|

Disposals Not Chargeable To Tax |

| << Computation of Capital Gain |

| TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME >> |

Taxation

Management FIN 623

VU

MODULE

9

LESSON

9.39

CAPITAL

GAINS

Disposals

Not Chargeable To Tax Under

Sec.79 Non Recognition

Rules

No

gain or loss shall be taken

to arise on the disposal of an

asset:

Between

spouses under an agreement to live

apart;

By

reason of the transmission of the asset

to an executor or beneficiary on the death of

person;

By

reason of a gift of the

asset;

By

reason of the compulsory acquisition of the

asset under any law where

the consideration

received

for the disposal is reinvested by the

recipient in an asset of a like kind

within one year of

the

disposal;

By a

company to its shareholders on

liquidation of the company; or

By an

association of persons to its

member on dissolution of the association

where the assets are

distributed

to members in accordance with

their interests in the capital of the

association

Exemptions

in

respect to capital gains

have been outlined in

various clauses of Part 1 of

Second Schedule.

Exemptions

as Contained in Second

Schedule

Clause

(110) Any

income chargeable under the head

"capital gains", being income

from the sale of

Mudarba

certificates or any instrument of

redeemable capital as defined in the

Companies Ordinance, 1984,

listed

on any stock exchange in

Pakistan or shares of public

company and the Pakistan

telecommunication

corporation

vouchers issued by the Government of

Pakistan derived by a tax-payer.

Clause(111)

any

income chargeable under the head

"capital gains" being income from the

sale of shares of

a

public company derived by any

foreign institutional investor as is approved by the

federal Government

for

the

purpose of this clause

Clause

(112) omitted.

Clause

(113) any

income chargeable under the head

"capital gains" being income from the

sale of shares of

a

public company set up in any

special industrial zone referred to in

clause [126] of this schedule,

derived

by a

person for a period of five

years from the date of

commencement of its commercial

production:

provided

that the exemption under this clause

shall not be available to a

person from the sale of

shares of

such

companies which are not

eligible for exemption from tax under

clause (126 ).

Clause

(114) any

income chargeable under the head

"capital gains " derived by a person

from an industrial

undertaking

set up in an area declared by the

Federal Government to be a "Zone"

within the meaning of

the

export processing zone

Authority Ordinance 1980.

Clause(114A)

any

income chargeable under the head

"capital gains", derived by a person

from sale of ships

and

all floating crafts

including tugs, dredgers,

survey vessels and other

specialized craft up to tax year

ending on the

thirtieth day of June

,2011]

Exercise

on Capital Gain

Exercise-1:

On 1st July 2006, the Govt.

prohibited the sale of plastic

bags through an Ordinance and

took over the

machines

of M/s WW Ltd; amounting Rs. 1,000,000/-.

As a compensation package the Govt. paid

Rs.

2,500,000/-

to the Company. The company

purchased new machines of the

related business on 1st April

2007

costing the company Rs.

4,000,000/-.

Calculate

gain on disposal and also

explain whether this gain is chargeable

to tax.

Solution

E 1:

Considerations

received (A)

Rs.

2,500,000

Cost

of Acquisition

(B)

Rs.

1,000,000

Capital

Gain = (A B)

Rs.1,500,000

Although

there is gain of Rs.1,500,000/ on

disposal but it is not

chargeable to tax since amount of

consideration

received has been invested

in the like business during

one year of disposal.

Exercise2:

On

01/01/2004 Mr. Y purchased

10,000 shares at a price of Rs 30

per share. He sold

these

shares

on 20/06/2006 at a price of Rs 50 per

share. Calculate the gain

taxable on this disposal.

Solution

Ex. 2:

74

Taxation

Management FIN 623

VU

-

Consideration received on disposal

(A)

(10,000

x 50) =

Rs.

500,000

-

Cost of acquisition (B)

(10,000

x 30) =

Rs.

300,000

- Capital

Gain (A-B)

Rs.

200,000

Since

shares held by the person for

more than one year therefore

under the provision of law

3/4th of the

gain

would be taxable.

Hence:

Taxable

Capital Gain=

200,000 x � = Rs

150,000

Exercise

3:

On

01/10/2006, Mr. A had

acquired mining rights at a cost of Rs

2,000,000. On 01/02/2007, he

disposed

of the rights to

Mr. Y for consideration of Rs 5,000,000.

Calculate Capital Gain.

Solution

to Ex. 3:

Consideration

received on disposal

(A)

Rs.

5,000,000

Cost

of acquisition (B)

Rs.

2,000,000

Capital

Gain

Rs.

3,000,000

Exercise4:

On

01/01/2004, M/s XYZ Pvt. Ltd.

purchased 5000 shares of a

public limited company at a

price of Rs

100

per share. On 10/05/2006, the

company disposed of these

shares at a price of Rs 150

per share.

Compute

taxable gain on disposal of

these shares.

Solution

to E 4:

Consideration

received on disposal

(A)

Rs.

750,000

Cost

of acquisition (B)

Rs.

500,000

Capital

Gain

Rs.

250,000

Since

Capital assets held by the person for

more than one year therefore

under the provisions of law 3/4th

of the

gain would be taxable.

Hence,

Taxable

Capital Gain =

250,000 x � = Rs 187,500

However,

in this case, gain shall not

be taxable since exemption under clause

110 of part 1 of 2nd schedule

has

been granted on gain on

account of disposal of shares of a

public limited

company.

75

Taxation

Management FIN 623

VU

MODULE

10

LESSON

10.39

INCOME

FROM OTHER SOURCES (SECTION

39)

Incomes

not covered by any given

heads of income are covered

under this head.

Some

types covered under the head `Income

from other Sources'

Income

from Dividends

Income

from Royalty

Profit

on debt

Profit,

yield, interest, premium etc. received as

well as accrued.

However,

Rental income (Leasing)

received by a bank shall be `Income from

Business' not "Income

from

other sources'.

Any

amount received by bank from Mutual

Funds shall be taxed under the

head `Income from

Business'

not

under `Income from other

sources'.

Profit

derived from National Saving

Scheme is covered under the head `Income

from other sources'.

Other

Miscellaneous Incomes Covered Under

the Head `Income From Other

Sources'

Income

from:

Annuities

including annuities paid to a lender of

trademark.

Pension

Income

arising out of exploration rights

(exploration of oil fields.

Income

on account of interest- free loans

(Over Bench mark

rate).

Sum

paid for vacating premises

shall be treated as income of

recipient.

Other

Specific Items Covered Under the

Head Income From Other

Sources:

Sum

received not through

permissible banking channels on

account of loans, Advances,

Gifts, and

Deposits

for issuance of Shares of

companies offered for public

subscription.

Sec.

39(3): if above sums

received:

Otherwise

than through crossed bank

cheque

Otherwise

than through banking channel

or from a person not holding

National Tax Number

shall

be

treated as income chargeable to tax under

the head `Income from Other

Sources' for the tax

year

in which it was

received.

Exception

to above:

Sub

Sec. (4): sub

Section 3 of section 39 shall

not apply to an advance payment

for the sale of

goods

or supply of services.

Advances

received from customers in connection

with sale of goods &

services are not to

be

included

/added to income.

However,

advances received against execution of

contract or any other purposes

shall be included

to

income if amount not received

through crossed bank cheques or

through permissible

banking

channels.

Unexplained

Investments

Sec.

111 unexplained income or

assets

Where

A

person has made an

investment,

Any

amount credited to person's books of

account

A

person has incurred expenditure

A

person has made an

investment,

Any

amount credited to person's books of

account

A

person has incurred expenditure.

Sec.

III unexplained income or

assets

But no

reasonable explanation offered regarding

sources of fund the amount as

(a), (b) and (c) above

shall

be included in

person's income chargeable to

tax.

Sub

Sec. 1 of Sec. 111 does

not apply to any amount of Foreign

Exchange remitted from

outside

Pakistan

through normal banking

channels that is en-cashed

into Pak. Rupees by a

scheduled Bank and

encashment

certificate from such bank is produced to

that effect.

76

Taxation

Management FIN 623

VU

Sub

Sec. 1 of Sec 111 does not

also apply to any unexplained amount relating to a

period beyond pre-

ceding

five tax years.

Immune

(Exempted) Investments/Income

Private

foreign Currency Accounts

Three

years Foreign Currency

Bearer Certificates

Rupees

withdrawn or assets created

out of:

Withdrawal

from US Dollar Bearer

Certificates,

Withdrawal

from F.C. Accounts

Encashment

of foreign exchange bearer

certificates

Admissible

Deductions:

Expenditure

incurred to derive income chargeable to

tax.

A

person receiving any profit on

debt chargeable to tax under the head

Income from Other

Sources'

shall

be allowed a deduction for any Zakat paid

by the person at the time the profit is paid to

the

person,

deducted at the time of making payment of

profit.

Depreciation

allowed as deduction.

77

Taxation

Management FIN 623

VU

MODULE

11

LESSON

11.39

56.

SET

OFF OF LOSSES

(1)

Subject to sections 58 and

59, where a person sustains

a loss for any tax year

under any head

of

income specified in section

11, the person shall be

entitled to have the amount of the

loss

set

off against the person's

income, if any, chargeable to tax under

any other head of

income

for

the year.

(2)

Except as provided in this Part, where a

person sustains a loss under a

head of income for a

tax

year that cannot be set off

under sub-section (1), the person

shall not be permitted

to

carry

the loss forward to the next tax

year.

(3)

Where, in a tax year, a person

sustains a loss under the head

"Income from Business" and

a

loss

under another head of income, the loss

under the head "Income from

Business shall be

set

off last.

57.

Carry

forward of Business Losses

(1)

Where a person sustains a

loss for a tax year under the

head "Income from

Business"

(other

than a loss to which section

58 applies) and the loss cannot be

wholly set off under

section

56, so much of the loss that

has not been set

off shall be carried forward

to the

following

tax year and set off

against the person's income

chargeable under the head

"Income

from Business" for that

year.

(2) If

a loss sustained by a person

for a tax year under the head

"Income from Business" is

not

wholly

set off under sub-section

(1), then the amount of the loss

not set off shall be

carried

forward

to the following tax year and applied as

specified in subsection (1) in

that year, and

so on,

but no loss can be carried

forward to more than six tax

years immediately succeeding

the tax

year for which the loss

was first computed.

(2A)

Where a loss, referred to in sub-section

(2), relating to any assessment

year commencing on

or after

1st day of July,

1995, and ending on the 30th day of June 2001, is

sustained by a

banking

company wholly owned by the Federal

Government as on first day of

June, 2002,

which

is approved by the State Bank of Pakistan

for the purpose of this sub-section,

the

said

loss shall be carried

forward for a period of ten

years.

(3)

Where a person has a loss

carried forward under this section

for more than one tax

year,

the

loss of the earliest tax year

shall be set off

first.

(4)

Where the loss referred to in sub-section

(1) includes deductions allowed under

sections 22,

23 and

24 that have not been

set off against income, the

amount not set off shall be

added

to the

deductions allowed under those sections

in the following tax year, and so on

until

completely

set off.

(5) In

determining whether a person's deductions under

sections 22, 23 and 24 have

been set

off

against income, the deductions allowed

under those sections shall be

taken into account

last.

57A.

Set off of business loss

consequent to Amalgamation

(1)

The accumulated loss under the

head "Income from Business"

(not being a loss to

which

section

58 applies) of an amalgamating company or

companies shall be set off

or carried

forward

against the business profits

and gains of the amalgamated

company and vice

versa

up to a

period of six tax years immediately

succeeding the tax year in which the

loss was first

computed in the

case of amalgamated company

amalgamating company or

companies.

(2)

The provisions of sub-section (4)

and (5) of section 57 shall,

mutatis

mutandis, apply

for the

purposes

of allowing unabsorbed depreciation of

amalgamating company or companies

in

the

assessment of amalgamated company

and vice versa

(3)

Where any of the conditions as

laid down by the State Bank of

Pakistan or the Securities

and

Exchange

Commission of Pakistan or any court, as

the case may be, in the

scheme of

amalgamation,

are not fulfilled, the set

off of loss or allowance for

depreciation made in any

tax

year of the amalgamated company or the

amalgamating company or companies

shall be

deemed

to be the income of that amalgamated

company or the amalgamating company

or

78

Taxation

Management FIN 623

VU

companies,

as the case may be, for the

year in which such default

is discovered by the

Commissioner

or taxation officer, and all

the provisions of this 0rdinance shall

apply

accordingly.

59.

Carry forward of Capital

Losses

(1)

Where a person sustains a

loss for a tax year under the

head "Capital Gains"

(hereinafter

referred to as a

"capital loss"), the loss

shall not be set off

against the person's income,

if

any,

chargeable under any other

head of income for the year,

but shall be carried forward

to

the

next tax year and set

off against the capital

gain, if any, chargeable under the

head

"Capital

Gains" for that

year.

(2) If

a capital loss sustained by a

person for a tax year under the

head "Capital Gains" is

not

wholly

set off under sub-section

(1), then the amount of the loss

not set off shall be

carried

forward

to the following tax year, and so

on, but no loss shall be

carried forward to

more

than

six tax years immediately succeeding the

tax year for which the loss

was first computed.

(3)

Where a person has a loss

carried forward under this section

for more than one tax

year, the

loss

of the earliest tax year shall be

set off first.

Deductible

Allowances:

60.

Zakat

(1) A

person shall be entitled to a deductible

allowance for the amount of any

Zakat paid by the

person

in a tax year under the Zakat and

Ushr Ordinance, 1980 (XVIII of

1980).

(2)

Sub-section (1) does not

apply to any Zakat taken

into account under subsection

(2) of

section

40.

(3)

Any allowance or part of an

allowance under this section for a tax

year that is not able to

be

deducted

under section 9 for the year

shall not be refunded, carried

forward to a subsequent

tax

year, or carried back to a

preceding tax year.

61.

Charitable donations:

(1) A person shall be

entitled to a tax credit in respect of

any sum paid, or any

property given by

the

person in the tax year as a donation to

a)

any board of education or any

university in Pakistan established by, or under, a

Federal

or a

Provincial law;

b)

any educational institution,

hospital or relief fund established or

run in Pakistan by

Federal

Government or a Provincial Government or

a local authority; or

c)

any non-profit organization.

Sub-section

(1) substituted by Finance

Act, 2003 which previously

read as follows:

A

person shall be entitled to a tax credit

for a tax year in respect of

any amount paid, or

property

given by the person in the tax year as a

donation to a non-profit

organization."

(2)

The amount of a person's tax credit allowed under

sub-section (1) for a tax

year shall be

computed

according to the following formula,

namely:

(A/B) x

C

Where:

A

is

the amount of tax assessed to the person

for the tax year before allowance of

any tax credit under

this

Part;

B

is

the person's taxable income

for the tax year; and

C

is

the lesser of:

(a)

the total amount of the person's donations referred to

in subsection (1) in the year,

including

the

fair market value of any

property given; or

(b)

where the person is:

(i)

an

individual or association of persons,

thirty per cent of the

taxable income of

the

person for the year;

or

(ii)

a

company, fifteen per cent of the

taxable income of the person

for the year.

(3)

For the purposes of clause

(a) of component C

of

the formula in subsection (2), the

fair

market

value of any property given

shall be determined at the time it is given.

(4) A

cash amount paid by a person as a

donation shall be taken into

account under clause (a)

of

component

C

of

sub-section (2) only if it

was paid by a crossed cheque drawn on a

bank.

79

Taxation

Management FIN 623

VU

(5)

The Central Board of Revenue may

make rules regulating the procedure of

the grant of

approval under

sub-clause (c) of clause

(36) of section 2 and any

other matter

connected

with,

or incidental to, the operation of this

section.

62.

Investment in shares

(1) A

person other than a company

shall be entitled to a tax credit for a

tax year in respect of

the

cost of acquiring in the year new

shares offered to the public by a

public company listed

on a

stock exchange in Pakistan

where the person other than

a company is the original

allottee of the

shares or the shares are

acquired from the Privatization

Commission of

Pakistan.

(2)

The amount of a person's tax credit allowed under

sub-section (1) for a tax

year shall be

computed

according to the following formula,

namely:

(A/B) x

C

Where:

A

is

the amount of tax assessed to the person

for the tax year before allowance of

any tax credit

under this

Part;

B

is

the person's taxable income

for the tax year; and

C

is

the lesser of:

(a)

the total cost of acquiring the shares

referred to in sub-section (1) in the

year;

(b) ten

per cent of the person's

taxable income for the year;

or

(c)

two hundred thousand

rupees.

(3)

Where:

a)

a

person has been allowed a tax credit

under sub-section (1) in a tax year

in

respect

of the purchase of a share;

and

b) the person

has made a disposal of the

share within twelve months of the

date

of

acquisition,

The

amount of tax payable by the person for

the tax year in which the shares

were

disposed

of shall be increased by the amount of the credit

allowed.

63.

Contribution to an Approved Pension

Fund

(1) An

eligible person as defined in sub-section

(19A) of section 2 deriving

income chargeable

to tax under the

head "Salary" or the head

"Income from Business" shall

be entitled to a tax

credit

for a tax year in respect of

any contribution or premium paid in the

year by the person

in approved

pension fund under the Voluntary

Pension System Rules,

2005.

(2)

The amount of a person's tax credit allowed under

sub-section (1) for a tax

year shall be

computed

according to the following formula,

namely:

(A/B) x

C

Where:

A

is

the amount of tax assessed to the person

for the tax year, before allowance of

any tax credit

under this

Part;

B

is

the person's taxable income

for the tax year; and

C

is

the lesser of

(a)

the total contribution or premium referred to in

sub-section (1) paid by the person in

the

year;

or

(b)

twenty per cent of the eligible

person's taxable income for

the relevant tax year; Provided

that

an eligible person (words "a person"

substituted by Finance Bill

2006) joining the

pension

fund at the age of forty-one

years or above, during the

first ten years starting

from

July

1, 2006 (words "of the

notification of the Voluntary Pension

System Rules, 2005"

substituted

by Finance Bill 2006), shall

be allowed additional contribution of 2%

per annum

for

each year of age exceeding

forty years. Provided

further that the total

contribution

allowed to

such person shall not

exceed 50% of the total taxable

income of the preceding

year;

or

(c)

five hundred thousand

rupees.

(3)

The transfer by the members of approved

employment pension or annuity scheme or

approved

occupational

saving scheme of their existing

balance to their individual

pension accounts

maintained

with one or more pension

fund managers shall not

qualify for tax credit under this

section.

63.

Retirement annuity scheme

80

Taxation

Management FIN 623

VU

(1)

Subject to subsection (3), a

resident individual deriving

income chargeable to tax under

the

head "Salary" or the head

"Income from Business" shall

be entitled to a tax credit for

a tax

year in respect of any

contribution or premium paid in the year by the

person under

a contract of

annuity scheme approved by , Securities

and Exchange Commission

of

Pakistan

of an insurance company duly

registered under the Insurance Ordinance,

2000

(XXXIX of

2000), having its main object the

provision to the person of an annuity in

old

age.

(2)

The amount of a resident individual's tax

credit allowed under sub-section (1) for

a tax

year

shall be computed according to the

following formula,

namely:

(A/B) x

C

Where:

A

is

the amount of tax assessed to the person

for the tax year before allowance of

any tax credit

under this

Part;

B

is

the person's taxable income

for the tax year; and

C

is

the lesser of:

a) the

total contribution or premium referred to in

sub-section (1) paid by the

individual

in the year;

b) ten

(Substituted for "five" by

Finance Act, 2003) per

cent of the person's

taxable

(Substituted

for "total" by Finance Act,

2003) income for the tax

year; or

c)

two (Substituted for

"one" by Finance Act, 2003)

hundred thousand

rupees.

(3) A

person shall not be entitled

to a tax credit under sub-section (1) in

respect of a contract

of

annuity which provides:

(a)

for the payment during the

life of the person of any amount

besides an annuity;

(b)

for the annuity payable to the

person to commence before the person

attains the age

of sixty

years;

(c)

that the annuity is capable, in

whole or part, of surrender, commutation,

or

assignment;

or

(d)

for payment of the annuity

outside Pakistan.

64.

Profit on

debt:

(1) A

person shall be entitled to a tax credit

for a tax year in respect of

any profit or share

in

rent and share in appreciation

for value of house paid by the

person in the year on a

loan

by a scheduled bank or non-banking

finance institution regulated by the

Security

and

Exchange Commission of Pakistan or

advanced by Government or the

local

authority

or a statutory body or a public company

listed on a registered stock

exchange

in

Pakistan where the person

utilizes the loan for the construction of a

new house or

the acquisition of

a house.

Sub-Section

(1) substituted by Finance

Act, 2003 which previously

read as follows:

"(1)

A person shall be entitled to a tax

credit for a tax year in respect of

any profit or

share

in rent and share in appreciation of

value of house paid by the person in the

year on a

loan

by a scheduled bank under a house finance

scheme approved by the State Bank

of

Pakistan

or advanced by Government, the local

authority or House Building

Finance

Corporation

where the person utilizes

the loan for the construction of a new

house or the

acquisition of a

house."

(2)

The amount of a person's tax credit allowed under

sub-section (1) for a tax

year shall be

computed

according to the following formula,

namely:

(A/B) x

C

Where:

A

is

the amount of tax assessed to the person

for the tax year before allowance of

any tax credit

under this

Part;

B

is

the person's taxable income

for the tax year; and

C

is

the lesser of:

(a)

the total profit referred to in

sub-section (1) paid by the person in the

year;

81

Taxation

Management FIN 623

VU

(b)

forty (substituted "twenty

five" by Finance Act, 2003)

per cent of the

person's

taxable

(Substituted for "total" by

Finance Act, 2003) income

for the year; or

(c)

five (Substituted for

"one" by Finance Act, 2003)

hundred thousand

rupees.

(3) A

person is not entitled to tax credit

under this section for any

profit deductible under

section

17.

Common

Rules

Income

of joint owners Section

66

Where

any property is own by two

or more persons and there

respective shares are

definite and

ascertainable:

a) the persons shall

not be assessed as an AOP in

respect of the property;

and

b) the share of each

person in the income from

property for a tax year

shall be taken into

account

in the computation of persons taxable

income for that

year.

This

section shall not apply in

computing income chargeable under the

head "Income from

Business"

Apportionment

of deductions Section 67

Where

the expenditure relates to:

The

derivation of more than one

head of income; or

The

derivation of income comprising of

taxable income and any

income under final tax

regime

The

derivation of income chargeable to tax

under a head of income and to

some other purpose,

The

expenditure shall be apportioned on any

reasonable basis taking

account of the relative nature

and

size

of the activities to which the amount

relates.

Fair

Market Value Section

68

Fair

market value of any property

or rent, asset, service, benefit or

perquisites at a particular time

shall

be the

price which these mentioned

above would ordinarily fetch on

sale or supply in the open market

at

that

time.

Receipt

of Income Section

69:

A

person shall be treated as having

received an amount, benefit, or

perquisites if it is:

(a)

actually

received by the person

(b)

applied on behalf of the

person, at the instruction of the person

or under any law; or

(c) made available to

the person.

Recouped

expenditure: Section 70

where

a person has been allowed a deduction

for any expenditure or loss incurred in a

tax year in the

computation

of persons income chargeable to tax under

a head of income and,

subsequently, the person

has

received

in cash or in kind, any amount in

respect of such expenditure or loss, the

amount so received shall

be included in the

income chargeable under the head

for the tax year in which it is

received.

Currency

Conversion: Section 71

Every

amount taken into account under this

ordinance shall be in

Rupees

Where

an amount is in a currency other than

Rupees, the amount shall be converted to the

Rupees at

the

State Bank of Pakistan exchange

rsate applicable on that

date.

Cessation

of Source of Income: Section

72

Where:

a) any income

is derived by a person in a tax year from

any business, activity, investment or

other

source

that has ceased either before the

commencement of the year or during the

year; and

b) if the income

has been derived before the business,

activity, investment or other

source

ceased,

it would have been

chargeable to tax under this

ordinance,

This ordinance

shall apply to the income on the basis

that the business, activity, investment

or other

source

had not ceased at the time the

income was derived.

Rules

to prevent double Derivation and double

Deductions: Section 73

Sec

73

(1)

Where:

(a)

any amount is

chargeable to tax under this ordinance on the

basis that it is receivable,

the

amount

shall not be chargeable

again on the basis that it is

received; or

(b)

any amount is

chargeable to tax under this ordinance on the

basis that it is received,

the

amount

shall not be chargeable

again on the basis that it is

receivable; or

82

Taxation

Management FIN 623

VU

(2)

For the purposes of this

Ordinance,

Where:

(a)

any expenditure is deductible under this Ordinance on the

basis that it is payable,

the

expenditure

shall not be deductible again on the

basis that it is paid; or

(b)

any expenditure is deductible under this Ordinance on the

basis that it is paid, the

expenditure

shall not be deductible again on the

basis that it is

payable.

83

Taxation

Management FIN 623

VU

MODULE

12

LESSON

12.39

TAXATION

OF INDIVIDUALS

AND

TAXATION

OF ASSOCIATION OF PERSONS

Exercise1-Sole

Proprietorship

Mr. A

is running business as sole

proprietor. From the following

information/data relevant to tax

year

2007.

Opening

Stock

Rs.800,000

Purchases

Rs.1,000,000

Sales

Rs.2,000,000

Carriage

inwards

Rs.30,000

Closing

stock

Rs.800,000

Electric

bill of office paid

Rs

18,000

Telephone

bill paid

Rs

20,000

Rent

of office

Rs

120,000

Stationary

for office

Rs

4000

Postages

Rs

3000

Salaries

to staff

Rs

200,000

Advertisement

expenses

Rs

10,000

Advance tax

paid

Rs

60,000

Compute

taxable income and tax

thereon.

Solution

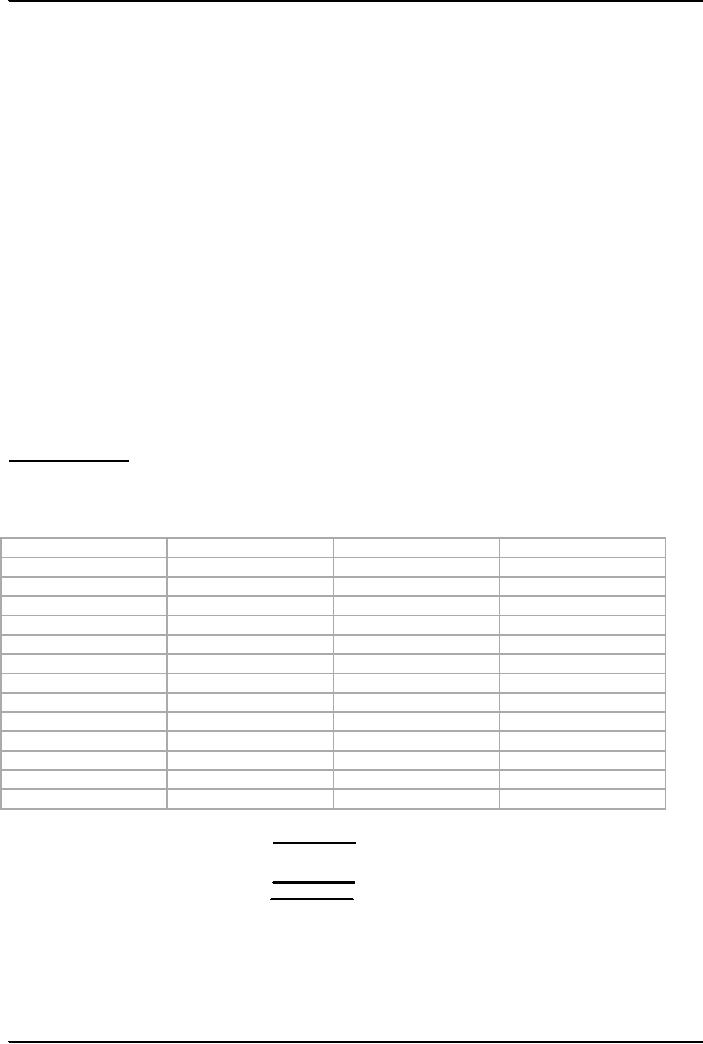

to Ex. 1:

Tax

Payer: Mr. A

.

Tax

Year: 2007

Sole

proprietorship

NTN:

000111

Trading

and Profit & Loss Account

In

Rs

Opening

balance

800,000

Sale

2,000,000

Purchases

1,000,000

Closing Stock

800,000

Carriage

inward

30,000

Gross

profit

970,000

Total

2,800,000

2,800,000

Electricity

18,000

Telephone

20,000

Office

rent

120,000

Stationary

4,000

Postages

3,000

Salaries

200,000

Advertising

10,000

Net

profit

595,000

Total

970,000

970,000

Tax

payable 595,000 x

12.50%=

Rs.

74,375

Advance tax

paid

Rs

60,000

Tax

payable

Rs

14,375

Tax

paid with return

Rs

14,375

Tax

payable / refundable

Nil

Exercise

2: Taxation of Association of

Persons

From

the following information/ data

for tax year 2007 regarding

M/S XYZ brothers, a partnership firm,

compute

taxable income and tax

liability of the firm as well as

individual members.

This

firm comprises of three

partners Mr. X, Mr. Y and

Mr. Z, each partner has

equal share in

profits.

Net

profit of M/S XYZ brothers for tax year

2007 is worked out as Rs

900,000.

Mr. Z

has also earned income

amounting Rs 200,000 from other

sources.

84

Taxation

Management FIN 623

VU

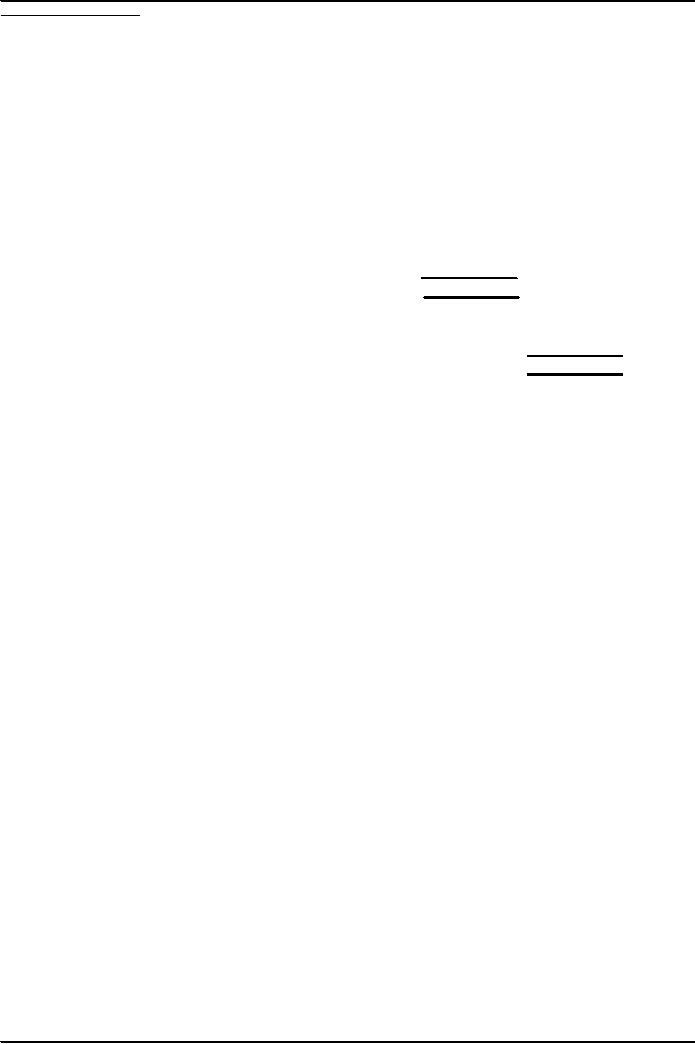

Solution

Exercise 2:

Tax

Payer: M/S. XYZ

Tax

Year: 2007

Partnership

Firm

NTN:

000111

Net

profit (taxable

income)

= Rs

900,000

Tax

liability of firm

(900,000

x 17.50 %*)

= Rs

157,500

*Tax

rate at serial # 12 for

income range Rs 800,000 to

1,000,000 is applied.

Note:

Tax

liability is the obligation of firm

and not of the partners.

However, if partner has income

from any

other

source, his share of income

from partnership is added to taxable

income only for rate

purposes.

Share

of profit of each member Mr.

X, Mr. Y and Mr. Z Rs

300,000 each.

Computation

of tax liability of Mr.

Z

Income

from other sources

Rs200,000

Share

of profit of Mr. Z from firm

M/s XYZ brothers

(Add

for rate purposes

only)

Rs

300,000

Taxable

income

Rs

500,000

Tax

payable (500,000 x 10%)

Rs

50,000

Subtract

tax liability due to addition of Rs

300,000 for rate

purposes

(50,000/

500,000 x 300,000 =

30,000)

Rs

30,000

Tax

payable by Mr. Z

Rs

20,000

(50,000-30,000=20,000)

If Rs

300,000 would have not

been added for rate

purposes, Mr. Z would have

paid tax at the rate of 4 %

that

is 200,000 x 4% = 8,000 instead of Rs

20,000.

85

Taxation

Management FIN 623

VU

MODULE

13

LESSON

13.39

TAXATION

OF COMPANIES

Minimum

Tax on Resident Companies Sec

113

Resident

Company is subjected to minimum tax @

0.50% of its turnover for a

tax year, even in

cases

where the company sustains

loss.

Turnover

under this section means:

the

gross receipts, exclusive of

sales tax and central excise

duty or any trade discounts

shown on

invoice

or bills, derived from the sale of

goods;

the

gross fees for the rendering of

services or giving benefits,

including commissions;

the

gross receipts from the

executions of contracts;

and

the

company's share of the amounts

stated above of any

association of persons of which

the

company

is a member

Exercise-1

M/S XYZ

(PVT) Ltd. filed return

for tax year 2007, declaring

taxable income of Rs.

1,300,000 and paid

entire

liability of tax. On scrutiny of record

by tax authorities, it came to their notice

that following

amounts

have

been paid by Cash. In the light of this

information/data compute tax liability of

said company for tax

year-2007.

Salary

Rs.

30,000

Office

Rent

Rs.

120,000

Professional

Fee

Rs.

80,000

Postages

Rs.

8,000

Freight

paid

Rs.

9,000

Electricity

bill

Rs.

7,000

Telephone

Rs.

5,000

Penalty

Rs.

9,000

Solution

of E-1

Add

Back Inadmissible Deductions Under

Section 21

Salary

paid by cash

Rs.

30,000

Rent

of office paid by cash

Rs.

120,000

Professional

fee paid by cash

Rs.

80,000

Total

Additions

Rs.

230,000

Declared

income

Rs.

1,300,000

Tax

already paid (1,300,000 x 35%)

Rs.

455,000

Additions

made U/S 21

Rs.

230,000

Tax

payable on additions

Rs.

80,500

Note:

Additions

on account of rest of payments,

although by cash not required to be

added back as provided

in

section

21(L)

Computation

of Depreciation

Exercise

2

M/S

A.K. Brothers is a partnership firm. In the books of

accounts the following information/data

has been

provided

with respect to plant and

machinery. Compute normal depreciation and

initial allowance in the

light

of the given information.

Book

value of plant and machinery

as on 01-07-2006

Rs.

1,800,000

Machinery

disposed of during the year

with book value.

Rs.

600,000

Additions

of eligible depreciable asset during the

year

Rs

1,000,000

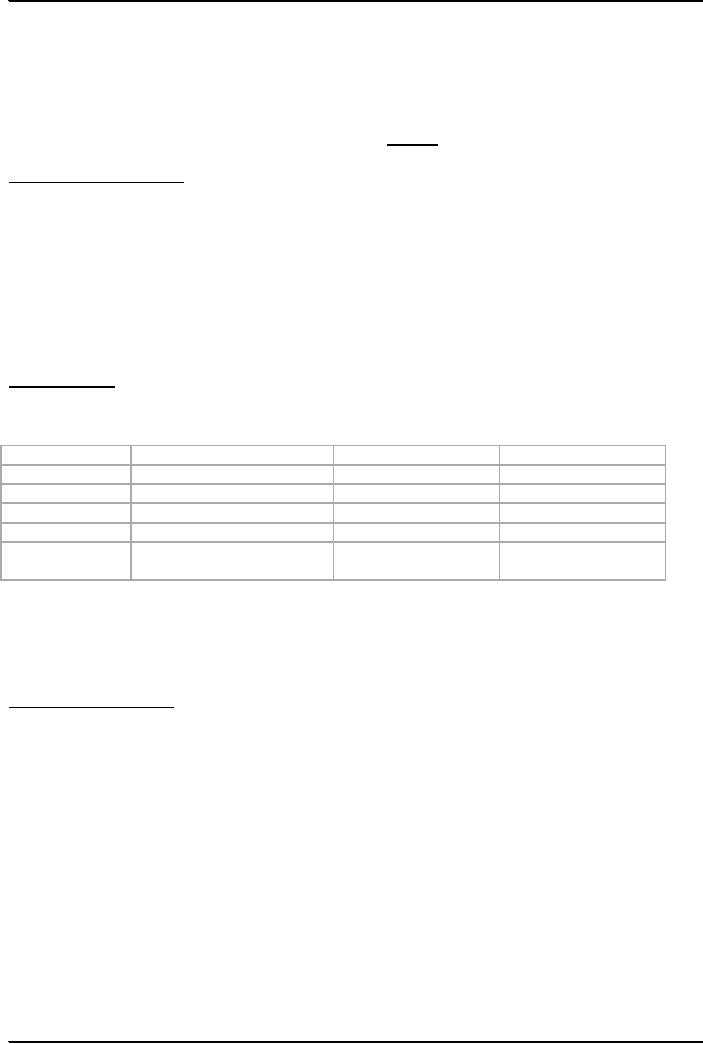

Solution

of E-2

Tax

Payer: A.K. Brothers

Tax

Year: 2007

Residential

Status: Resident

NTN:

000111

Particulars

Book

value

Depreciation

Opening

W.D.V

1,800,000

----

Disposals

(600,000)

----

86

Taxation

Management FIN 623

VU

Balance

W.D.V

1,200,000(X)

----

Additions

during Year

1,000,000

Initial

allowance

@ 50% on

1,000,000

500,000

Balance

book value

(Y)

500,000

Total

book value (X+Y)

1,700,000

Normal

Depreciation@ 15%

255,000

Total

Depreciation

755,000

On

Speculation Business

Exercise

3

M/s

ABC Ltd. A manufacturing company

has furnished the following accounting

information for tax

year

2007.

Compute taxable income and tax

thereon:

-

Gross Income from normal

business

Rs.2,500,000

- Expenditures on

normal business

Rs.

1,000,000

-

Gross income from

speculation business

Rs.

600,000

- Expenditures on

speculation business

Rs.300,000

- Loss

carried forward on normal

business

Rs.

200,000

- Loss

Carried forward on speculation

business

Rs.

900,000

- Advance

Tax Paid

Rs.

200,000

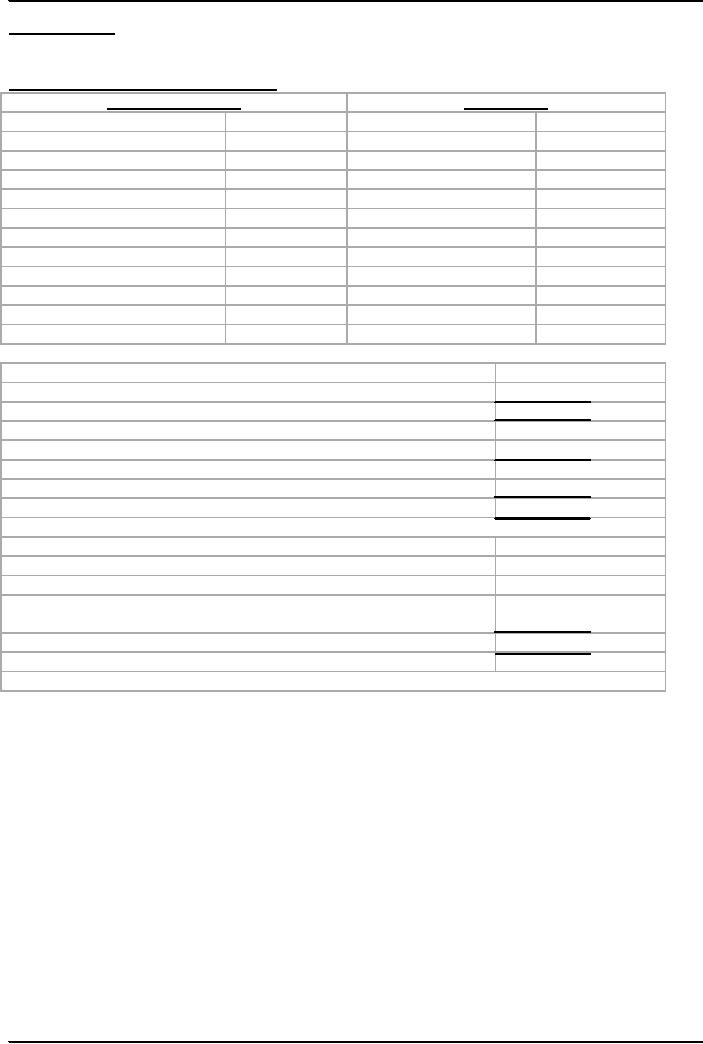

Solution

of E-4

Tax

Payer: ABC Ltd.

Tax

Year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs.

Particulars

Speculation

Operations

Normal

Business

Total

Gross

Income

600,000

2,500,000

3,100,000

Expenditures

(300,000)

(1,000,000)

(1,300,000)

Net

Income

300,000

1,500,000

1,800,000

C/F

Loss

(900,000)

(200,000)

(1,100,000)

Taxable

Income

(600,000)

1,300,000

---

Note-1

Taxable

Income:

Normal

business Rs.1,300,000

Tax

payable= (1,300,000 x 35%) = Rs.

455,000

Note-1:

Loss

of Rs. 600,000 from

speculation business can not

be set off against business

income, it can be set

off

against

speculation business income,

and hence this loss of Rs.

600,000 shall be carried

forward to next year.

Taxation

of Companies

Exercise-4

M/S XYZ is a

limited company, running a

chain of hospitals. The

company filed tax return along

with

relevant accounts/

documents for tax year 2006.

This return has been

selected for total audit. As a

taxation

officer,

work out taxable income

and tax liability of the said

company for tax year

2006.

Medicines

purchased Rs.

1,000,000

Ambulances-

running expenses.

Rs.

300,000

Depreciation on

ambulances

Rs.

40,000

Depreciation on

other assets

Rs.

60,000

Salaries

paid through bank accounts of

employees

Rs.

300,000

Unsupported

payment for purchase of

stationery

Rs.

12,000

Depreciation on

account of car owned by director

and in his personal use

Rs. 40,000

Payment

of legal fee by cash

Rs.

60,000

Received

payments from corporations on the panel

of the hospitals

Rs.

6,000,000

Other

receipts

Rs.

2,000,000

Gain

on sale of a vehicle

Rs.

200,000

Purchase

of X-Ray machine for shown

as expense in revenue

account

Rs.

1,000,000

Withholding

tax deductions

Rs.

525,000

87

Taxation

Management FIN 623

VU

Loss

carried forward from tax

year 2005

Rs.

1,200,000

Solution

of E-4

Tax

Payer: M/S XYZ Ltd.

Tax

Year: 2006

Resident

Company

NTN:

000111

Revenue

Account as Submitted by Co.

RECEIPTS

EXPENDITURES

Particulars

Amount

in Rs. Particulars

Amount

in Rs.

Medicines

1,000,000

From

Corporations

6,000,000

Ambulances

300,000

Other

Receipts

2,000,000

Depreciation

(Ambulances)

40,000

Gain

on Sale of Vehicles

200,000

Depreciation

Others

60,000

Salaries

thru bank

300,000

Unsupported

PAMT

12,000

Depreciation on

personal car

40,000

Legal

Fee by cash

60,000

X-Ray

machine

1,000,000

Net

Profit

5,388,000

8,200,000

8,200,000

Computation

of Tax Payable:

Net

Profit as computed by Co.

5,388,000

Less

set off of c/f losses

(1,200,000)

Taxable

Income

4,188,000

Tax

Payable 4,188,000x35%

1,465,800

Less

withholding Tax

deductions

525,000

Balance

Tax Payable

940,800

Tax

Paid with Return

940,800

Tax

Payable/Refundable

NIL

Additions

by Taxation Officer on account of inadmissible

expenses:

Unsupported

payments

12,000

Depreciation

claimed on personal car of

Director

40,000

Payment

of legal fee by cash

60,000

Purchase

of X-Ray machine ( to be capitalized,

balance sheet item as such

1,000,000

not to

be shown in Revenue

a/c)

Total

additions

1,112,000

Tax

payable on account of add

backs (1,112,000 x 35%=

389,200)

389,200

The

company shall have to pay

tax amounting Rs 389,200.

88

Taxation

Management FIN 623

VU

MODULE

14

LESSON

14.39

Presumptive

income

Taxation

of permanent establishment

(pe)

Presumptive

Income:

Under

normal tax regime, income tax is

chargeable on taxable income

but under some exceptional

circumstances,

the income tax shall be charged on

gross receipts. This is also

called as presumptive tax

regime.

Under following situations the tax

will be charged on gross

receipts basis.

Tax

on dividends:

(a)

Subject to this

Ordinance, a tax shall be imposed, at the

rate specified in Division III of

Part I of

the

First Schedule, on every

person who receives a

dividend from a

company.

(b)

The tax

imposed under sub-section (1) on a

person who receives a

dividend shall be computed

by

applying the relevant rate of tax to the

gross amount of the dividend.

(c) This section

shall not apply to a dividend

that is exempt from tax under this

Ordinance.

6.

Tax

on Certain Payments to Non-Residents:

(1)

Subject to this Ordinance, a tax shall be

imposed, at the rate specified in

Division IV of Part I of

the

First Schedule, on every non-resident

person who receives any

Pakistan-source royalty or

fee

for

technical services.

(2)

The tax imposed under sub-section

(1) on a non-resident person shall be

computed by applying

the relevant

rate of tax to the gross amount of the

royalty or fee for technical

services.

(3)

This section shall not apply

to:

(a)

any royalty where the

property or right giving

rise to the royalty is effectively

connected

with a

permanent establishment in Pakistan of

the non-resident person;

(b)

any fee for technical

services where the services

giving rise to the fee are

rendered through

a

permanent establishment in Pakistan of

the non-resident person; or

(c)

any royalty or fee for

technical services that is

exempt from tax under this

Ordinance.

(4)

Any Pakistani-source royalty or

fee for technical services

received by a non-resident person

to

whom

this section does not apply by

virtue of clause (a) or (b) of

sub-section (3) shall be

treated

as

income from business

attributable to the permanent

establishment in Pakistan of the

person.

7.

Tax

on Shipping and Air Transport Income of a Non-Resident

Person

(1)

Subject to this Ordinance, a tax shall be

imposed, at the rate specified in

Division V of Part I of

the

First Schedule, on every non-resident

person carrying on the business of

operating ships or

aircraft as the

owner or chatterer thereof in respect

of

(a)

the gross amount received or receivable

(whether in or out of Pakistan) for the

carriage of

passengers,

livestock, mail or goods embarked in

Pakistan; and

(b) the

gross amount received or receivable in

Pakistan for the carriage of

passengers, livestock,

mail or

goods embarked outside

Pakistan.

(2)

The tax imposed under sub-section

(1) on a non-resident person shall be

computed by applying

the relevant

rate of tax to the gross amount referred to in

subsection (1).

(3)

This section shall not apply to

any amounts exempt from tax

under this Ordinance.

Taxation

of PE

105.

Taxation of a Permanent Establishment in Pakistan of a

Non-Resident Person.

(1)

The following principles shall apply in

determining the income of a permanent

establishment in

Pakistan

of a non-resident person chargeable to tax under the

head "Income from

Business",

namely:

(a)

The profit of the permanent

establishment shall be computed on the

basis that it is a

distinct

and separate person engaged

in the same or similar activities under the

same or

similar

conditions and dealing

wholly independently with the nonresident

person of which

it is a

permanent establishment;

(b)

subject to this Ordinance, there shall be

allowed as deductions any expenses

incurred for

the

purposes of the business activities of the

permanent establishment including

executive

and

administrative expenses so incurred, whether in

Pakistan or elsewhere;

(c) no

deduction shall be allowed for amounts

paid or payable by the permanent

establishment

to its

head office or to another permanent

establishment of the non-resident person

(other

89

Taxation

Management FIN 623

VU

than

towards reimbursement of actual

expenses incurred by the non-resident person

to

third

parties) by way of:

(i)

royalties,

fees or other similar

payments for the use of any

tangible or

intangible

asset by the permanent

establishment;

(ii)

compensation

for any services including

management services

performed

for

the permanent establishment; or

(iii)

profit

on debt on moneys lent to the

permanent establishment, except

in

connection

with a banking business;

and

(d) no

account shall be taken in the

determination of the income of a

permanent establishment

of

amounts charged by the permanent

establishment to the head office or to

another

permanent

establishment of the non-resident person

(other than towards

reimbursement of

actual

expenses incurred by the permanent

establishment to third parties) by

way of:

(i)

royalties,

fees or other similar

payments for the use of any

tangible or

intangible

asset;

(ii)

compensation

for any services including

management services performed

by

the

permanent establishment; or

(iii)

profit

on debt on moneys lent by the

permanent establishment, except

in

connection

with a banking

business.

(2) No

deduction shall be allowed in computing the

income of a permanent establishment

in

Pakistan

of a non-resident person chargeable to tax under the

head "Income from Business"

for

a tax

year for head office

expenditure in excess of the amount as bears to the

turnover of the

permanent

establishment in Pakistan the same

proportion as the non-resident's total

head office

expenditure

bears to its worldwide

turnover.

(3) In

this section, "head office

expenditure" means any

executive or general

administration

expenditure

incurred by the non-resident person outside

Pakistan for the purposes of

the

business

of the Pakistan permanent establishment

of the person, including:

(a)

any rent, local rates and

taxes excluding any foreign

income tax, current repairs,

or

insurance

against risks of damage or destruction

outside Pakistan;

(b)

any salary paid to an employee

employed by the head office

outside Pakistan;

(c)

any traveling expenditures of

such employee; and

(d)

any other expenditures which

may be prescribed

(4) No

deduction shall be allowed in computing the

income of a permanent establishment

in

Pakistan

of a non-resident person chargeable under the

head "Income from Business"

for:

(a)

any profit paid or payable by the

non-resident person on debt to finance the

operations

of the

permanent establishment; or

(b)

any insurance premium paid or payable by

the non-resident person in respect of

such

debt.

90

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS