|

Cost

& Management Accounting

(MGT-402)

VU

LESSON

# 10

ACCOUNTING

FOR LOSSES

There

is always a chance of occurrence of

losses during the

manufacturing process and

even in the

finished

goods godown. Such losses

are classified as normal

loss and abnormal

loss:

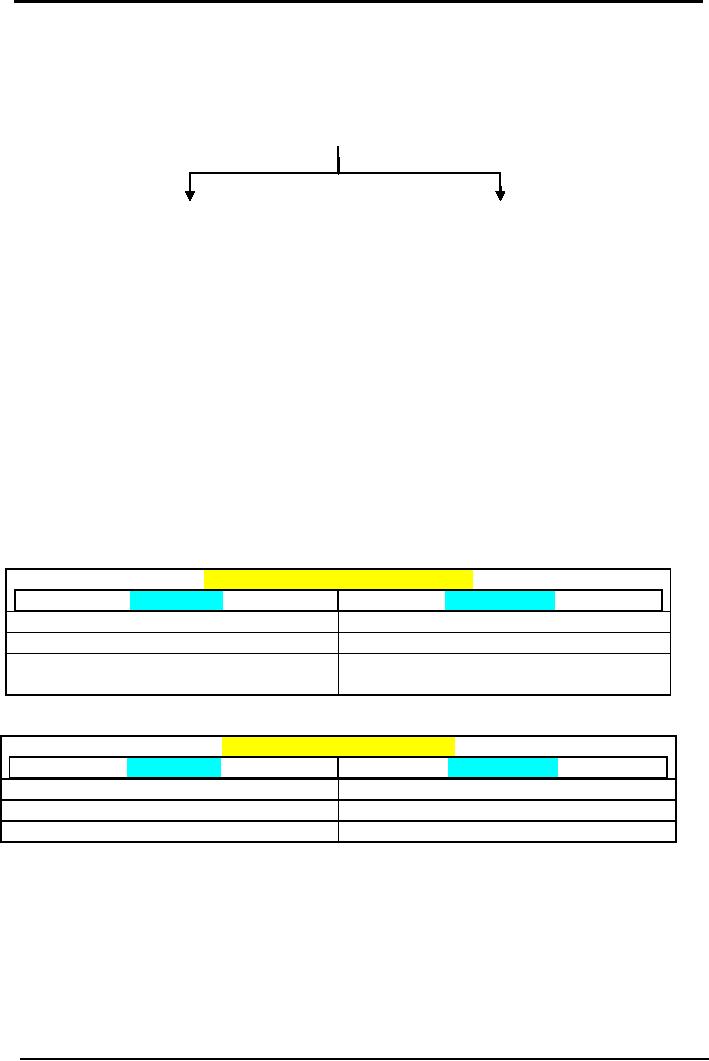

LOSSES

Normal

losses

Abnormal

losses

Normal

loss

Occurrence

of this type of loss is

always expected. It is unavoidable loss

and is inherent in

the

manufacturing

process or its chances of happening are

more likely than not.

For example; while

transporting

petrol, it is normal that a

little quantity will be

evaporated.

Abnormal

loss

It

is an unexpected loss. Measures are

always taken to avoid abnormal

losses. For example;

security

system

is installed to secure loss by theft

from godown of finished

goods. Safety measures

are

undertaken

during manufacturing process

against any loss of breakage of

the output. Special care

is

taken

during transportation of petrol to avoid

its leakage.

Normal

and abnormal losses are

treated differently in the

financial accounting and in

the cost

accounting

as well. Following is the self

explanatory chart that will

help in understanding

the

difference

between accounting treatment of

the two different types of

losses.

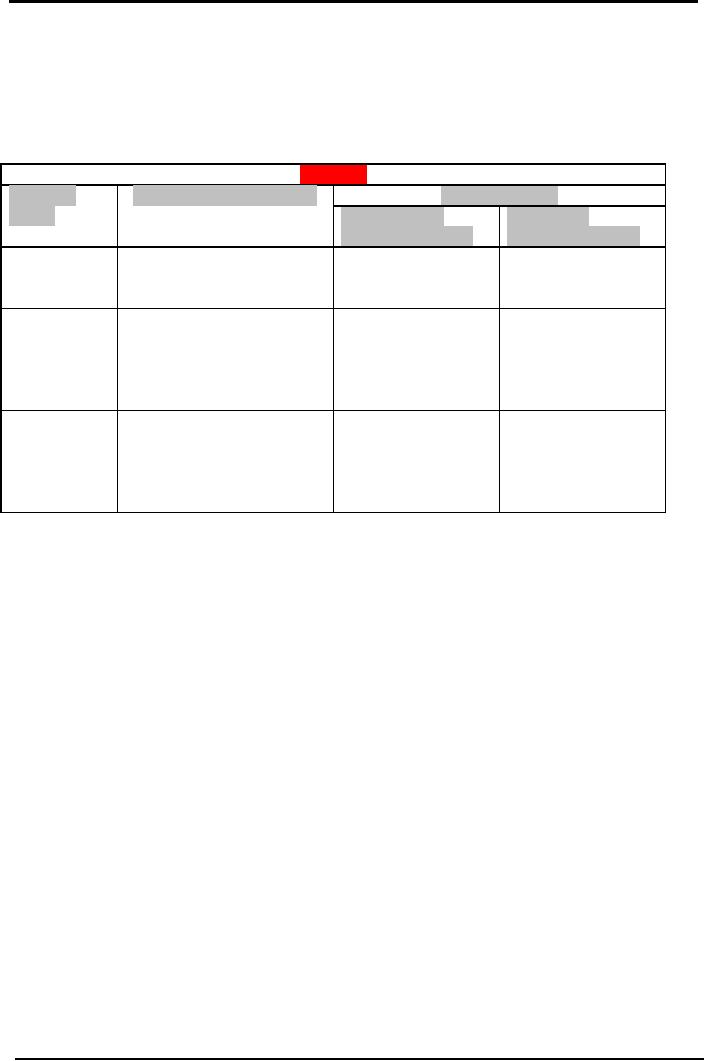

Treatment

in Financial Accounting

Normal

loss

Abnormal

loss

1.

Ignored

(no treatment).

1.

Specifically

recorded

2.

Per

unit cost increases.

2.

Inventory

per unit cost remains

same

3.

Normal

losses are absorbed by the

good

units.

Treatment

in Cost Accounting

Normal

loss

Abnormal

loss

1.

Charged

to FOH account.

1.

Charged

to specific WIP account.

2.

Overall

per unit cost

increases

3.

No impact on

individual job cost.

In

manufacturing process there

are two types of distortions

that can be identified as

losses:

1.

Defective output/work

2.

Spoiled output

Defective

output/work

At

the end of or during the

manufacturing process the inspection or

quality control

department

tells

about the defective output/work.

This can be made good by

adding further cost into

it. For

example;

in a winding department, 10 of the

capacitors were found

improperly wound up.

A

60

Cost

& Management Accounting

(MGT-402)

VU

further

cost of material, labor and FOH

will be required to re-wind these

capacitors. Doing

this

will

remove the defect. (Output means

completed units/work means in

process).

Spoiled

output

This

is cost of the goods that

have been destroyed because

of any reason. This can not

be made

good

and therefore are sold as

scrap inventory.

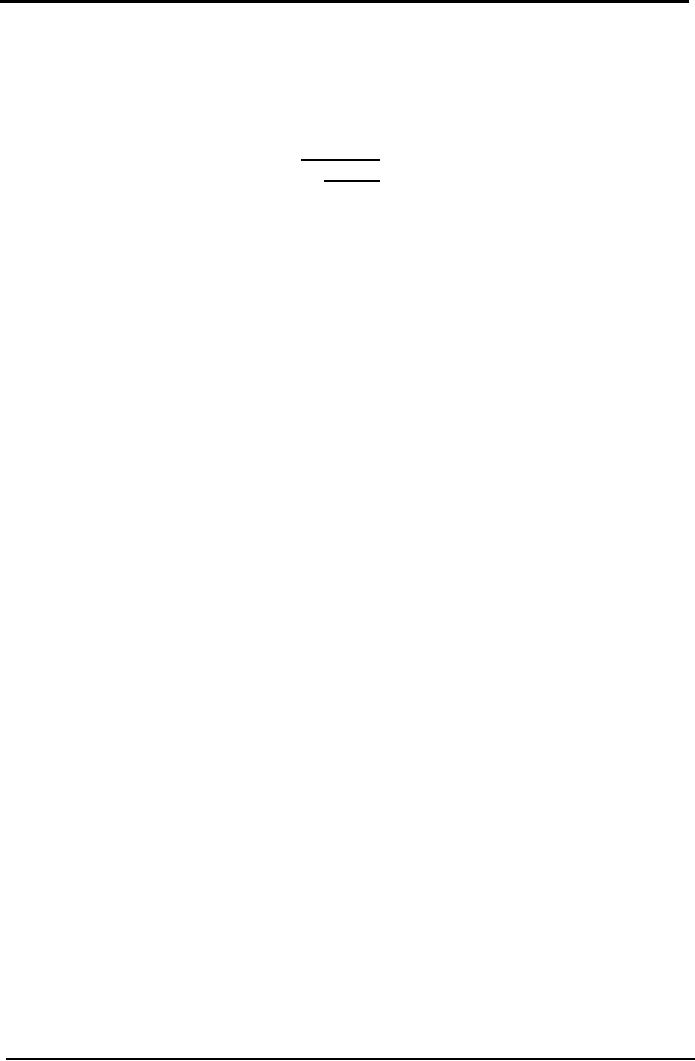

LOSSES

Types

of

Defective

Output/Work

Spoiled

Output

losses

Having

some

Having

no

recoverable

value

recoverable

value

Cost

of loss

Total

cost of

Additional

cost (Material,

Total

cost of

charged

as

production

(less)

Labor,

FOH)

production

expenses

recoverable

value

Accounting

Scrap

inventory

FOH

control A/C

Entries

FOH

control A/c

Material

FOH

control A/c

Normal

WIP

or Job A/c

Payroll

WIP

or Job A/c

losses

FOH

applied/(items)

Accounting

Scrap

inventory

WIP

or Job A/C

Entries

WIP

or Job A/c

Material

Abnormal

No

Entry

Payroll

losses

FOH

applied/(items)

Accounting

treatment

Normal

loss

Normal

losses are charged to

factory overhead control

account and thence become

part of

the

total production/manufacturing

cost.

The

additional cost incurred to

remove the defect is

charged to the factory

overhead cost,

as

it is explained in the accounting

entry shown in the above

table.

Whereas,

the total cost of spoiled

output is taken

out of the cost already

charged to the

job

and is then split into to

two; scrap inventory and

factory overhead cost.

Scrap

inventory

shows the amount recoverable

from the spoiled output

through its disposal

and

the

balancing amount that is

estimated to be irrecoverable is charged to

the factory

overhead

cost. Where nothing is expected to be

recovered from the scrap

inventory, total

cost

of the spoiled output is taken

out of the job and

charged to the factory

overhead.

Abnormal

loss

Abnormal

losses are charged to the

specific job/work in process

account and thence

become

part of the cost of the

specific job. This treatment

causes an increase in the

cost of

the

job.

The

additional cost incurred to

remove the defect is

charged to the work in

process

account,

as it is explained in the accounting

entry shown in the above

table.

Whereas,

a part of the cost of spoiled

output that

is expected to be recoverable

(scrap

inventory),

is taken out of the cost

charged to the job. The

estimated irrecoverable cost

(loss

portion) remains a part of

cost of the job, which

means that the loss

has been charged

to

the job.

Scrap

inventory shows the amount

recoverable from the spoiled

output through its

disposal.

Where nothing is expected to be recovered

from the scrap inventory,

no

accounting

entry in this case is required to be

passes, as total cost of the

spoiled output is

irrecoverable

and should remain in the

cost of the job.

61

Cost

& Management Accounting

(MGT-402)

VU

Practice

Question

Q.

1

A

& Co manufactured 500 ceiling fans to

fill an order by

incurring:

Direct

material

Rs.

150,000

Direct

labor cost

100,000

F.O.H

(60%

of labor cost)

60,000

Total

production cost

310,000

Some

of the work was found

defective, to make good such loss,

following cost was

incurred:

Rework

cost on defective work

Material

Rs.

10,000

Labor

30,000

F.O.H

(60%

of Labor cost)

18,000

Required:

Pass

accounting entries to record the

cost incurred along with the

adjusting entry

for

re-work cost, treating the

loss as:

a)

Normal

b)

Abnormal

Solution

a)

Normal loss

Work

in process A/C

310,000

Material

150,000

Payroll

100,000

F.O.H

applied

60,000

FOH

Control A/C

58,000

Material

10,000

Payroll

30,000

F.O.H

applied

18,000

Finished

goods A/C

310,000

Work

in process A/C

310,000

Cost

per unit =

310,000/500

=

Rs.

620 per unit

b)

Abnormal loss

Work

in process A/C

310,000

Material

150,000

Payroll

100,000

F.O.H

applied

60,000

Work

in process A/C

58,000

Material

10,000

Payroll

30,000

F.O.H

applied

18,000

Finished

goods A/C

368,000

Work

in process A/C

368,000

Cost

per unit =

368,000/500

=

Rs.

736 per unit

62

Cost

& Management Accounting

(MGT-402)

VU

Q.

2

Using

the data in Q. 1, now

suppose the spoiled output

is 50 fans, which can be sold as scrap

for

Rs.

200 each.

Cost

of spoiled output

=

Rs. 310,000 x 50

=

Rs.

31,000

Estimated

recoverable amount = Rs. 200

x 50

=

Rs.

10,000

Cost

of loss

Rs.

21,000

Solution

a)

Normal loss

Work

in process A/C

310,000

Material

150,000

Payroll

100,000

F.O.H

applied

60,000

Scrap

inventory

10,000

FOH

Control A/C

21,000

Work

in process A/C

31,000

Finished

goods A/C

279,000

Work

in process A/C

279,000

Cost

per unit =

279,000/500

=

Rs.

558 per unit

b)

Abnormal loss

Work

in process A/C

310,000

Material

150,000

Payroll

100,000

F.O.H

applied

60,000

Scrap

inventory

10,000

Work

in process A/C

10,000

Finished

goods A/C

300,000

Work

in process A/C

300,000

Cost

per unit =

300,000/500

=

Rs.

600 per unit

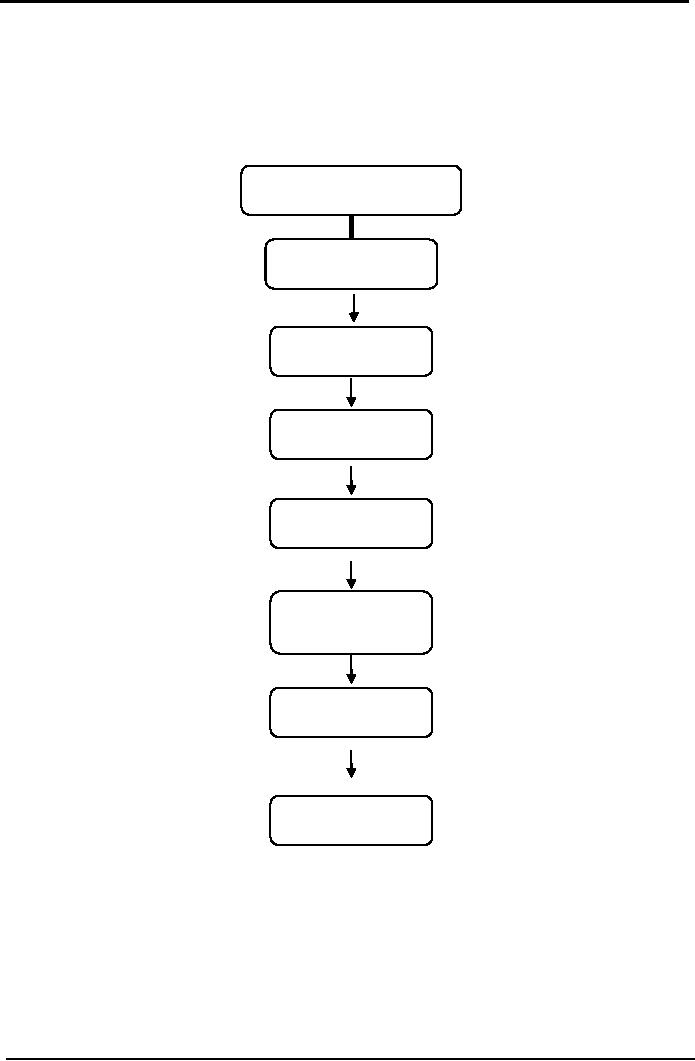

Different

documents are used in the

process of requisition, purchasing,

production and for

procurement

of material. These are used in

sequence presented in the

following diagram:

63

Cost

& Management Accounting

(MGT-402)

VU

Material

/ Store requisition

Purchase

requisition

Purchase

order

Delivery

note

Purchase

invoice

Goods

received

note

Bin

card

Store

ledger card

64

Cost

& Management Accounting

(MGT-402)

VU

Material/Store

Requisition

It

is a document through which

work station incharge requires/receives

material from the store.

It

is

sent to the store incharge

duly approved by the production

manager, stating the number of

units

required

for consumption based on

which the store incharge

issues the required material to

the

work

shop.

Purchase

Requisition

It

is forwarded by the store department to

the purchase department, indicating

the maximum and

minimum

stock levels, it also states

the reorder level along with

the economic order quantity. It

is

used

to require further purchase to be made by

the purchase department. It

also indicates the

current

position of the material in the

store.

Purchase

Order

It

is used to place order to

the supplier for purchase of

further material. This document

contains

information

regarding the quantity, specification,

rate, discount, settlement

term, time of

delivery,

and

dealing person. Based on the

purchase order the supplier

manages to deliver material to

the

ordering

entity.

Delivery

Note

It

is issued by the supplier/seller to

the purchaser, mentioning the

quantity and specification of

the

material

dispatched. On receipt of the material

the recipient acknowledges by the

signing the

delivery

note and returns it back to

the supplier

Purchase

Invoice

It

is the document that

evidences the transaction of purchase of

material. It is issued by the

seller

stating

quantity, rate, discount,

and amount of the purchased

material. Settlement terms are

also

stated

at bottom of the invoice.

Receiving an invoice means

that money is payable to the

supplier.

Goods

Received Note

It

is prepared by the inspection department

after verifying the quantity

and quality of the

material

received.

Received material along with the

goods received note is sent

to the store

incharge.

Bin

Card

Store

incharge after receiving the material as

per the goods received

note, places the material at

its

location

and makes an entry in the

bin card. Bin card is

used to maintain physical record of

the

material

received in and issued from

the store. It updated for

balance in the store after

each

transaction.

It also contains information regarding

reorder level, economic order

quantity,

maximum

and minimum stock levels,

maximum and minimum daily

consumption, and lead

time.

It

is placed at the location where

the material is stored.

Store

Ledger Card

It

is maintained by the accounting

department, more precisely stating it is

maintained by the cost

accounting

department that is concerned about

the calculation of cost per

unit. It is similar to the

bin

card as far as receipt and

issue of the quantity of material is

concerned, but the main

purpose

of

maintaining the store ledger

card is to know the cost of

material consumed and material in

store

along

with the cost per

unit of the material. Store

ledger card is maintained using the

FIFI, LIFO

and

W Avg methods.

Inventory

Turnover Ratio

Inventory

Turnover ratio shows the

stock position of the store

room. In how many

times

inventory

is used in a year and for

how long the inventory is

held in the store.

65

Cost

& Management Accounting

(MGT-402)

VU

Inventory

Turn over Ratio

Cost

of goods sold or Material consumed =

times

Average

Inventory

Average

Inventory

Opening

Inventory +

Closing

Inventory = Average

inventory

2

Stock

holding period

Number

of days in a year =

number

of days

Inventory

turnover ratio

PRACTICE

QUESTION

Opening

stock

1,000

units

Material

Purchase

7,000

units

Closing

Stock

500

units

Material

consumed

Rs.

7,500

Solution

Inventory

Turn over Ratio

Material

consumed

Average

Inventory

7500

.=

10

times

(1000+500)/2

Inventory

holding period

No

of days in a year

Inventory

Turn over Ratio

=

36 days

360

10

MULTIPLE

CHOICE QUESTIONS

The

following information is to be used

for questions 1 and 2

A

national chain of tyre fitters

stocks a popular tyre for

which the following

information is

available:

Average

usage: 140 tyres per

day

Minimum

usage: 90 tyres per

day

Maximum

usage: 175 tyres per

day

Lead

time:

10

to 16 days

Re-order

quantity: 3,000 tyres

1

Based on the data above, at

what level of stocks should

a replenishment order be

issued?

A

2,240

B

2,800

66

Cost

& Management Accounting

(MGT-402)

VU

C

3,000

D

5,740

2

Based on the data above,

what should be the maximum

level of stocks

possible?

A

2,800

B

3,000

C

4,900

D

5,800

3

Moura

uses the economic order

quantity formula (EOQ) to

establish its optimal reorder

quantity

for its single raw material.

The following data relates

to the stock costs:

Purchase

price: �15 per

item

Carriage

costs:

�50

per order

Ordering

costs: �5 per

order

Storage

costs:

10%

of purchase price plus �0.20

per unit per

annum

Annual

demand is 4,000

units.

What

is the EOQ to the nearest

whole unit?

A

53 units

B

170 units

C

485 units

D

509 units

4

Which of the following

statements is correct?

A

store ledger account will be

updated from goods received

note only.

A.

A stores requisition will

only detail the type of

product required by a customer.

B.

The term 'lead time' is

best used to describe the

time between receiving an order

and

paying

for it.

C.

To make an issue from stores

authorization should be required.

5

What would be the most

appropriate cost unit for a

cake manufacturer?

Cost

per:

A

Cake

B

Batch produced

C

Kilogram produced

D

Production run

The

following information relates to

questions 6 and 7

Turner

Limited has the following

stock record:

Date

Number

of units

Cost

(Rupees)

1

March Opening stock 100

units

at

3.00/unit

3

March Receipt

200

units

at

3.50/unit

8

March Issue

250

units

15

March Receipt

300

units

at

3.20/unit

17

March Receipt

200

units

at

3.30/unit

21

March Issue

500

units

23

March Receipt

450

units

at

3.10/unit

27

March Issue

350

units

6

What is the valuation of closing stock

using LIFO at each issue?

A

Rs. 460

B

Rs. 465

67

Cost

& Management Accounting

(MGT-402)

VU

C

Rs. 467

D

Rs. 469

7

What

is the valuation of issues using

the weighted average method of stock

valuation at each

issue?

A

Rs. 3,248

B

Rs. 3,548

C

Rs. 3,715

D

Rs. 4,015

68

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS