|

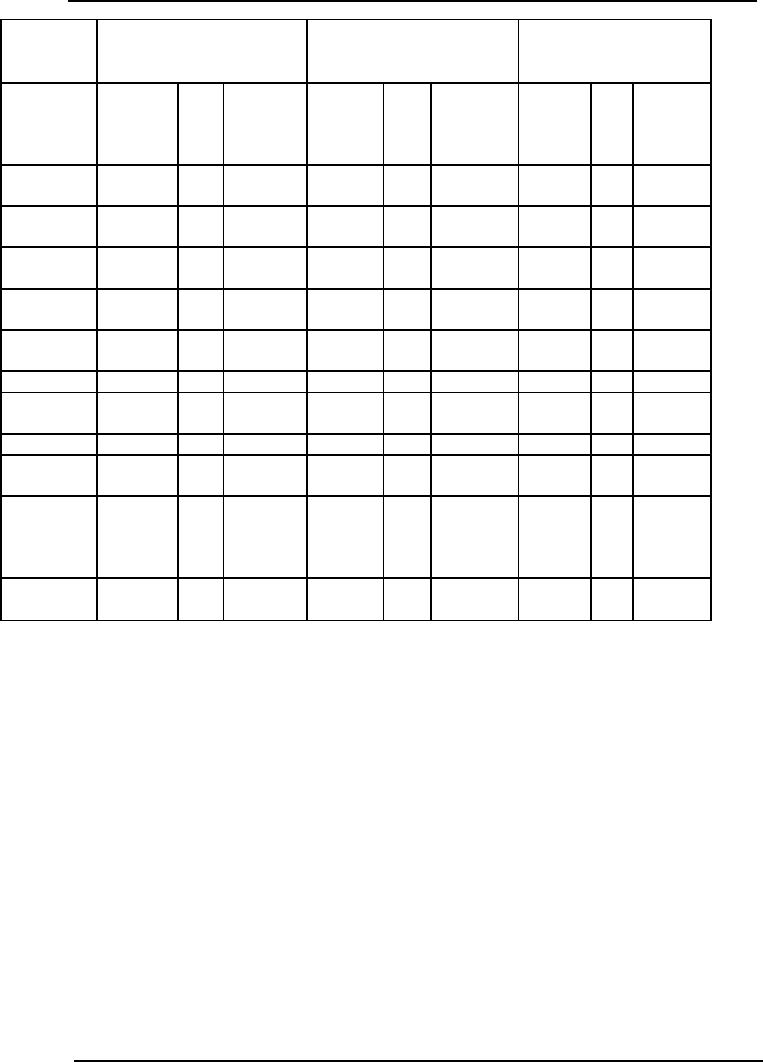

Production & Sales Budget:Illustration 1, Production budget |

| << Production & Sales Budget:Rolling budget, Sales budget |

| FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity >> |

Cost

& Management Accounting

(MGT-402)

VU

Division

Mar

Jan

Feb

Product

Qty.

Price

Value

Qty.

Pr

Value

Qty.

Pric

Value

(Units)

(Rs.

(Rs.)

(Units)

ice

(Rs.)

(Units)

e

(Rs.)

)

(Rs.)

(Rs.

)

Town

A

54,000

16

8,64,000

50,000

16

8,00,000

62,500

16

10,00,00

X

0

37,500

16

3,75,000

35,000

10

3,50,000

37,500

10

3,75,000

Y

Total

91,500

----

12,2,9000

85,000

----

11,50,000

----

13,75,00

0

Banglore

12,500

10

2,00,000

----

-----

16

X

Town B

61,500

10

6,15,000

55,000

10

5,50,000

62,500

10

6,25,000

Y

Total

74,500

---

8,15,000

55,000

5,50,000

62,500

----

6,25,000

Hyderabad

80,000

16

12,80,000

75,000

16

12,00,000

77,500

16

12,40,00

IX

0

II

Y

9,000

10

90,000

----

----

10

Total

89,000

----

13,80,000

75,000

12,00,000

----

12,40,00

0

Product

1,46,500

16

23,44,000

1,25,000

16

20,00,000

1,40,00

16

22,40,00

X

1,08,500

10

10,80,000

90,000

10

9,00,000

0

10

0

Product

II

1,00,00

10,00,00

Y

0

0

Total

2,54,500

----

34,24,000

2,15,000

29,00,000

2,40,00

----

32,40,00

0

0

Production

budget

This

budget provides an estimate of the total

volume of production distributed

product-wise with

the

scheduling of operations by days, weeks

and months and a forecast of

the inventory of

finished

products.

Generally, the production budget is

based on the sales -budget.

The responsibility for

the

overall

production budget lies with

Works Manager and that of

departmental production budgets

with

departmental works management Production

budget may be expressed in physical or

financial

terms

or both in relation to production.

The production budgets

attempt to answer questions

like:

(i)

What

is to be produced?

(ii)

When

it is to be produced?

(iii)

How

it is to be produced?

(iv)

Where

it is to be produced?

The

production budget envisages the

production program for achieving the

sales target it serves

as

a

basis Job preparation of related cost-

budgets, e.g., materials

cost budget, labor cost budget,

etc.

It

easily facilities the preparation of a

cash budget. The production budget is

prepared after taking

into

consideration several factors like:

(i)

Inventory

policies. (II)

Sales

requirements, (iii)

Production

stability, (iv)

Plant

capacity, (v)

Availability

of materials and labor,

(vi)

Time

taken in

production

process, etc.

207

Cost

& Management Accounting

(MGT-402)

VU

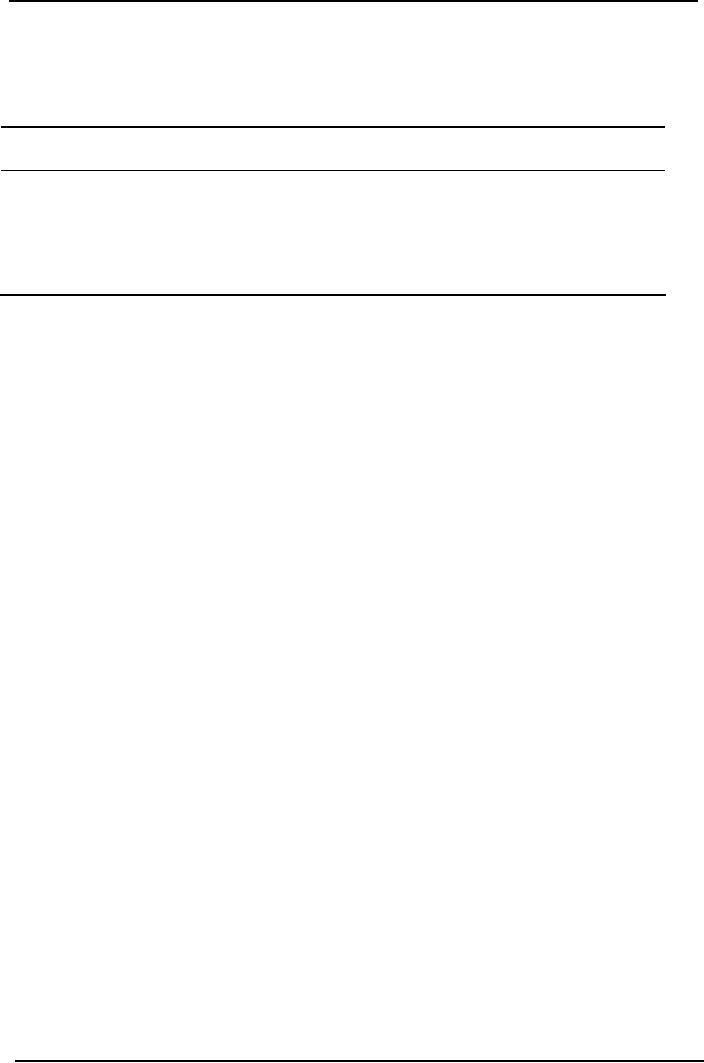

Activity

2

From

the following details of

Mysore Cement Works Limited, complete

the production budget

for

the

three-month period ending March 31,

19x6 (Production budget for

product P has already

been

worked

out.

Estimated

stock

Estimated

sale during

Desired

closing stock

Type

of product

on

Jan 1, 19x6

Jan-March

1986

on

March 31, 19x6

(Units)

(Units)

(Units)

1,000

5,000

1,500

P

Q

1,500

7,500

2,500

R

2,000

6,500

1,500

S

1,500

6,000

1,000

208

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS