|

Gratuity Exercise |

| << Tax treatment of Gratuity |

| PROVIDENT FUND >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.30

SALARY

AND ITS COMPUTATION

GRATUITY

RECEIVED UNDER SIXTH

SCHEDULE

In

the case of employees

covered by approved gratuity

under Sixth

Schedule:

Any

gratuity received by an employee

from a gratuity fund approved by the

Commissioner of Income

Tax

in

accordance with the rules contained in

Part III of the Sixth Schedule, is

fully exempt under clause

(13)(ii),

Part I

of Second Schedule.

Exercise-2

on Gratuity:

Mr. A,

an employee of a private Company,

received Rs. 1,000,000 at the time of

retirement on 01-10-2006,

from a

gratuity fund approved by the

Commissioner of Income Tax under Sixth

Schedule.

Other

information/data for tax year

2007 is given here under:

1.

Basic salary

Rs.360,000

2.

Bonus

Rs.

90,000

3.

Gardener

Rs.

48,000

Compute

taxable income and tax thereon

for tax year 2007.

Solution

of Exercise 2:

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

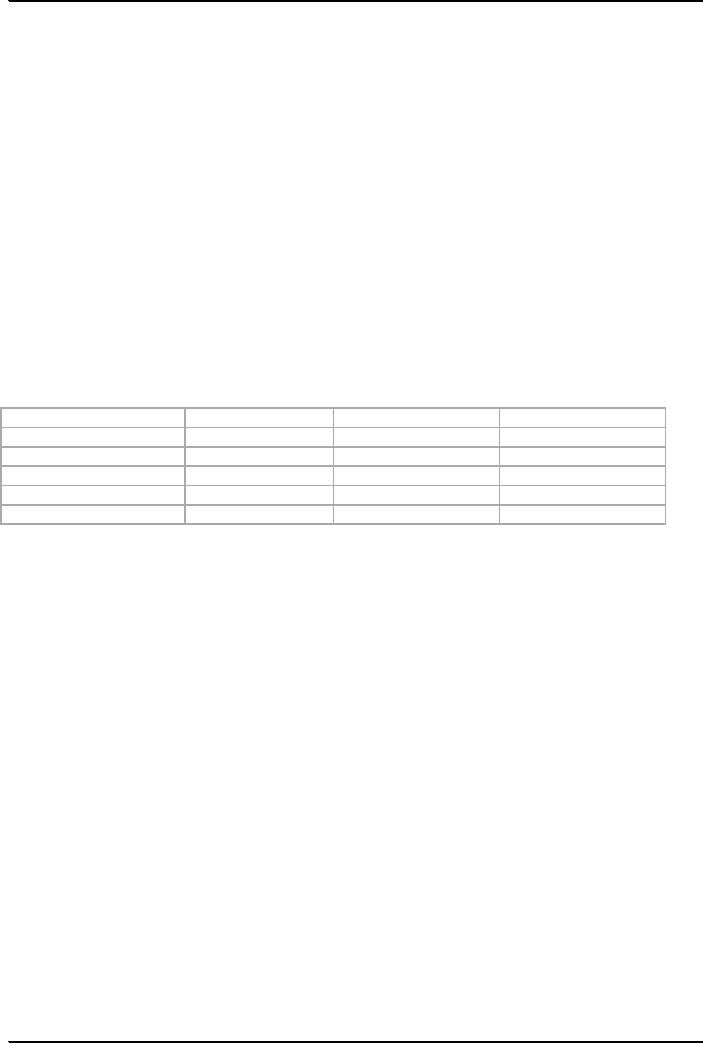

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

Salary

360,000

Nil

360,000

Bonus

90,000

Nil

90,000

Gardener

48,000

Nil

48,000

Gratuity

1,000,000

1,000,000

Nil

Taxable

Income

498,000

Tax

Liability:

Tax

payable = 498,000 x 3.5%=17,430

N-1

Gratuity

fund approved by the Commissioner of

Income Tax is exempt under

Sixth Schedule.

Treatment if

Gratuity Approved by Central Board of

Revenue

In

Case Gratuity Approved Under

clause (13)(iii), Part I, Second

Schedule-CBR approval

� First

gratuity received up to Rs.

200,000 is exempt.

� Amount

exceeding Rs. 200,000/- will

be taxable as salary.

Treatment of

Gratuity not Covered under

any other Clause of Part I of 2nd

Schedule:

Gratuity

received by an employee/family on retirement or

death shall be exempt from

tax to the extent of

the

least of the following:

a. 50% of

amount receivable

Or

b. Rs.

75,000

However,

this exemption is not available in the

following cases:

� If

gratuity is received outside

Pakistan

� Received

by a director of a company who is

not a regular employee of the

company

� If

received by a non resident

person

� If recipient

has already received any

gratuity from the same or

any other employer

Exercise-3

Mr. A

retired on 01.01.2007, he received

gratuity amounting Rs. 600,000.

The gratuity fund was

not

approved by the

authorities stipulated in the ordinance. Explain

treatment of gratuity received by the

said

employee

under the provisions of the Ordinance.

Solution:

51

Taxation

Management FIN 623

VU

As per

clause (13)(iv), Part I of Second

Schedule, exemption is available as

follows:

50% of

Rs. 600,000 received = Rs.

300,000 or Rs.75,000, whichever is

less.

In this

case Rs.75,000 is exempt and

balance amount of Rs.225,000 will be

taxable.

Gratuity:

Points to Remember:

� Gratuity

will be ignored while computing

taxable income and tax

liability of a deceased

person.

� In

case the gratuity is received by

legal heirs, where employee

dies before retirement the gratuity

would

be

taxable in the hands of legal

heirs of the deceased.

Pension

Pension

is the amount received on account of past

services/employment

Tax

treatment of Pension

Pension

Totally Exempt

If

received by a citizen of Pakistan under

clause (8) part I of second

Schedule. Provided

As

stated above the recipient

should be citizen of Pakistan

The

recipient must not be working

for the same employer for

any remuneration.

In

case a person receives

pension from more than

one employer, the exemption

shall be available to the

higher of the

pensions received by

him.

Pension

Received by Ex-Government Employees and Members of

Armed Forces.

Any

pension received by employees of

federal govt./Provincial govts.

Members of Armed Forces

of

Pakistan

or granted under the rules to their

families is exempt from tax under

clause (9), part I of

second

Schedule

Clauses

(8),(9), (12), (16), (17) Part I of Second

Schedule.

Clause

(8)

Any

pension received by a citizen of Pakistan

from a former employer,

other than where the

person

continues

to work for the employer (or an

associate of the employer).

Provided

that where the person

receives more than one

such pension, the exemption

applies only to the

higher of the

pensions received.

Clause

(9)

Any

Pension:

(i)

Received in respect of services

rendered by a member of the Armed

Forces of Pakistan of

Federal

Government

or a Provincial Government;

(ii)

Granted under the relevant rules to the

families and dependents of

public servants or members of

the

Armed

Forces of Pakistan who die

during service.

Clause

(12)

Any

payment in the nature of commutation of

pension received from

Government or under any

pension

scheme

approved by the Central Board of Revenue for the

purpose of the clause.

Clause

(16)

Any

income derived by the families and

dependents of the "Shaheeds" belonging to

Pakistan Armed Forces

from

the special family pension, dependents**

pension or children's allowance.

Clause

(17)

Any

income derived by the families and

dependents of the "Shaheeds" belonging to the

Civil Armed Forces

of

Pakistan to whom the provisions of the

Joint Services Instruction

No. 5/66 would have applied

had they

belonged to the

Pakistan Armed Forces from

any like payment made to

them.

Exercise

on Pension

Mr. A

retired on 01-01-2007 and thereafter

joined a private Co.

Other

information/data for tax year

2007 is given here under:

1.

Salary

Rs.600,000

2.

Pension

Rs.300,000

Compute

taxable income and tax thereon

for tax year 2007.

Solution:

In this

case taxable income for tax

year 2007 will be Rs.

600,000.

Pension

from ex-employer is exempt under

clause (17), Part I, Second

Schedule.

Taxable

income = 600,000

Tax

payable = 600,000 x 6%= Rs

36,000

52

Taxation

Management FIN 623

VU

Pension

Granted to Injured or

Disabled:

Pension

granted to a public servant or

personnel of Armed Forces on injuries or

body disability and

to

families

and dependents of `Shaheeds'

belonging to civil or Pakistan

Armed Forces; or public

servant or

member

of Armed Forces, who dies

during service is exempt as

provided in part I of Second

Schedule.

Any

payment in the nature of commutation of

pension [Clause (12), Part

I, 2nd Schedule] is Exempt

from

tax:

Any

payment in the nature of commutation of

pension received from the government or

under any pension

scheme

approved by the Central Board of Revenue under clause

(12), Part I, Second

Schedule is exempt

from

tax.

Exercise

on Commutation of Pension:

Mr. A,

a government servant, retired on 1-12-2006

and received Rs.900,000 as commutation of

pension.

Compute

taxable income for tax year

2007.

Solution:

Commutation

of Pension is exempt under clause

(12) Part I of Second

Schedule.

Exercise-

on lump sum payments

received:

Mr. A

received Rs. 1,500,000 on

opting for Golden Handshake

in the tax year 2007. He received

total

income

amounting Rs. 600,000 as

salary during said year.

Rate of tax for preceding

three tax year was

20%,

15%

and 10%. Compute taxable

income and tax thereon for tax

year 2007.

Solution:

Tax

payer can opt to seek

approval from CIT to charge

lump sum payments received

in a tax year at

average

tax rate of last three

years. In this case average tax

rate for last three

years comes to 15%. So it

is

advisable

to opt for charging this amount as

per procedure prescribed

above.

Computation

of Tax:

Salary

at normal rate = Rs 600,000 x 6%=

36,000

Lump

sum payments= 1,500,000 x 15% =

225,000

If

lump sum payments of Rs

1,500,000 had been included in

salary income, taxable

income would have

been

2,100,000 and that would

have been charged at the

rate of 25% as shown at serial number 14

for

taxable

income exceeding

1,300,000.

Tax

liability would

have been Rs 2,100,000 x 25%

that is Rs 525,000. Hence it is

advisable for tax payer

to

opt

for charging the tax at average

rate of last three

years.

53

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS