|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

18

JOB

ORDER COSTING

SYSTEM

It has

been explained that a cost

accounting system is composed of

two sub-systems:

(i)

A

system of recording and summarizing

costs and

(ii)

A

costing system.

Costing

system means "the

ascertainment of costs ", It includes

determination of total cost as

well as

unit

cost. A costing system determines

and reports to management

total and unit cost of

product

or

project of service with

details of cost

components

Costing

is compulsory for satisfying at least

three important needs of

management.

I.

Unit cost must be known to

assist the management in making

price decisions.

II.

Ascertainment of cost at every stage of

production is important for

exercising control

over

costs.

III.

In order to operate a system of

accounting for costs,

management needs to know

cost of

materials,

labor and overhead to be

charged to work in process,

cost of work completed

and

transferred to finished goods

and the cost of goods sold

so that necessary debit

and

credit

entries can be

passed.

Choice

of a Costing System

Job

Order Costing or Process

Costing?

What

type of costing system an accounting

entity should adopt? It

depends upon:

(1)

Nature

of operations and

(2)

Information

needs of management.

Take

the example of a construction

company that produces houses

in response to customers'

orders

and according to their

specifications. All the

times, the company remains

engaged in the

construction

of many houses at different

sites for different customers.

Such a company

definitely

wants

to know the cost incurred on

each house separately so

that customers' can be billed

properly

and

profit (or loss) on each

contract may be ascertained.

Here the nature of operations is such

that

each

house is clearly distinguishable from the

other and separate

calculation of cost for each

house

is

desirable and practically possible.

This company will employ

job costing system.

On

the other hand take

the example of a company

producing cement. All of the

bags of cement

produced

are quite similar. Here

separate calculation of cost of cement

supplied to each

customer

is neither desirable nor

feasible. The company can

calculate cost per bag of

cement

produced

by dividing total cost

incurred during the

accounting period by total number of

bags

produced

during the period.

Accordingly,

the company can fix

the price per bag

and bill each customer

according to the

number

of bags supplied to him. This

company will use process

costing system.

Job

costing and process costing are

two basic types of costing

systems and can be

viewed

as

two ends of a spectrum or range. In

practice we find companies

employing either one of

these

two or some combination of

features of the two both of

these at the same time.

For

example,

a ready made garments

manufacturer employs process costing to

accumulate and

determine

the cost of free size shirts

produced by him in large quantity. At

the same time he

uses

job costing to accumulate the

cost of waiters' uniforms supplied to a

hotel under a

contract.

Job

costing may be

defined:

The

costing system that separately

accumulates costs incurred to produce each job in a

situation where each job is

distinguishable

from the other throughout the

production process.

The

job may be a single unit or

a multi unit batch, a contract or a

project, program or a service.

Job

costing

is employed by organisations possessing

following characteristics:

1.

Production is generally in response of customers'

orders.

2.

Every order has its own

manufacturing specifications. Therefore,

every job is different from

the

other

and requires different

amounts materials, labor and

overhead.

127

Cost

& Management Accounting

(MGT-402)

VU

3.

Each job is clearly distinguishable from

the other at all stages

production process which

makes

job-wise

accumulation of possible.

4.

Job-wise accumulation of cost is

desirable and/or necessary

for and profit determination

and

5.

Each job is generally of high

value.

Following

are the examples of

organisations employing job costing

include:

a)

Accounting firms

b)

Civil engineering

c)

Furniture manufacturing

d)

Medical care

e)

Printing press

f)

Ship-building

g)

Advertising agencies

h)

Computer programming

i)

Jewellery manufacturing

j)

Movie studios

k)

Repair shops

As

the costs are accumulated

separately for each job,

therefore, job costing requires

considerable

amount

of clerical work. Where production is

carried in different departments of a

factory,

department

wise cost accumulation is

also necessary for

performance evaluation of

departmental

management.

In this way clerical work is

further increased. Consequently,

job costing is more

expensive

as

compared with process costing.

Job costing is also called

specific order costing or

production

order costing.

Job

order costing

procedures

Most

of the times, organisations

employing job order costing

are required to submit

quotation

before

finalization of customer's order.

Therefore, naturally, the

first step in job order

costing is to

prepare

an estimate of cost likely to be

incurred to produce the job.

The estimation is done by

coordination

of sales, designing and

production departments. On the basis of

estimated cost price

is

quoted. When customer's order has

been initialized production

planning and control

department

takes the first step towards

execution of the

order.

On

receipt of production order,

cost accounting department

prepares a job cost sheet

for each

job.

Job cost sheet may be

defined as a

document used for accumulating costs

incurred to produce a job.

Design

and contents of job cost

sheet vary widely depending

on customs of manufacturing

operations

and information needs of

management.

However,

generally, a job cost sheet is

designed to show the

following information:

1.

Job number

2.

Name of the customer

3.

Description and specifications of

the job

4.

Date of commencement of production

5.

Date of completion of job.

6.

Direct materials cost

incurred on the job

7.

Direct labor cost incurred

on the job

8.

Factory overhead applied to

the job

9.

Total cost of the

job

10.

Selling and administration

expenses chargeable to the

job

11.

Sales price of the

job

12.

Profit (or loss) on the

job

13.

Where the job consists of a batch,

the quantity produced and

unit cost

14.

Where cost estimates are

prepared before production, estimated

cost should also be shown

for

comparison

and efficiency

evaluation.

128

Cost

& Management Accounting

(MGT-402)

VU

Job

cost sheet is one of the

basic

documents used

in job order costing. Upto

the time the job

is

incomplete;

job

cost sheet serves as a

subsidiary

record .for work in process control

account and is

placed in

work

in process subsidiary ledger. On

completion

of

job, the relevant job

cost sheet is removed

from

work in process subsidiary

ledger.

Now

it reveals the cost of completed

job and serves as source

document for

debiting finished goods

account

(or completed jobs control account)

and for crediting work in

process account.

Then

it is placed in finished goods

subsidiary ledger and serves

as subsidiary

record .for finished

goods

account.

When

completed job is shipped to the

customer, relevant job cost

sheet serves as source

document

for

debiting cost of goods sold account

and for crediting finished

goods account. Then

it

is

placed in cost of goods sold

subsidiary ledger where the

same job cost sheet

serves as subsidiary

record

for cost of goods sold

account.

Manufacturing

process is, most of the

times, divided into departments. This

departmentalization

is

the logical result of different

types of operations performed to produce a

product. For example,

furniture

manufacturing is divided into cutting,

assembling and finishing and

polishing

departments;

readymade garments manufacturing is

divided into cutting, stitching

finishing and

packing

departments.

These

departments are regarded as cost

centers. Cost

Centre means

a

division or segment for which

a

separate

individual is made responsible .for

incurrence of cost. Accumulation

of cost for each department

is

necessary

to achieve better control

over cost. In job order

costing it is necessary to identify

cost

not

only with the department

but also with the

relevant job.

Direct

materials, direct labor and

factory overhead to be charged to

each job and to

each

department

are recorded in the

following manners:

Direct

Materials: Every

materials requisition issued to

secure direct materials bears

the name of

department

and job number for

which materials are required.

Periodically (weekly or fortnightly

etc)

a summary of materials requisitions is

prepared. Materials requisition

summary analyses cost

of

materials issued and

ascertains cost of materials

chargeable to each department

and to each job.

Indirect

materials issued cannot be

associated with particular jobs,

therefore, these are

summarised

only

by department. Instead of posting each

individual materials issue to

job cost sheets,

the

periodic

totals are recorded on

relevant job cost

sheets.

The

periodic

grand total are

debited to work in process

and factory overhead

-control accounts and

credited

to materials control

account.

Direct

Labor: Primary

labor cost data are

accumulated on Job Time Tickets.

Job time tickets

contain

names of departments and job

numbers for which labor

time is used. A labor cost

analysis

sheet

is prepared periodically that analyses

the direct labor cost by departments

and by jobs. As

indirect

labor cost cannot be

identified with particular jobs,

therefore, labor cost

analysis sheet

analyses

it only by departments. The periodic

totals are

posted to job cost sheets

and debited to

work

in process and factory

overhead control accounts.

Factory

Overhead:

Factory overhead is applied to jobs on

the basis of predetermined

departmental

factory overhead applied

rates. Factory overhead is

also periodically

applied

to the

jobs

and entered in job cost

sheets. Total applied

factory overhead is debited to

work in process

control

account and credited to

factory overhead applied

account.

Practice

Question

Job

Order Costing. Shah

Taj Engineering Works on April 5,

2006 started production of

100 lawn

mower

of model EG- 72 ordered by

Capital Development Authority.

Islamabad, vide Order

No.

2119-M

dated April 1, 2006 at a

price of Rs. 3,600 per

lawn mower.

Production

Planning Department allotted

Job No. J-832-LM and

instructed the factory

to

complete

production by April 20,

2006. However, the factory

completed production on April

18,

2006.

129

Cost

& Management Accounting

(MGT-402)

VU

On

April 11, weekly Materials Requisitions

Summary. No. MRS-16 and

weekly Labor Cost

Analysis

Sheet No.LAS-16 showed

following charges to Job No.

J-832-LM.

.

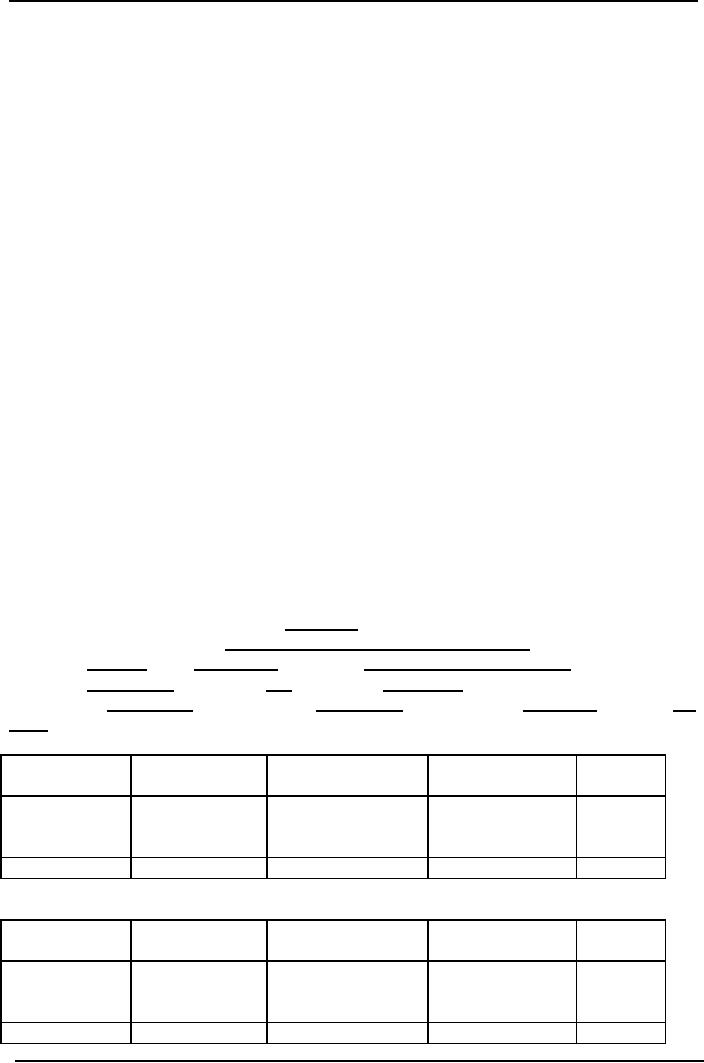

Department

101

Department

102

Direct

materials

Rs.

58,500

11,700

Direct

labor

Rs.

13,500

15,750

(900

hours)

Materials

Requisitions Summary No. MRS-17 and

Labor Cost Analysis Sheet

No. LAS-17

prepared

on April 18 revealed following direct

costs for the

job.

Department

101

Department

102

Direct

materials

Rs.71,500

Rs.

14,300

Direct

labor

Rs.

16,500

Rs.

19,250

(1100

hours)

In

department 101 factory

overhead is applied @ 50% of direct

labor cost and in department

102

@

Rs. 12 per direct labor

hour. Marketing and

administration expenses chargeable to

the job were

respectively

7.5 % and 5% of the sale

price. The lawn mowers were

delivered to customer on

April

22,

2006

Required:

(i)

Prepare a Job Cost Sheet

for Job No.

J-832-LM.

(ii)

Assuming that J-832-LM was

the only job worked on

during the two weeks period,

pass

account

entries in General Journal form to

record:

(a)

Cost incurred on the

job:

(b)

Completion of the job;

and

(c)

Sale of the job.

Solution

SHAH

TAJ ENGINEERING WORKS LIMITED

JOB

COST SHEET FOR JOB NO.

J-832-LM

Customer's

Name:

Capital

Development Authority.

Islamabad.

Order

No. 2119-M Dated 02-04-2006

Description Lawn Mowers

Model EG- 72

Total

Cost Rs. 260.000 No. of

units. 100Date Started

05-04-2006

Date

wanted 20-04-2006 Date Completed 18-04-2006

Unit Sales Price Rs.

3,600 Unit Cost

Rs.

2,600

DIRECT

MATERIALS

Date

Mat.

Req. Sum. Department

101

Department

102

Total

No

11-04-2006

MRS-16

Rs.

58,500

11,700

70,200

18-04-2006

MRS-17

71,500

14,300

85,800

Total

130,000

26,000

156,000

DIRECT

LABOR

Date

Lab

Analysis

Department 101

Department

102

Total

Sheet

No.

11-04-2006

LAS-16

Rs.

13,500

15,750

29,250

18-04-2006

LAS-17

16,500

19,250

35,750

Total

30,000

35,000

65,000

130

Cost

& Management Accounting

(MGT-402)

VU

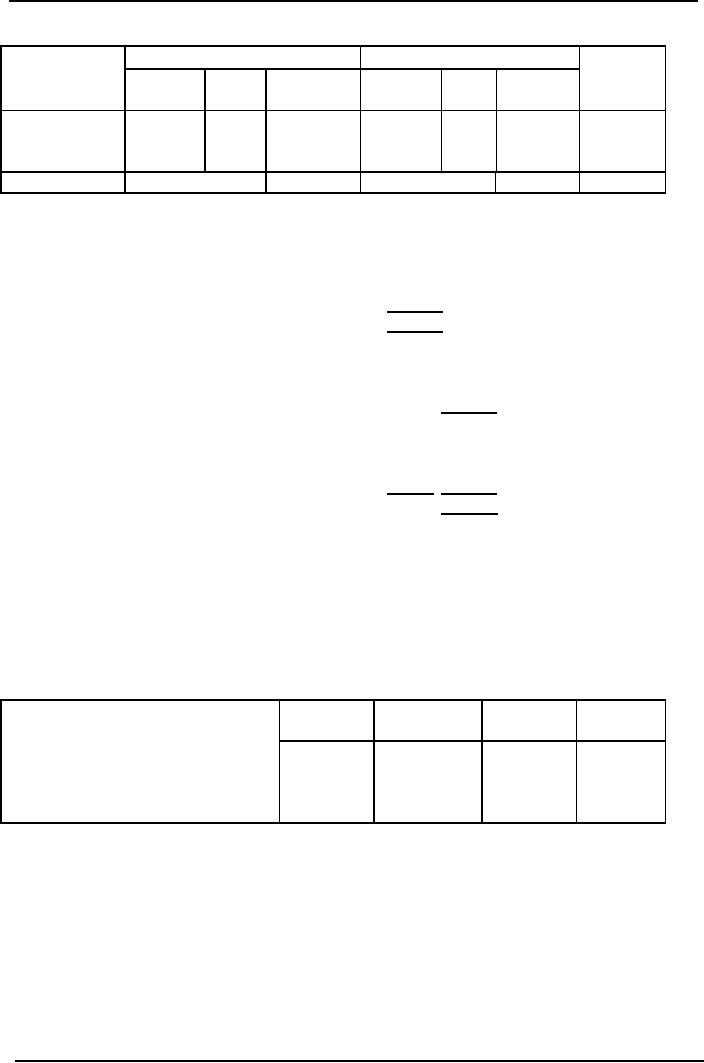

FACTORY

OVERHEAD APPLIED

Date

Department

101

Department

102

Total

D.L

Rate

Amount

D.L

Rate

Amount

Cost

Hours

11-04-2006

13,500

50%

6,750

900

12

10,800

17,750

18-04-2006

16,500

50%

8,250

1,100

12

13,200

21,450

Total

15,000

24,000

39,000

Total

Production Cost

Direct

material cost

156,000

Direct

labor cost

65,000

Factory

overhead cost

39,000

260,000

Income

Statement

Sales

price 100 units @ Rs.

3,600

360,000

Cost

of production

260,000

Gross

profit

100,000

Operating

expenses

Marketing

Expenses (Rs. 360,000 x

7.5%)

27,000

Administration

Expenses (Rs. 360,000 x 5%)

18,000

45,000

Net

Income/profit

55,000

Problem

Questions

Q.

1

Arman

Advertisers on November 15, 2006

received an order from

Pheasent Cosmetics Limited

for

manufacturing

and installation of a huge

neon sign for a contract

price of Rs. 180,000. Job

No.

676-PN

was allotted and

manufacturing was begun on November

21, 2006 .The costs

are charged

to

the jobs periodically by means of weekly

summaries.

Following

costs were related to Job

No. 676-PN

WEEK

ENDED

Nov.

23

Nov.

30

Dec.7

Dec.

14

Rs.

Rs.

Rs.

Rs.

Direct

materials

13,300

24,800

16,400

12,600

Direct

labor

1,800

12,400

20,100

14,200

Factory

overhead is applied @ 25% of

prime cost. The Job

was completed on December 14,

2006

Selling

expenses are applied to the

job @ 3 % of contract price

and administration expenses @

2%

of

contract price.

Required:

Prepare a job cost sheet

containing above

information

Q.

2

In

order to submit quotation

for air conditioning of Hina

Shopping Centre, management of

Indus

Electrical

Industries made following

estimates:

Direct

materials Rs.

280,000;

Direct

labor Rs. 120,000;

Predetermined

overhead applied rate is 50%

of direct labor cost;

131

Cost

& Management Accounting

(MGT-402)

VU

Predetermined

rates for charging marketing and

administration expenses are respectively

3% and

2%

of the contract

price.

On

the basis of above estimates

contract price was quoted as

Rs. 575,000

The

quotation was accepted by

the owners of Hina Shopping Centre and

the order was

finalized

on

October 6, 2006.

Job

No. 1617 was assigned to

the order and the

work was started on October

12, 2006. Weekly

materials

requisition summaries and

labor cost analysis sheets

showed following charges to

Job

No.

1617.

Date

Direct

Material

Direct

labor

October

17

Rs.

120,000

Rs.

46,000

October

24

Rs.

96,000

Rs.

44,000

October

31

Rs.

60,000

Rs.

48,000

The

job was completed on October

31. However, the time

allowed for completion of job

was upto

November

4.

Required

(i)

Prepare

job cost sheet for

Job No. 1617.

(ii)

Assuming

that Job No. 1617

was the only job

worked on during the above

period, pass

entries

in general journal form to record

production and sale of the

job. Job was accepted by

the

customer

on November 4 and cash

received for the contract

price.

Q.

3

Hussain

Engineering Co. Ltd. produces

machines as per customer's

specifications. The

following

data

pertains to Job Order No. K

101:

Customer:

Azam Banking Co.

Date

Started: 06-08-2006.

Customer

Order No. C 467.

Date

Finished: 20-08-2006.

Dated:

31-07-2006. Total Cost of

manufacture?

Sales

Price?

Description:

6 Banking Machines.

Week

End 13/08

Week

End 20/08

Materials

used. Dept. A.

Rs.

4,800

Rs.

2,600

Direct

labor rate. Dept. A.

Rs

40 per hour

Rs.

40 per hour

Labor

hours used, Dept. A.

1,200

800

Direct

labor rate, Dept. B.

Rs

42 per hour

Rs.

42 per hour

Labor

hour uses, Dept. B.

600

280

Machine

hours. Dept. B.

400

240

Applied

factory overhead Dept. A.

Rs. 20/labor hr.

Rs.

20/labor hr.

Applied

factory overhead Dept. B Rs.

18/machine hr

Rs.18/machine

hr

Marketing

and administrative costs are

charged to each order @ 20%

of the cost to

manufacture

Required:

a)

Prepare

a job order cost

sheet

b)

Calculate

sales price of the job,

assuming that it has been

contracted with a

markup

of 40%

132

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS