|

PROVIDENT FUND |

| << Gratuity Exercise |

| Exemptions on Business income, Treatment of Speculation Business >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.31

SALARY

AND ITS COMPUTATION

PROVIDENT

FUND

Types:

� Statutory

Provident Fund, governed by the Provident

Funds Act, 1925 (GP

Fund)

� Recognized

Provident Fund (recognized by

Commissioner of Income Tax under

Part I of Sixth

Schedule).

� Unrecognized

Provident Fund

Recognized

Provident Fund defined in

clause (48) of Section 2 as

under:

Means

a provident fund recognized by the

commissioner in accordance with

Part I of Sixth

Schedule.

Recognized

Provident Fund under Part I of 6th

Schedule

CIT

may accord recognition, if

fund in compliance with

requirements as laid down in rule

2.

CIT

may withdraw recognition after

providing reasonable opportunity to the

trustees of the fund of

being

heard.

Condition

for Approval

� All

employees shall be employed in

Pakistan or

� Shall

be employed by employer whose principal

place of business is in

Pakistan.

� Contributions

by employee in a tax year shall be a

definite proportion of his

salary.

� Contributions

by employer to the Individual account of an

employee in a tax year shall

not exceed the

contributions

made by the employee.

� Fund

shall be vested in two or

more trustees, or official

trustee.

� The

accumulated balance due to an

employee shall be payable on the

day, he ceases to be an

employee

of the

employer, who is maintaining the

Fund.

Tax

Treatment:

The

following is the tax treatment of different kinds of

provident funds:

� Statutory

Provident Fund [Wholly exempt]

Clause 22.

� Recognized

Provident Fund [Partially taxable

within limits].This is defined in

section 2(48) as a

provident

fund which has been

recognized by the Commissioner of Income

Tax in accordance

with

the

rules contained in Part I of the Sixth

Schedule. Employer's contribution up to 10

per cent of

salary

is exempt. Employer's contribution

exceeding 10% of `salary' is taxable

under rule 3, Part 1

of

Sixth Schedule.

Recognized

Provident Fund

The

accumulated balance due and

becoming payable to any

employee participating in a

recognized

provident

fund is fully

exempt under

clause

(23) Part I

of Second Schedule.

Provident

Fund

Un-recognized

provident fund [wholly

taxable]

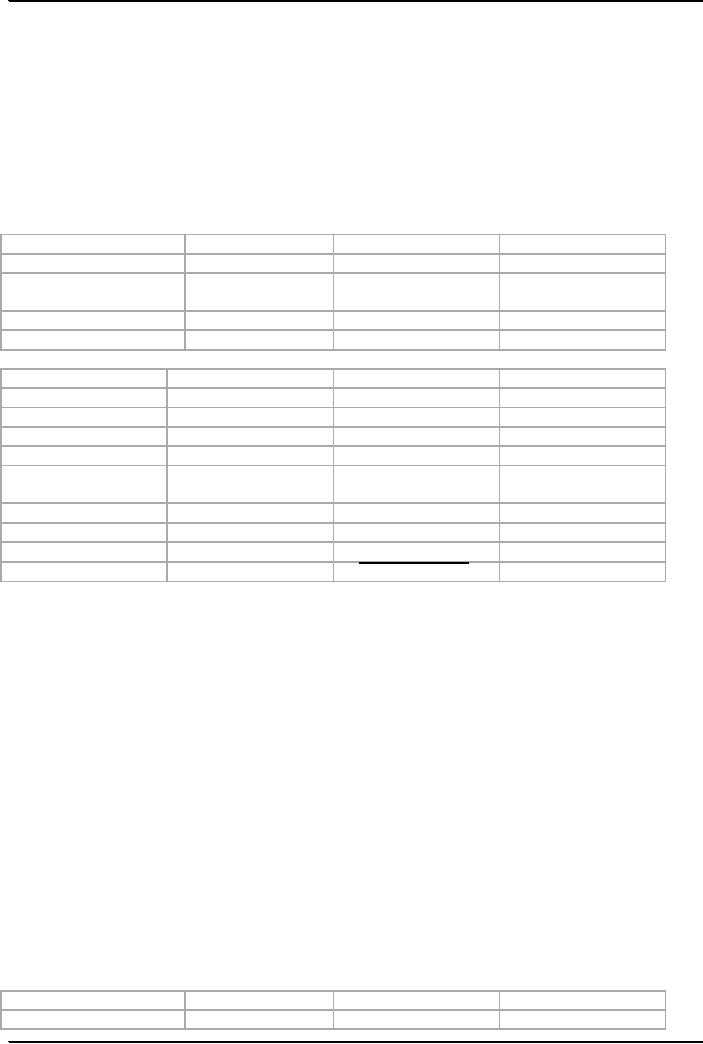

Exercise

on Provident Fund

Mr. A

received credit of Rs. 50,000 as

employer's contribution to recognized

provident fund, his

salary

during

tax year 2007 is given below:

1.

Basic salary

Rs.840,000

2. Computer

allowance

Rs.

12,000

3.

Medical allowance

Rs.

60,000

Compute

taxable income and tax thereon

for tax year 2007.

Solution:

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs.

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

Salary

840,000

Nil

840,000

Computer

allowance

12,000

Nil

12,000

54

Taxation

Management FIN 623

VU

Medical

allowance

60,000

84,000

Nil

(10% of

basic exempt)

Employer's

contribution

---

---

---

to SPF

Exempt (Note-1)

Taxable

Income

852,000

N-1:

Under

rule 3 of Part I of Sixth Schedule

exemption is available up to 10% of

salary and excess

amount

shall

be taxable. In this case entire amount

i.e.; Rs. 50,000 is exempt

as it is within prescribed limit

of

10% of

salary.

N-2:

Taxable

income shall be Rs 852,000

and tax can be computed as explained in previous

exercise.

Benevolent

Grant

Exercise

on Benevolent Grant:

Mr. A,

a govt. servant retired on 01-05-2007. He

received Rs. 600,000 from

duly approved benevolent fund.

He

received total income amounting

Rs. 480,000 under the head

salary during tax year

2007.

Compute

taxable income and tax thereon in

respect of Mr. A for tax

year 2007.

Exemption

on account of benevolent grant paid from the

Benevolent Fund under clause (24) of

part 1

of 2nd schedule.

(24)

any benevolent grant paid from the Benevolent

Fund to the employees or members of

their

families

in accordance with the provisions of the Central

Employee Benevolent Fund and

Group

Insurance

Act, 1969.

MODULE

7.31

INCOME

FROM PROPERTY

Taxation

of rental income arising from

use and exploitation of immovable

property `Income

from

Property'

includes

Rent received or receivable by a

person in a tax year other

than rent exempt from

tax.

Sec 15

(1)

Rent

means

any income received or

receivable by the owner of land or building as

consideration for:

Use of

land or building

Occupation of land

or building

Right

to use the land or building

Rent

also includes forfeited

deposits paid under a contract for the

sale of land or building.

Where

a building leased out together

with Plant & Machinery, it is not

income from property' but

`income

from

other sources' Sec.

15(3).

Rent

to be in line with Fair Market

Rent. Where the rent

received or receivable by a person is

less than the

fair

market rent for the

property; the person shall be

treated as having derived the fair market

rent for the

period,

the property is let on rent in the tax

year.

Where

utilities provided by any

person are included in rent, such amount

shall be chargeable to tax under

the

head income from other

sources and not under the

head income from

property.

Exemptions

available under property

income:

Any

income of a trust or welfare institution

from housing property clause

(58)(1) as provided in sub

clause

(2)

and (3) of clause (58).

The said clauses are

reproduced below:

(2)

A

trust administered under a scheme approved by the

Federal Government in this behalf

and

established

in Pakistan exclusively for the

purposes of carrying out

such activities as are for the

benefit

and

welfare of-

i.

Ex-servicemen

and serving personnel,

including civilian employees of the

Armed Forces, and

their

dependents;

or

ii.

Ex-

employees and serving

personnel of the Federal Government or a

Provincial Government

and

their

dependents, where the said trust is

administered by a committee nominated by the

Federal

Government

or , as the case may be, a

Provincial Government.

(3)

A

trust or welfare institution [or

non- profit organization] approved by

[Regional Commissioner of

Income

Tax] for the purposes of this

sub-clause.

55

Taxation

Management FIN 623

VU

Exemptions

available under Clause (59)

of part 1 of 2

nd

schedule on

income from property

held

under

trust or other legal obligations

for religious or charitable

purpose.

Certain

deductions were allowable/

permissible under sec 17 up to tax year

2006. Section 17 stands

omitted

by

Finance Act, 2006. Hence no

deductions are permissible

from 1st

July

2006.

Sec 15

(7) the provisions of sub section

(1) Section 15 shall not

apply in respect of a Tax Payer

who:

i.

is an

individual or association of

persons;

ii.

Derives

income chargeable to tax under this

section not exceeding Rs.

150,000 in a tax year;

and

iii.

Does

not derive taxable income under

any other head.

However,

Fair Market Rent not

applicable when lessee

chargeable to tax under the head `Salary

Income'.

The

rent received shall not be

chargeable to tax in respect of a tax

payer who

Is an

individual or association of

persons;

Derives

income chargeable to tax under this

section not exceeding Rs.

150,000/- in a tax year;

and

Does

not derive taxable income under

any other head.

Treatment of

Non-Adjustable Amounts Received in

Relation to Buildings

These

amounts shall be treated as

rent and chargeable to tax under the

head "income from property".

These

amounts

are spread over a period of

10 years, It is adjustable as

Rent.

ILLUSTRATION

Say

non-adjustable advance rent received

Rs.120,000.

Amount

adjustable shall be 120,000/10 =

Rs.12,000 Rs12,000 shall be

adjustable for ten

years.

Admissible

Deductions before tax year

2007

� Allowance

for Repair-----1/5 of total

Rent in a tax year. It is a statutory

allowance.

� Insurance

Expenses (Payment of

Premium)

� Taxes,

charges, property tax

� Ground

rent paid or payable by the

person.

� Interest

(Mark-up, Profit) paid on money

borrowed for the

property.

� Rent

sharing by House Building Finance

Corporation.

� Rent

collection charges, actually incurred---

(not to exceed 6% of total

rent receivable for the tax

year.

� Legal

expenses in connection with the relevant

property.

� Unpaid

rent (irrecoverable rent).

� Any

expenditure allowed to a person under this head as

deduction, shall not be allowed as

expense

under

any other `Head of

income'.

Treatment of

Income from Property under

Sec 155:

(1)

[Every] prescribed person making a

payment in full or part

(including a payment by way

of

advance)

to any person on account of

rent of immovable property) including

rent of furniture and

fixtures,

and amounts for services

relating to such property) shall

deduct tax from the gross amount

of

rent

paid at the rate specified in the First

Schedule (5% of gross rent

paid).

(2)

The tax deducted under sub-section

(1) shall be a final tax on the

income from property.

(3)

In this section, "prescribed person"

means--

i.

The

Federal Government;

ii.

A

Provincial Government;

iii.

Local

authority;

iv.

A

company;

v.

A

non-profit organization;

vi.

A

diplomatic mission of a foreign

state; or

vii.

Any

other person notified by the

CBR for the purpose of this

section.

The

Rate of Tax on Property

Income under section 15, 5% of the

gross amount of rent is chargeable to

tax.

Exercise-1

Compute

taxable income of Mr. A, an

individual in the light of following

data/ information, relevant to tax

year

2006.

� Mr.

A let out a building to M/S XYZ

and received rent amounting Rs

1,600,000 during the tax

year.

� M/S XYZ

also paid amount of Rs 800,000 as non-adjustable

advance.

� Mr.

A spent Rs 60,000 on account of

repairs of said

building.

� Insurance

premium paid by Mr. A Rs 40,000

� Property tax

in lieu of said property paid Rs

50,000

56

Taxation

Management FIN 623

VU

� Property tax

paid in lieu of house owned and

occupied by Mr. A Rs

20,000

� Salary

paid to employees hired for the

purpose of rent collection Rs

120,000

� Fee

paid to a law firm Rs

50,000

� Mr.

A entered into a sale

agreement with Mr. Y on

account of sale of a building at a

price of Rs 2

million

and received Rs 200,000 as an

advance. Mr. Y failed to

make the balance payment,

hence

advance

forfeited.

� Mr.

A had constructed the said

property after availing loan from a

commercial bank and paid mark-up

amounting Rs

40,000 during the tax

year.

Solution

of Exercise 1

Tax

payer: Mr. A

Tax

year: 2006

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs.

Particulars

Total

income

Exempt

Income

Taxable

Income

Rental

Income

1,600,000

Nil

1,600,000

Non

adjustable advance

80,000

Nil

80,000

N-1

Forfeited

deposit

200,000

Nil

200,000

Gross

Total

1,880,000

Particulars

Total

income

Deductions

Taxable

Income

Gross

income B/F

1,880,000

----

----

Repairs

N2

----

136,000

----

Insurance

Premium

----

40,000

----

Property

tax

----

50,000

----

Property tax of

self-

----

----

----

occupied

House N-3

Rent

Collection N-4

----

112,800

----

Legal

charges

----

50,000

----

Mark-up

paid

----

40,000

----

Total

668,800

1,211,200

Taxable

income is:

Rs.

1,211,200

Tax

thereon:

Rs.

1,211,200 x 5%= 60560

N-1:

Non

adjustable advance is spread

over ten years.

N-2:

Repairs

allowed as statutory allowance@ 1/5th of

gross rental.

N-3:

Expenditures

allowed in respect of building that is

generating rental income.

N-4:

Rent

Collection charges not to

exceed 6% of gross rental

income.

N-5:

Forfeited

amount on account of cancellation of sale

agreement of building shall be

treated as rental income.

Exercise

2:

Compute

taxable income and tax thereon in

respect of Mr. A for tax

year 2007. Relevant

information / data

is given

here under:

Rental

income from shop Rs

120,000

Mr. A

is an employee of a federal government

and received gratuity, Rs.900,000 on

retirement.

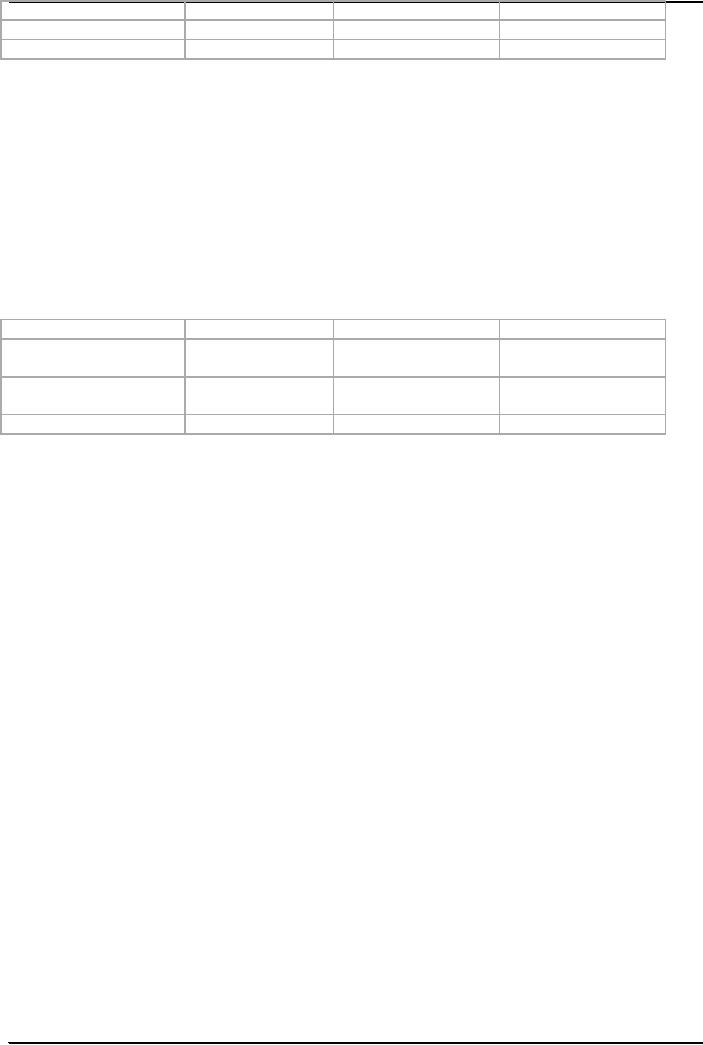

Solution

of Exercise 2

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs.

Particulars

Total

income

Exempt

Income

Taxable

Income

Rental

Income

120,000

120,000

Nil

57

Taxation

Management FIN 623

VU

Note-1

Gratuity

900,000

900,000

Nil

Taxable

Income

Nil

N-1:

Rent

received under the head income

from property shall be

exempt, if following condition

are met;

Person

receiving rent under this head is an

individual or AOP.

Income

under this head for a tax year

does not exceed Rs

150,000

The

person does not derive

taxable income from any

other head of income.

Exercise

3:

Compute

taxable income and tax thereon in

respect of Mr. A for tax

year 2007 from the

following

information

/ data.

Rental

income from building

Rs

450,000

Non-

adjustable advance

received

Rs

200,000

Solution

of Exercise 3

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs.

Particulars

Total

income

Exempt

Income

Taxable

Income

Rental

Income

450,000

Nil

450,000

Note-1

Non

adjustable advance

---

---

20,000

(Note-1)

Taxable

Income

470,000

Under

the head "Income from

Property" tax is payable at the rate of

5% of gross amount of rent

received.

Hence

tax payable = 470,000 x 5% = Rs

23,500

N-1:

Non

adjustable amount received by the owner of the

building from the tenant shall be

treated as rent

chargeable

to tax under the head "Income from

Property" in the tax year in which it

was received and

following

9 tax years in equal proportion.

Sec16.

58

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS