|

Methods of Accounting |

| << Deductions: Special Provisions, Depreciation |

| Taxation of Resident Company >> |

Taxation

Management FIN 623

VU

MODULE

8

LESSON

8.35

INCOME

FROM BUSINESS & ITS

COMPUTATION

Methods of

Accounting

Under

section 32, a person's

income is to be computed in accordance

with method of accounting

regularly

employed

by such person.

Types of

Accounting Methods

(i)

Cash-Basis

accounting-Sec. 33

(ii)

Accrual-Basis

accounting Sec. 34

For

Companies Accrual basis

mandatory.

For

Others --- optional, cash or

Accrual Basis

Under

Cash-Basis

Accounting, a

person shall derive income when it is

received and shall

incur

expenditure when it

is paid.

Under

Accrual

Basis Accounting a

person derives income when

it is due to the person and

shall incur

expenditure

when it is payable by the

person.

Change

in the method of accounting after seeking approval

from commissioner Sec.

32(4)

Valuation

of Stock:

Cost

of stock-in-trade disposed of (consumed)

during the year shall be computed as

under.

A+B-C

A:

Opening stock

B:

Stock acquired during the

year

C:

Closing stock.

Records:

Kinds

of Record to Be Maintained

Records

of Money received &

expended

Sales

& purchases record

Assets

&Liabilities record

Stock

register

If

computerized system ---Electronic

receipts.

General

Instructions

Back

up system in place.

Security

Arrangements/system.

Record

to be maintained in line with

International Accounting

Standards.

To

keep record at specified

place.

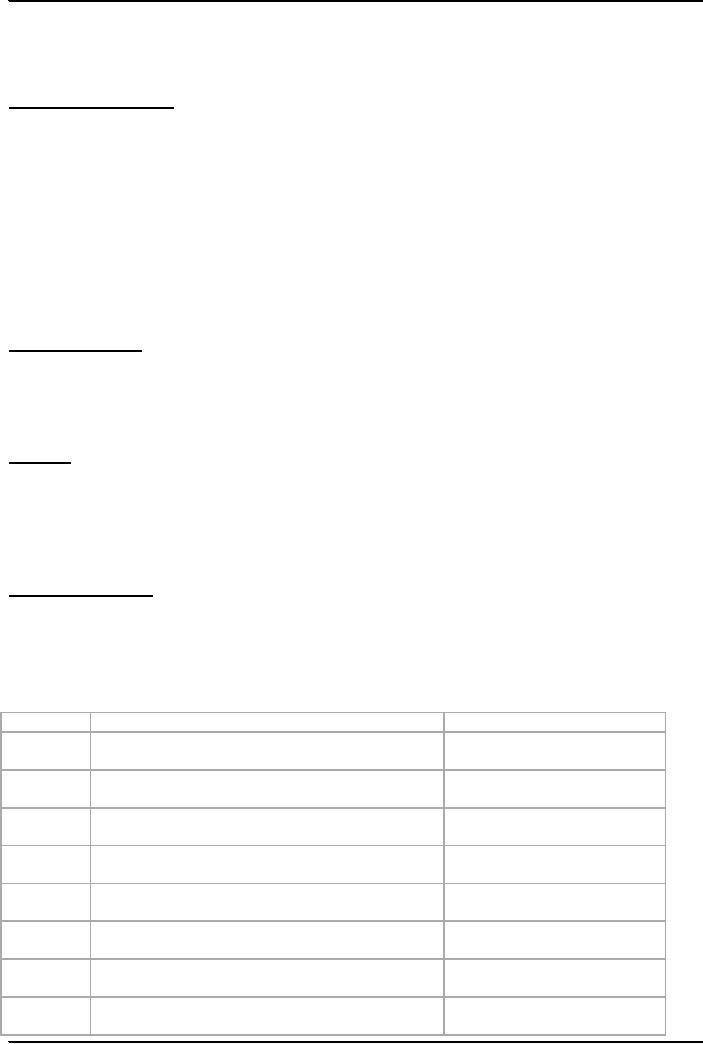

Rates

of Tax for Individuals and

AOP 1st schedule.

For

Tax year 2007

Serial

No. Taxable Income

Rate

of Tax

1)

Where

the taxable income does not

exceed Rs

0%

100,000

2)

Where

the taxable income exceeds

Rs. 100,000 but

0.5%

does

not exceed Rs.

110,000

3)

Where

the taxable income exceeds

Rs. 110,000 but

1.00%

does

not exceed Rs.

125,000

4)

Where

the taxable income exceeds

Rs. 125,000 but

2.00%

does

not exceed Rs.

150,000

5)

Where

the taxable income exceeds

Rs. 150,000 but

3.00%

does

not exceed Rs.

175,000

6)

Where

the taxable income exceeds

Rs. 175,000 but

4.00%

does

not exceed Rs.

200,000

7)

Where

the taxable income exceeds

Rs. 200,000 but

5.00%

does

not exceed Rs.

300,000

8)

Where

the taxable income exceeds

Rs. 300,000 but

7.50%

does

not exceed Rs.

400,000

63

Taxation

Management FIN 623

VU

9)

Where

the taxable income exceeds

Rs. 400,000 but

10.00%

does

not exceed Rs.

500,000

10)

Where

the taxable income exceeds

Rs. 500,000 but

12.50%

does

not exceed Rs.

600,000

11)

Where

the taxable income exceeds

Rs. 600,000 but

15.00%

does

not exceed Rs.

800,000

12)

Where

the taxable income exceeds

Rs. 800,000 but

17.50%

does

not exceed Rs.

1,000,000

13)

Where

the taxable income exceeds

Rs. 1,000,000 but

21.00%

does

not exceed

14)

Where

the taxable income exceeds Rs

1,300,000

25.00%

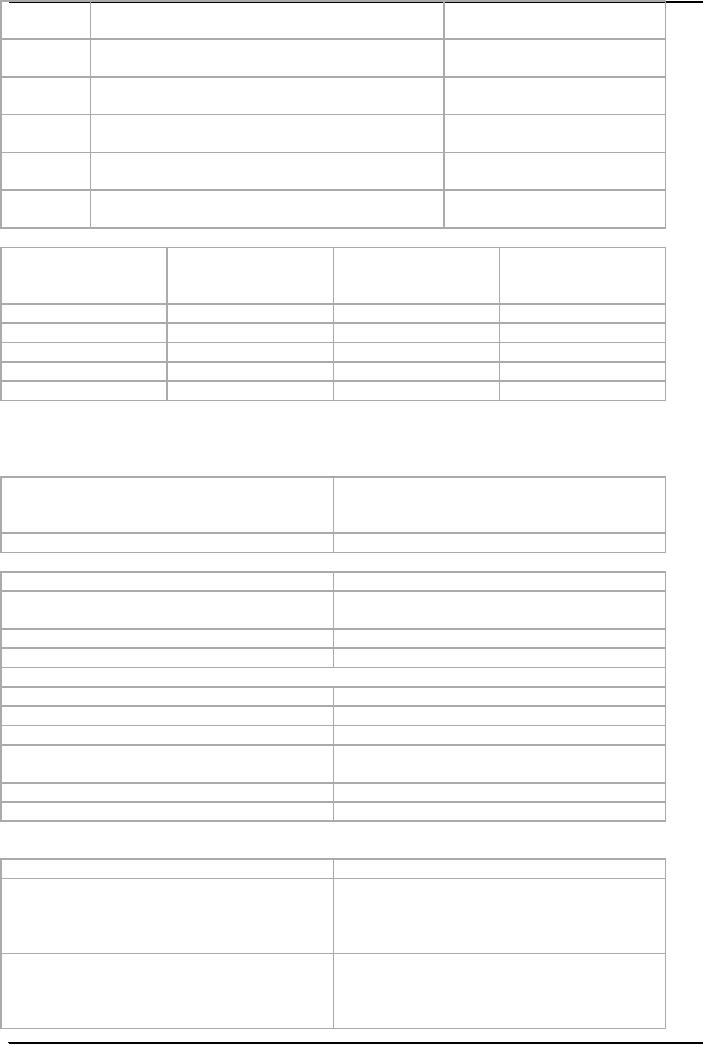

Rates

of Tax for Companies for Tax

Year 2007

Tax

Year

Banking

Company

Public

Company

Private

Company

other

than Banking

other

than Banking

Company

Company

2003

47%

35%

43%

2004

44%

35%

41%

2005

41%

35%

39%

2006

38%

35%

37%

2007

35%

35%

35%

In

case the taxpayer is a society or a

cooperative society, the tax shall be

payable at the rates

applicable

to a

public company or an individual,

whichever is beneficial to the tax payer.

Rate

of tax for a small company

shall be 20% of taxable

income.

Rate

of Dividend tax under

Section 5:

a) in

case, dividend received by a

public company 5% of gross amount

received.

or

insurance company or any

other resident

company.

b) in

any other case.

10% of

gross amount of dividend

received.

Rate

of tax on certain payments to Non-

Residents under Section

6:

Royalty or

fee for technical

services

15% of

gross amount received

Rate

of tax on shipping or Air Transport of

a

8% of

gross amount of dividend

received

non-resident

person

Shipping

income

8% of

gross amount received

Air

transport income

3% of

gross amount received

Deduction

of tax at source

Profit

on debt under section

151

10% of

profit paid

Prizes

and winnings under section

156

On a

prize bond

10% of

gross amount paid

On winnings

from raffle, lottery, prize

on

20% of

gross amount paid

winning

a quiz etc

Depreciation

(Sec.22) Third Schedule Part

1

Depreciation

rates specified for the

purposes of section 22 shall

be:

1.

Building (all types)

10%

2.

Furniture (including fittings)

and machinery

15%

and

plant (not otherwise

specified), Motor

Vehicles

(all types), ships, technical

or

professional

Books.

3. Computer

hardware including

printer,

30%

monitor

and allied items [machinery

and

equipment

used in manufacture of I.T.

products],

aircrafts

and aero engines.

64

Taxation

Management FIN 623

VU

4. In

case of mineral oil concerns the

income of

which

is liable to be computed in accordance

with

the rules of Part 1 of the fifth

Schedule.

a) Below

ground installations

100%

b)

Offshore platform and

production

20%

installations.

65

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS