|

LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST |

| << PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS |

| ALLOCATION AND APPORTIONMENT OF FOH COST >> |

Cost

& Management Accounting

(MGT-402)

VU

LESSON

# 14

LABOR

TURNOVER AND LABOR EFFICIENCY

RATIOS

&

FACTORY OVERHEAD

COST

Labor

Turnover:

Labor

turnover may be defined as the

rate of change in the

composition of the labor

force of an

organisation

high rate of labor turnover

denotes that labor is not

stable and there is

frequent

change

in the labor force in the

organisation. The high labor

turnover rate is an

important

indication

of high labor cost. It is

therefore not

desirable.

Measurement

of Labor Turnover:

There

are various methods for the

measurement of labor turnover.

The choice of method

of

measurement

would depend on the organisation.

But, however, once a

particular method is

adop-

ted

for it, it should be

followed for quite some

times, so that a clear and

comparative picture is

obtained.

The methods of measurement

are:

(1)

Separation method;

Labor

turnover is measured by dividing

the total number of

separations (workers

left

the

organisation) during a period by the

average number of workers on

the pay roll.

Labor

turnover

Number

of separations in a period x 100 Average

number of

workers

in a period

(2)

Flux method:

Labor

turnover is measured by dividing

the total number of

separations and

replacements

by the average number of

workers.

Labor

turnover

Number

of separations + number of replacement x

100 Average number

of

workers during the

period.

(3)

Replacement method:

Labor

turnover is measured by dividing

the number of replacements

during a

period

by the average number of

workers employed in that period.

Labor

turnover

Number

of workers replaced during

the period

Average

number of workers during the

period.

Average

workers employed = Number of workers at

the beginning of the period + Number

of

workers

at the end of that period divided by

2.

PRACTICE

QUESTION

The

personnel department of a company has

supplied the following information

relating to its

work

force during the month of

June, 2006.

Number

of workers:

1st.

June

1900

th

30

. June

2100

During

the month 60 persons were

discharged and 20 left the

company. During the month

200

workers

were engaged out of which

only 40 workers were appointed

against the vacancy caused

by

the

number of workers separated

and the remaining on account of an

expansion scheme of the

company.

Calculate

labor turnover rate and

equivalent rate under

different methods.

99

Cost

& Management Accounting

(MGT-402)

VU

Solution:

Average

number of workers

1900

+ 2100 = 2,000

2

1.

Separation Method:

Labor

turnover ratio

80

x 100

=

4%

2,000

Equivalent

annual turnover

4

x 365

=

48.67%

30

2.

Flux Method:

Labor

turnover

80

+ 40 x 100 =

6%

2,000

Equivalent

annual turnover

6

x 365

=

73%

30

3.

Replacement Method:

Labor

turnover

40x

100

=

2%

2,000

Equivalent

annual turnover

2

x 365

=

24.33%

30

The

working results of the above

practice question reveals wide

fluctuations among the

different

annual

labor turnover rates obtained by

different methods of measurement.

The

flux method of labor

turnover denotes the total

change in the composition of

labor force.

While

replacement method takes

into account only workers

appointed against the vacancy

caused

due

to discharge or quitting of the

organisation. This method does

not take into account

the

workers

employed under the expansion schemes of

the company.

However,

it must be noted that if a

department is closed and

workers retrenched, it would not be

a

case

of labor turnover.

The

higher percentage of labor

turnover, the higher will be

the cost of recruitment and

training of

new

workers. A higher rate of labor

turnover also reduces the

efficiency since good deal

of work

would

be done by new inexperienced workers. The

objective of management therefore should

be

to

keep the percentage of labor

turnover at minimal. However, in any

organisation a minimum rate

of

labor turnover will always

occur particularly due to

retirement, marriages, death

and personal

betterment.

Causes

of Labor Turnover

Labor

turnover arises because of various

factors including dissatisfaction

with job, low rate

of

wages,

unsatisfactory working conditions

and non-availability of adequate

basic amenities.

The

causes of labor turnover may

be sub-divided as:

(1)

Avoidable causes, and

(2)

Unavoidable causes.

100

Cost

& Management Accounting

(MGT-402)

VU

(1)

Avoidable Causes:

a)

These include low wages

rate in the present organisation

and the worker may

look

for

higher wages

elsewhere,

b)

Dissatisfaction with job,

c)

Bad working

conditions,

d)

Long and odd working

hours,

e)

Unsatisfactory relationship with

the supervisors,

f)

Bad relationship with the

fellow workers,

g)

Lack of adequate recreational

facilities,

h)

Inadequate housing, medical

facilities,

i)

Unfair methods of promotion and

lack of promotions

avenues,

j)

Lack of planning and

foresight on the part of

management, seasonal nature

of

industry,

non-availability of raw materials,

power, etc.

(2)

Unavoidable Causes include:--

a)

Personal betterment of

worker,

b)

Retirement and death leading

to labor turnover,

c)

Domestic responsibilities--to look

after old parents,

d)

Accident or illness rendering workers

permanently incapable to

work,

e)

Dismissal or discharge due to

insubordination, negligence,

inefficiency, etc.,

f)

Marriages, specially in case of

women workers,

Effect

of Labor Turnover

The

higher rate of labor

turnover results in increased cost of

production. This is due

to--

(i)

Increased

cost of new recruitment,

training,

(ii)

Interruption

of production,

(iii)

Decrease

in production due to inefficiency

and inexperience of

newly

recruited workers,

(iv)

The

new workers are more

accident prone and are

liable to cause

more

damage to machinery, tools

than old employees,

(v)

Losses

due to wastage, spoilage and

defectives,

(vi)

Increased

number of accidents causing

loss of output and

increase

in

medical expenses and cost of

repairs,

(vii)

Lack of cooperation and

coordination between old and

new

employees

resulting fall in output and

increased cost of

production,

LABOR

EFFICIENCY AND UTILISATION

Labor

is a significant cost in many

organisations and it is important to

continually measure

the

efficiency

of labor against pre-set

targets.

Measuring

labor efficiency

To

measure labor efficiency:

Compare actual efficiency

with predetermined targets (or

budgets)

using

`standard hours'.

A

standard hour is the

number of production units

which should be achieved by an

experienced

worker

within a period of one hour.

We

can assume that all

organisations will benefit

from efficient labor, thus

it is important to

measure

how efficient workers are

and identify opportunities

for improvement.

The

following practice question shows

the calculation of the

efficiency ratio.

101

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Standard

time allowed per unit

30

minutes

Actual

output in period

840

units

Actual

hours worked

410

Budget

hours worked

400

The

efficiency ratio is calculated by

the following

formula:

Actual

output measured in standard

hours Actual hours

Actual

hours

840

x � hours (30 minutes) = 420

hours

420

x 100 = 102.44%

210

Problem

Question

Calculate

the efficiency ratio from

the following data.

Standard

time allowed per unit

15

minutes

Actual

production

900

units

Actual

hours

250

Budget

hours

200

FACTORY

OVERHEAD COST (FOH)

Factory

overhead costs are those

costs incurred which cannot

be identified directly to cost

unit.

These

are incurred in many

different parts of organisation.

These

include:

1.

Indirect materials

2.

Indirect labor and

3.

Indirect costs attributable to

production and the service

activities associated with

manufacturing.

Marketing,

general administration, research

and development costs that

are not associated

with

manufacturing

are not usually treated as

overheads for this

purpose.

Factory

overhead costs are incurred

in three main

centers:

�

Production

centers

costs

arising in production departments such as

the costs of

fuel,

protective clothing, depreciation

and supervision.

�

Service

centers

the

cost of operating support departments or

sections

within

the factory, for example,

the costs of materials

handling, production control,

and

canteen.

�

General

costs centersgeneral

production overhead such as factory

rent/taxes, heating and

lighting

and production management

salaries.

The

purpose of cost accounting is to provide

information to the management. Management

need

to

know cost per unit as a

basis for valuing inventory

and for decision

making.

FOH

Cost Allocation &

Apportionment

The

total cost of factory

overhead needs to be distributed among

specific cost centers. Some

items

102

Cost

& Management Accounting

(MGT-402)

VU

can

be allocated immediately, e.g.

the salary of a cost centre supervisor or

indirect materials

issued

to

a cost centre. Other items

need to be apportioned between a

number of centers, e.g.

factory rent

and

taxes or the factory

manager's salary.

Cost

Allocation

It

refers to the costs that

can be identified with

specific cost

centers.

Apportionment

It

refers to the costs that

cannot be identified with

specific cost centre but

must be divided among

the

concerned department/cost centers.

Steps

of Allocation &

Apportionment

1.

Item wise collection of FOH

cost.

2.

Identifying cost centre (Production &

Services).

3.

Allocating and apportioning

general F.O.H cost to the

cost centers.

4.

Apportioning FOH cost of service

cost centers to the

production cost

centers.

5.

Calculation of total FOH cost

for each production cost

centers.

6.

Determining FOH rate for

each production cost

center.

FOH

Absorption Rate

Finally

FOH absorption rate is calculated at

which the cost is absorbed

in the cost unit. This is

also

known

as overhead absorption rate

(OAR) this can be calculated

as under:

OAR

= Estimated F.O.H cost

Base

Bases

for FOH Absorption

Rate

Following

can be used as base to

calculate overhead absorption

rate:

1.

Direct Labor hours

2.

Machine hours

3.

No. of unit produced

4.

Direct labor cost

5.

Prime cost

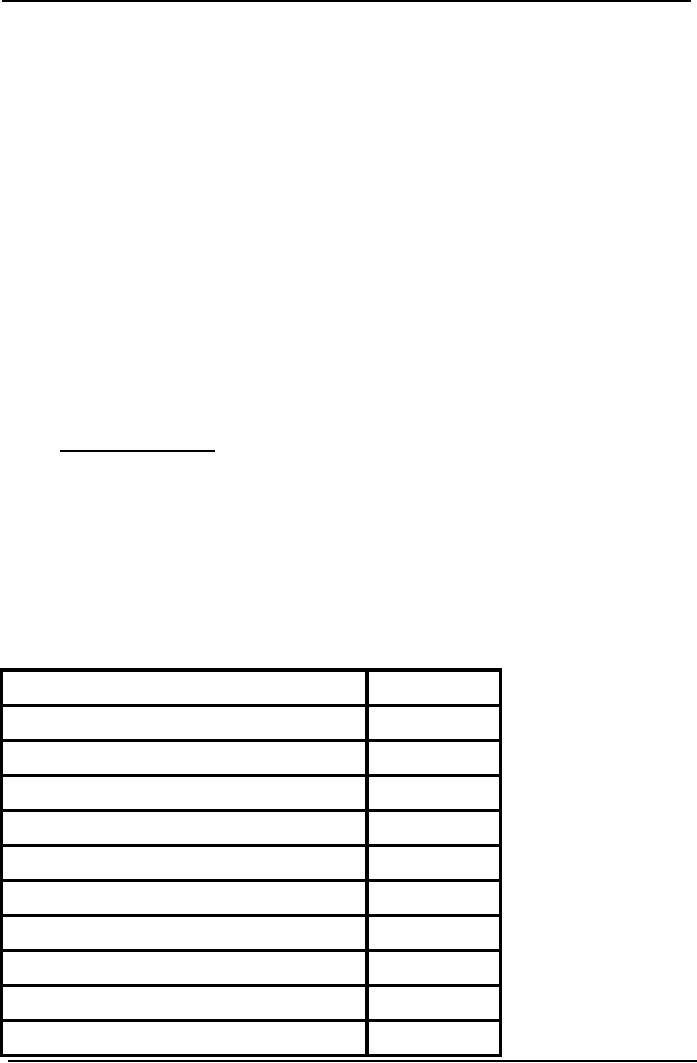

Problem

Question

Apportion

each of the cost given in four

cost centers A, B, C, and

D

Supervision

Rs.

7,525

Indirect

workers

6,000

Holiday

pay & national

Insurance

6,200

Tolling

cost

9,400

Machine

Maintenance labor cost

4,500

Powers

1,944

Small

tools & Supplies

1,171

Insurance

of machinery

185

Insurance

of building

150

Rent

& rates

2,500

Depreciation

of machinery

9,250

103

Cost

& Management Accounting

(MGT-402)

VU

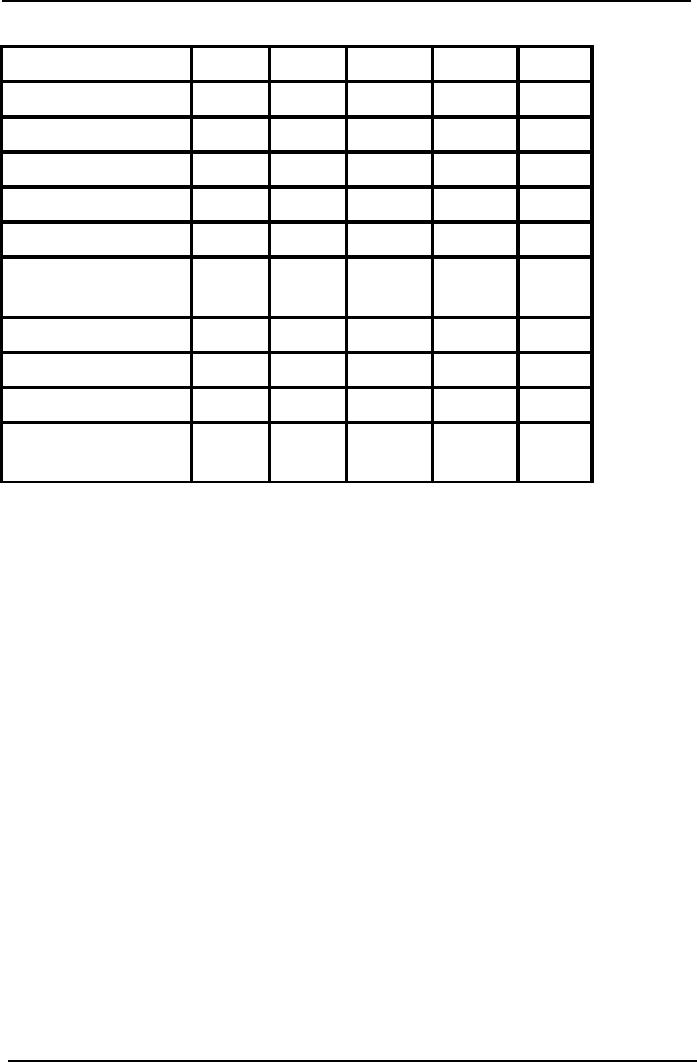

Basis

of apportionment of different

costs:

A

B

C

D

Total

1.

Floor Space

1,800

1,500

800

900

5,000

2.

Kilowatt hours

270,000

66,000

85,000

65,000

486,000

3.

Cost of machine

30,000

20,000

8,000

16,000

74,000

4.

Indirect workers

3

3

1

1

8

5.

Total workers

19

24

12

7

62

6.

Machine maintenance

3,000

2,000

3,000

1,000

9,000

hrs

7.

Supervision cost

2,050

2,200

1,775

1,500

7,525

8.

Tooling cost

3,500

4,300

1,000

600

9,400

9.

Small tools &

supplies

491

441

66

173

1,171

10.

Machine running

30,000

36,000

19,000

8,000

93,000

hours

104

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS