|

Brand

Management (MKT624)

VU

Lesson

9

BUILDING

BRAND VISION

Answers

to filling the growth

gap

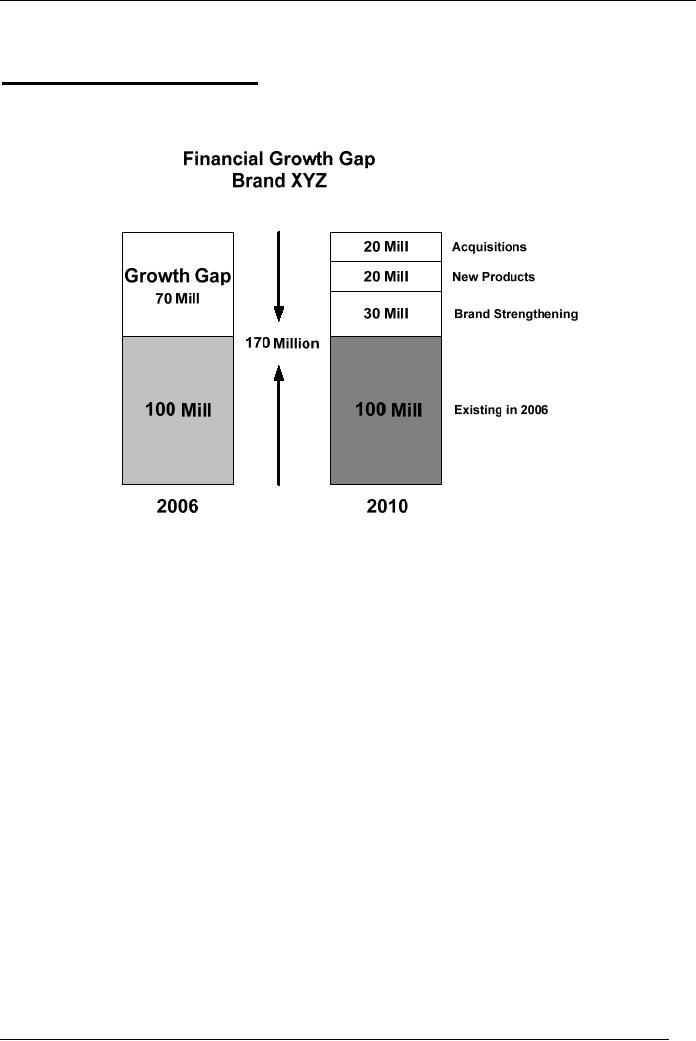

The

answers could be best obtained

with the help of the

following figure 13.

Figure

13

Source:

Scot M. Davis: "Brand Asset Management

Driving Profitable Growth through

Your Brands"; Jossey-

Bass,

A Wiley Imprint (46)

The

company plans to register

sales revenue of RS.170

million by the end of 2010.

The

existing

revenue level of year 2006 is

RS.100 million. The plan, in

other words, envisages

a

growth

of 70 percent, which translates

into a yearly average growth

rate of 17.5 percent.

(This

is

a hypothetical situation and does

not represent a real life

company case; in real life a

growth

rate

of 17.5 percent is very high

and is witnessed only in high

growth industries).

The

challenging part is how to

achieve what is envisaged. The

senior management is convinced

that

additional revenue of RS.70

million will come from a combination of

the following

strategic

moves:

�

Strengthening

of existing brand(s)

�

Introduction

of new products, and

�

Acquisitions

The

questions of brand managers

regarding how to fill the

contribution gap stand answered.

What

the above reveals is that no

single move can bring the

company the desired level

of

growth;

rather, it needs to move

into three strategic

directions to achieve the

objective.

The

brand and marketing management

know what they need to

plan to strengthen the

existing

brand(s),

to introduce new brands, and to formulate

moves for brands that are

planned to be

acquired.

The

intended targets of acquisitions may

not be revealed to brand management

immediately at

the

time the top management

envisions to do so. But, the

fact remains that acquired

brands will

also

bring their part of

contribution. Generally, acquisitions

bring with them staff

members at

the

level of brand managers, who get

immersed into company's management and

continue

performing

their functions to maintain

consistency.

38

Brand

Management (MKT624)

VU

With

the questions answered, brand

managers find themselves a

step further in building

the

brand

vision toward a clear

picture of the brand.

3.

Collect industry data and create a

brand vision

starter

Translation

of visionary thinking into

financial and strategic goals must

have a base. Nothing

could

provide a better base than

analyzing the industry the

company is a part of.

Industry

analysis

comprises the following:

�

Defining

the industry

�

Determining

industry growth and size

�

Key

growth factors

�

Seasonality

�

Industry

lifecycle

Defining

the industry: Defining the

industry is the first step

toward the analysis. You

must

consider

the following:

A

description of the economic sector

that the industry occupies

manufacturing,

services,

distribution, or any

other

The

range of products and services offered by

the industry

A

description of the geographic

scope of the industry

whether local,

regional,

national,

or international

The

industry definition may also

include a listing of major

market segments. For example,

a

computer

manufacturer may divide its

market into desk top

computers, laptops and

notebooks,

and servers for web

hosting.

The

idea is to find a definition

that is broad enough to include

all of the company's

major

competitors

but narrow enough to permit

useful comparisons. However, it is

better to be a

little

broad than being too

narrow.

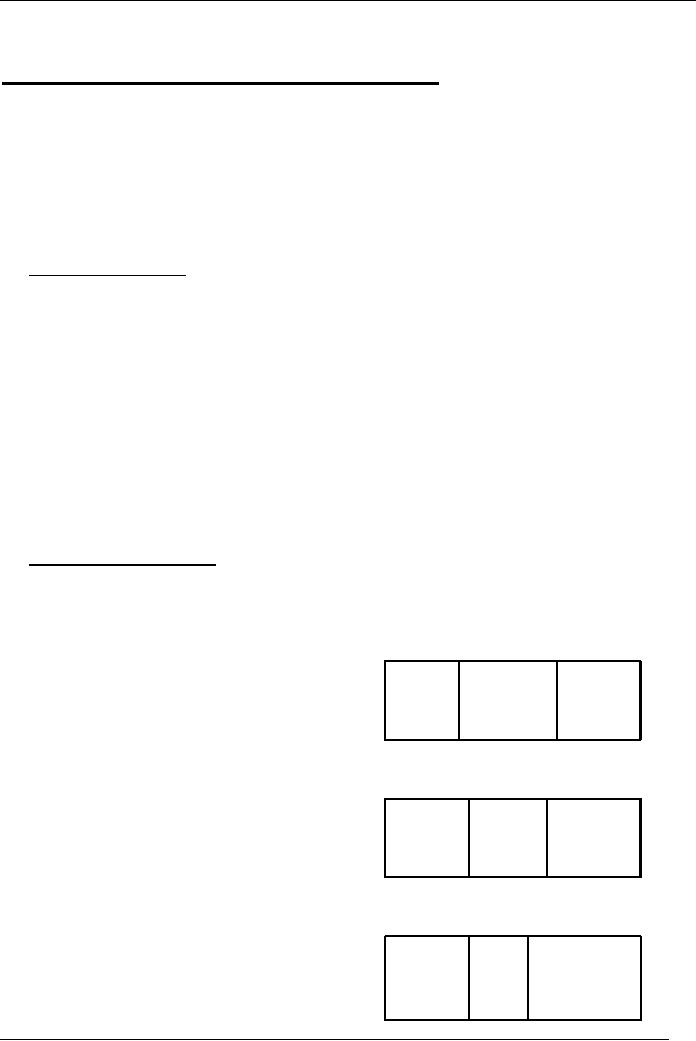

Market

Share

Industry

size and growth: You have

Figure

14

Years

2006 - 2008

to

determine the current size of

the

industry

for the company's

products

2006

or

services. You can determine this

through

published data or

informal

ABC

MNP

XYZ

means

and arrive at numbers for

total

units

sold and revenue generated

by

29%

38%

33%

all

the players in the

industry.

You

can then go on to determining

the

annual growth rate

of

yesteryears,

project for the next

few

2007

years

and compare that with

your

company's.

That will show you

how

you

seem to be growing as much

as

33%

31%

37%

the

industry, faster, or slower.

Such

analysis

will also enable you to

compare

your company's growth

with

other major

competitors.

2008

Figure

14 exhibits market

shares

enjoyed

by three different companies

33%

23%

44%

ABC,

MNP, and XYZ as projections

for

a three-year period.

39

Brand

Management (MKT624)

VU

Company

XYZ shows a consistent rise in its

market share at the expense

of the other

two

companies. Company MNP is losing

over the three-year period,

while company

ABC

is barely maintaining the

marginal growth it is projecting to

register in year

2007.

This

kind of a comparison helps

managers develop a realistic

picture of the

industry

and,

hence, the standing of their

own company while they

are in the process of

developing

a vision for their

brand.

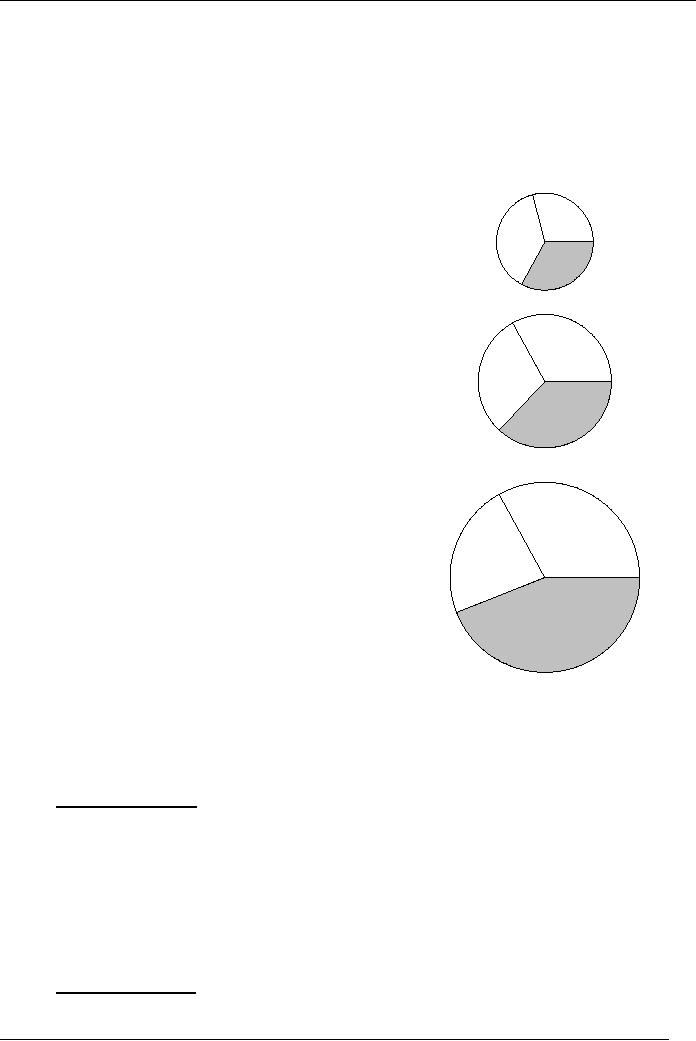

Another

factor that brand managers

should

Industry

Growth

Figure

15

consider

while analyzing market is

the

Years

2006-2008

growth

of the category or market.

The rise or

2006

drop

of market shares as projected

for the

ABC

three

companies can be interpreted in

yet

29%

another

way giving the managers

better

38%

MNP

insights

into the movements of

different

33%

XYZ

players.

It

is evident from figure 15

that company

2007

XYZ

has a market position

stronger than it

may

look from the preceding

figure 14. This

33%

company

is gaining market share in a

fast

30%

growing

category, which is different

from

having

the same level of shares in

a category

37%

that

is growing slower or is

static.

Company

MNP is dropping its share

fast over

the

three-year period, but may

not be losing

2008

the

volume as fast. The volume

may still be

the

same as it is in the year

2006. Although a

consolation

by way of utilizing

the

33%

production

capacity, the company

definitely

23%

is

not growing and is on the

declining path.

Company

ABC may be static in terms

of the

market

share, but it is gaining volume

on

yearly

basis. The situation,

however, is not as

44%

rosy

as that of XYZ and company ABC is

not

reaping

optimal benefits of the

category

growth.

Refer to the advantages that

number

one

brand enjoys as per the PIMS

findings in lecture 2.

Such

analyses arm the brand

managers with analytical

insights into

realistic

comparisons

and solid basis for

developing the right vision

for their brands.

Key

growth factors: Growth

factors are trends and

conditions beyond the

control of the

industry

or firms within it. Such

factors significantly affect

market growth and the

level

of

demand, hence having impact on

all.

The

car and electronic industries in Pakistan

have undergone a tremendous

growth

phase

owing basically to bank

financing, which is easily

available. The access to

bank

financing

is the key growth factor,

which has given a new

shape to the whole

supply

chain

of the two industries. The

level of demand on part of those who

are into

manufacturing

of car accessories and electronic parts

for TVs, for example,

has

witnessed

a growth rate unprecedented in the

past.

Cyclical

Influences

Cyclical

industries are those that

are directly affected by the

rise and fall of external

economic

cycles, usually the national

business cycle. Cyclical

industries generally do

40

Brand

Management (MKT624)

VU

well

during strong periods of growth and do

poorly during recessions.

Typical cyclical

industries

are manufacturing (consumer

durables) and construction (cement and

other

building

materials), to name a couple.

Cyclical

patterns should be identified to

know the strengths and

weakness of such

industries,

if those affect your business.

Seasonality:

It refers to the distribution of

business activity during the

year. If an

industry

is subject to seasonality, then

its sales in one part of the

year are

disproportionate

to the other part of the

year. For example ice cream and

cold drinks

have

a higher level of demand in the

typical season of summer.

Brand managers must

consider

such seasonal variations

while they are in the

process of developing the

brand

vision.

Industry

life cycle: It is important to

know the level of maturity

of an industry. There

are

four stages that

characterize maturity:

o

Embryonic

o

Growth

o

Mature

o

Aging

You,

as brand managers, have to see

what stage the industry is

in and how you relate

to

that

cycle (one of the above four

stages) in terms of growth

rate, market share,

product

line

planning, investment in technology

etc.

4.

Meeting with top management to create the

vision

Equipped

with all the relevant

details and information, you

are now in a position to make

a

presentation

to the top management. In

all chances, the findings

should be acceptable to

all

since

many vital factors in the

report owe their inclusion

to information from the

top

management.

It can still be debatable, but you

have a chance to defend the

bases that have

led

to

the conclusion. It offers a good

opportunity to iron out any

differences that brand

and

marketing

management may have with

other departments for the good of

the brand.

A

consensus on the report puts

the company on the course to

developing a clear brand

picture,

which

is the next strategic step

in the brand management

process.

BRAND

PICTURE

The

second step of the strategic

brand management process is development

of brand picture.

Toward

creating the right picture,

you have to do everything possible to

create the right

image.

The

whole exercise of creating the

right picture is to create

meaningful parallels between

the

brand's

identity and its image. We know by

now that more the image

coincides with

identity

the

more brand managers are

successful in communicating the

right identity and creating

the

right

image.

Creating

the right identity is of

paramount importance, for it

means that the product

has been

given

the right meaning that will

be rightly received at the

consumer's end. Creating a

brand,

therefore,

is the end of the process

that is the sum total of

all company resources

deployed to

create

the point of difference that

highlights brand's

identity.

Brands

therefore are born out of

the marketing strategies of

differentiation and segmentation,

as

is

already clear from the

discussion on all preceding concepts in

general and the example

of

company

XYZ's vision statement in

particular.

41

Brand

Management (MKT624)

VU

The

soul of branding

Branding

is not just putting a name on

top of a product. Branding is

that you do inside of

the

product,

that is, give it meaning

through creating the point

of difference in a way that

its

identity

is taken at the receiving end

the way it is intended. It is

because of such an identity

of

powerful

brands that you look at them

as relevant and genuine even in

the absence of a label2.

You

do not give the same

treatment to a fake brand

even if it carries the label

that may look

genuine.

Why? Because the actual

brand (the inner soul) is

not there! The brand name

is

visible,

yet the brand is absent. The

image, in other words, that

consumers have of the

two

products

is different. In case of the

original, it has the top of

the mind image; in case of

the fake

one,

it has the bottom of the

mind image.

How

to develop the right

picture?

The

question is how do you

create a brand that injects

into the product what

gives it the right

image?

The first task toward doing

that is to envision3:

�

What

attributes materialize?

�

What

advantages are

created?

�

What

benefits emerge?

�

What

obsessions does the brand

represent?

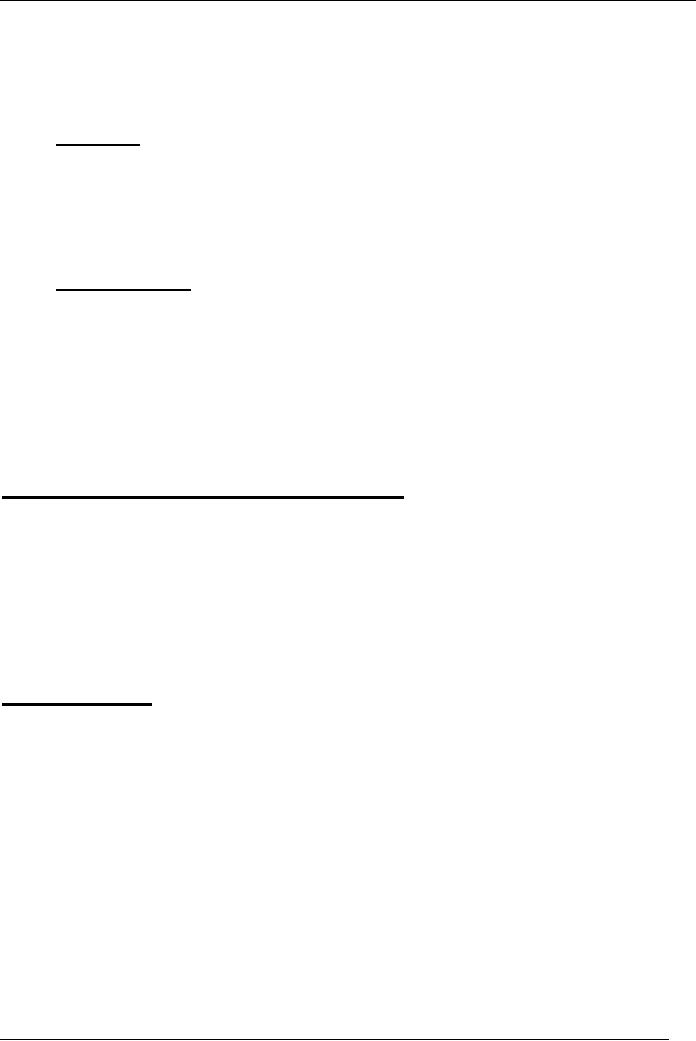

A

brand picture has to answer

all the

Brand

Picture Process

Starter

questions.

A simple question that

embodies

all

the above-mentioned four

questions is,

"what

would the market lack if

our brand

Right

Segment

was

not there?" If the answer is

nothing, then

the

brand managers may not go

ahead with

the

brand development.

If

the answer is substantive,

then the

substance

will be found systematically

through

the above four questions in

knowing

Right

the

features, advantages, benefits, and

the

Differentiation

Figure

16

obsessions

the brand offers. Therefore,

once

brand

managers are gone ahead with

the right

vision

and the purpose, the right image

will

result.

Figure

16 illustrates the

process of

Right

Product

developing

the brand picture - right

segment,

right

differentiation, right product,

right

identity,

the right image!

The

right picture gives you

the right basis

for

the

brand strategies that will

leverage the

brand

the way it is envisioned. An

important

thing

to keep in mind is that

brand picture is

Right

Identity

externally

driven with customers as the

focal

point3. It

takes into account customer

needs

and

the competition. The

competitive

environment

gives you the right

customer

perspective

regarding your product

vis-�-vis

competition.

Right

Image

42

Brand

Management (MKT624)

VU

Summary

- lectures 8 and 9

Building

brand vision is the first

step of the strategic brand

management process. To

leverage

your

brand, you should build up

the brand vision by

considering all possible strategic

factors

like

growth the company envisages,

the ability to reach strategic

goals, introduction of

products

and

then sustaining those

products.

Brand

managers must start the

process by seeking top management's

input on matters of

strategic

moves before they develop

the right vision, which

leads to developing the

right brand

picture.

The whole process is very

strategic and therefore must take

into account why a

particular

segment should be served and how the

company offering will best serve

that segment

of

the market.

Identification

of the right segment will enable the

brand managers to develop

the right product.

Identity

of the product, if created

right, will lead to the right image

that lays the foundation

for

the

right brand picture.

Bibliography:

1.

Jean-Noel Kapferer: "Strategic Brand

Management"; Kogan Page

(47)

2.

Jean-Noel Kapferer: "Strategic Brand

Management"; Kogan Page

(47)

3.

Scot M. Davis: "Brand Asset

Management Driving Profitable

Growth through

Your

Brands";

Jossey-Bass, A Wiley Imprint

(53)

Suggested

readings:

1.

Scot M. Davis: "Brand Asset

Management Driving Profitable

Growth through

Your

Brands";

Jossey-Bass, A Wiley Imprint

(37-48)

2.

Jean-Noel Kapferer: "Strategic Brand

Management"; Kogan Page

(46-59)

43

Table of Contents:

- UNDERSTANDING BRANDS – INTRODUCTION:Functions of Brand Management, Sales forecast, Brand plan

- INTRODUCTION:Brand Value and Power, Generate Profits and Build Brand Equity

- BRAND MANIFESTATIONS/ FUNDAMENTALS:Brand identity, Communication, Differentiation

- BRAND MANIFESTATIONS/ FUNDAMENTALS:Layers/levels of brands, Commitment of top management

- BRAND CHALLENGES:Consumer Revolt, Media Cost and Fragmentation, Vision

- STRATEGIC BRAND MANAGEMENT:Setting Objectives, Crafting a Strategy, The Brand Mission

- BRAND VISION:Consensus among management, Vision Statement of a Fast Food Company, Glossary of terms

- BUILDING BRAND VISION:Seek senior management’s input, Determine the financial contribution gap

- BUILDING BRAND VISION:Collect industry data and create a brand vision starter, BRAND PICTURE,

- BRAND PICTURE:Brand Value Pyramid, Importance of being at pinnacle, From pinnacle to bottom

- BRAND PERSONA:Need-based segmentation research, Personality traits through research

- BRAND CONTRACT:The need to stay contemporary, Summary

- BRAND CONTRACT:How to create a brand contract?, Brand contract principles, Understand customers’ perspective

- BRAND CONTRACT:Translate into standards, Fulfill Good Promises, Uncover Bad Promises

- BRAND BASED CUSTOMER MODEL:Identify your competitors, Compare your brand with competition

- BRAND BASED CUSTOMER MODEL:POSITIONING, Product era, Image Era, An important factor

- POSITIONING:Strong Positioning, Understanding of components through an example

- POSITIONING:Clarity about target market, Clarity about point of difference

- POSITIONING – GUIDING PRINCIPLES:Uniqueness, Credibility, Fit

- POSITIONING – GUIDING PRINCIPLES:Communicating the actual positioning, Evaluation criteria, Coining the message

- BRAND EXTENSION:Leveraging, Leveraging, Line Extension in detail, Positive side of line extension

- LINE EXTENSION:Reaction to negative side of extensions, Immediate actions for better managing line extensions

- BRAND EXTENSION/ DIVERSIFICATION:Why extend/diversify the brand,

- POSITIONING – THE BASE OF EXTENSION:Extending your target market, Consistency with brand vision

- DEVELOPING THE MODEL OF BRAND EXTENSION:Limitations, Multi-brand portfolio, The question of portfolio size

- BRAND PORTFOLIO:Segment variance, Constraints, Developing the model – multi-brand portfolio

- BRAND ARCHITECTURE:Branding strategies, Drawbacks of the product brand strategy, The umbrella brand strategy

- BRAND ARCHITECTURE:Source brand strategy, Endorsing brand strategy, What strategy to choose?

- CHANNELS OF DISTRIBUTION:Components of channel performance, Value thru product benefits

- CREATING VALUE:Value thru cost-efficiency, Members’ relationship with brand, Power defined

- CO BRANDING:Bundling, Forms of communications, Advertising and Promotions

- CUSTOMER RESPONSE HIERARCHY:Brand-based strategy, Methods of appropriations

- ADVERTISING:Developing advertising, Major responsibilities

- ADVERTISING:Message Frequency and Customer Awareness, Message Reinforcement

- SALES PROMOTIONS:Involvement of sales staff, Effects of promotions, Duration should be short

- OTHER COMMUNICATION TOOLS:Public relations, Event marketing, Foundations of one-to-one relationship

- PRICING:Strong umbrella lets you charge premium, Factors that drive loyalty

- PRICING:Market-based pricing, Cost-based pricing

- RETURN ON BRAND INVESTMENT – ROBI:Brand dynamics, On the relevance dimension

- BRAND DYNAMICS:On the dimension of knowledge, The importance of measures

- BRAND – BASED ORGANIZATION:Benefits, Not just marketing but whole culture, Tools to effective communication

- SERVICE BRANDS:The difference, Hard side of service selling, Solutions

- BRAND PLANNING:Corporate strategy and brands, Brand chartering, Brand planning process

- BRAND PLANNING PROCESS:Driver for change (continued), Brand analysis

- BRAND PLAN:Objectives, Need, Source of volume, Media strategy, Management strategy