|

SALES TAX RETURNS |

| << SALES TAX |

Taxation

Management FIN 623

VU

MODULE

19

LESSON

19.45

SALES

TAX RETURNS

Appointment

of Officer of Sales Tax Sec

30

� A collector

of Sales Tax

� A

Collector of Sales Tax

(Appeals)

� An

additional Collector of Sales

Tax

� A

Deputy Collector of Sales

Tax

� An

Assistant Collector of Sales

Tax

� A

Superintendent of Sales Tax

� An

officer of sales tax with

any other designation

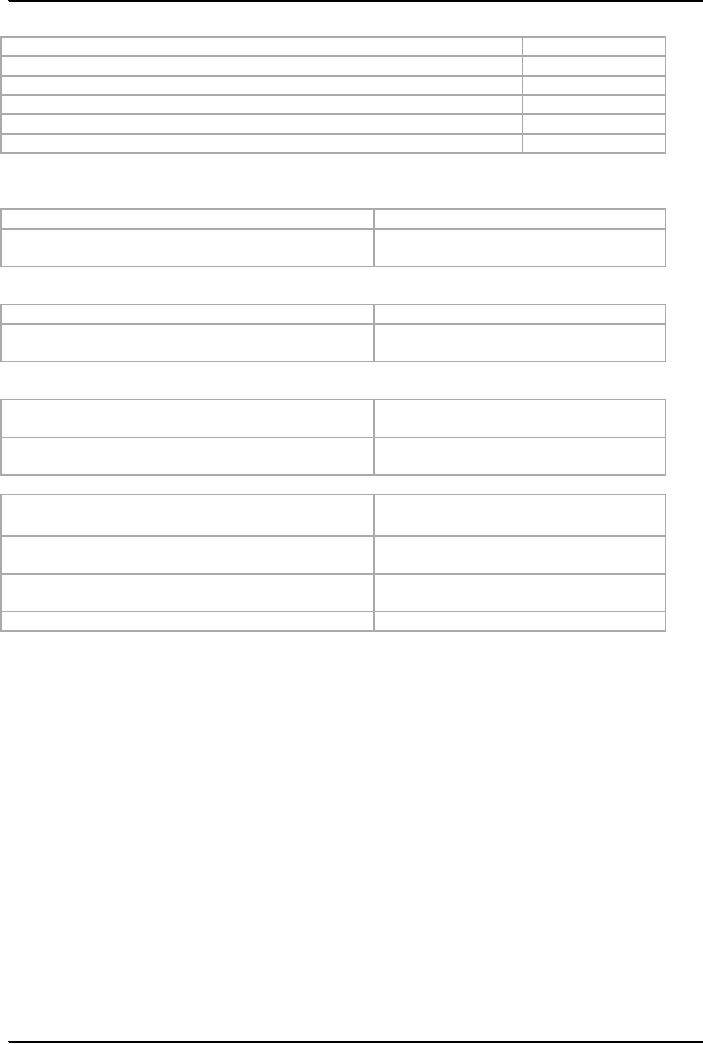

Offences

and Penalties

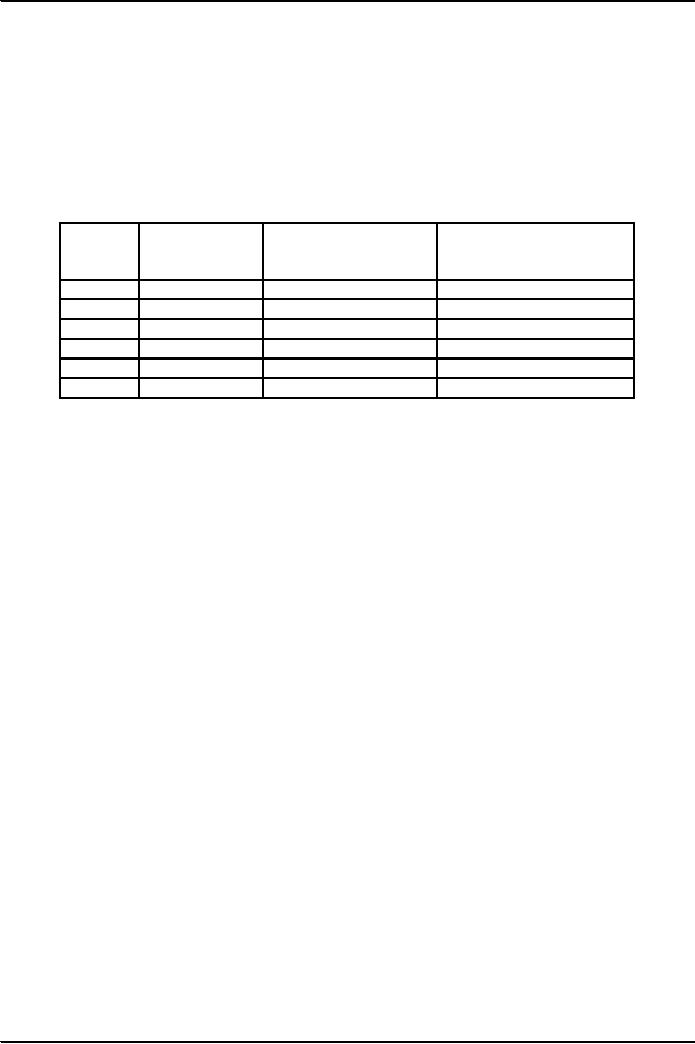

Offences

Penalties

Any

person fails to

furnish

Rs

5,000

a

return within the due

Date.

Any

person who fails to

issue

an invoice

Rs

5,000 or 3%

of the

amount

of tax

involved,

whichever

is

higher

A

person who fails to

deposit

the amount of tax

due.

Rs

10,000 or

5% of

the

amount of

tax

involved,

whichever

is

higher

A

person who fails to apply

for

registration before

Rs

10,000

making

taxable supplies.

or

5% of

the

amount of

tax

involved,

whichever

is

higher

A

person who fails to

maintain

records

Rs

10,000

or

5% of

the

amount of

tax

involved,

whichever

is

higher

A

person who submits a

false

or

forged document to any

officer

of

sales tax

Rs

25,000

or

111

Taxation

Management FIN 623

VU

100% of

the

amount of

tax

involved,

whichever

is

higher

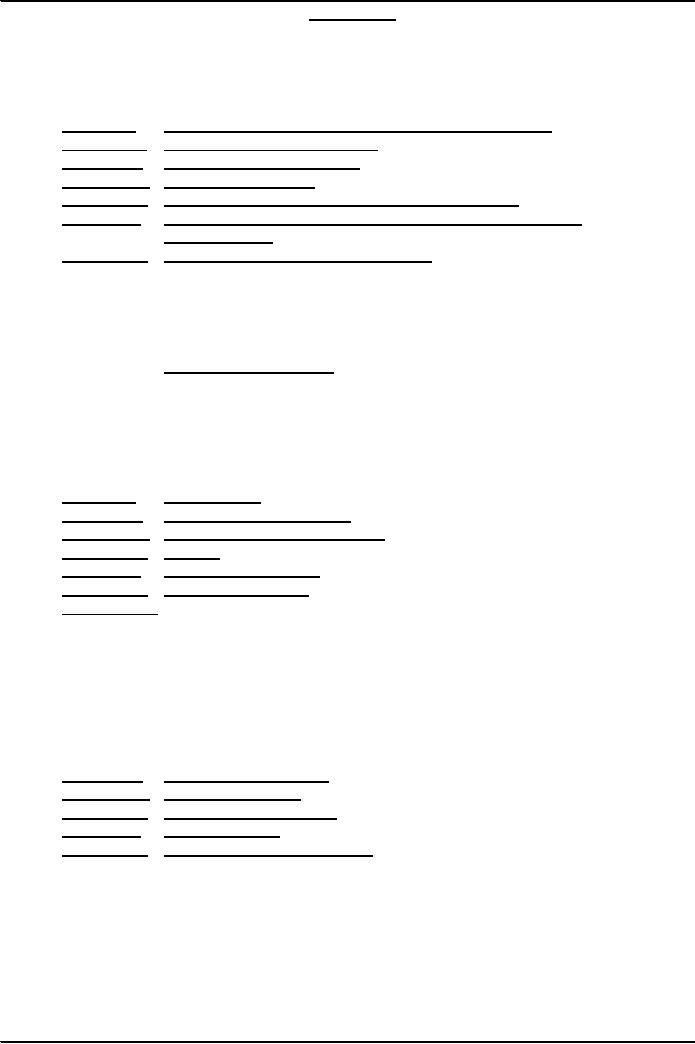

Appeals:

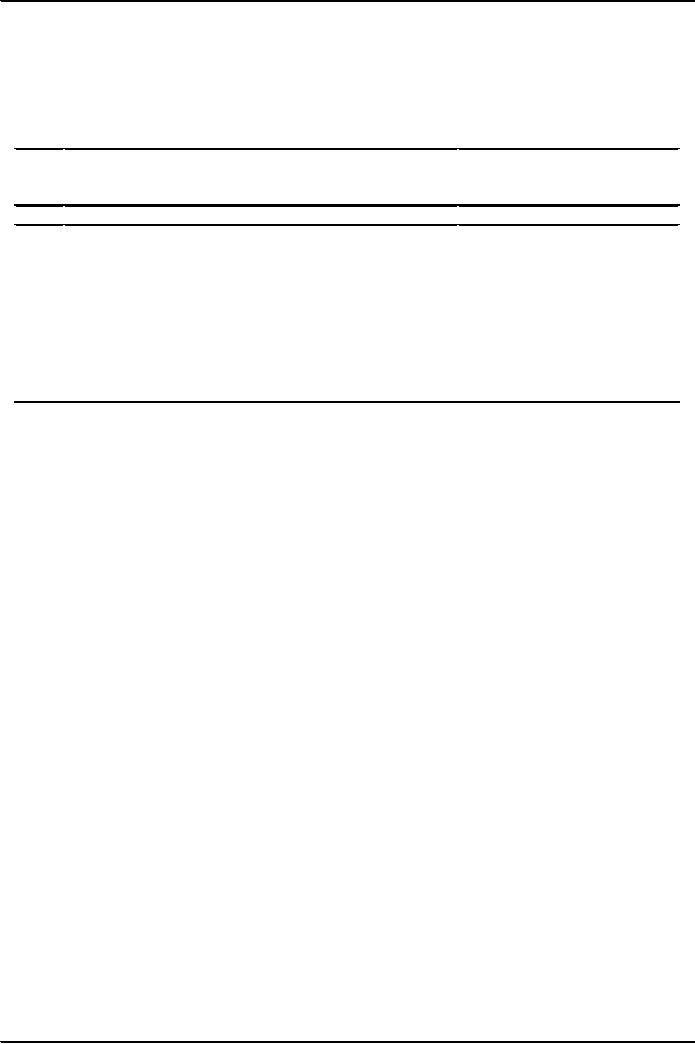

Powers

of adjudication are vested in the

following officers:

Additional

Collector Cases falling under

sub-section (2) of section 11

and section 36 without

any

restriction as to

the amount of tax involved or amount erroneously

refunded.

Deputy

Collector

(a)

Cases falling under sub-section

(1) of section 11

(b)

Cases falling under sub-section

(2) of section 11 and

section 36 provided that the amount

of

tax

involved or the amount erroneously refunded

exceeds one million rupees,

but does not

exceed

two and a half million

rupees.

Assistant

Collector

Cases

falling under sub-section (2) of

section 11 and section 36

provided that the amount of tax

involved

or the amount erroneously refunded exceeds ten

thousand rupees, but does

not exceed one

million

rupees.

Superintendent

Cases

falling under sub-section (2) of

section 11 and section 36

provided that the amount of tax

involved

or the amount erroneously refunded does

not exceed ten thousand

rupees.

An

officer of sales tax with

any other designation

Such

cases as may be notified by the

Board:

CBR

and Collector may at its

own motion call for

and examine the record of

any departmental proceedings.

Appeal

to collector of Sales Tax

(Appeals) Sec 45 b

Appeal

may be filed by any person

other than officer of sales

tax within 30 days of the date of

receipt of

such

decision or order against

which appeals is

proffered.

Appeals to

Appellant Tribunal:

(1)

Any person including an

officer of Sales Tax not

below the rank of an Additional

Collector (words "

the

Sales Tax Department"

substituted by Finance Act

2006), aggrieved by:

a.

any order passed by the

Collector under sub-section (4) of

section 45A or (words

inserted by

Finance

Act 2005.) the Collector of

Sales Tax (Appeals) under

section 45B; and

b. Any

order passed by the Board or the

Collector of Sales Tax under

section 45A, may, within

sixty

days

of the receipt of such decision or order,

prefer appeal to the Appellate

Tribunal.

(2)

The Appellate Tribunal may

admit an appeal preferred after the period of

limitation specified in

sub-

section

(1) if it is satisfied that

there was sufficient cause

for not presenting it within

the specified

period.

(3)

The appeal shall be

accompanied by a fee of one

thousand rupees paid in such

manner as the Board

may

prescribe.

(4)

The Appellate Tribunal, after

giving the parties to the appeal, an

opportunity of being heard may

pass

such

orders in relation to the matter before

it as it thinks fit:

� Provided

that when any such order

amounts to an interim order

staying the recovery of tax,

such order

shall

cease to have effect on the expiration of

a period of six months following the

day on which it is

made

unless the case is finally

decided, or the interim order is

withdrawn by the Tribunal

earlier:

� Provided

further that such interim

order or orders, as the case

may be, shall cease to

have effect on the

expiration

of a total period of six months

following the day on which the

first interim order is

made,

unless

the case is finally decided, or the

interim order is withdrawn by the

Appellate Tribunal

earlier.

� Order

under this section shall be passed

within six months of the filing of

appeal.

Reference

to High Court

(1)

Within ninety days of the communication

of the order of the Appellate Tribunal

under sub-section (5)

of

section 46, the aggrieved

person or any officer of

Sales Tax not below the

rank of an Additional

Collector

may prefer an application in the

prescribed form along with a

statement of the case to the

High

Court, stating any question of

law arising out of such

order.

� A

reference to the high court under this

section shall be heard by a

bench of not less than

two judges of

the

high court.

112

Taxation

Management FIN 623

VU

MODULE

20

LESSON

20.45

CAPITAL

VALUE TAX (CVT)

PROCEDURE

FOR LEVY & COLLECTION OF

CAPITAL VALUE TAX

CAPITAL

VALUE TAX RECOVERY & REFUND

RULES

Capital

Value Tax was levied with

effect from 1st July, 1989

on the capital value of

assets.

This

is payable by every individual,

association of persons, firm or a

company which acquires by

purchase

gift,

exchange, relinquishment, surrender if rights by the

owners (whether effected orally or by

deed or

obtained

through court decree) except

by inheritance an asset or a right to the

use thereof for more

than

twenty

years. An asset or a right to the

use thereof for more

than twenty years.

Levy

of tax on Capital Value of

certain assets:

� Capital

value tax shall be payable

by

Individual

Association of

persons, firm or

A

company which acquires

by:

� Purchase

� Gift

� Exchange

� Power

of attorney

� Surrender

of rights

� Relinquishment

of rights by the

owner

Exceptions:

when

capital assets acquired

by:

Inheritance

Gift

from spouse, Parents, Grand

parents, a brother and a

sister

An

asset or a right to use

thereof for more than 20

years

Capital

value tax shall be payable at the

rates specified in sub

section of 2 of Section 7

Explanation

of certain "Expressions"

� "association

of persons" and

"firm" shall have the same

meaning as contained in the Income

Tax

Ordinance,

1979 (XXXI of 1979);

and

"company"

shall

have the same meaning as

defined in the Income Tax Ordinance,

1979 (XXXI of

1979);

� "development

authority" means

an authority formed by or under any

law for the purposes

of

development of an

area and includes any

authority, society, agency, trust,

association or institution

declared

as development authority by the Central Board of

Revenue by a notification in the

official

Gazette;

and

"registration

authority" means

the person responsible for

registering or attesting the transfer of

the

asset

or of the right to use thereof

for more than twenty

years, and in the case of a

development

authority

or a cooperative society, its principal

officer.

� "Urban

area" means

area falling within the

limits of:

The

Islamabad Capital Territory;

A cantonment board;

or

A municipal

body;

In

case of Karachi up to 40 kilometers from the

outer limit of municipal or cantonment

limits;

In

case of Lahore and Faisalabad up to 30

kilometers from the outer limit of

municipal or

cantonment

limits;

In

other cases, up to 10 kilometers from the

outer limits of municipal bodies or

cantonment boards;

and

Includes

areas defined as such in the

Urban Immovable Property Tax

Act, 1958 and such

areas as

the Central Board

of Revenue may, for time to time, by

notification in the official Gazette

specify.

Capital

Value Tax-- Tax

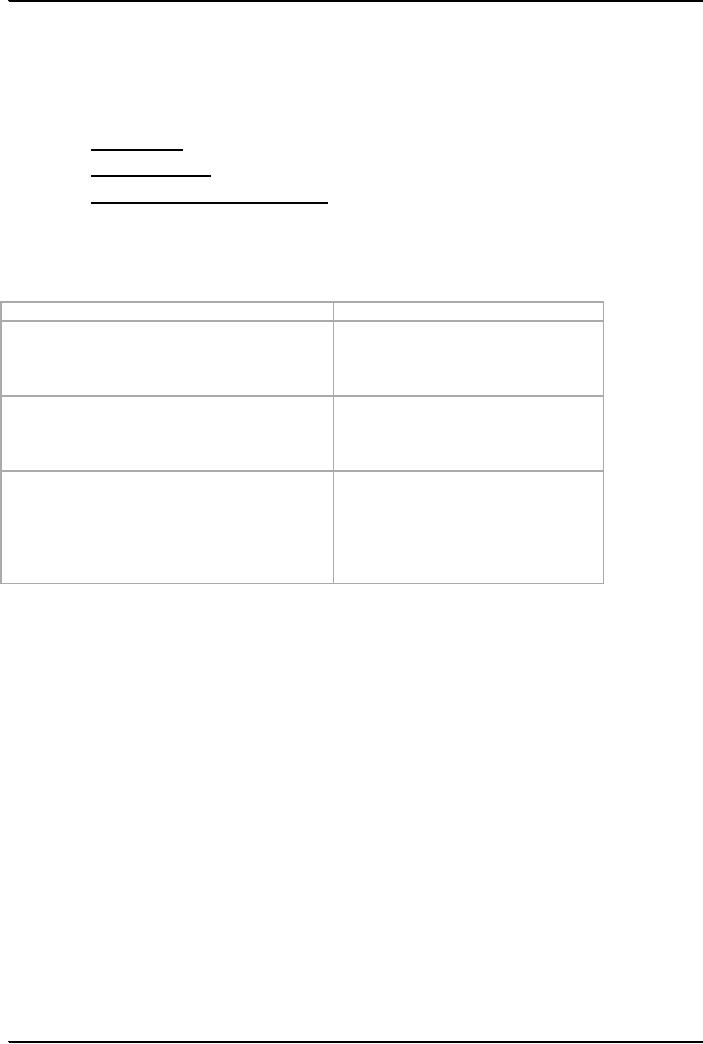

Rates

Motor

vehicles:

113

Taxation

Management FIN 623

VU

Capital

Value Tax shall be payable

on purchase of motor vehicles,

not previously used in Pakistan, at

the

following

rates:

Motor

vehicle of an engine

capacity

Tax

Rates

Not

exceeding 800 cubic

centimeters and three

wheelers.

Nil

Exceeding

800 cubic centimeters but

not exceeding 1000 cubic

centimeters

3.75%

Exceeding

1000 cubic centimeters but

not exceeding 1300 cubic

centimeters

5%

Exceeding

1300 cubic centimeters but

not exceeding 1600 cubic

centimeters

6.25%

Exceeding

1600 cubic

centimeters

7.5%

Immovable

property (other

than commercial property and

residential flats), situated in urban

areas,

measuring

at list one canal or 500

square yards whichever is

less.

Tax

Rates

(i)

Where the value of immovable Property is

recorded. 2% of the recorded

value

(ii)

Where the value of immovable property is

not

Rs. 50

per square Yard of the

landed area.

recorded.

Commercial

immovable property of any size

situated in urban area.

Tax

Rates

(i)

Where the value of immovable Property is

recorded. 2% of the recorded

value

(ii)

Where the value of immovable property is

not

Rs. 50

per square Yard of the

landed area.

recorded.

Residential

flats with

covered areas measuring 1500

sq. feet and above.

Tax

Rates

(i)

Where the value of immovable Property

is

2% of the

recorded value

recorded.

(ii)

Where the value of immovable property is

not

Rs. 50

per square Yard of the

landed area.

recorded.

Description

Rate

of Tax

Purchase

of modaraba certificates or shares of a

listed

0.02%

of the purchase value

public

company.

Imported

motor vehicle not plying

for hire customs

Landed

cost a determined by

authorities.

Motor

Vehicle Purchased from a

manufacturer in

The

price paid by the Purchase.

Pakistan.

Others

As

declared by the transferee.

� CVT

to be collected by the person responsible

for registering or attesting the

transfer of the asset.

� In

case of purchase of motor

vehicle from a manufacturer in

Pakistan, CVT shall be

collected by the

manufacturer

before making the delivery of said

vehicle.

� Collector

of customs shall collect CVT

in case of motor vehicle

imported into

Pakistan.

� Registered

stock exchange in Pakistan

shall collect CVT on the

purchase value of Modaraba

Certificates

or

shares of a public company

from the resident

persons.

� The

proceeds of the tax collected shall be

credited to the Federal Consolidated

Funds under the head

specified

by the Federal Government.

� Where

any person fails to collect or having

collected fails to pay the capital

value tax as required, he

shall

be personally liable to pay the tax along

with additional tax at the rate of 15%

per annum for the

period

for which such tax or part

thereof remains unpaid.

� The

Commissioner of Wealth Tax, on an

application by the assessee, may

revise any order made

under

this

section.

� The

Federal Government may, by

notification in the official Gazette,

exempt any person or class

of

persons

or asset or class of assets

from the Capital Value Tax.

114

Taxation

Management FIN 623

VU

Annexure

First

& Third

Schedule

THE

FIRST SCHEDULE

Part

I.

Rates

of Tax

Rates

of Tax for Individuals and Association of

Persons

Division

I:

Rate

of Tax on certain

persons

Division

IA:

Rates

of Tax for Companies

Division

II:

Rate

of Dividend Tax

Division

III:

Rate

of Tax on Certain Payments to

Non-residents

Division

IV:

Rate

of Tax on Shipping or Air Transport

Income of a Non-

Division

V:

resident

Person

Rate

of Tax on Income From

Property

Division

VI:

Part

II.

Rates

of Advance Tax

Tax

on Import of Goods

Part

III.

Deduction

of Tax at Source

Division

I:

Profit on

debt

Payments to

non-residents

Division

II:

Division

III:

Payments

for Goods or

Services

Exports

Division

IV:

Income

from Property

Division

V:

Prizes

and Winnings

Division

VI:

Division

VIA:

Petroleum

Products

Petroleum

Products [Omitted]

Division

VII:

Part

IV.

Deduction

or Collection of Advance Tax

Transfer

of Funds [Omitted]

Division

I:

Brokerage

Commission

Division

II:

Transport

Business

Division

III:

Electricity

Consumption

Division

IV:

Division

V:

Telephone

users

Cash

Withdrawal from a

bank

Division

VI:

115

Taxation

Management FIN 623

VU

PART

I

RATES

OF TAX

(See

Chapter II)

Division

I

Rates

of Tax for Individuals and Association of

Persons

1.

Subject

to clause (1A) the rates of tax

imposed on the taxable income of

every individual

except

a

salaried taxpayer or association of

persons to which sub-section

(1) of section 92

applies

shall

be as set out in the following

table, namely:

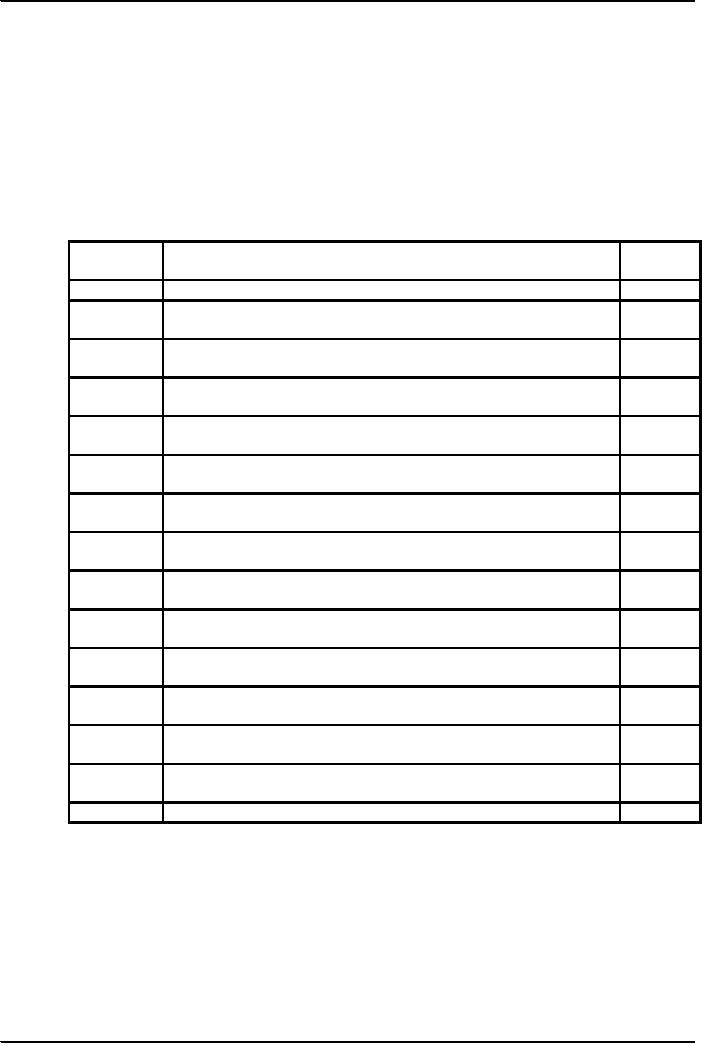

TABLE

S.

No.

Taxable

income

Rate

of

tax

(1)

(2)

(3)

1

Where

the taxable income does not

exceed Rs.100,000

0%

2

Where

the taxable income exceeds

Rs.100,000 but does not

exceed

0.50%

Rs.110,000

3

Where

the taxable income exceeds

Rs.110,000 but does not

exceed

1.00%

Rs.125,000

4

Where

the taxable income exceeds

Rs.125,000 but does not

exceed

2.00%

Rs.150,000

5

Where

the taxable income exceeds

Rs.150,000 but does not

exceed

3.00%

Rs.175,000

6

Where

the taxable income exceeds

Rs.175,000 but does not

exceed

4.00%

Rs.200,000

7

Where

the taxable income exceeds

Rs.200,000 but does not

exceed

5.00%

Rs.300,000

8

Where

the taxable income exceeds

Rs.300,000 but does not

exceed

7.50%

Rs.400,000

9

Where

the taxable income exceeds

Rs.400,000 but does not

exceed

10.00%

Rs.500,000

10

Where

the taxable income exceeds

Rs.500,000 but does not

exceed

12.50%

Rs.600,000

11

Where

the taxable income exceeds

Rs.600,000 but does not

exceed

15.00%

Rs.800,000

12

Where

the taxable income exceeds

Rs.800,000 but does not

exceed

17.50%

Rs.10,00,000

13

Where

the taxable income exceeds

Rs.10,00,000 but does not

exceed

21.00%

Rs.13,00,000

14

Where

the taxable income exceeds

Rs.13,00,000

25.00%

Provided

that where income of a woman

taxpayer is covered by this clause, no

tax shall be

charged

if the taxable income does

not exceed Rs.125,000/-.

116

Taxation

Management FIN 623

VU

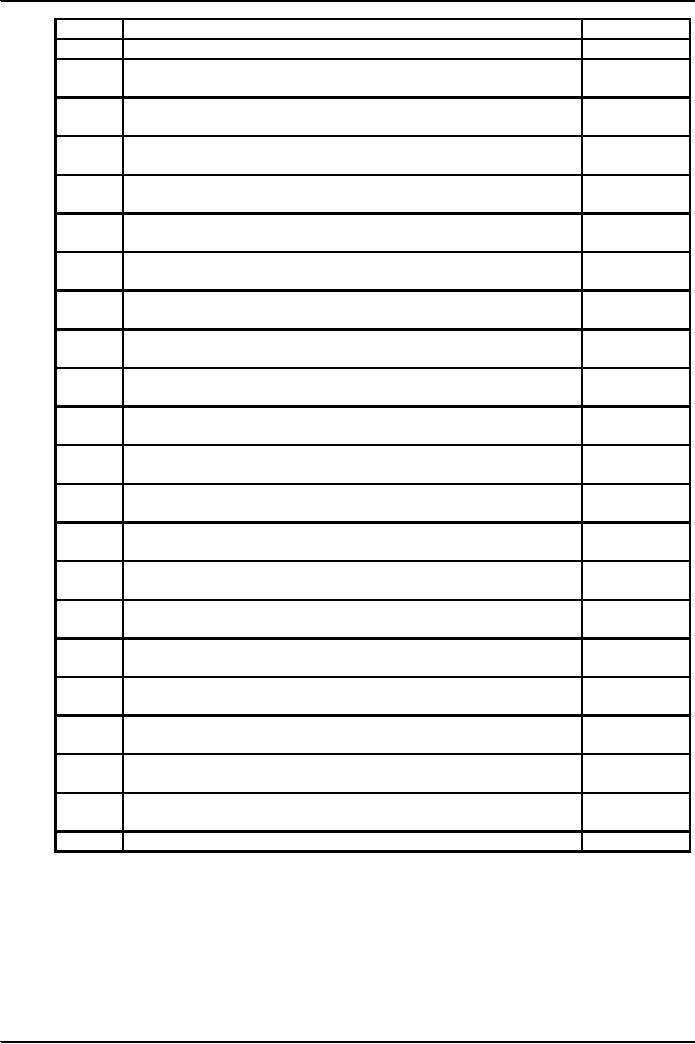

TABLE

S.

No.

Taxable

income

Rate

of tax

(1)

(2)

(3)

1

Where

the taxable income does not

exceed Rs.150,000

0%

2

Where

the taxable income exceeds

Rs.150,000 but does not

exceed

0.25%

Rs.200,000

3

Where

the taxable income exceeds

Rs.200,000 but does not

exceed

0.50%

Rs.250,000

4

.

Where the taxable income

exceeds Rs.250,000 but does

not exceed

0.75%

Rs.300,000

5

Where

the taxable income exceeds

Rs.300,000 but does not

exceed

1.50%

Rs.350,000

6

Where

the taxable income exceeds

Rs.350,000 but does not

exceed

2.50%

Rs.400,000

7

Where

the taxable income exceeds

Rs.400,000 but does not

exceed

3.50%

Rs.500,000

8

Where

the taxable income exceeds

Rs.500,000 but does not

exceed

4.50%

Rs.600,000

9

.

Where the taxable income

exceeds Rs.600,000 but does

not exceed

6.00%

Rs.700,000

10

Where

the taxable income exceeds

Rs.700,000 but does not

exceed

7.50%

Rs.850,000

11

Where

the taxable income exceeds

Rs.850,000 but does not

exceed

9.00%

Rs.950,000

12

Where

the taxable income exceeds

Rs.950,000 but does not

exceed

10.00%

Rs.1,050,000

13

Where

the taxable income exceeds

Rs.1,050,000 but does not

exceed

11.00%

Rs.1,200,000

14

Where

the taxable income exceeds

Rs.1,200,000 but does not

exceed

12.50%

Rs.1,500,000

15

Where

the taxable income exceeds

Rs.1,500,000 but does not

exceed

14.00%

Rs.1,700,000

16

Where

the taxable income exceeds

Rs.1,700,000 but does not

exceed

15.00%

Rs.2,000,000

17

Where

the taxable income exceeds

Rs.2,000,000 but does not

exceed

16.00%

Rs.3,150,000

18

Where

the taxable income exceeds

Rs.3,150,000 but does not

exceed

17.50%

Rs.3,700,000,

19

Where

the taxable income exceeds

Rs.3,700,000 but does not

exceed

18.50%

Rs.4,450,000,

20

Where

the taxable income exceeds

Rs.4,450,000 but does not

exceed

19.00%

Rs.8,400,000,

21

Where

the taxable income exceeds

Rs.8,400,000.

20.00%

Provided

that where income of a woman

taxpayer is covered by this clause, no

tax shall be

charged

if the taxable income does

not exceed Rs.200,000/-

117

Taxation

Management FIN 623

VU

Division

IA

Rate

of Tax on certain

persons

The

rate of tax to be paid under

sub- section (1) of section

113A shall be 0.75% of

the

turnover.

Division

II

Rates

of Tax for Companies

(i)

The

rates of tax imposed on the taxable

income of a company shall be as

set out in the

following

table, namely:

TABLE

Tax

Banking

Public

company other

Private

company other

Year

company

than a

banking

than a

banking company

company

(1)

(2)

(3)

(4)

2003

47%

35%

43%

2004

44%

35%

41%

2005

41%

35%

39%

2006

38%

35%

37%

2007

35%

35%

35%

(ii)

Where the taxpayer is a society or a

cooperative society, the tax shall be

payable at the rates

applicable

to the public company or an individual,

whichever is beneficial to the taxpayer.

(iii)

Where the taxpayer is a small

company as defined in section 2, tax

shall be payable at the rate

of

20%

Division

III

Rate

of Dividend Tax

The

rate of tax imposed under section 5 on

dividend received from a

company shall be

(a) in

the case of dividend received by a

public company or an insurance

company, or any other

resident

company 5% of the gross amount of the

dividend; or

(b) in

any other case, 10% of the

gross amount of the dividend.

Division

IV

Rate

of Tax on Certain Payments to

Non-residents

The

rate of tax imposed under section 6 on

payments to non-residents shall be 15% of

the gross amount

of the

royalty or fee for technical

services.

Division

V

Rate

of Tax on Shipping or Air Transport

Income of a Non-resident

Person

The

rate of tax imposed under section 7

shall be:

(a) in

the case of shipping income, 8% of the

gross amount received or receivable;

or

(b) in the

case of air transport income, 3% of the

gross amount received or

receivable.

Division

VI

Income

from property: the

rate of tax to be paid under section 15

shall be 5% of the gross amount of

rent

chargeable to tax under that

Section.

118

Taxation

Management FIN 623

VU

PART

II

RATES

OF ADVANCE TAX

(See

Division II of Part V of Chapter

X)

The

rate of advance tax to be collected by

the Collector of Customs under section

148 shall be 6% of

the

value of the goods.

PART

III

DEDUCTION

OF TAX AT SOURCE

(See

Division III of Part V of Chapter

X)

Division

I

Profit on

debt

The

rate of tax to be deducted under section

151 shall be 10% of the yield or

profit paid.

Division

II

Payments to

non-residents

(1)

The rate of tax to be deducted

from a payment referred to in sub-section

(1A) of section 152 shall

be

6% of the

gross amount payable.

(2)

The rate of tax to be deducted under

sub-section (2) of section

152 shall be 30% of the gross

amount

paid.

Division

II substituted by Finance Bill

2006. Before substitution it read as

follows:

The

rate of tax to be deducted under

sub-section (2) of section

152 shall be 30% of the gross amount

paid.

Division

III

Payments

for Goods or

Services

(1)

The rate of tax to be deducted

from a payment referred to in clause

(a) of sub-section (1) of

section

153

shall be:

a. In the

case of the sale of rice,

cotton seed or edible oils,1.5% of the

gross amount payable; or

b. In the

case of the sale of any

other goods, 3.5% of the

gross amount payable.

(2)

The rate of tax to be deducted

from a payment referred to in clause (b)

of sub-section (1) of

section

153

shall be 6% of the gross amount

payable.

(3)

the rate of tax to be deducted from a

payment referred to in clause of

sub-section (1) of

section

153

shall be 6% of the gross amount

payable.

119

Taxation

Management FIN 623

VU

Division

IV

Exports

(1)

The

rate of tax to be deducted under

sub-section (1A) of section

153 and sub-section (1),

(3), (3A)

or

(3B) of section 154 shall be

as set out in the following

table, namely:

TABLE

S.

Nature

of goods exported.

Rate

of deduction of tax.

No.

(1)

(2)

(3)

1.

Exports

listed in Part I of the Seventh

Schedule

0.75%

of the proceeds of the

export

2.

Exports

listed in Part II of the Seventh

Schedule

1.0%

of the proceeds of the

export

3.

Exports

listed in Part III of the Seventh

Schedule

1.25%

of the proceeds of the

4.

Exports

listed in Part IV of the

Seventh

export

Schedule

1.50%

of the proceeds of the

export

(2)

The

rate of tax to be deducted under

sub-section (2) of section

154 shall be 5.

Division

V

Income

from Property

The

rate of tax to be paid under section 15

shall be 5% of the gross amount of rent

chargeable to tax

under

that section.

Division

VI

Prizes

and Winnings

(1)

The rate of tax to be deducted under

section 156 on a prize on

prize bond shall be 10% of

the

gross

amount paid.

(2)

The rate of tax to be deducted under

section 156 on winnings from a

raffle, lottery, prize

on

winning

a quiz, prize offered by companies for

promotion of sale, or cross-word

puzzle shall be

20% of the

gross amount paid.

Division

VIA

Petroleum

Products

Rate

of collection of tax under section 156 A

shall be 10% of the amount of

payment.

120

Taxation

Management FIN 623

VU

PART

IV

(See

Chapter XII)

DEDUCTION

OR COLLECTION OF ADVANCE TAX

Division

II

Brokerage

and Commission

The

rate of collection under sub-section

(1) of section 233 shall be

10% of the amount of the payment.

Division

III

Transport

Business

Rates

of collection of tax under section

234,

(1)

In the case of goods transport

vehicles with registered

laden weight of:

(a)

Less

than 2030 kilograms.

Rs.

1,200.

(b)

2030

kilograms or more but less

than 8120

Rs.

7,200.

kilograms.

(c)

8120

kilograms or more but less

than 15000

Rs.12,000.

kilograms.

(d)

15000

kilograms or more but less

than 30,000

Rs.18,000.

kilograms.

(e)

30,000

kilograms or more but less

than 45,000

Rs.24,000.

kilograms.

(f)

45,000

kilograms or more but less

than 60,000

Rs.30,000.

kilograms.

(g)

60,000

kilograms or more.

Rs.36,000.

(1A)

In the case of goods transport vehicles

with laden weight of 8120 Kg or

more, advance tax after a

period

of ten years from the date of

first registration of vehicle in Pakistan

shall be collected at the

rate

of twelve

hundred rupees per

annum;

(2) In

the case of passenger transport vehicles

plying for hire with

registered seating capacity

of:

(a)

Four

or more persons but less

than ten persons.

Rs. 25

per

seat

per

annum

(b)

Ten or

more persons but less

than twenty persons.

Rs. 60

per

seat

per

annum.

(c)

Twenty

persons ore more.

Rs.100

per

seat

per

annum

(3)

Other private motor cars

with engine capacity

of:

(a)

1000cc

to 1199 cc.

Rs.

500.

(b)

1200cc

to 1299cc.

Rs.

750.

121

Taxation

Management FIN 623

VU

(c)

1300cc

to 1599cc.

Rs.

1,500

(ca)

1600cc

to 1999cc.

Rs.

2,000

(d)

2000cc

and above.

Rs.

3,000.

Division

IV

Electricity

Consumption

Rate

of collection of tax under section 235

where the amount of electricity

bill,-

(a)

does

not exceed Rs.

400.

Rs.

60

(b)

exceeds

Rs. 400 but does

not exceed Rs.

600

Rs.

80

(c)

exceeds

Rs. 600 but does

not exceed Rs.

800

Rs.

100

(d)

exceeds

Rs. 800 but does

not exceed Rs.

1000

Rs.

160

(e)

exceeds

Rs. 1000 but does

not exceed Rs.

1500

Rs.

300

(f)

exceeds

Rs. 1500 but does

not exceed Rs.

3000

Rs.

350

(g)

exceeds

Rs. 3000 but does

not exceed Rs.

4500

Rs.

450

(h)

exceeds

Rs. 4500 but does

not exceed Rs.

6000

Rs.

500

(i)

exceeds

Rs. 6000 but does

not exceed Rs.

10000

Rs.

650

(j)

exceeds

Rs. 10000 but does

not exceed Rs.

15000

Rs.

1000

(k)

exceeds

Rs. 15000 but does

not exceed Rs.

20000

Rs.

1500

(l)

exceeds

Rs. 20000

Rs.

2000

Division

V

Telephone

users

(a)

In

the case of prepaid

telephone cards

10%

of the

Amount

of sale

Price

of prepaid

Telephone

card

(b)

In

the case of post-paid telephone

bill

--

Where the monthly bill

exceed

10% of the

amount

Rs

1000

of

bill; and

122

Taxation

Management FIN 623

VU

Division

VI

Cash

Withdrawal from a

bank

The

rate of tax to be deducted under section

231A of the cash amount

withdrawn.

THE THIRD

SCHEDULE

Part

I.

Depreciation

Part

II.

Initial

Allowance

Part

II.

Pre-Commencement

Expenditure

PART

I

DEPRECIATION

(See

Section 22)

Depreciation

rates specified for the

purposes of section 22 shall

be:

I.

Building (all types)

10%

II.

Furniture (including fittings)

and machinery

15%

and

plant (not otherwise

specified), Motor

Vehicles

(all types), ships, technical

or

professional

Books.

III. Computer

hardware including

printer,

30%

monitor

and allied items [machinery

and

equipment

used in manufacture of I.T.

products],

aircrafts

and aero engines.

IV. In

case of mineral oil concerns the

income of

which

is liable to be computed in accordance

with

the rules of Part 1 of the fifth

Schedule.

a) Below

ground installations

100%

b)

Offshore platform and

production

20%

installations.

PART

II

INITIAL

ALLOWANCE

(See

Section 23)

The

rate of initial allowance under

section 23 shall be 50%.

PART

III

PRE-COMMENCEMENT

EXPENDITURE

(See

Section 25)

The

rate of amortization of pre-commencement expenditure

under section 25 shall be

20%.

123

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS