|

Complex Cash Budget & Flexible Budget:Comparing actual with original budget |

| << TYPES OF BUDGET:Format of Cash Budget, |

| FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting >> |

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

39

Complex

Cash Budget & Flexible

Budget

The

cash budget is a summary of the

firm's expected cash inflows

and outflows over a

particular

period

of time. In other words,

cash budget involves a projection of

future cash receipts

and

cash

disbursements over various time

intervals.

A

cash budget helps the

management in:

�

Determining

the future cash needs of

the firm

�

Planning

for financing of those

needs

�

Exercising

control over cash and

liquidity of the

firm.

The

overall objective of a cash budget is to

enable the firm to meet

all its commitments in

time

and

at the same time prevent

accumulation at any lime of unnecessary

large cash balances

with

it:

Practice

Question---Complex Cash Budget

Data

relating to the months of February to

June is available

Prepare

the cash budget for the

month of April to

June

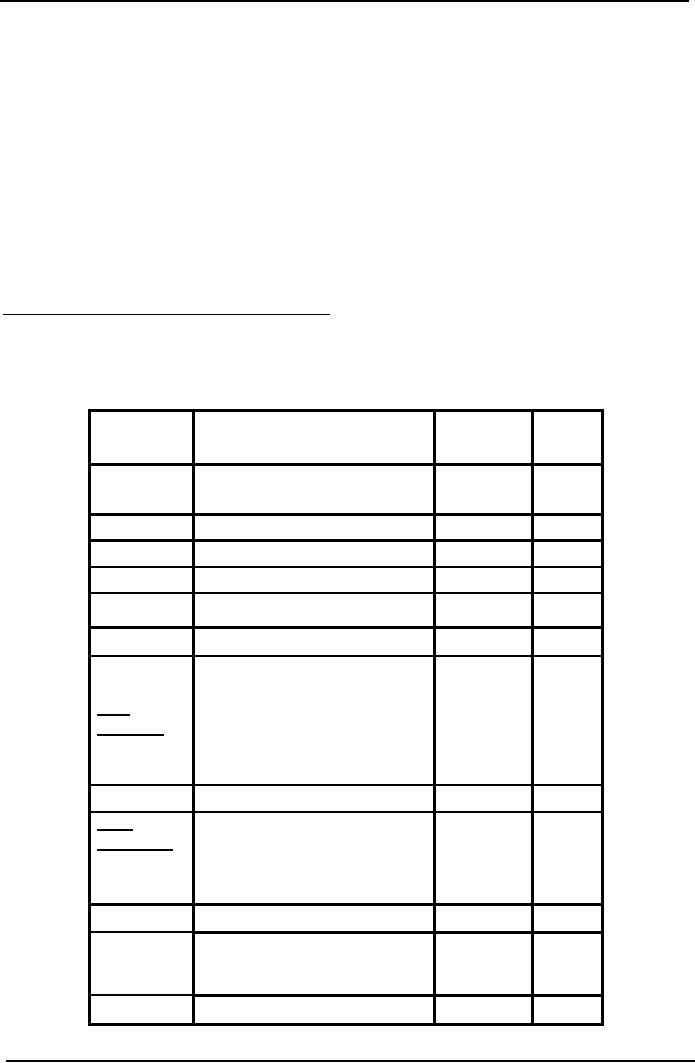

Months

Sales

Purchases

Wages

February

18,000

12,480

1,200

March

19,200

14,400

1,400

April

10,800

24,300

1,100

May

17,400

24,600

1,000

June

12,500

26,800

1,500

Particulars

April

May

June

Opening

2,500

2,480

0

Balance

Add

15,480

15,960

13,460

Receipts

Sales

Total

(1)

17,980

18,440

13,460

Less

14,400

24,300

24,600

Payments

Purchases

1,100

1,000

1,500

Wages

Total

(2)

-15,500

-25,300

-26,100

Closing

2,480

-6,680

-12,640

Balance

(1-

2)

Bank

O/D

0

6,860

12,640

Total

Bank O/D = 6,860 + 12,640 =

19,500

216

Cost

& Management Accounting

(MGT-402)

VU

Flexible

budget:

The

Flexible Budget is designed to change in

accordance with the level of

activity attained.

Thus,

when

a budget is prepared in such a manner

that the budgeted cost

for any level of activity

is

available,

it is termed as flexible budget. Such a budget is

prepared after considering the

fixed and

variable

elements of cost and the

changes that may be expected

for each item at various

levels of

operations.

Flexible budgeting is desirable in the

following cases:

�

Where,

because of the nature of

business, sales are unpredictable,

e.g. in luxury or

semi-luxury

trades.

�

Where

the venture is a new and,

therefore, it is difficult to foresee

the demand e.g.,

novelties

and

fashion products.

�

Where

business is subject to the vagaries of

nature, such as soft

drinks,

�

Where

progress depends on adequate

supply of labor and the

business is in an area

which

suffering

forms shortage of

labor.

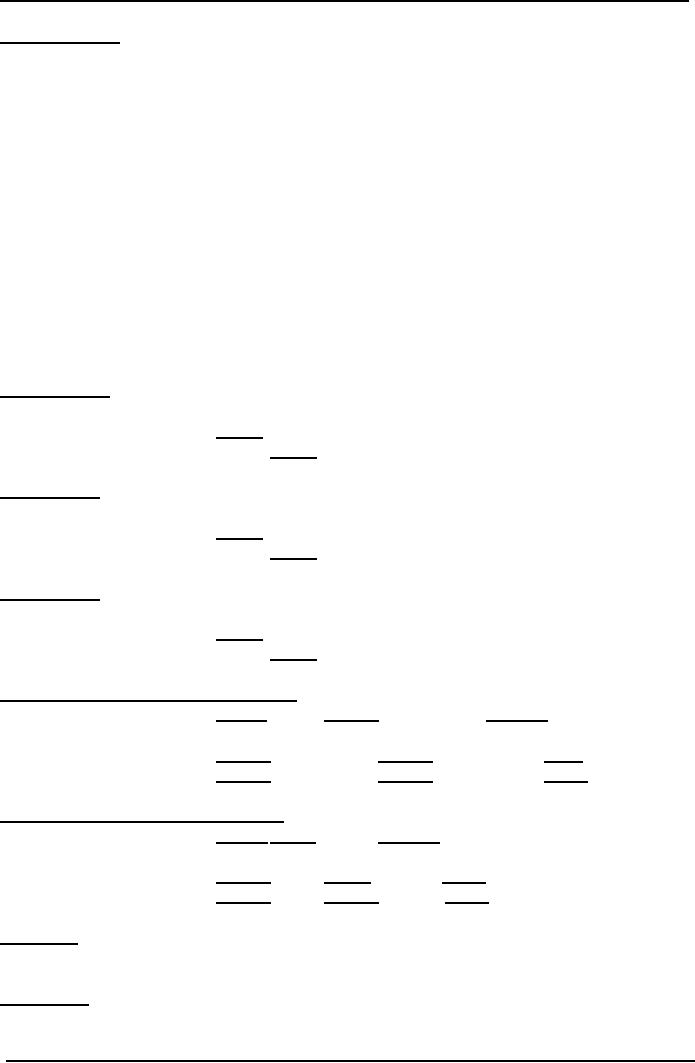

Normal

capacity level 2,000

units

Original

budget

Fixed

cost

10,000

Variable

cost

40,000

50,000

Actual

capacity attained 1,500

units

Flexed

budget

Fixed

cost

10,000

Variable

cost

30,000

40,000

Cost

actually incurred

Flexed

budget

Fixed

cost

11,000

Variable

cost

33,000

44,000

Comparing

actual with original budget

Actual

Budget

Variance

Fixed

cost

11,000

10,000

(1,000)

UF

Variable

cost

33,000

40,000

7,000

F

44,000

50,000

6,000

F

Comparing

actual with flexed budget

Flexed

Actual

Variance

Fixed

cost

10,000

11,000

(1,000)

UF

Variable

cost

30,000

33,000

(3,000)

F

40,000

44,000

4,000

UF

Production

cost at normal

capacity:

Direct

cost

Direct

material

Rs.

30,000

Direct

labor

20,000

Indirect

cost

Indirect

material (Variable)

800

Other

variable production OH

cost

4,200

217

Cost

& Management Accounting

(MGT-402)

VU

Deprecation

(Fixed)

10,000

Other

fixed OH cost

5,000

Total

budgeted cost

70,000

Normal

capacity at 20,000

units

Direct

material

Rs.

26,900

Direct

labor

19,540

Indirect

material (Variable)

1,000

Other

variable production OH cost

3,660

Deprecation

(Fixed)

10,000

Other

fixed OH cost

5,400

Total

budgeted cost

66,500

Capacity

attained 17,600 units

Prepare

Flex budget at 16,000, 20,000

and 24,000 units

218

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS