|

FACTORY OVERHEAD COST:Marketing, Research and development |

| << ALLOCATION AND APPORTIONMENT OF FOH COST |

| FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance >> |

Cost

& Management Accounting

(MGT-402)

VU

LESSON

# 16

FACTORY

OVERHEAD COST

(Apportionment

& Variance Analysis)

Reciprocal

Apportionment

This

method recognizes the fact

that if a service department

receives from other service

e

department,

the department receiving services

should be charged. Thus the

costs of

interdepartmental

services are taken into

account on reciprocal basis.

There

are two main methods

which may be used for

reciprocal distribution:

1.

Repeated distribution

method

2.

Algebraic method

Repeated

distribution method

Under

this method, the total of

overhead costs of the

service departments are distributed to

other

service

and product ion department

according to the given percentage

till the expense of all

service

departments

are exhausted or remains

insignificant.

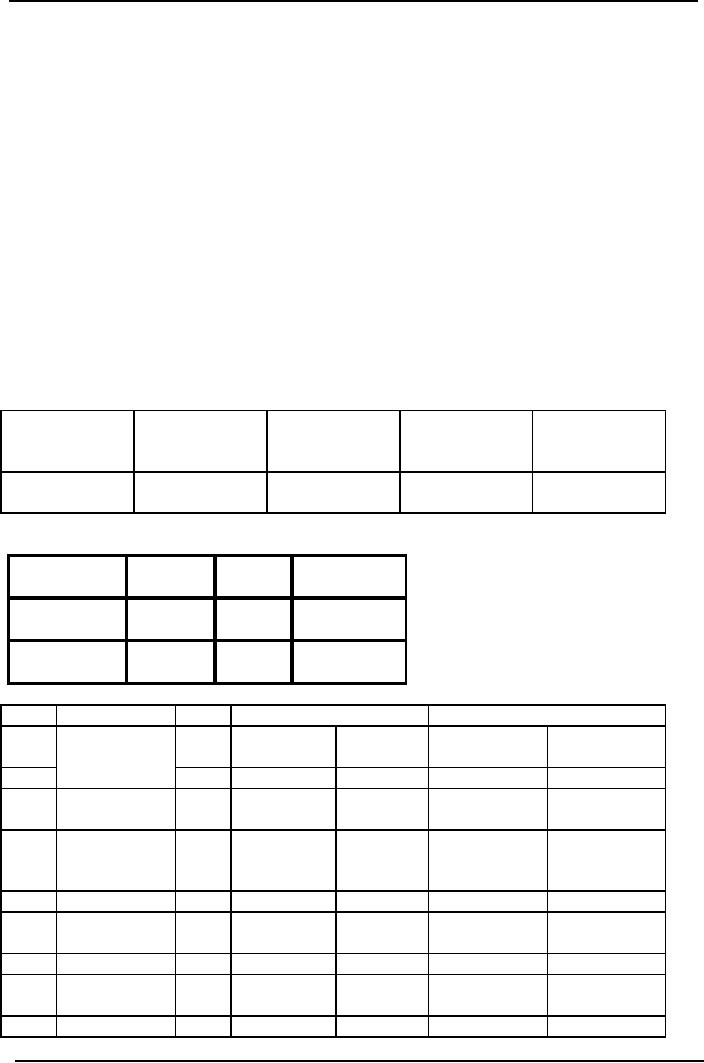

PRACTICE

QUESTION

Following

is the cost of summary of

allocated indirect cost of an

organization

Machining

Finishing

Maintenance

Air-conditioning

Allocated

indirect

cost

100,000

70,000

40,000

30,000

240,000

The

above costs of service departments

are apportioned among the

departments in the following

ratios.

Machining

Finishing

Air-

conditioning

Maintenance

60%

15%

25%

Appropriation

Air

70%

25%

5%

Conditioning

Production

Service

Machining

Finishing

Maintenance

Air-

Allocate

conditioning

Indirect

cost

Rs.

240,000

100,000

70,000

40,000

30,000

Maintenance

24,000

6,000

(40,000)

10,000

Air-

28,000

10,000

2,000

(40,000)

conditioning

Maintenance

1200

300

(2,000)

500

Air-

350

125

25

(500)

conditioning

Maintenance

15

3.50

(25)

6.50

Air-

5

1.50

0.50

(6.50)

conditioning

153,570

86,430

108

Cost

& Management Accounting

(MGT-402)

VU

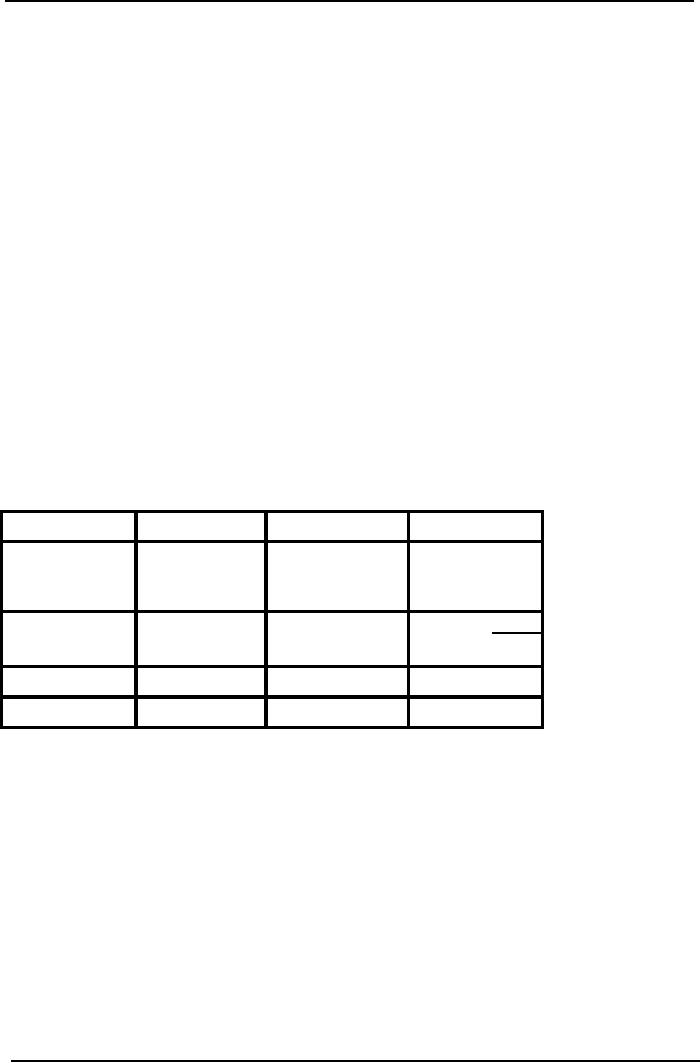

Solution

(Algebraic method)

Maintenance

Dept

=X=

(40,000)+5%

of Air condition

Air

conditioning Cost

=Y=

(30,000)+25%

of maintenance

X

=40,000+5% of y

X

= 30,000 + 25% of x

X

=40,000+0.05(30,000+0.25x)

X

=40,000+1500+0.0125x

X

=0.0125x = 41,500

0.9875x

= 41,500

X

= 41,500

0.9875

Cost

of Maintenance Dept

X

= 42,025

Y

= 30,000 + 25% of x

Y

= 30,000 + 0.25 (42,025)

Y

= 30,000 +10,506 = 40,506

Y

= 40,506

Apportionment

Machinery

Finishing

Maintenance

Air-condition

1,00,000

70,000

40,000

30,000

(42,025)

25,215

6,304

2,025

10,506

(40,506)

28,354

10,127

2,025

40,506

1,53,569

86,431

0

0

Over/under-absorption

of overhead

In

the previous LESSON s

reference was made to an

accounting problem associated

with the use

of

predetermined absorption rates.

Where

the amount of overhead

absorbed exceeds the actual

overhead cost incurred, the

excess is

known

as over-absorption; if the amount

absorbed is less than the

cost incurred then

the

difference

is know as under-absorption.

Accounting

for over/under

absorptions

The

extent of any over/under-absorption is a

balancing figure in the

production overhead account.

This

is normally transferred to the costing

profit and loss account

each month. Though it may

be

carried

forward in the production

overhead account until the

end of the year when any

net

over/under-absorption

for the year is transferred

to profit and loss account.

This treatment, it is

argued,

is reasonable because the predetermined

absorption rate is based on

annual costs and

activity

levels.

109

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Q.

1

From

the following data calculate

the over/under absorption

and show how the

transactions

would

be recorded in the production

overhead account.

Absorption

rate

=

Rs.5.00 per direct labor

hour

Number

of direct labor hours =

1,400

Production

overhead incurred = Rs.

6,900

Solution

Rs.

Production

overhead absorbed =

Rs.5.00

x 1,400

7,000

Production

overhead incurred

6,900

Over-absorption

100

Production

overhead account

Rs.

Rs.

6,900

Work-in-progress

7,000

Creditors

100

Balance

(over-absorption)

7,000

7,000

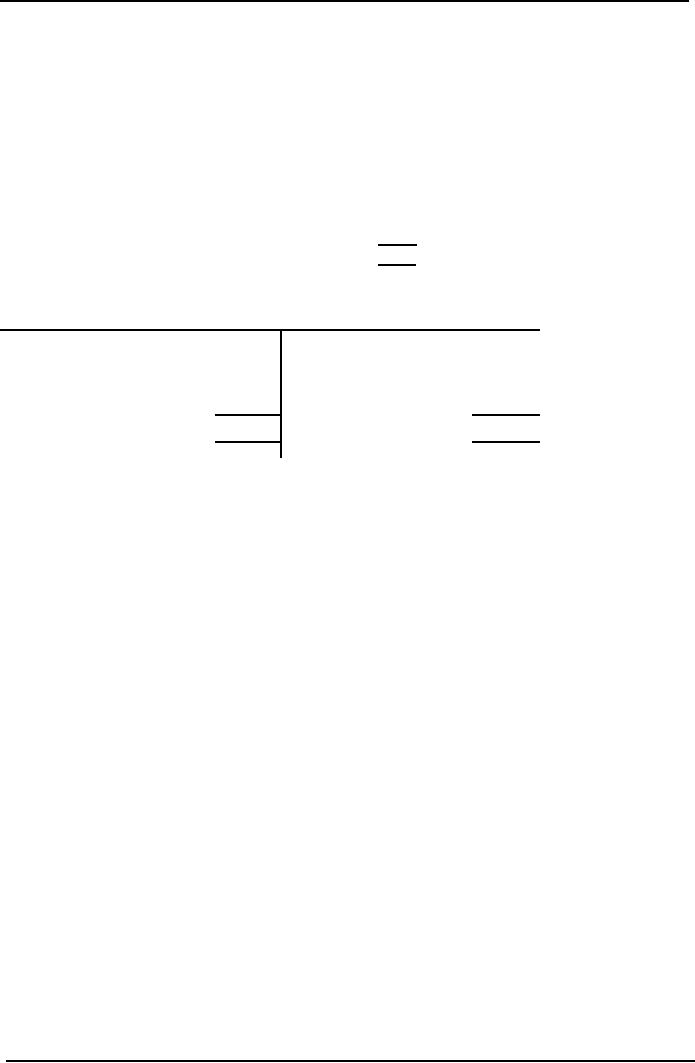

Q.

2

From

the following data relating to

four departments of a factory you

are required to:

(a)

Journalize departmental overheads

incurred

(b)

Journalize departmental overheads

recovered

(c)

Give the journal entry

recording

under or over-absorbed overhead

expenditure.

Actual

expenses

Absorption

rates (based on pre-determined

Rs.

annual

estimates}

Department

A

1,000

Rs.0.10

per machine hour

Department

B

4,000

Rs.0.75

per direct labor hour

Department

C

7,000

100%

on direct wages

Department

D

3,500

Rs.0.25

per unit

Machine

Direct

Direct

wages

Units

produced

hours

worked

labor

hours

�worked

Rs.

Department

A

10,000

11,000

6,000

100,000

Department

B

3,000

5,300

6,000

48,900

Department

C

6,000

18,000

6,800

52,000

Department

D

14,000

30,000

10,000

13,800

110

Cost

& Management Accounting

(MGT-402)

VU

Solution

(a)

Departmental overheads

incurred.

Dr

-

Cr

Rs.

Rs.

Department

A overhead account

1,000

Department

B overhead account

4,000

Department

C overhead account

7,000

Department

D overhead account

3,500

Factory

overhead control

account

15,500

Transfer

of actual departmental expenses

15,500

15,500

for

period

(b)

Departmental overheads

recovered

Dr

Cr

Rs.

Rs.

Work

in progress account

15,225

Department

A overhead account

1,000

Department

B overhead account

3,975

Department

C overhead account

6,800

Department

D overhead account

3,450

Transfer

of absorbed departmental expenses for

period

15,225

15,225

(c)

Under- or over-absorbed overhead

expenditure

Dr

Cr

Rs.

Rs.

Profit

and loss account

275

Department

B overhead account

25

Department

C overhead account

200

Department

D overhead account

50

275

275

Transfer

of under-absorbed departmental expenses for

period

(c)

Under or over-absorbed overhead

expenditure

Department

A

10.000

machine hours x Rs.0.10

1,000

Department

B

5.300

labor hours x Rs.0.75

3,975

Department

C

100%

of Rs.6.800

6,800

Department

D

13,800

units x Rs.0.25

3,450

111

Cost

& Management Accounting

(MGT-402)

VU

If

predetermined

absorption

rates

are used. It is likely that

there

will be under or over-absorption

of

overheads. This is

the

balance on the

production overhead account

and will be debited

or

credited

in the

costing profit

and

loss account.

Absorption

of non-production costs

Non-production

costs

are costs incurred

for non-manufacturing reasons such as

administration

or

selling and marketing cost.

The

cost

of

administration,

marketing,

research

and development

etc.

has a great

impact

on

the

fortunes

of a business,

and

thus must be allowed for in

cost-per-unit. Calculations which

provide

information

for cost control and

disclose the

effect

of

management

decisions

on other function

costs,

and

vice

versa.

Marketing

Marketing

comprises

the activities of selling, publicity and

distribution.

The

cost accounting system

should show:

�

Suitable cost centre analysis to

identify costs with

responsibility

�

Analysis between fixed and

variable, especially for

distribution costs, e.g.

packaging and

delivery

�

Statistical bases to measure

and compare costs,

e.g.

salesmen's calls, number of

orders

General

administration

General

administration

represents the costs of

general management, secretarial

accounting and

administrative

services except for any such

costs which can be directly

related to production,

marketing,

research or development.

Once

again the cost accounting

emphasis will be on analysis by

cost centre for

control.

Research

and development

Research

costs are those incurred in

seeking new or improved

products or methods. Development

costs

are those incurred by those stages

from decision implementation to

production.

Cost

analysis will usually relate

to natural classification, such as

materials or laboratory services

and

will

accumulate costs by specific

project.

Attributing

non-production costs to output

IAS

2 regulates the valuation of

stocks and work-in-process

for financial accounting

purposes and

states

that only production costs

should be included in stock valuations.

This defeat the

argument

for

attributing non-production costs to

output. However, as has been

stated above, such costs

are

often

significant, and their

inclusion in internal unit

costs may be necessary in

order to ensure that

they

are fully recognized in any

pricing policy discussions

undertaken by management

accountants.

For

pricing purposes the most

common method of attributing

non-production costs to

output

units

is by an absorption rate calculated as a

percentage of production cost.

The alternative to this

is

to treat non-production overheads as period

costs and write them

off in full as an expense of

the

period

in which they are incurred,

with no absorption into

units produced in the period.

Multiple

Choice Questions

1

The

following statements relate to

the effects or advantages of using a predetermined

overhead

absorption

rate, rather than calculating

overhead costs on the basis

of actual costs and

actual

activity

levels.

112

Cost

& Management Accounting

(MGT-402)

VU

(a)

IAS 2 requires the

absorption of production overhead to be

based on normal levels

of

activity

rather than actual levels of

activity.

(b)

Using a pre-determined absorption

rate avoids fluctuations in

unit costs caused by

abnormally

high or low overhead

expenditure or activity

levels.

(c)

The net profit each

year, allowing for the

under- or over-absorbed overhead

adjustment

to

profit, will be the same

with pre-determined overhead rates as

with actual rates.

(d)

Using a pre-determined absorption rate

offers the administrative convenience

of

being

able to record full production

costs sooner.

All

of these statements are

correct except:

A.

Statement

(a)

B.

Statement

(b)

C.

Statement

(c)

D.

Statement

(d)

2

What

is cost apportionment?

A.

The

charging of discrete identifiable items

of cost to cost centers or

cost units

B.

The

collection of costs attributable to

cost centers and cost

units using the costing

methods,

principles and techniques prescribed for

a particular business

entity

C.

The

process of establishing the

costs of cost centers or

cost units

D.

The

division of costs amongst two or

more cost centers in

proportion to the

estimated

benefit

received, using a proxy, e.g.

square feet

3

Grumpy

& Dopey Ltd estimated

that during the year

75,000 machine hours would be

used

and

it has been using an overhead

absorption rate of Rs.6.40

per machine hour in its

machining

department. During the year

the overhead expenditure

amounted to Rs.472,560

and

72,600 machine hours were

used.

Which

one of the following statements is

correct?

A.

Overhead

was under-absorbed by Rs.7,440

B.

Overhead

was under-absorbed by Rs.7,920

C.

Overhead

was over-absorbed by

Rs.7,440

D.

Overhead

was over-absorbed by

Rs.7,920

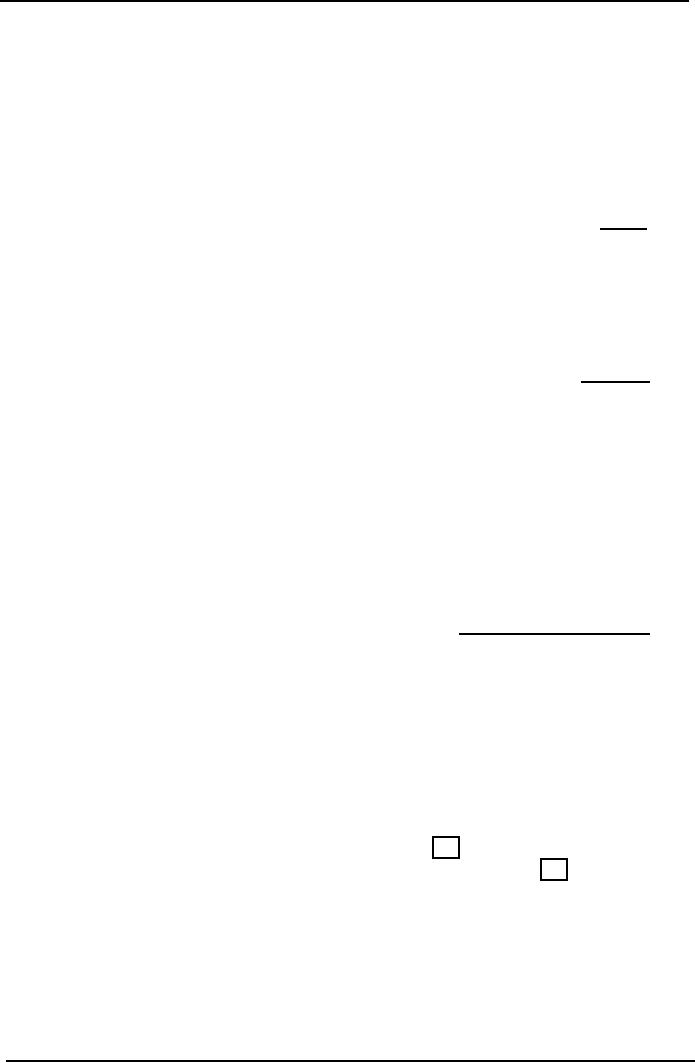

PROBLEM

QUESTION

You

are the cost accountant of

an industrial concern and

have been given the

following

budgeted

information regarding the

four cost centers within

your organisation.

You

also ascertain the following

points:

(i)

The canteen staff is outside

contractors.

(ii)

Departments 1 and 2 are

production cost centers and

the Maintenance department

and

Canteen

are service cost

centers.

(iii)

The Maintenance department provides 4,000

service hours to Department 1

and 3,000 service

hours

to Department 2

(iv)

Department 1 is machine-intensive and

Department 2 is labor-intensive.

(v)

6,320 machine hours and

7,850 labor hours are

budgeted for Departments 1

and 2 respectively

for

2006.

Required

Prepare

an overhead cost statement showing

the allocation and

apportionment of overhead to

the

four

cost centers for the

year 2006, clearly showing

the basis of apportionment.

Consider the

following

given information:

113

Cost

& Management Accounting

(MGT-402)

VU

Dept

1

Dept

2

Maint-

Canteen

Total

enance

Rs.

Rs.

Rs.

Rs.

Rs.

Indirect

labor

60,000

70,000

25,000

15,000

170,000

Consumables

12,000

16,000

3,000

10,000

41,000

Heating

and lighting

12,000

Rent

and rates

18,000

Depreciation

30,000

Supervision

24,000

Power

20,000

315,000

You

are also given the following

information:

Dept

1

Dept

2

Mainte

Canteen

Total

dept

Floor

space in

10,000

12,000

5,000

3,000

30,000

square

meters

Book

value of

150,000

120,000

20,000

10,000

300,000

machinery

in Rs

Number

of employees

40

30

10

80

Kilowatt

hours

4,500

4,000

1,000

500

10,000

114

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS