|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

32

BREAKEVEN

ANALYSIS CHARTS AND

GRAPHS

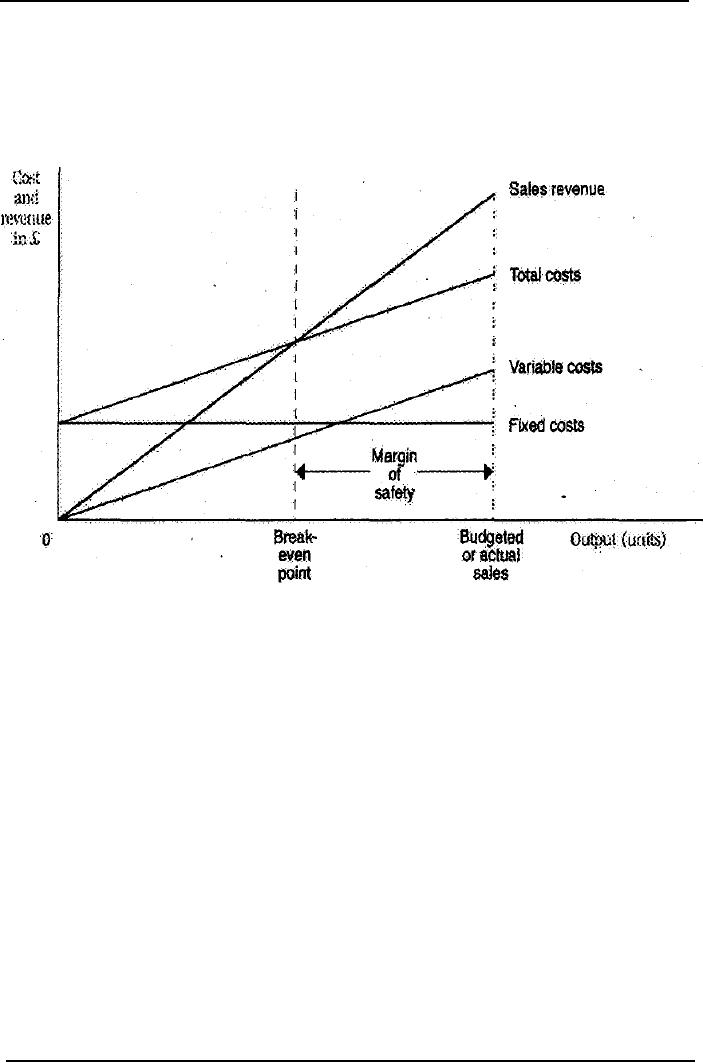

The

conventional break-even chart

The

conventional break-even chart

plots total costs and

total revenues at different

output levels

and

shows the activity level at

which break-even is

achieved.

Conventional

break-even chart

The

chart or graph is constructed as

follows:

�

Plot fixed costs, as a

straight line parallel to the

horizontal axis

�

Plot sales revenue and

variable costs from the

origin

�

Total costs represent fixed

plus variable costs.

The

point at which the sales

revenue and total cost lines

intersect indicates the breakeven

level of

output.

The amount of profit or loss

at any given output can be read

off the chart.

By

multiplying the sales volume

by the unit price at the

break-even point the level

of revenue

needed

to break even can be

determined.

The

chart is normally drawn up to

the budgeted sales

volume.

The

difference between the

budgeted sales volume and

break-even sales volume is referred to

as

the

margin of safety.

Usefulness

of charts

The

conventional form of break-even charts

was described above. Many

variations of such charts

exist

to illustrate the main relationships of

costs, volume and

profit.

Unclear

or complex charts should, however, be

avoided, as a chart which is

not easily understood

defeats

its own object.

Generally,

break-even charts are most

useful for the following

purposes:

�

comparing products, time periods or

actual outcomes versus planned

outcomes

�

showing the effect of

changes in circumstances or to

plans

�

giving a broad picture of

events,

195

Cost

& Management Accounting

(MGT-402)

VU

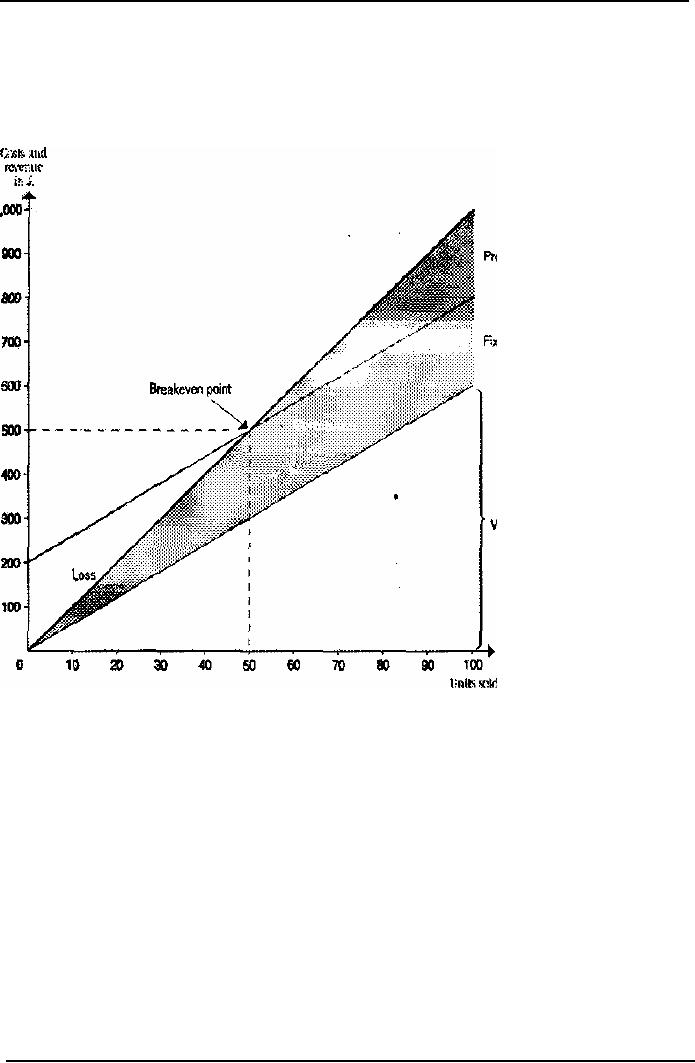

Contribution

break-even charts

A

contribution break-even chart is

constructed with the

variable costs at the foot

of the diagram

and

the fixed costs shown

above the variable cost

line.

The

total cost line will be in

the same position as in the

break-even chart illustrated

above; but by

using

the revised layout it is

possible to read off the

figures of contribution at various

volume

levels,

as shown in the following

diagram.

Profit-volume

chart

A

profit-volume chart is a graph which

simply depicts the net

profit and loss at any given

level of

activity.

196

Cost

& Management Accounting

(MGT-402)

VU

Profit

Sales

0

500

Breakeven

Point

Loss

1,000

Loss

= Fixed cost at zero sales

activity

From

the above chart the

amount of net profit or loss

can be read off for any

given level of sales

activity,

unlike a break-even chart

which shows both costs

and revenues over a given

range of

activity

but does not highlight

directly the amounts of

profits or losses at the various

levels.

�

The

points to note in the

construction of a profit-volume chart

are as follows:

�

The

horizontal axis represents

sales (in units or sales

value, as appropriate). This is the same

as

for

a break-even chart.

�

The

vertical axis shows net

profit above the horizontal

sales axis and net

loss below.

�

When

sales are zero, the net

loss equals the fixed

costs and one extreme of the

'profit-volume'

line

is determined. Therefore this is

one-point on the graph or

chart.

�

If

variable cost per unit

and fixed costs in total

are both constant throughout

the relevant range

of

activity under consideration, the

profit-volume chart is,

depicted by a straight line

(as

illustrated

above). Therefore, to draw

that line it is only

necessary to know the profit

(or loss)

at

one level of sales. The

'profit-volume ' line is then

drawn between this point

and the one for

zero

sales, extended as

necessary.

�

If

there are changes in the

variable cost per unit or

total fixed costs at various activities,

it

would

be necessary to calculate the

profit (or loss) at each

point where the cost

structure

changes

and to plot these on the

chart. The 'profit-volume'

line will then be a series

of straight

lines

joining these points

together, as shown in the

simple illustration

below.

197

Cost

& Management Accounting

(MGT-402)

VU

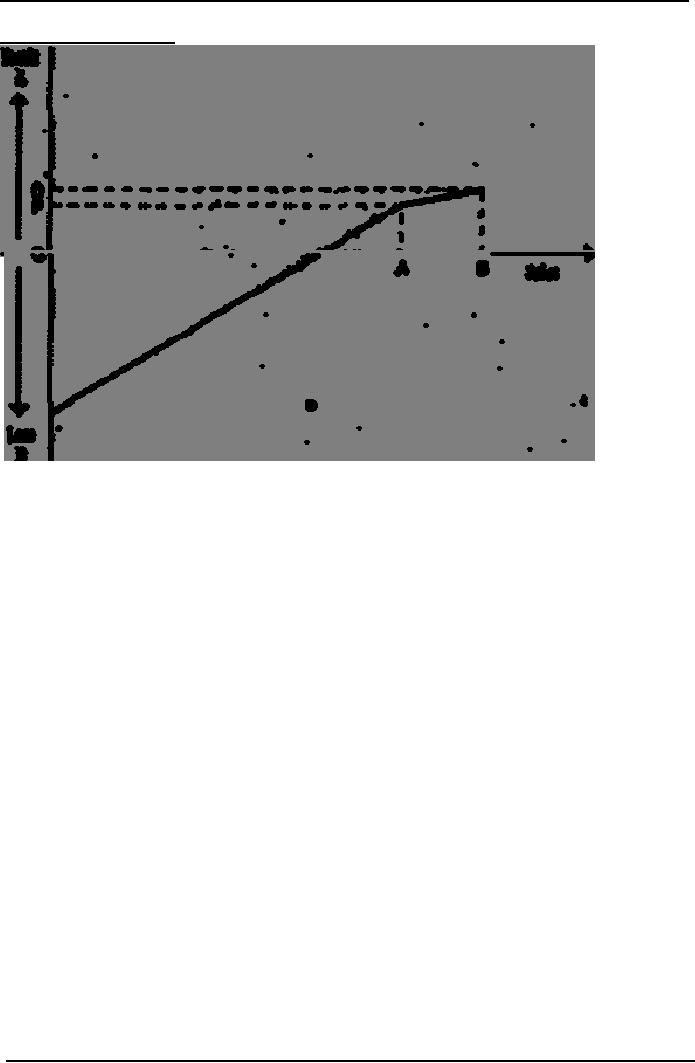

Profit-volume

chart (2)

This

illustration depicts the

situation where the variable

cost per unit increases

after a certain level

of

activity (OA), e.g. because

of overtime premiums that

are incurred when production

(and sales)

exceed

a particular level.

Points

to note:

�

The

profit (OP) at sales level

OA would be determined and

plotted.

�

Similarly

the profit (OQ) at sales

level of OB would be determined and

plotted.

�

The

loss at zero sales activity

(= fixed costs) can be

plotted.

�

The

"profit-volume' line is then

drawn by joining these

points, as illustrated.

As

long as we make the

assumptions that contribution

per unit is constant, and

fixed costs do not

change,

we can draw straight-line

graphs to show profit or

costs and revenues at all

possible

activity

levels.

MULTIPLE

CHOICE QUESTIONS

1.

If

contribution margin is

positive?

(a)

Profit will occur.

(b)

Both a profit and loss

are possible.

(c)

Profit will occur if the

fixed expenses are greater

than the contribution

margin.

(d)

A loss will occur if the

contribution margin is greater

than fixed expenses.

2. At

the breakeven point:

(a)

Profit is Rs. 0.

(b)

. Fixed Cost + Variable Cost =

Safes

(c)

Fixed Cost = Contribution

Margin

(d)

All of the above

198

Cost

& Management Accounting

(MGT-402)

VU

3.

A

completed CVP graph will show

that profit or loss at any

level of sales is measured

by:

(a)

A

vertical line between the

fixed cost line and

the x axis.

(b)

A

horizontal line between the

revenue line and the y

axis.

(c)

A

vertical line between the

total revenue line and the

total expenses line.

(d)

A

horizontal line between the

total revenue line and the

total expenses line.

4.

Contribution

margin ratio is:

(a)

Total

Contribution Margin /

Sales.

(b)

Sales

/ Contribution Margin per

unit,

(c)

Fixed

cost / Contribution margin

per unit.

(d)

Sales

/ Variable costs.

5.

The

impact on net operating income of any given dollar

change in total sales can be

computed

by

applying which ratio to the

dollar change?

(a)

Profit margin.

(b)

Variable cost ratio.

(c)

Contribution Margin.

(d)

Ratio of Variable to Fixed Expenses.

6.

The

Hino Corporation has a

breakeven point when sales

are Rs. 160,000 and

variable costs at

that

level of sales are Rs.

100,000. How much would

contribution margin increase or

decrease, if

variable

expenses dropped by Rs.

20,000?

(a)

37.5%.

(b)

60%.

(c)

12.5%.

(d)

26%

7.

Which

of the following represents

the CVP equation?

(a)

Sales

= Contribution margin + Fixed expenses +

Profits

(b)

Sales

= Contribution margin ratio + Fixed

expenses + Profits

(c)

Sales

= Variable expenses + Fixed expenses +

Profits

(d)

Sales

= Variable expenses - Fixed expenses +

Profits

8.

Margin

of Safety is a term best

described as the excess

of:

(a)

Contribution

margin over fixed

expenses.

(b)

Total

expenses over the breakeven

point.

(c)

Sales

over the breakeven

point.

(d)

Sales

over total costs.

Point

out which of the following statements are

TRUE/FALSE

1.

Cost-volume-profit

(CVP) analysis summarizes the effects of

change on an organization's

volume

of activity on its costs, revenue, and

profit.

2.

The

break-even point is the

volume of activity where an organization's

revenues and expenses

are

equal,

3.

Total

contribution margin can be

calculated by subtracting total

fixed costs from

total

revenues.

4.

Contribution

margin / Sales price per

unit = Contribution margin

ratio.

5.

The

sales price of a single unit

minus the unit's variable

expenses is called the unit

contribution

margin-

199

Cost

& Management Accounting

(MGT-402)

VU

6.

The

contribution-margin ratio of a firm is

determined by dividing the per

unit contribution

margin

by the per unit sales

price.

7.

The

safety margin of an enterprise is the

difference between the budgeted

sales revenue and

the

break-even sales revenue-

8.

A company's

break-even sales revenues

are Rs, 400,000, and its

contribution margin is 40%.

If

fixed

costs increase by Rs.

24,000, breakeven sales will

increase to Rs.

440,000.

9.

If

the total contribution

margin at break-even sales is

Rs, 45,000, then the

fixed costs must

also

be Rs. 45,000,

10.

If a company

sells 50 units of A at Rs. 8

contribution margin and 200

units of B at a Rs. 6

contribution

margin, the weighted-average contribution

margin is Rs. 7.00.

200

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS