|

Type of Taxes, Taxation Management |

| << What is Fiscal Policy, Canons of Taxation |

| BASIC FEATURES OF INCOME TAX >> |

Taxation

Management FIN 623

VU

MODULE

1

LESSON

1.3

AN

OVERVIEW OF TAXATION

Type

of Taxes:

Different

types of taxes are explained

below:

Direct

taxes

Direct

taxes are the taxes where

incidence of taxation is on the person on

whom levied. For

example

income tax

Indirect

Taxes

Indirect

taxes are the taxes where

incidence of tax can be shifted by the

person on whom levied to

other

persons. For example sale

tax

Proportional

Taxes

These

taxes are levied with the

same percentage. For

example, sales tax is levied at the rate

of 15%.

Progressive

Taxes

This is

based on the "capacity to pay" principle

of taxation. In this type, the rate of tax

increase as

the

income increase.

Regressive

taxes

It is

based on the benefits received

principle

Value

Added Taxes.

This

type of tax is levied at each stage of

value addition. For example

sales tax

Taxation

Structure of Pakistan:

Federal

Taxes:

Federal

taxes are the taxes which

can be levied by the federal government

and include among others

the

followings:

Income

tax

Corporate

tax

Customs

duties/Tariffs

Sales

tax

Provincial

Taxes:

Stamps

Duty

Registration

Tax

Motor

vehicle tax

Taxation

Management--Explained

Taxation

management is a strategy where by a

person manages its business

and other transactions/

activities

in such a way so as to make

maximum use of tax holidays, exemption,

concession, rebates, tax

credits,

deductible allowances available under law

and as a result is able to derive the

benefit of

minimizing

his tax liability. To achieve this

objective, clear understanding of respective

laws and

professional

expertise of their application is of at

most importance. Scope of taxation

management is

multi-dimension,

while making choices among

different opportunities available to a

person, the tax

factor

among others also plays an

important role. Taxation management

covers a decision

regarding

available

choice between an employment and

self- employment or available choice of a

business as sole

proprietorship,

partnership, private company or public

company. It is professional strategy to

plan tax

affairs

of a person. It is of significant importance in

business management

decision.

Person

includes a living person (natural) or

artificial person (corporate

person).

Scope

of Taxation Management ranges

from incorporation of a business to

mergers, amalgamation,

winding

up, liquidation, dissolution etc of

business

Essentials

of Taxation Management

Understanding

and application of updated laws

particularly tax laws, rules and

procedures

Application/use

of benefits such as Tax credits,

rebates, exemptions, reductions

etc available under

the

law.

Maintenance of

Records/Books of Accounts as per requirement of

law

Disclosure

of true facts (no concealment)

that is i-e; there should be no

concealment with regard

to

furnishing

of information or preparation of accounts /

data.

3

Taxation

Management FIN 623

VU

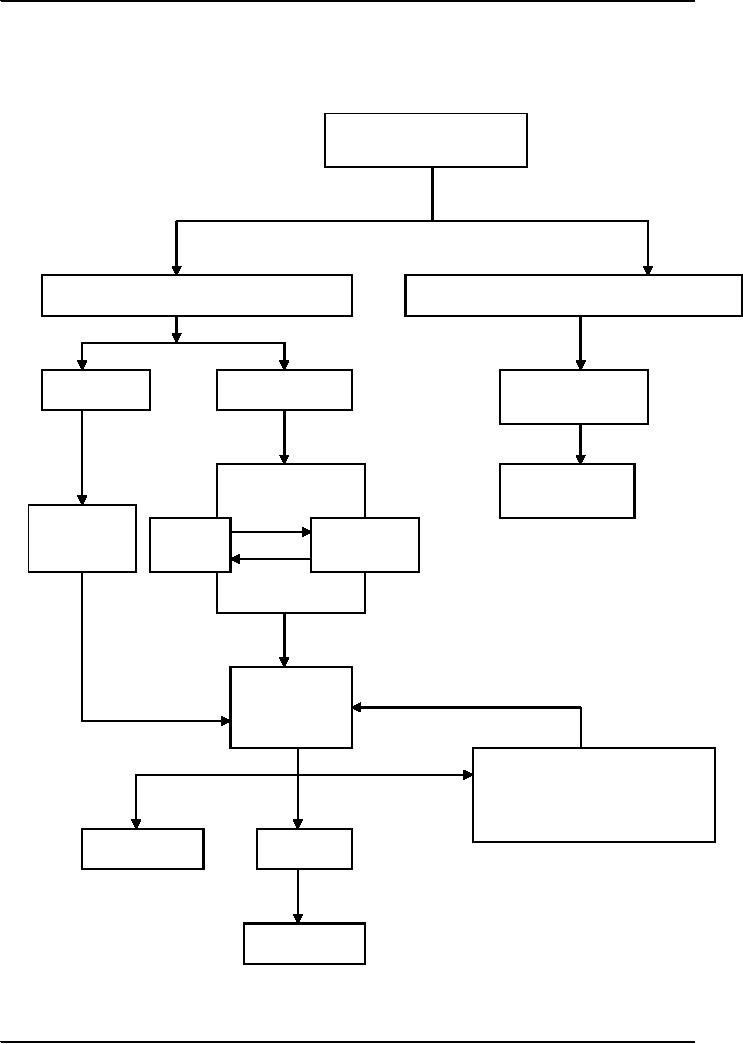

Process

of Legislation

When

National Assembly is in

Session

When

National Assembly is not in

Session

Money

Bill

All Other

Bills

President

Ordinance

National

National

Senate

Assembly

Assembly

President

Sent for

reconsideration to

Parliament

(Joint

sitting of

National

Assembly and

Senate)

Reject

Assent

Act/Law

4

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS