|

Cost

& Management Accounting

(MGT-402)

VU

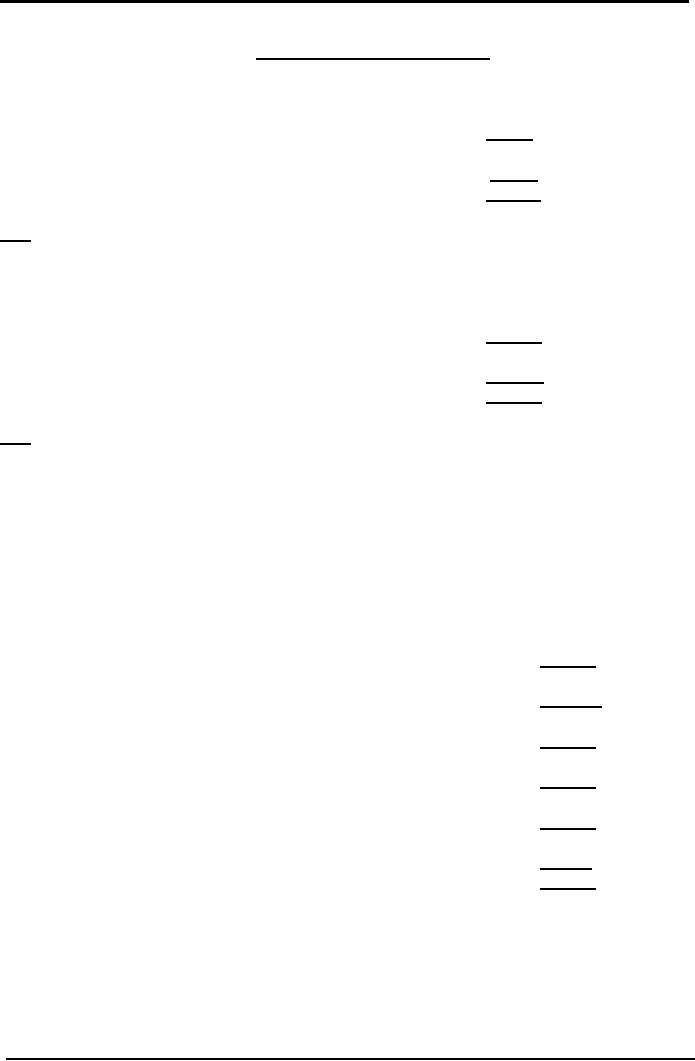

LESSON#

4

FINANCIAL

STATEMENTS

Cost

of Goods Manufactured

Rupees

Total

factory Cost

230,000

Add

Opening Work in process

inventory

30,000

Cost

of goods to be manufactured

260,000

Less

Closing Work in process

50,000

Cost

of goods manufactured

210,000

Note:

Cost of the work that was in process in

the last year (Closing WIP

inventory) becomes Opening

WIP

inventory

of the current year.

Cost

of Goods Sold

Cost

of goods manufactured

210,000

Add

Opening finished goods

inventory

100,000

Cost

of goods to be sold

310,000

Less

Closing finished goods

(10,000)

Cost

of goods sold

300,000

Note:

Cost of the goods that were in process in the

last year (closing finished goods

inventory) becomes opening

finished

goods inventory of the current

year.

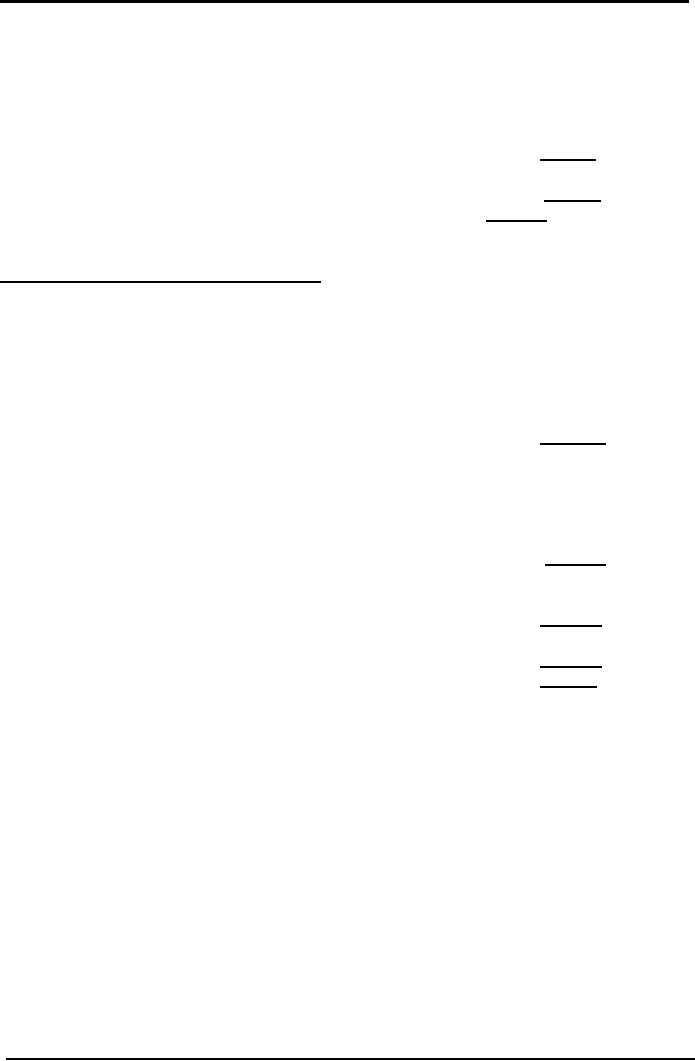

Standard

format of the cost of goods

manufactured and sold statement:

Entity

Name

Cost

of Goods manufactured statement

for

the year ended_______

Rupees

Direct

Material Consumed

Opening

inventory

10,000

Add

Net Purchases

100,000

Material

available for use

110,000

Less

Closing inventory

(20,000)

Direct

Material used

90,000

Add

Direct labor

60,000

Prime

cost

150,000

Add

Factory overhead Cost

80,000

Total

factory cost

230,000

Add

Opening Work in

process

30,000

Cost

of good to be manufactured

260,000

Less

Closing Work in process

50,000

Cost

of good manufactured

210,000

22

Cost

& Management Accounting

(MGT-402)

VU

Entity

Name

Cost

of goods sold statement

For

the year ended_______

Rupees

Add

Opening finish goods

100,000

Cost

of goods manufactured

210,000

Cost

of good to be sold

310,000

Less

closing finish goods

10,000

Cost

of good to sold

300,000

Standard

format of the Income

Statement:

Entity

Name

Income

Statement

For

the year ended_______

Rupees

Sales

600,000

Less

Cost of goods

sold

(300,000)

Gross

profit

300,000

Less

Operating expenses

Selling

and marketing

50,000

Distribution

30,000

Administrative

20,000

(100,000)

Operating

profit

200,000

Less

Financial Expenses

Interest

on loan

(50,000)

Profit

before tax

150,000

Less

Income Tax

(60,000)

Net

profit

90,000

Applied

Factory Overhead Cost

Often

at the end of the accounting

period total FOH cost is not

known in actual because of

the

specified

nature of expenses in the

list of indirect

cost.

For

this reason, the third

element of cost "FOH" is included in the

total factory cost based

on

predetermined

FOH cost rate; such cost is

known as Applied FOH

Cost.

Predetermined

(FOH cost) rate

Factory

overhead rate is determined on the

basis of normal activity

level. Normal activity

level

means

the capacity level at which

the business can operate in

normal circumstances.

Capacity

level

can be in terms of:

Direct

Labor Cost

Direct

Material Cost

Direct

Labor Hours

Machine

Hours

Prime

Cost

23

Cost

& Management Accounting

(MGT-402)

VU

Selection

of capacity level depends

upon the nature of the

business, if its inclination is

towards

machine

hours then machine hours

will be taken as a base as capacity

level. It is also known

as

overhead

absorption rate

(OAR).

Calculations

pertaining to the overhead application

rate will not be discussed

here, in this

chapter

we will use pre-calculated overhead

application rate.

Details

of the topic will be covered

in a LESSON relating to Factory Over

Head.

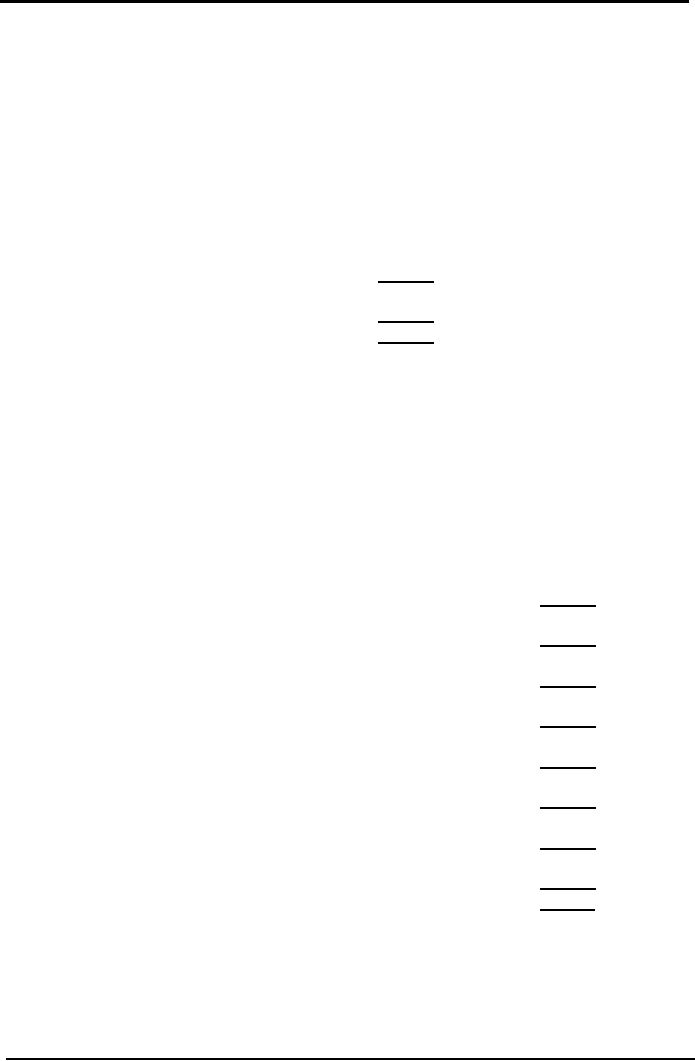

Total

Factory Cost based on Applied FOH

Cost

Assume

applied factory overhead rate is

150% of direct labor

cost.

Rupees

Direct

material Consumed

90,000

Add

Direct labor

60,000

Prime

Cost

150,000

FOH

Applied (150%

of Rs. 60,000)

90,000

Total

Factory Cost

240,000

The

cost of goods sold in which

factory overhead cost is

included on the basis

of

predetermined

rate is termed as "Cost of Goods

Sold at Normal"

Entity

Name

Cost

of Goods Sold statement

At

normal

for

the year ended_______

Rupees

Direct

Material Consumed

Opening

inventory

10,000

Add

Net Purchases

100,000

Material

available for use

110,000

Less

Closing inventory

20,000

Direct

Material used

90,000

Add

Direct labor

60,000

Prime

cost

150,000

Add

Factory overhead Cost

(60,000

x 150%)

90,000

Total

factory cost

240,000

Add

Opening Work in

process

30,000

Cost

of good to be manufactured

270,000

Less

Closing Work in process

50,000

Cost

of good manufactured

220,000

Add

Opening finish goods

100,000

Cost

of good to be sold

320,000

Less

closing finish goods

10,000

Cost

of good to sold at

normal

310,000

Variance

Difference

between the actual cost

and applied cost is

calculated by subtracting actual

cost from

the

applied cost. Where the

applied cost is greater than

the actual cost it is favorable

variance,

but

where the applied cost is

lesser than the actual

cost it is unfavorable

variance.

24

Cost

& Management Accounting

(MGT-402)

VU

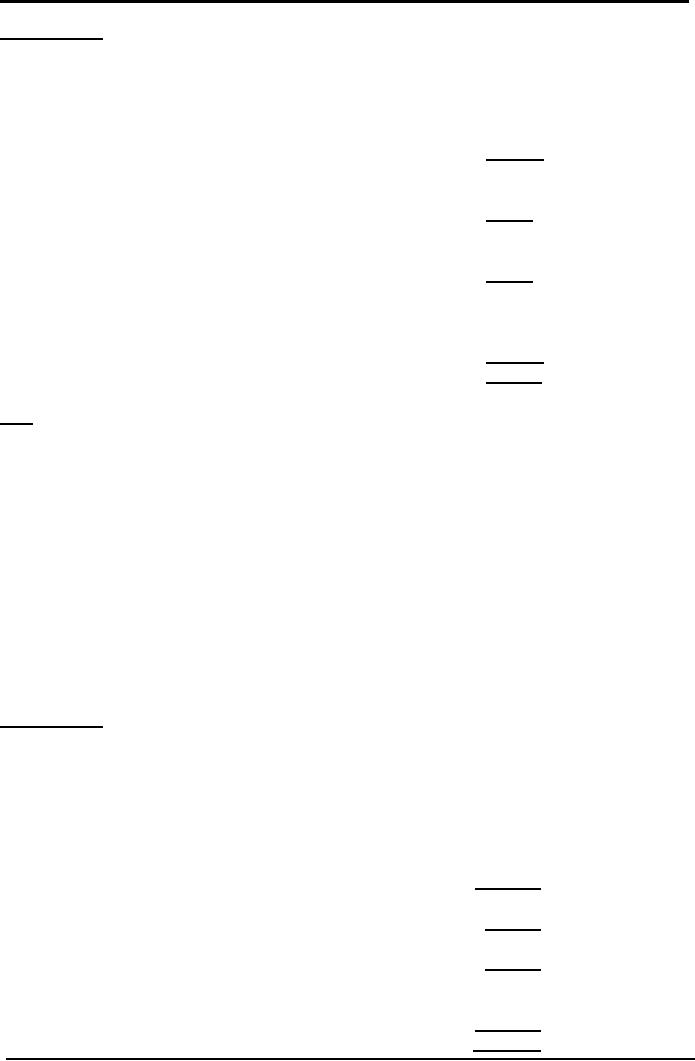

Under/Over

applied FOH cost

Applied

FOH Cost

90,000

Less

Actual

FOH Cost

80,000

Over

applied FOH cost

10,000

Adjustment

of Under/Over applied FOH cost

Such

variance should be eliminated form

the financial statements

through adjustment.

Under/Over

applied FOH cost can be

adjusted in following costs/profit

figures:

1.

Entire Production

a)

work

in process inventory

b)

finished

goods inventory

c)

cost

of goods sold

2.

Cost of Goods

Sold

3.

Net profit

Adjustment

in the Entire Production

Work

in process Cost

(50,000

- 1,350)

48,650

Finished

goods Cost

(10,000

- 270)

9,730

Cost

of goods sold

(310,000

- 8,380)

301,620

The

concept of addition to and subtraction

from the relevant amount is

that because there is a

favorable

variance i.e. the applied

factory overhead cost is

more than the actual

cost therefore,

to

make correction in the

information containing cost

items (entire production)

there must be

subtraction

equal to the amount which

was over added.

Obviously

the difference will be added

if there is an unfavorable variance

i.e. the applied

factory

overhead

cost is less than the

actual cost. This is so

because the cost charged is

lesser than the

actual,

and to make the cost

items (entire production)

equal to their actual figures we

need

inclusion

of further amount.

Entire

production includes three items;

work in process inventory,

finished goods

inventory,

and

cost of goods sold. These

three items are the

three parts in which total

cost of production

(either

finished or semi finished)

has been divided.

Adjustment

in the Cost of Goods

Sold

Some

times it is required to adjust all of the

variance in the cost of

goods sold, here the

same

principle

of addition or subtraction will be

followed which has already

been discussed in the

above

paragraphs. This is so because

the cost of goods sold is

also a cost item. The

amount of

cost

of goods sold before adjustment is known

as cost of goods sold at normal

and after

adjustment

is known cost of goods sold at

actual.

Cost

of goods sold at normal

310,000

Add

over applied FOH

(10,000)

Cost

of goods sold at actual

300,000

25

Cost

& Management Accounting

(MGT-402)

VU

Adjustment

in the Income Statement

Entity

Name

Income

Statement

Based

on applied FOH cost

For

the year ended_______

Rupees

Sales

600,000

Less

Cost of goods sold (at

normal)

(310,000)

Gross

profit

290,000

Less

Operating expenses

Selling

and marketing

50,000

Distribution

30,000

Administrative

20,000

(100,000)

Operating

profit

190,000

Less

Financial Expenses

Interest

on loan

(50,000)

Profit

before tax

140,000

Less

Income Tax

(60,000)

Net

profit

80,000

Add

over-applied FOH cost

10,000

Net

profit

90,000

Principle

of addition or subtraction of factory

overhead variance is reverse in income

statement.

This

is so because here the

amount of net profit is

adjusted for the variances,

which is income in

nature.

Over-application

of factory overhead cost

causes an increase in the

cost of goods sold

which

reduces

the gross profit and

also the net profit, so to

bring the amount of net

profit at its actual

amount

we need to add over-applied factory

overhead cost in the net

profit. Obviously in case

of

under

application of factory over head

cost the variance will be

subtracted from the amount of

net

profit.

PRACTICE

QUESTIONS

Following

data relates to Qasim &Co,

Q.

1

Rupees

Opening

stock of raw material

52,000

Opening

stock of work in process

46,000

Purchases

of raw material

255,000

Direct

labor cost

85,000

Factory

overheads

76,000

Closing

stock of raw material

61,000

Closing

stock of work in process

36,000

Required:

Prepare

Cost of Goods Manufactured

Statement.

26

Cost

& Management Accounting

(MGT-402)

VU

SOLUTION:

Qasim

& Co.

Cost

of goods manufactured statement

Rupees

Opening

stock of raw material

52,000

Add:

Purchases of raw material

255,000

Less:

Closing stock of raw material

(61,000)

Cost

of raw material consumed

246,000

Add:

Direct labor cost

85,000

Prime

cost/Direct cost

331,000

Add:

Factory overheads

76,000

Manufacturing

cost/Factory cost

407,000

Add:

Opening stock of work in

process

46,000

Less:

Closing stock of work in process

(36,000)

Cost

of goods manufactured

417,000

Q.

4

Ayesha

Products Limited purchased materials of

Rs. 440,000 and incurred

direct labor of

Rs.

320,000 during the year

ended June 30, 2006.

Factory overheads for the

year were Rs.280,000.

The

inventory balances are as

follows:

July

1, 2005

June

30, 2006

Rupees

Rupees

Finished

goods

90,000

105,000

Work

in process

121,000

110,000

Materials

100,000

105,000

Required:

1)

Cost

Of Goods Manufactured

Statement.

2)

Cost

Of Goods Sold

Statement.

SOLUTION:

1)

Ayesha

Products Limited

Cost

of goods manufactured statement

For

the year ended June 30,

2006

Materials

inventory, July 1

2005

100,000

Add:

purchases of materials

440,000

Less:

materials inventory, June

30, 2006

(105,000)

Cost

of materials consumed

435,000

Add:

direct labor

320,000

Prime

cost/Direct cost

755,000

Add:

factory overheads

280,000

Manufacturing

cost/Factory cost

1,035,000

Add:

Inventory of work in process,

July 1, 2005

121,000

Less:

Inventory of work in process,

June 30, 2006

(110,000)

Cost

of goods manufactured

1,046,000

27

Cost

& Management Accounting

(MGT-402)

VU

2)

Ayesha

Products Limited

Cost

of goods sold statement

For

the year ended June 30,

2006

Cost

of goods manufactured

1,046,000

Add:

inventory of finished goods,

July 1, 2005

90,000

Less:

inventory of finished goods,

June 30, 2006

(105,000)

Cost

of goods sold

1,031,000

Q.

5

FNS

manufacturing company submits the

following information on June

30, 2005.

Sales

for the year

450,000

Raw

material inventory, July 1,

2004

15,000

Finished

goods inventory, July 1,

2004

70,000

Purchases

120,000

Direct

labor

65,000

Power,

heat and light

2,500

Indirect

material purchased and consumed

4,500

Administrative

expenses

21,000

Depreciation

of plant

14,000

Selling

expenses

25,000

Depreciation

of building

7,000

Bad

debts

1,500

Indirect

labor

3,000

Other

manufacturing expenses

10,000

Work

in process, July 1,

2004

14,000

Work

in process, June 30,

2005

19,000

Raw

materials inventory, June

30, 2005

21,000

Finished

goods inventory, June 30,

2005

60,000

Applied

factory head rate is 20% of

the prime cost

Required

1)

Cost

Of Goods Manufactured

Statement.

2)

Cost

Of Goods Sold Statement at

normal and at actual

3)

Income

statement.

SOLUTION:

FNS

manufacturing company

Cost

of goods manufactured statement

For

the year ended June 30,

2005

Raw

materials inventory, July 1

2004

15,000

Add:

purchases of materials

120,000

Less:

materials inventory, June

30, 2005

(21,000)

Cost

of materials consumed

114,000

Add:

direct labor

65,000

Prime

cost/Direct cost

179,000

Factory

overhead applied

(179,000x20%)

35,800

Manufacturing

cost/Factory cost

214,800

Add:

Inventory of work in process,

July 1, 2005

14,000

28

Cost

& Management Accounting

(MGT-402)

VU

Less:

Inventory of work in process,

June 30, 2006

(19,000)

Cost

of goods manufactured

209,800

2)

FNS

manufacturing company

Cost

of goods sold statement

For

the year ended June 30,

2006

Cost

of goods manufactured

209,800

Add:

inventory of finished goods,

July 1, 2004

70,000

Less:

inventory of finished goods,

June 30, 2005

(60,000)

Cost

of goods sold at normal

219,800

Less:

over-applied factory overhead

(working)

1,800

Cost

of goods sold at actual

218,000

3)

FNS

manufacturing company

Income

statement

For

the year ended June 30,

2006

Sales

450,000

Less:

cost of goods sold

(218,000)

Gross

profit

232,000

Less:

operating expenses

Bad

debts

1,500

Depreciation

of building

7,000

Selling

expenses

25,000

Administrative

expenses

21,000

(54,500)

Net

profit

177,500

Working

Applied

factory overhead cost

35,800

Actual

factory overheads

Power,

heat and light

2,500

Indirect

material purchased and consumed

4,500

Depreciation

of plant

14,000

Indirect

Labor

3,000

34,000

Other

manufacturing expenses

10,000

Over-applied

factory overhead

1,800

29

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS