|

SALES TAX |

| << What is Value Added Tax (VAT)? |

| SALES TAX RETURNS >> |

Taxation

Management FIN 623

VU

MODULE

18

LESSON

18.44

SALES

TAX

(20)

"output tax" in

relation to any registered

person means the tax charged under this

Act in respect of a

supply of

goods made by that person

and shall include duties of

excise chargeable under section 3 of

the

Central

Excises Act, 1944 (I of

1944) on such excisable

goods or services as are

notified by the Federal

Government

under the third proviso to sub-section

(1) thereof and on which

such duties are charged,

levied

and

paid as if it were a tax payable under

section 3 of this Act;

(21)

"Person" includes

a company, an association, a body of

individuals whether incorporated or not,

a

public

or local authority, a Provincial

Government or the Federal

Government;

(22)

"Prescribed" means

prescribed by rules made under this

Act;

(23)

"registered office" means

the office or other place of

business specified by the registered

person in

the

application made by him for

registration under this Act or through

any subsequent application to

the

Collector;

(24)

"registration number" means

the number allocated to the registered

person for the purpose of

this

Act;

(25)

"registered person" means

a person who is registered or is liable

to be registered under this Act:

� Provided

that a person liable to be registered

but not registered under this

Act and shall remain liable

to

further

tax under sub-section (1A) of section 3

and shall not be entitled to

any benefit available to

a

registered

person under any of the provisions of this

Act or the rules made there

under;

(27)

"retail price", with

reference to the Third Schedule,

means the price fixed by the

manufacturer

inclusive

of all charges and taxes

(other than sales tax) at

which any particular brand or variety of

any article

should be

sold to the general body of

consumers or, if more than

one such price is so fixed

for the same

brand or variety,

the highest of such

price,

28)

"retailer" means

a person, supplying goods to general

public for the purpose of

consumption:

� Provided

that any person, who

combines the business of import

and retail or manufacture or

production

with retail, shall notify

and advertise wholesale

prices and retail prices

separately, and

declare

the

address of retail outlets, and his

total turnover per annum

shall be taken into account

for the

purposes

of registration under section 14.

(28A)

"retail tax" means

tax levied under section 3AA;

(29)

"return" means

any return required to be furnished under

Chapter V of this Act;

(29A)

"sales tax account" means

an account representing the double

entry recording of sales tax

transactions

in the books of account;

(30)

"Schedule" means

a Schedule appended to this

Act;

(31)

"similar supply", in

relation to the open market price of

goods, means any other

supply of goods

which

closely or substantially resemble the

characteristics, quantity, components

and materials of the

aforementioned

goods;

(31A)

"special audit" means

an audit conducted under section

32A;

(32)

"Special Judge" means

the Special Judge appointed under

Section 185 of the Customs

Act;

(33)

"supply" includes

sale, lease or other

disposition of goods in the course or

carried out for

consideration

and also includes

(a)

putting to private, business or

non-business use of goods

acquired, produced or manufactured

in

the

course of business;

(b) auction or

disposal of goods to satisfy a debt

owed by a person; and

(c)

possession of taxable goods held

immediately before a person ceases to be a

registered person:

Provided

that the Federal Government,

may by notification in the official

Gazette, specify such

other

transactions

which shall or shall not

constitute supply;

(34)

"tax" means

the sales tax, retail tax and

includes default surcharge, or

any other sum payable

under

any of

the provisions of this Act or the rules

made there under;

(35)

"taxable activity" means

any activity which is

carried on by any person, whether or

not for a

pecuniary

profit, and involves in

whole or in part, the supply of goods or rendering of

services on which

sales

tax has been levied under the respective

ordinance and use of goods

acquired for private

purposes or

for

the manufacture of exempt goods

without making supply to any

other person, whether for

any

107

Taxation

Management FIN 623

VU

consideration or

otherwise, and includes any

activity carried on in the form of a

business, trade or

manufacture;

(36)

"tax fraction" means

the amount worked out in accordance

with the following

formula:

a

100 +

a

('a'

is the rate of tax specified in section

3):

(37)

"Tax fraud" means

knowingly, dishonestly or fraudulently

and without any lawful

excuse (burden of

proof

of which excuse shall be

upon the accused)

(i)

doing of any act or causing

to do any act; or

(ii)

omitting to take any action or

causing the omission to take

any action including the making of

taxable

supplies without getting registration under this

Act; or

(iii)

falsifying the sales tax

invoices;

� In

contravention of duties or obligations

imposed under this Act, rules or

instructions issued there under

with

the intention of understating the tax liability or

underpaying the tax liability or underpaying the

tax

liability

for two consecutive tax

periods for two consecutive

tax periods or overstating the entitlement

to

tax credit or tax

refund to cause loss of

tax;

(39)

"taxable goods" means

all goods other than

those which have been

exempted under section

13;

(40)

"tax invoice" means

a document required to be issued under section

23;

(41)

"taxable supply" means

a supply of taxable goods made by an

importer; manufacturer,

wholesaler

(including

dealer), distributor or retailer other

than a supply of goods which is

exempt under section 13

and

includes

a supply of goods chargeable to tax at the

rate of zero per cent under

section 4;

(43)

"tax period" means

a period of one month or

such other period as the

Federal Government may,

by

notification

in the official Gazette,

specify;

(44)

"time of supply" means

a supply shall be deemed to have taken

place at the earlier of the time

of

delivery of

goods or the time when any payment is

received by the supplier in respect of

that supply:

� Provided

that where any part

payment is received

(a)

for a supply in a tax period, it shall be

accounted for in the return

for that tax period;

and

(b) in

respect of an exempt supply, it

shall be accounted for in the

return for that tax period

during

which

the exemption is withdrawn from

such supply:

Provided

further that:

(a)

where any goods are supplied

by a registered person to an associated

person and the goods are

not

to be

removed, the time of supply shall be the

time at which these goods

are made available to

the

recipient;

and

(b)

where the goods are supplied under

hire purchase agreement, the time of

supply shall be the time

at

which the agreement is entered

into;

(46)

"Value of supply" means;

(a) in

respect of a taxable supply, the

consideration in money including all

Federal and

Provincial

duties

and taxes, if any, which the

supplier receives from the recipient for

that supply but

excluding the

amount of tax:

Provided

that:

(i) in

case the consideration for a supply is in

kind or is partly in kind

and partly in money,

the

value

of the supply shall mean the open market

price of the supply excluding the amount of

tax;

(ii)

in case the supplier and recipient are

associated persons and the supply is

made for no

consideration or

for a consideration which is lower

than the open market price, the

value of

supply

shall mean the open market

price of the supply excluding the amount of tax;

and

(iii)

in case a taxable supply is made to a

consumer from general public

on installment basis on a

price

inclusive of mark up or surcharge rendering it higher

than open market price, the

value

of supply

shall mean the open market

price of the supply excluding the amount of

tax.

(b) In

case of trade discounts, the

discounted price excluding the amount of

tax,. provided the tax

invoice

shows the discounted price

and the related tax and the discount

allowed is in conformity

with

the normal business

practices;

(c) in

case where for any

special nature of transaction it is

difficult to ascertain the value of a

supply,

the open

market price;

108

Taxation

Management FIN 623

VU

(d) in

case of imported goods, the

value determined under section 25 of the

Customs Act,

including

the amount of

customs-duties and central

excise duty levied

hereon;

(e) in

case where there is

sufficient reason to believe

that the value of a supply

has not been

correctly

declared

in the invoice, the value determined by the Valuation

Committee comprising

representatives

of trade and the Sales Tax

Department constituted by the Collector ;

and

(f)

in case the goods other

than taxable goods are

Supplied to a registered person for

processing, the

value

of supply of such processed goods

shall mean the price excluding the amount

of sales tax

which

such goods will fetch on

sale in the market;

Provided

that, where the Central Board of Revenue

deems it necessary, it may, by

notification

in the

official Gazette, fix the

value of any taxable

supplies or class of supplies

and for that

purpose

fix different values for

different classes or description of same

type of supplies:

Provided

further that where the value

at which the supply is made is higher

than the value fixed

by the Central

Board of Revenue, the value of goods

shall, unless otherwise

directed by the

Board, be

value at which the supply is

made;

(g) in

case of a taxable supply,

with reference to retail tax, the

price of taxable goods excluding

the

amount of retail

tax, which a supplier will

charge at the time of making taxable supply by

him, or

such

other price as the Board may, by a

notification in the Official Gazette,

specify.

(47)

"wholesaler" includes

a dealer and means any

person who carries on,

whether regularly or otherwise,

the

business of buying and

selling goods by wholesale or of

supplying or distributing goods, directly

or

indirectly,

by wholesale for cash or deferred

payment or for commission or

other valuable consideration or

stores

such goods belonging to

others as an agent for the

purpose of sale; and

includes a person supplying

taxable

goods to a person and a

person who in addition to making

retail supplies is engaged in

wholesale

business;

(48)

"zero - rated supply" means

a taxable supply which is charged to tax

at the rate of zero per

cent

under

section 4

Scope

of the Tax:

Subject

to this act, sales tax shall be

charged, levied and paid at the rate of

15 % of the value of:

taxable

supplies made by a registered

person in the course or furtherance or

any taxable activity

carried

on by him;

goods

imported into

Pakistan

Taxable

supplies specified in third

schedule shall be charge to tax at the

rate of 15% of the retail

price.

Liability

to pay tax shall be:

� In the

case of supply of goods, of the

person making the supply

and

� In the

case of goods, imported into

Pakistan, of the person importing the

goods

However

federal Government may by

notification specify the goods in

respect of which the

liability

to pay

tax shall be of the person receiving the

supply

Retail

Tax

� Under

section 3AA, the retailer shall

pay retail tax at the rate specified in

section 3.

� The

retail tax shall be charged, collected

and paid in such manner and

at such higher or lower rate

or

rates

as may be specified in the said

notification.

Zero

Rating Sec. 4

� Notwithstanding

the provisions of section 3, the following

goods shall be charged to tax at the

rate of

zero

per cent:

(a)

goods exported, or the goods specified in

the5th schedule

(b) supply of

stores and provisions for consumption

aboard a conveyance proceeding to a

destination

outside

Pakistan as specified in section 24 of

the Customs Act, 1969;

and

(c)

such other goods as the

Federal Government may, by

Notification specify:

Levy

and collection of tax on specified

goods on value

addition

(1)

Notwithstanding

anything contained in this Act or the

rules made there under, the

Federal

Government

may specify, by notification in the

official gazette, that sales

tax chargeable on the

supply of

goods of such description or class

shall, with such limitations

or restrictions as may be

prescribed,

be levied and collected on the difference

between the value of supply for

which the

goods

are acquired and the value

of supply for which the goods, either in

the same state or on

further

manufacture, are supplied.

109

Taxation

Management FIN 623

VU

(2)

Notwithstanding

anything contained in this Act or the

rules made there under, the

Federal

Government

may, by notification in the official

Gazette, and subject to the conditions,

limitations,

restrictions

and procedure mentioned therein, specify

the minimum value addition required to

be

declared

by certain persons or categories of

persons, for supply of goods of

such description, or

class

as may be prescribed, and to

waive the requirement of audit or scrutiny of

records if such

minimum

value addition is

declared.

Taxable

Supplies--defined

in section 2 (41)

Supply--defined

in section 2 (33)

Taxable

Goods--defined

in section 2 (39)

Exempt

Supplies--defined

in section 2 (11): means a supply

which is exempt from tax under

section

13

Retailer--defined

in section 228

Registered

person--defined

in section 225

Registration

Section 14:

� Persons

required to get registration subject to

sales tax rules

� Under

this Act, registration will be required

for such persons and be

regulated in such manner

and

subject

to rules as the Board may, by

notification in the official Gazette,

prescribe.

Requirement of

registration:

(1)

The following persons

engaged in making of taxable supplies in

Pakistan (including

zero-rated

supplies)

in the course or furtherance of any

taxable activity carried on by

them, if not already

registered,

are required to be registered under this

Act, namely:

(i) a

manufacturer whose annual

turnover from taxable

supplies made in any period

during

the

last twelve months ending any tax period

exceeds two and half

million rupees;

(ii) a

retailer whose value of supplies in

any period during the last

twelve months ending any

tax

period exceeds twenty

million rupees;

(iii)

an importer; and

(iv) a

wholesaler (including dealer)

and distributor:

� Provided

that buyers or importers of taxable

plant and machinery who

intend to make taxable

supplies

in due

course and wish to claim

any credit or refund of tax paid on the

said plant and machinery

shall

also

be required to be registered under this

Act.

De-Registration,

Black listing and Suspension of

Registration Section 21

(1)

The Board or any officer, authorized in

this behalf, may subject to the rules,

de-register a registered

person

or such class of registered

persons not required to be registered

under this Act.

(2)

Notwithstanding anything contained in this

Act, in cases where the Collector is

satisfied that a

registered

person is found to have

issued fake invoices, or has

otherwise committed tax fraud, he

may

blacklist

such person or suspend his

registration in accordance with such

procedure as the Board may,

by

notification in the official Gazette,

prescribe.

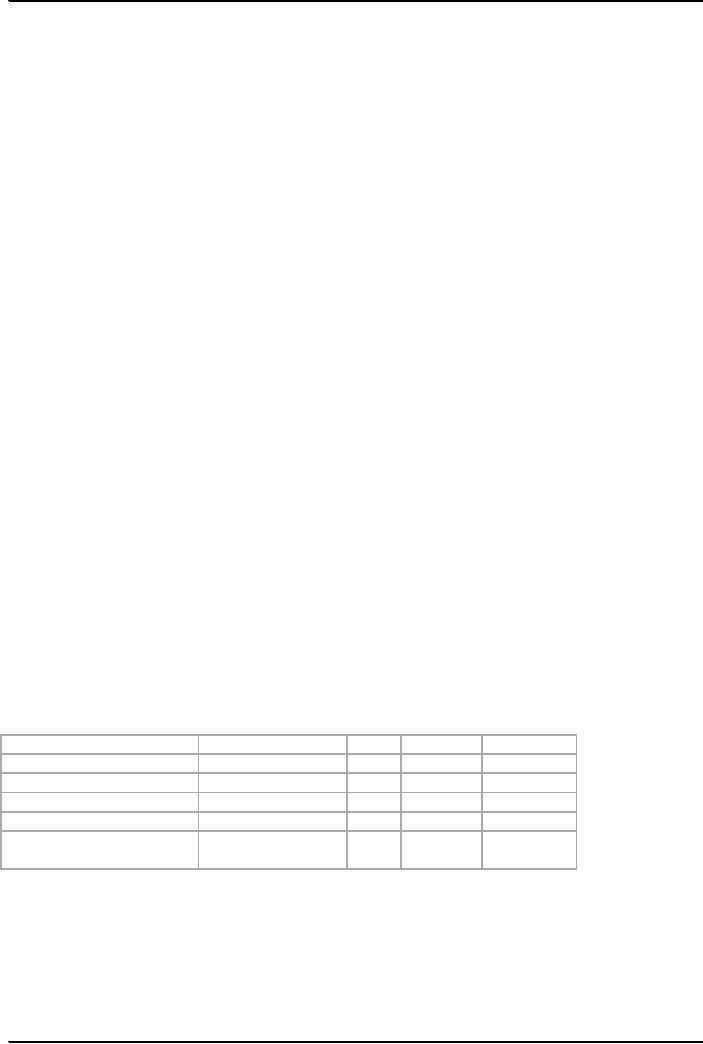

Solution: Sales

tax liability of M/S WW

brothers

Particulars

Value

of Supplies

Rate

Sales

tax

Sales

tax

Out

put tax

4,500,000

15%

675,000

Input

tax

1,000,000

15%

(150,000)

Input

tax on dying

300,000

15%

(45,000)

Subtract

total input tax

(195,000)

Sales

Tax Payable

(675,000

- 195,000)

Rs.480,000

110

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS