000

b.

The

assembly costs are not

relevant costs because they

are unaffected by the make

or buy

decision.

The units subcontracted should be those

which will add least to

the costs of Green

Ltd.

Since

4,000 hours of work must be

sub-contracted, the cheapest policy is to

subcontract work

which

adds the least extra costs

(the least extra variable

costs) per hour of own-time

saved.

245

Cost

& Management Accounting

(MGT-402)

VU

c.

Alpha

Beta

Rs.

Rs.

Variable

cost of making

20

36

Variable

cost of buying

29

40

Extra

variable cost of

buying

Machine

hours saved by buying

3

hours

2

hours

Extra

variable cost of buying, per

hours saved

Rs.

3

Rs.

2

It

is cheaper to buy Betas than

to buy Alphas and so the

priority for making the

components in-

house

will be in the reverse order

the preference for buying

them form a

subcontractor.

d.

Hours

per unit to Hours required in

Cumulative

Component

make

in-house

total

hours

Alpha

3

hours

12,000

12,000

Beta

2

hours

8,000

20,000

20,000

Hours

available

16,000

Shortfall

4,000

There

are enough machine hours to

make all 4,000 units of

Alpha and 2,000 units of

Beta. 4,000

hours

production of Beta must be

sub-contracted. This will be the

cheapest production

policy

available.

e.

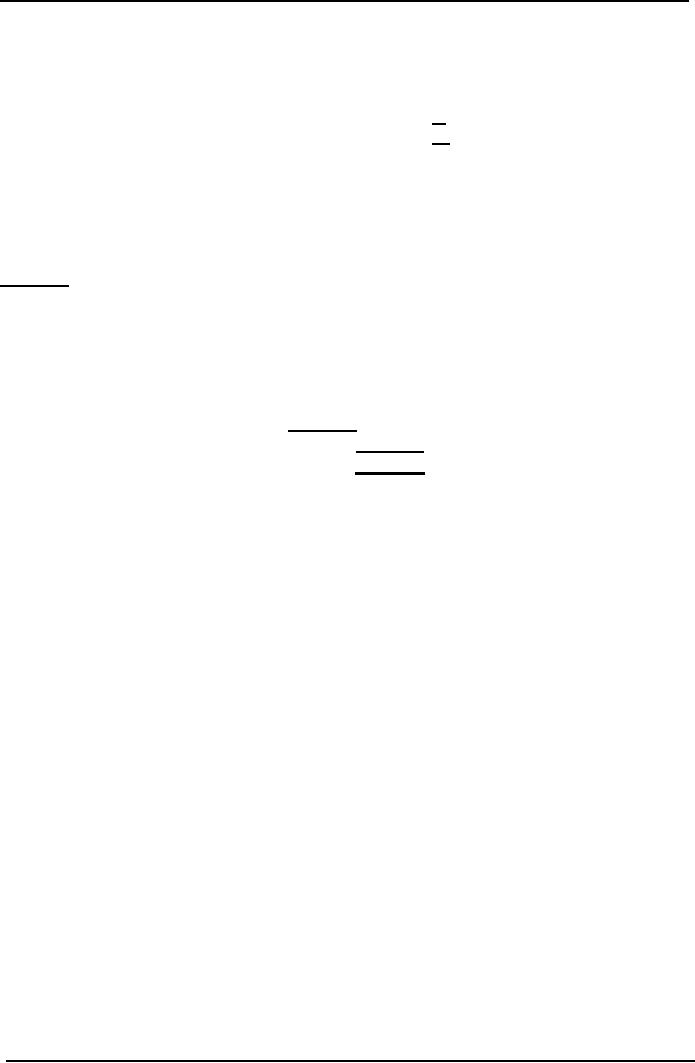

Component

Machine

Number

of

Units

variable

Total

hours

units

cost

variable

cost

Make

Rs.

Rs.

Alpha

12,000

4,000

20

80,000

Beta

(balance)

4,000

2,000

36

72,000

16,000

152,000

Buy

Hours

saved

Beta

(balance)

4,000

2,000

40

80,000

Total

variable cost of

components

232,000

Assembly

costs (4,000 x Rs.

20)

80,000

Total

variable costs

312,000

SHUT

DOWN DECISIONS

Shut

down decisions involve the

following:

�

Whether

or not to shut down a

factory, department, or product

line either because it

is

making

a loss or it is too expensive to

run.

�

If

the decision is to shut

down, whether the closure

should be permanent or

temporary.

Example:

Shut Down Decisions

Suppose

that a company manufactured

three products, Corfus,

Cretes and Zantes.

The

present

net profit from these is as

follows.

246

Cost

& Management Accounting

(MGT-402)

VU

Corfus

Cretes

Zantes

Total

Rs.

Rs.

Rs.

Rs.

Sales

50,000

40,000

60,000

150,000

Variable

costs

30,000

25,000

35,000

90,000

Contribution

20,000

15,000

25,000

60,000

Fixed

costs

17,000

18,000

20,000

55,000

Profit/loss

3,000

(3,000)

5,000

5,000

The

company is concerned about its poor

profit performance, and is considering

whether

or

not to cease selling Cretes. It is

felt that selling prices

cannot be raised or lowered

without

adversely affecting net income.

Rs. 5,000 of the fixed

costs of Cretes are

attributable

fixed costs which would be

saved if production ceased.

All other fixed

costs

would

remain the same.

Solution:

a.

By stopping production of Cretes,

the consequences would be a

Rs. 10,000 fall in

profits.

Rs.

Loss

of contribution

(15,000)

Savings

in fixed costs

5,000

Incremental

loss

(10,000)

b.

Suppose, however, it were

possible to use the

resources realized by

stopping

production

of Cretes and switch to

producing a new item,

Rhodes, which would

sell

for

Rs. 50,000 and incur

variable costs of s. 30,000

and extra direct fixed costs of

Rs.

6,000.

A new decision is now

required.

Cretes

Rhodes

Rs.

Rs.

Sales

40,000

50,000

Less

variable costs

25,000

30,000

Contribution

15,000

20,000

Less

direct fixed costs

5,000

6,000

Contribution

to shared fixed costs and

profit

10,000

14,000

It

would be more profitable to

shut down production of

Cretes and switch resources

to

making

Rhodes, in order to boost contribution to

shared fixed costs and

profit from

Rs.

10,000 (from Cretes) to Rs.

14,000 (from Rhodes).

ONE-OFF

CONTRACTS

i.

Introduction

The

decision to accept or reject a contract

should be made on the basis

of whether or not the

contract

increases contribution and

profit.

This

type of decision-making situation will

concern a contract which

would utilize an

organization's

spare capacity but which

would have to be accepted at a

price lower than

that

normally

required by the organization. In general

you can assume that a

contract will

probably

be accepted if it increases contribution

and hence profit, and

rejected it reduces

contribution

(and hence profit). Let us

consider an example,

ii.

Example:

One-off Contracts

Belt

and Braces Ltd makes a

single product which sells

for Rs. 20. It has a

full cost of Rs. 15

which

is made up as follows:

247

Cost

& Management Accounting

(MGT-402)

VU

Rs.

Direct

Material

4

Direct

Labor

6

Variable

Overhead

2

General

Fixed Overhead

3

15

The

labor force is currently

working at 90% of capacity

and so there is a spare

capacity for 2,000

units.

A customer has approached

the company with a request

for the manufacture of a

special

order

of 2,000 units for which he

is willing pay Rs. 25,000.

Assess whether the contract

should be

accepted.

Solution:

Rs.

Rs.

Value

of order

25,000

Cost

of order

Direct

materials (Rs. 4 x

2,000)

8,000

Direct

labor (Rs. 6 x 2,000)

12,000

Variable

overhead (Rs. 2 x

2,000)

4,000

Relevant

cost of order

24,000

Profit

form order acceptance

1,000

Fixed

costs will be incurred

regardless of whether the

contract is accepted and so

are not relevant

to

the decision. The contract

should be accepted since it

increases contribution to profit by

Rs.

1,000.

Other

factors to consider in the one-off contract

decision.

a.

The

acceptance of the contract at a

lower price may lead

other customers to demand

lower

prices

as well.

b.

There

may be more profitable ways

of using the spare

capacity.

c.

Accepting

the contract may lock up

capacity that could be used

for future full-price

business.

d.

Fixed costs may, in

fact, if the contract is

accepted.

-----------------THE

END-------------

248

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS