|

Tax treatment of Gratuity |

| << SALARY AND ITS COMPUTATION EXERCISES 3 |

| Gratuity Exercise >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.29

SALARY

AND ITS COMPUTATION

GRATUITY

Purpose:

� Provision

of Gratuity to employees or

� Undertaking

of provision (payment) of gratuity on

retirement or

� On

employees becoming incapacitated

or

� On

termination of their employment after

completion of minimum period of

service specified in

the

regulations of fund or to the widows,

children or dependants of such employees

on their death

� All

benefits granted by the fund shall be

payable only in

Pakistan

Approved

Gratuity Fund

� Commissioner

of Income Tax may accord

approval to any gratuity

fund.

Condition

for Approval

� Fund

established under an irrevocable trust and

purposes of gratuity

fulfilled.

Tax

treatment of Gratuity is as

under:

� Gratuity

pertaining to government employees/ their

families:

�

Any

gratuity received on retirement/

death by employee of the government, a

local authority or a

statutory

body or corporation or family is

wholly exempt from tax under

clause 13(i), part I of

second

schedule.

Clause

13, Part I of Second

Schedule

(i)

In the

case of an employee of the Government, a

local authority, a statutory body or

corporation

established

by any law for the time being in force,

the amount receivable in accordance with

the

rules

and conditions of the employee's

services;

(ii)

Any

amount receivable from any

gratuity fund approved by the

Commissioner in accordance

with

the

rules in Part III of the Sixth

Schedule;

(iii)

In the

case of any other employee,

the amount not exceeding two

hundred thousand

rupees

receivable

under any scheme applicable to

all employees of the employer and

approved by the

Central Board of

revenue for the purposes of this

sub-clause; and

(iv)

In the

case of any employee to whom

*sub-clause (i), (ii) and

(iii) do not apply, fifty

per cent of the

amount

receivable or seventy-five thousand

rupees, whichever is the less:

Provided

that nothing in this sub-clause

shall apply:

(a) To

any payment which is not

received in Pakistan.

(b) To

any payment received from a

company by a director of such

company who is not a

regular

employee

of such company.

(c) To

any payment received by an

employee who is not a

resident individual; and to

any gratuity

received

by any employee who has

already received any

gratuity from the same or

any other

employer.

Exercise-1

on Gratuity:

Compute

taxable income and tax thereon

for tax year 2007 in respect

of Mr. A, an employee of

Government

of the Punjab.

Relevant

information/data is given below.

Salary

Rs.

800,000

Gratuity

Rs.

1,000,000

Tax

deducted at source

Rs.

54,000

Solution

to Exercise 1:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

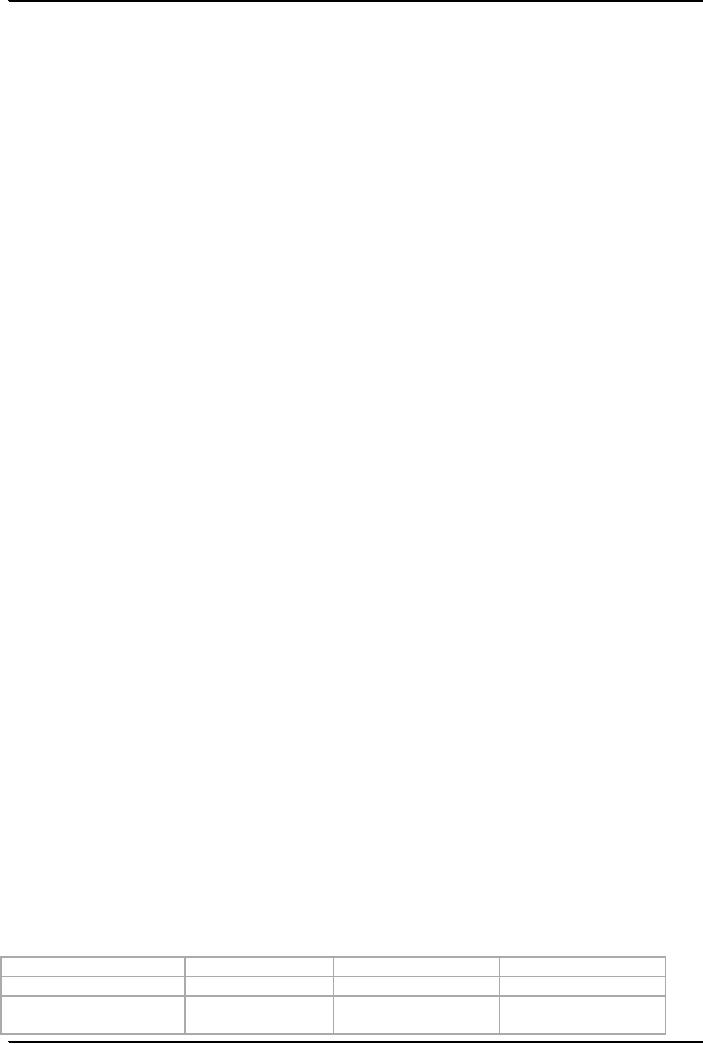

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

800,000

Nil

800,000

Gratuity

1,000,000

1,000,000

Nil

Refer

(Note-1)

49

Taxation

Management FIN 623

VU

Taxable

Income

800,000

Tax

liability:

Tax

rate of 7.50 is at serial no 10

for taxable income exceeding

Rs 700,000 up to Rs 850,000 shall

be

applied.

800,000

x 7.5% = Rs.60,000

Tax

payable =

Rs

60,000

Tax

deducted at source =

Rs

54,000

Tax

payable with return

Rs

6,000

N-1:

Amount

received as gratuity is exempt in this

case under clause 13(i),

Part I, Second Schedule of

the

Ordinance.

50

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS