|

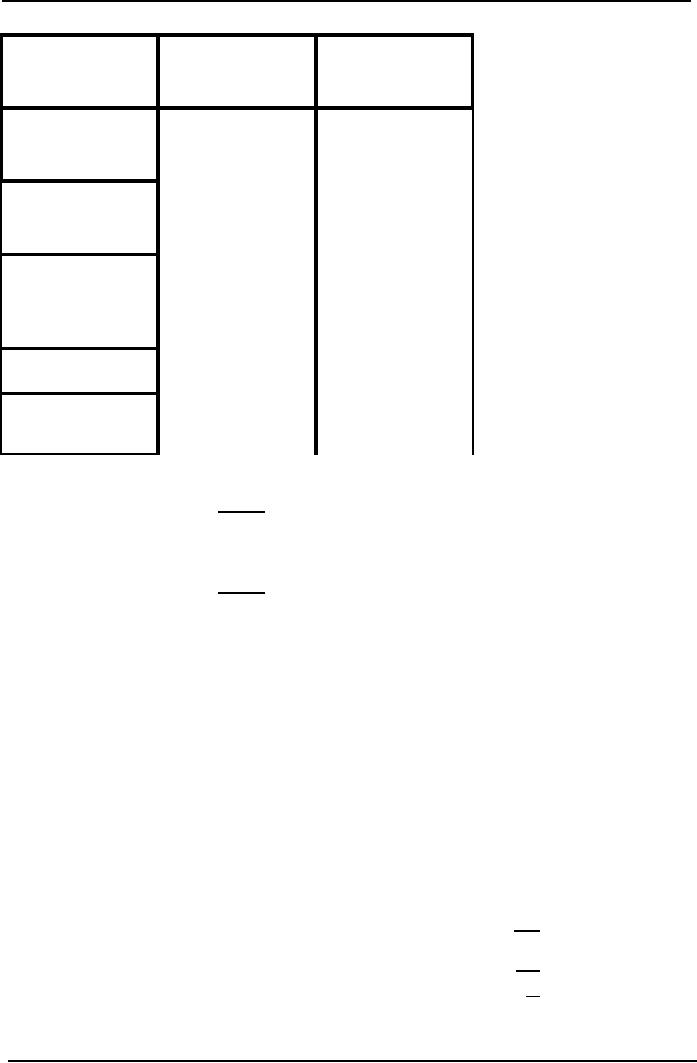

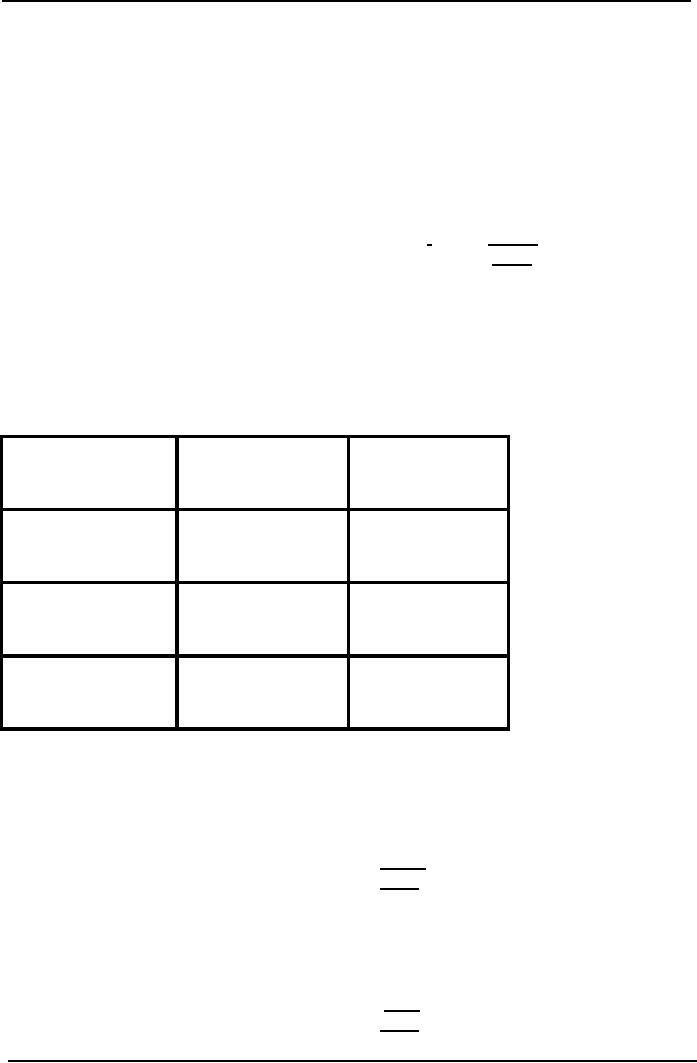

Cost

& Management Accounting

(MGT-402)

VU

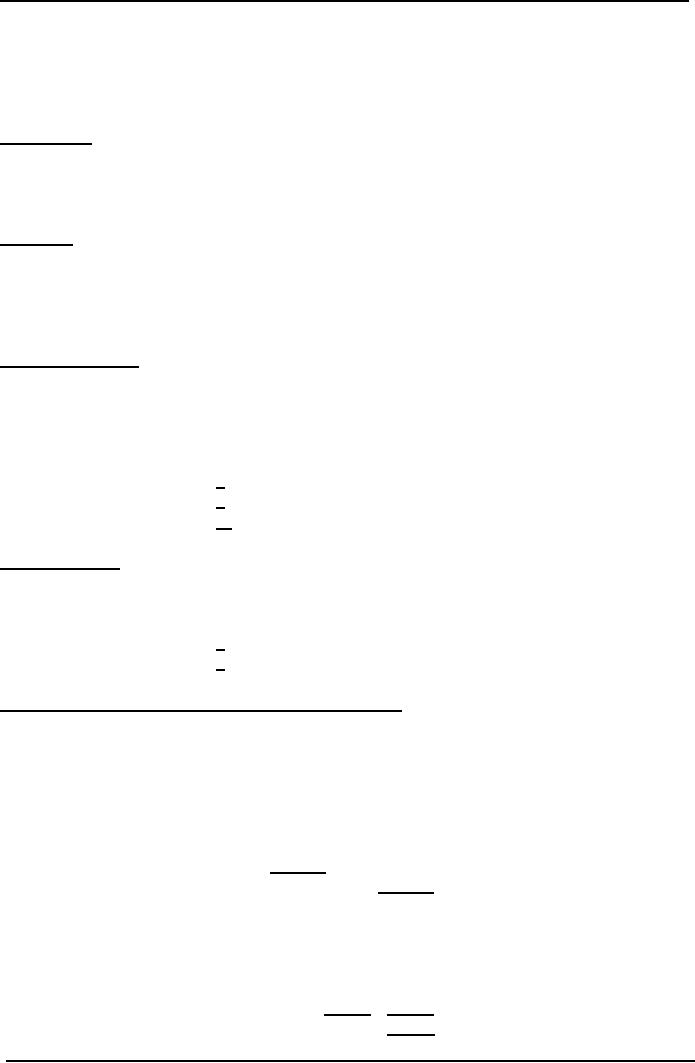

Absorption

Costing

Marginal

Costing

100

units

100

units

Direct

Material

8,000

8,000

Rs.

80 per unit

5,000

5,000

Direct

Labor

Rs.

50 per unit

3,000

3,000

Factory

Overhead

2,000

Variable

FOH

Fixed

FOH

18,000

16,000

Product

Cost

2,000

Fixed

Cost

(Period

Expenses)

Cost

per Unit

Under

Absorption costing

18,000

Rs.

180 per unit

100

Under

Marginal costing

16,000

Rs.

160 per unit

100

Contribution

Margin

Contribution

margin is the difference

between sales and the

variable cost of

sales.

This

can be written as:

Contribution

margin = Sales less

variable

costs of sales

Contribution

margin is short for

"contribution to fixed costs

and profits".

The

idea is that after deducting

the variable costs from

sales, the figure remaining is

the amount

that

contributes to fixed costs,

and once fixed costs

are covered the remaining

amount is that of

profits.

Contribution

and profit

Marginal

costing values goods at variable

cost of production (or marginal cost)

and contribution

can

be shown as follows;

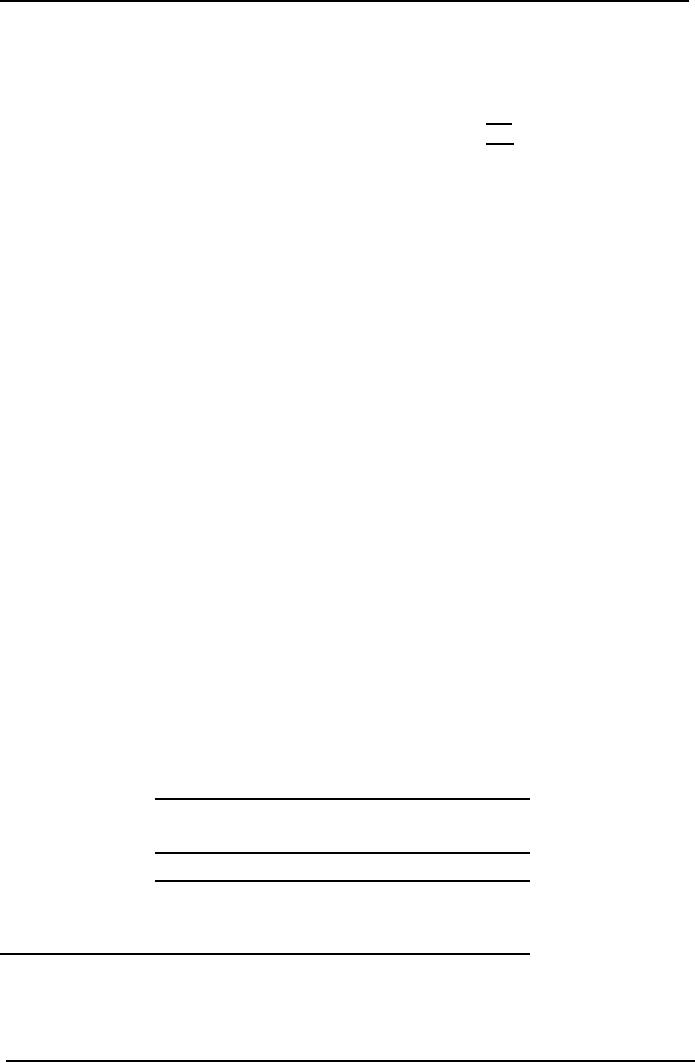

Marginal

costing: Profit calculation

Rs

X

Sales

(X)

Less:

variable costs

X

Contribution

margin

(X)

Less:

fixed costs

X

Profit

Profit

is contribution less

fixed

costs. In absorption costing this is

effectively calculated in one

stage

as the cost of sales already

includes fixed costs

169

Cost

& Management Accounting

(MGT-402)

VU

Absorption

costing: profit calculation

Rs

Sales

X

Less:

absorption cost

(X)

Profit

X

Profit

statements under absorption

and marginal costing

To

produce financial statements in

accordance with IFRS 2,

absorption costing must be used,

but

either

marginal or absorption costing can be

useful for internal

management reporting the

choice

made

will affect:

�

The way

in

which profit information is

presented

�

The level of reported profit if

sales do not exactly equal

production (i.e. stock is increasing

or

decreasing).

PRACTICE

QUESTION

This

example continues with the

Company from the above

practice question.

Show

profit statements for the

month if sales are 4,800

units and production is

5,000 units under

(a)

Total absorption costing

(b)

Marginal costing.

Solution

(a)

Profit statement under absorption

casting

Rs.

Rs

Sales

(4,800 @ Rs10)

48,000

Less:

Cost

of sates

Opening

stock

Production

(5,000

@ Rs. 8)

40,000

Less:

Closing stock

(200 @ Rs. 8)

(1,600)

(38.400)

Operating

profit

9,600

(b)

Profit statement under marginal

costing

Sales

(4.800 @ Rs10)

48,000

Less:

Cost

of sates

Opening

stock

Production

(5,000 @ Rs6)

30,000

Less:

Closing stock (200 @ Rs6)

(1,200)

(28,800)

Contribution

19,200

Less:

Fixed overheads

10,000

Operating

profit

9,200

170

Cost

& Management Accounting

(MGT-402)

VU

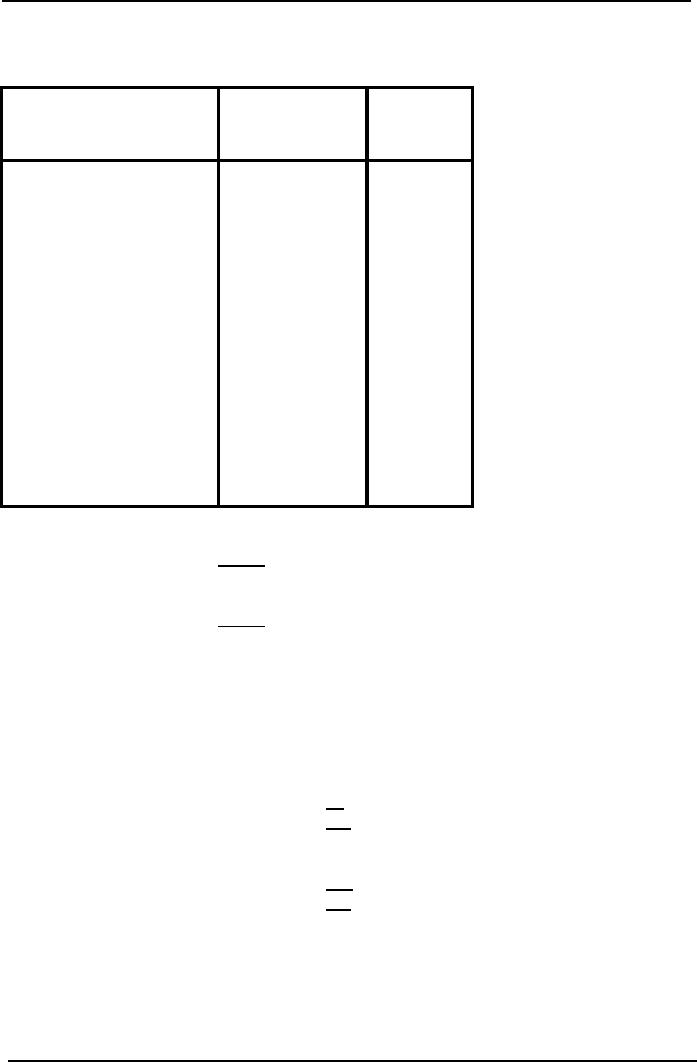

PRACTICE

QUESTION

Absorption

Costing

Marginal

100

units

Costing

100

units

Direct

Material

8,000

8,000

Rs.

80 per unit

Direct

Labor

5,000

5,000

Rs.

50 per unit

Factory

Overhead

Variable

FOH

3,000

3,000

Fixed

FOH

2,000

Product

Cost

18,000

16,000

Fixed

Cost

(Period

Expenses)

2,000

Cost

per Unit

Under

Absorption costing

18,000

Rs.

180 per unit

100

Under

Marginal costing

16,000

Rs.

160 per unit

100

Prepare

income statements under absorption

and marginal costing systems assuming

the following

facts:

a)

All

produced units Sold

b)

No.

of units sold

80

No.

of units in closing stock

20

No.

of units produced

100

c)

No.

of units sold

110

No.

of units in opening stock

10

No.

of units produced

100

171

Cost

& Management Accounting

(MGT-402)

VU

Selling

price Rs. 240 per

unit

Solution

a)

All

Units Sold

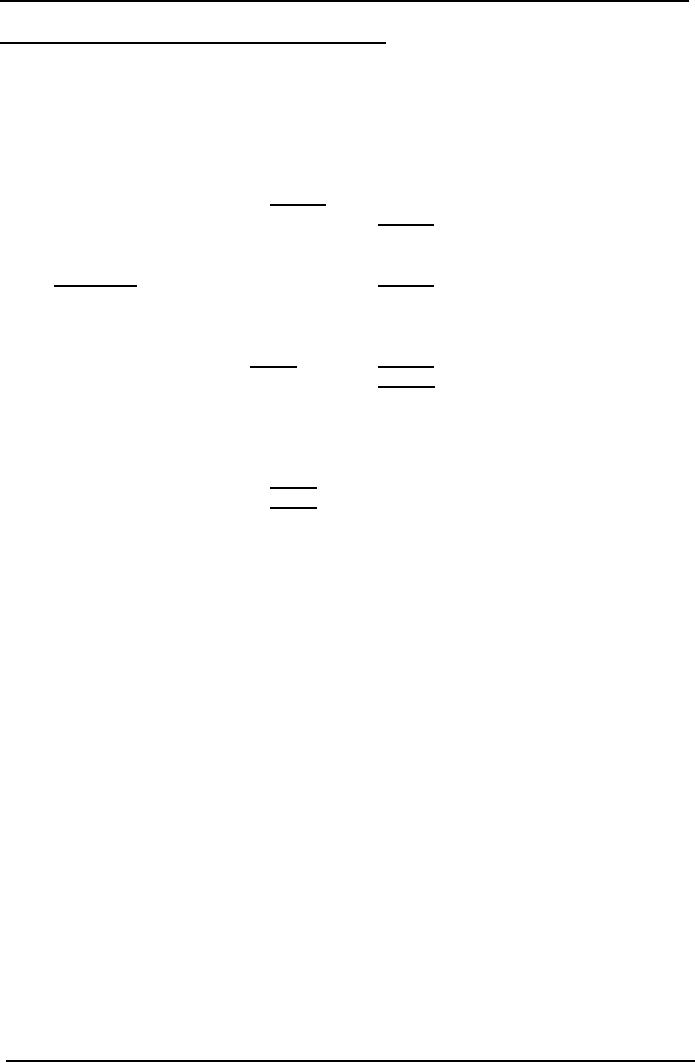

Absorption

Marginal

costing

costing

Sales

(110 x 240)

24,000

24,000

Less

Product cost

100

x 180

18,000

100

x 160

16,000

Gross

profit

6,000

Contribution

margin

8,000

Less

Fixed cost

0

(2000)

Profit

6,000

6,000

b)

80

units sold & 20 units in closing

stock

Absorption

costing

Marginal

costing

Sales

80 x 240

19,200

19,200

Production

cost

100

x 180 =

18,000

100

x 160 =

16,000

Less

closing stock

20

x 180 =

(3600)

20

x 160 =

(3,200)

14,600

12,800

Less

Fixed cost

2,000

Contribution

Margin

4,600

Profit

4,600

4,400

c)

110

units sold

Absorption

costing

Marginal

costing

Sales

110 x 240

26,400

26,400

Opening

stock

10

x 180 =

1,800

10

x 160 =

1,600

Production

cost

100

x 180 =

18,000

100

x 160 =

16,000

19,800

17,600

Less

Fixed cost

2,000

Contribution

Margin

6,600

Profit

6,600

6,800

Reconciliation

of the difference in profit

The

difference in profit is due to there

being a movement in stock levels - an

increase from 0 to

200

units over the

month.

172

Cost

& Management Accounting

(MGT-402)

VU

Under

absorption costing closing stock has been

valued at Rs 1,600 (i.e. Rs 8 per

unit which

includes

Rs 2 of absorbed fixed overheads).

Under marginal costing the increase in

stock is valued

at

Rs 1,200 (i.e. at Rs 6 per

unit) and all fixed

overheads are charged to the

profit and loss

account.

Only

if stock is rising or falling will

absorption costing give a different

profit figure from

marginal

costing.

If sales equal production,

the fixed overheads absorbed

into cost of sales under

absorption

costing

will be the same as the

period costs charged under marginal

costing and thus the

profit

figure

will be the same.

The

two profit figures can

therefore be reconciled as

follows:

Rs

Absorption

costing profit

9,600

Less:

fixed costs included in the

increase in stock (200 x

Rs2)

(400)

Marginal

costing profit

9,200

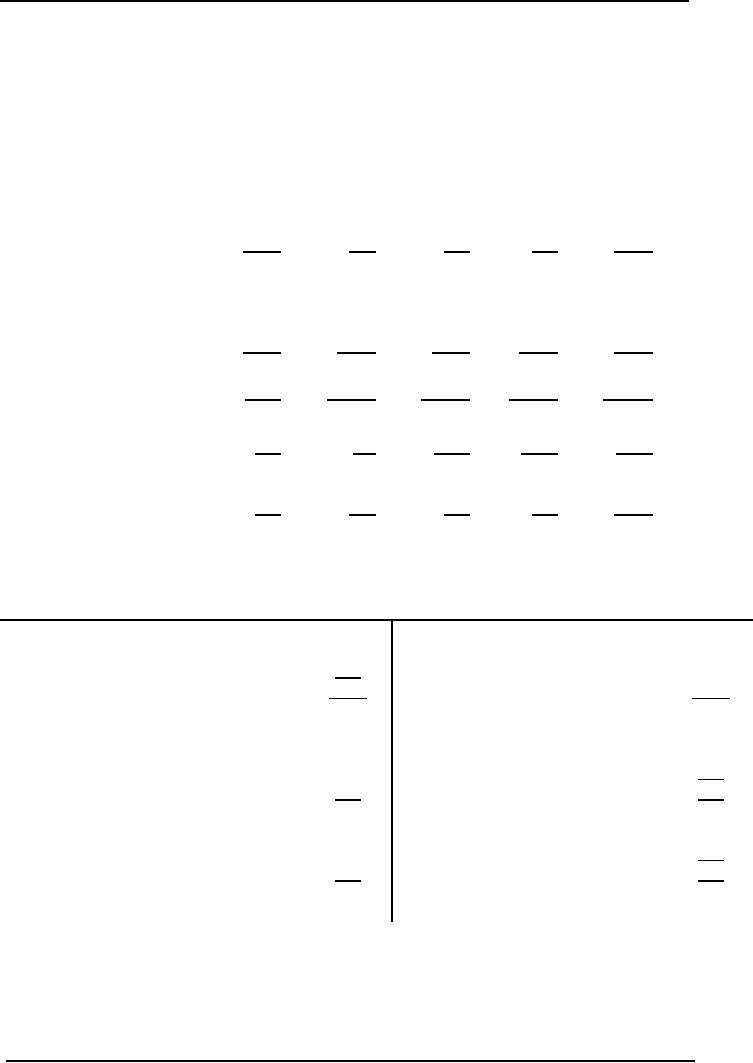

If

stock levels are rising from

opening to closing balance

Absorption

Costing profit > Margin Costing

profit

If

stock levels are falling

from opening to closing

balance

Absorption

Costing profit < Margin Costing

profit

(Fixed

costs carried forward are

charged in this period, under

absorption costing)

If

stock levels are the

same

Absorption

Costing profit = Margin Costing

profit

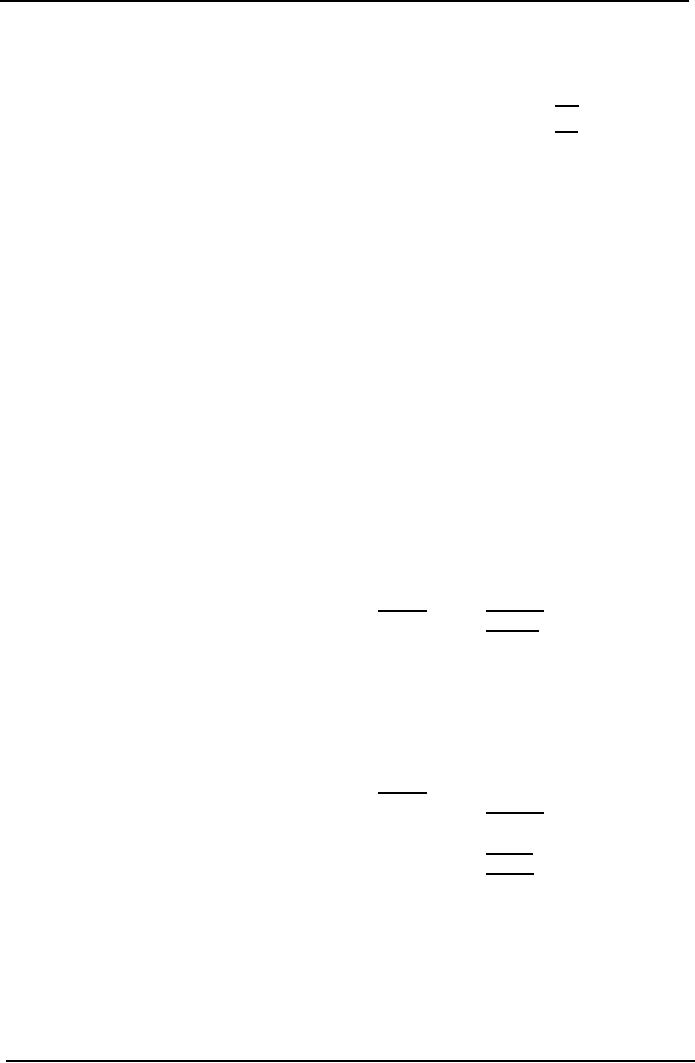

Absorption

Costing Marginal

Costing

Produced

units = Units

Same

Profit

Same

Profit

sold

Produced

units > Units

More

Profit

Less

Profit

sold

Produced

units < Units

Less

Profit

More

Profit

sold

Reconciliation

of the above practice question

b)

80

units sold & 20 units in closing

stock

Rs

Absorption

Profit

4,800

Less

Closing Stock @ Fixed FOH Rate

20

x

20

(400)

Marginal

Costing Profit

4,400

c)

110

units sold with an opening stock of 10

units

Absorption

Profit

6,600

Add

Opening Stock @ Fixed FOH

Rate

10

x

20

200

Marginal

Costing Profit

6,800

173

Cost

& Management Accounting

(MGT-402)

VU

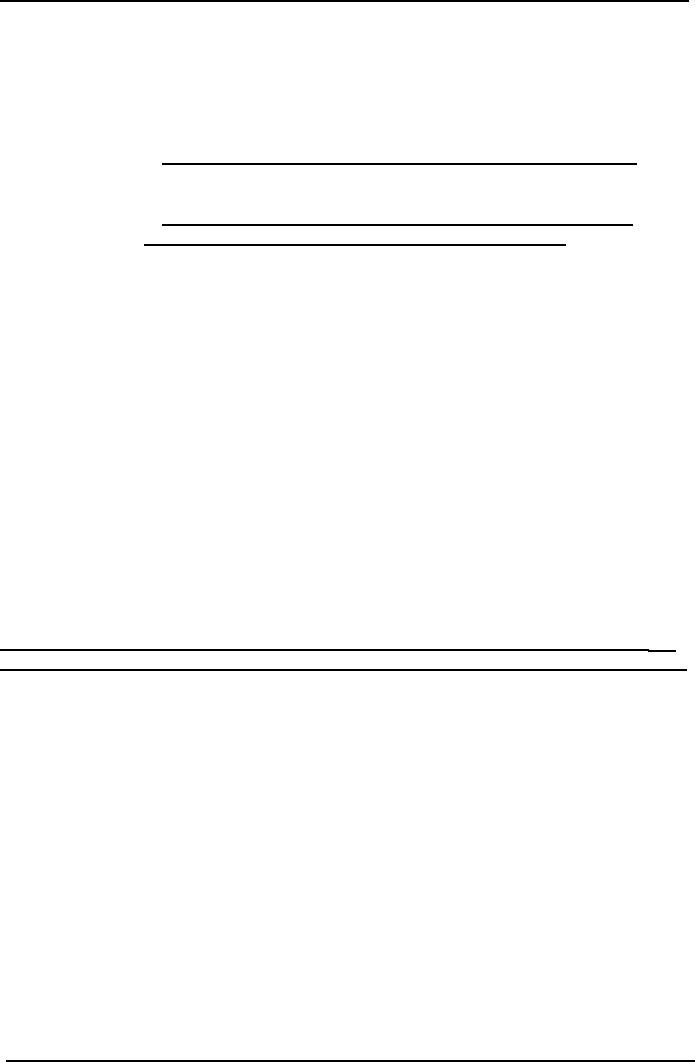

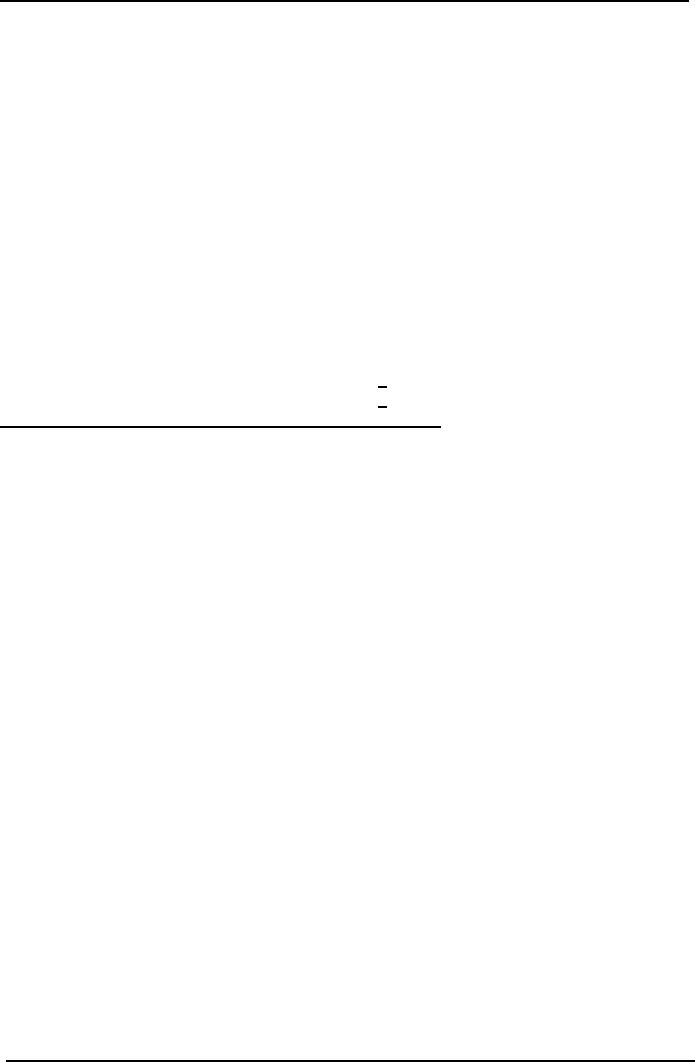

Reconciliation

formula to learn

Rs

Profit

as per absorption costing

system

xxx

Add

Opening stock @ fixed FOH rate at opening

date

xxx

Less

Closing stock @ fixed FOH rate at closing

date

xxx

Profit

as per marginal costing system

xxx

Advantages

of marginal costing

(Relative

to the absorption

costing)

Preparation

of routine operating statements using

absorption costing is considered less

informative

for

the following

reasons:

1.

Profit per unit is a

misleading figure: in the

example above the operating

margin of Rs2 per

unit

arises because fixed

overhead per unit is based

on output of 5,000 units. If

another basis

were

used margin per unit

would differ even though

fixed overhead was the

same amount in

total

2.

Build-up or run-down of stocks of

finished goods can distort

comparison of period operating

statements

and obscure the effect of

increasing or decreasing

sales.

3.

Comparison between products can be

misleading because of the

effect of arbitrary

apportionment

of fixed costs. Where two or

more products are

manufactured in a factory

and

share

all production facilities, the

fixed overhead can only be

apportioned on an arbitrary

basis.

4.

Marginal costing emphasizes variable

costs per unit and

fixed costs in total whereas

absorption

costing

accounts for all production

costs to calculate unit

cost. Marginal costing

therefore

reflects

the behavior of costs in

relation to activity. Since

most decision-making problems

involve

changes to activity, marginal costing is

more appropriate for short-run

decision-making

than

absorption costing.

PRACTICE

QUESTION

This

practice question illustrates the

misleading effect on profit

which absorption costing can

have.

A

company sells a product for

Rs10. and incurs Rs4 of

variable costs in its manufacture.

The fixed

costs

are Rs900 per year

and are absorbed on the

basis of the normal

production volume of

250

units

per year. The results for

the last four years,

when no expenditure variances

arose- were as

follows:

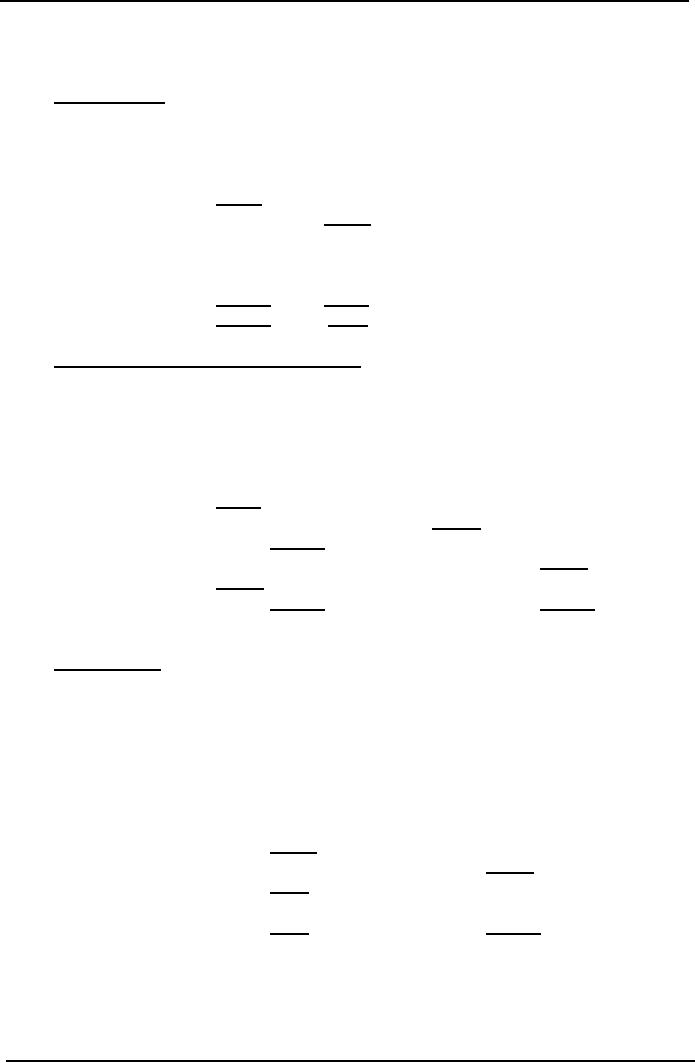

2nd year

3rd year

4th

year Total

Item

1st

year

units

units

units

units

Opening

stock

200

300

300

Production

300

250

200

200

950

300

450

500

500

950

Closing

stock

200

300

300

200

200

Sales

100

150

200

300

750

Rs

Rs

Rs

Rs

Rs

Sales

value

1,000

1,500

2,000

3,000

7,500

Prepare

a profit statement under absorption

and marginal costing.

174

Cost

& Management Accounting

(MGT-402)

VU

Solution

The

profit statement under absorption costing

would be as follows:

1st year

2nd year

3rd year

4th year

Items

Total

Rs.

Rs.

Rs.

Rs.

Rs.

Opening

stock @ Rs7.60

1,520

2,280

2,280

Variable

costs

of

1,200

1,000

800

800

3,800

production

@ Rs4

Fixed

costs � 900/250

1,080

900

720

720

3,420

=Rs3.60

2,280

3,420

3,800

3,800

7,220

Closing

stock @Rs7.60

1,520

2,280

2,280

1,520

1,520

Cost

of sales

(760)

(1,140)

(1,520)

(2,280)

(5,700)

(Under)/over

absorption

180

Nil

(180)

(180)

(180)

(w)

Net

Profit

420

360

300

540

1,620

Working:

Calculation

of over / under

absorption

Fixed

cost control account

Incurred

Year 1

900

Absorbed

1,080

300

x Rs. 3.60

Over

absorption

180

1,080

1,080

Year

2

900

250

x Rs. 3.60

Year

3

900

200

x Rs. 3.60

720

Under

absorption

180

900

900

Year

4

900

200

x 3.60

720

Under

absorption

180

900

900

175

Cost

& Management Accounting

(MGT-402)

VU

If

marginal costing had been used

instead of absorption, the results

would have

been

shown as

follows:

Item

1st

year

2nd

year

3rd

year

4th

year

Total

Rs

Rs

Rs

Rs

Rs

Sales

1,000

1,500

2,000

3,000

7,500

Variable

cost of sales

(@

Rs4)

400

600

800

1,200

3,000

Contribution

margin 600

900

1,200

1,800

4,500

Fixed

costs

900

900

900

900

3,600

Net

profit/ (loss)

(300)

-

300

900

900

The

marginal presentation indicates clearly that

the business must sell at

least 150 units per

year to

break

even, i.e. Rs900 + (10 -

4), whereas it appeared, using

absorption costing, that even at

100

units

it was making a healthy

profit.

The

total profit for the

four years is less under

the marginal principle because

the closing stocks at

the

end of the fourth year

are valued at Rs800 (Rs4 x

200) instead of Rs 1,520,

i.e. Rs720 of the

fixed

costs are being carried

forward under the absorption

principle.

The

profit figures shown may be reconciled as

follows:

Year

1

Year

2

Yea

3

Yea

r4

Total

Rs

Rs

Rs

Rs

Rs

Profit

/ (loss)

Under

marginal costing

(300)

Nil

300

900

900

Add:

Fixed overheads

Absorbed

in stock increase

200

x Rs3.60 =

720

100

x Rs3.60=

360

200

x Rs3.60=

720

Less:

Fixed overheads

Absorbed

in stock decrease

100

x 3.60=

(360)

Profit

per absorption

420

360

300

540

1,620

Problem

Questions

Q.1.

A

factory manufactures three components X,

Y and Z and the budgeted

production for the

year

is 1,000 units1,500 units and

2,000 units respectively. Fixed overhead

amounts to Rs6.750

and

has

been apportioned on the

basis of budgeted units: Rs

1,500 to X, Rs 2,250 to Y and Rs

3,000 to

Z.

Sales and variable costs

are as follows:

X

Y

Z

Selling

price Rs.

4

6

5

Variable

cost Rs.

1

4

4

Q.

2. A

company that manufactures one product

has calculated its cost on a

quarterly production

budget

of 10.000 units. The selling

price was Rs 5 per unit.

Sales in the four successive

quarters of

the

last year were as

follows:

Quarter

1

10,000

units

Quarter

2

9,000

units

Quarter

3

7,000

units

176

Cost

& Management Accounting

(MGT-402)

VU

Quarter

4

5,500

units

The

level of stock at the beginning of the

year was 1,000 units

and the company maintained

its

stock

of finished products at the

same level at the end of

each of the four

quarters.

Based

on its quarterly production budget, the

cost per unit was as

follows:

Cost

per unit

Rs.

Prime

cost

3.50

Production

overhead

0.75

Selling

and administration

overhead

0.30

Total

4.55

Fixed

production overhead, which

has been taken into account

in calculating the above figures,

was

Rs 5,000 per quarter.

Selling and administration

overhead was treated as

fixed, and was

charged

against sales in the period in

which it was

incurred.

You

are required to present a tabular

statement to bring out the

effect on net profit of

the

declining

volume of sales over the

four quarters given, assuming in

respect of fixed

production

overhead

that the company:

(a)

Absorbs it at the budgeted rate

per unit

(b)

Does not absorb it into

the product cost, but

charges it against sales in

each quarter (i.e.

the

company

uses marginal costing).

Advantages

of Absorption Costing

(Relative

to marginal costing)

Absorption

costing is widely used and

you must understand both

principles.

The

only difference between using

absorption costing and marginal costing as

the basis of stock

valuation

is the treatment of fixed

production costs.

The

arguments used in favor of absorption

costing are as follows:

1.

Fixed costs are incurred

within the production

function, and without those

facilities

production

would not be possible. Consequently such

costs can be related to

production

and

should be included in stock

valuation.

2.

Absorption costing follows the

matching concept by carrying forward a

proportion of the

production

cost in the stock valuation to be matched

against the sales

value

3.

When the items are

sold.

4.

It is necessary to include fixed

overhead in stock values for

financial statements

routine

cost

accounting using absorption costing

produces stock values which

include a share of

fixed

overhead.

5.

Overhead allotment is the

only practicable way of obtaining

job costs for estimating

prices

and

profit analysis.

6.

Analysis of under-/over-absorbed overhead is

useful to identify inefficient

utilization of

production

resources.

Arguments

against absorption

costing

The

fixed costs do not change as

a result of a change in the

level of activity. Therefore such

costs

cannot

be related to production and

should not be included in

the stock valuation.

The

inclusion of fixed costs in

the stock valuation conflicts

with the prudence concept,

therefore

the

fixed costs should be

written off in the period in

which they are

incurred.

177

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Following

information relates to a manufacturing

company

Selling

price

Rs.

20 per unit

Units

produced

30,000

Units

sold

20,000

Variable

cost

Direct

material

Rs.

5 per unit

Direct

labor

Rs.

3 per unit

F.O.H

Rs.

1 per unit

Selling

& administrative expenses

Rs.

2 per unit

Fixed

cost

F.O.H

Rs

120,000

Selling

& administrative expenses

Rs.

15,000

Solution

Working

for cost per unit

under

Absorption

Costing

Fixed

FOH Rate

120,000/30,000

=

4

Variable

FOH Rate

Direct

Material

5

Direct

Labor

3

FOH

1

9

13

Marginal

Costing

Variable

FOH Rate

Direct

Material

5

Direct

Labor

3

FOH

1

9

Income

Statement under Absorption Costing

System

Rupees

Sales

(20,000 x 20)

400,000

Less

Cost of goods sold

Opening

stock

0

Add

Production cost

(13

x 30,000)

390,000

Less

Closing stock

(13

x 10,000)

130,000

260,000

Gross

Profit

140,000

Less

Operating expenses

Selling

& Administrative expenses

Variable

expenses

(20,000

x 2) =

40,000

Fixed

expenses

15,000

55,000

Net

profit

85,000

178

Cost

& Management Accounting

(MGT-402)

VU

Income

Statement under Marginal Costing

System

Rupees

Sales

400,000

Less

Variable cost of goods sold

Opening

stock

0

Add

Variable production cost

(9

x 30,000)

270,000

Less

Closing stock

(9

x 10,000)

90,000

180,000

Gross

contribution margin

220,000

Less

Variable Selling & Admin

Expenses

(2

x 20,000)

40,000

Contribution

margin

180,000

Less

Fixed expenses

Production

120,000

Selling

& Admin Expenses

15,000

135,000

Net

Profit

45,000

Reconciliation

Profit

as absorption costing

85,000

Less

Closing stock (10,000 x 4)

40,000

Profit

as per Marginal costing

45,000

Multiple

Choice Questions

Q.1.

When

comparing the profits reported using marginal costing

with those reported using

absorption

costing in a period when closing stock was

1,400 units, opening stock was

2,000 units,

and

the actual production was

11,200 units at a total cost

of Rs 4.50 per unit compared

to a target

cost

of Rs 5.00 per unit, which

of the following statements is

correct?

A

Absorption costing reports profits Rs

2,700 higher

B

Absorption costing reports profits Rs

2,700 lower

C

Absorption costing reports profits Rs

3,000 higher

D

There is insufficient data to

calculate the difference between

the reported profits

Q.

2. When

comparing the profits reported under

marginal and absorption costing during a

period

when

the level of stocks

increased:

A.

An

absorption costing profits will be

higher and closing stock valuations

lower than those

under

marginal

costing

B.

An

absorption costing profits will be

higher and closing stock valuations

higher than those

under

marginal costing

C.

The

marginal costing profits will be higher

and closing stock valuations lower

than those under

absorption

costing

D. The

marginal costing profits will be lower

and closing stock valuations higher

than those under

absorption

costing

Q.

3. Contribution

margin is:

A.

Sales less total

costs

B.

Sales less variable

costs

C.

Variable costs of production less

labor costs

D.

None of the above

179

Cost

& Management Accounting

(MGT-402)

VU

Problem

Question

Rays

Company manufactures and sells electric

blankets.

The

selling price is Rs 12.

Each

blanket has the unit

cost set out

below.

Administration

costs are incurred at the

rate of Rs20 per

annum.

The

company achieved the

production and sales of blankets

set out below.

The

following information is also

relevant:

1.

The overhead costs of Rs2

and Rs3 per unit

have been calculated on the

basis of a budgeted

production

volume of 90 units.

2.

There was no

inflation.

3.

There, was no opening stock.

Unit

cost

Rs.

Direct

material

2

Direct

labor

1

Variable

production overhead

2

Fixed

production overhead

3

8

Year

1

2

3

Production

100

110

90

Sales

90

110

95

You

are required:

(a)

To prepare an operating statement for

each year using

(i)

Marginal costing and (ii)

absorption costing

(b)

To explain why the profit

figures reported under the two techniques

disagree.

180

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS