|

SALARY AND ITS COMPUTATION EXERCISES 2 |

| << SALARY AND ITS COMPUTATION EXERCISES 1 |

| SALARY AND ITS COMPUTATION EXERCISES 3 >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.27

SALARY

AND ITS COMPUTATION

Exercise

6:

Computation

of taxable income and tax thereon in

respect of Mr. Umar (a

salaried individual) for the

tax

year

2007 from the following

information/ data:

Basic

Salary

Rs

20,000 pm

Conveyance

Allowance

Rs

1,000 pm

Medical

Allowance

Rs

28,000 pa

Dearness

Allowance

Rs

1,000 pm

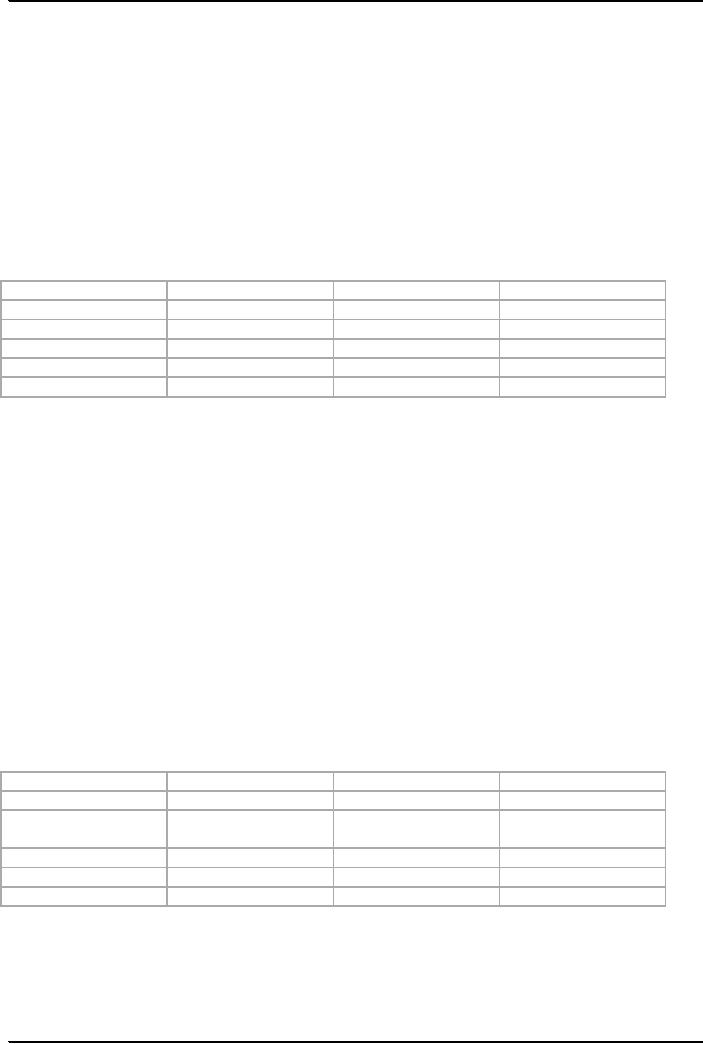

Solution

to Exercise 6:

Tax

payer: Mr. Umar

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

Salary

240,000

Nil

240,000

Conveyance

Allowance

12,000

Nil

12,000

Medical

Allowance

28,000

24,000

4,000

Dearness

Allowance

12,000

Nil

12,000

Total

268,000

Tax

liability:

Tax

rate of 0.75% percent as given at

serial #4 for taxable income

exceeding Rs.250,000 up to

Rs.350,000

Income

tax payable:

268,000

x 0.75%= Rs.2,010

Note:

Medical

allowance exempt up to 10% of Basic

salary, if free hospitalization services

or reimbursement of

medical

expenses not provided by

employer

Exercise

7:

Computation

of taxable income and tax thereon in

respect of Mr. Umar (a

salaried individual) for the

tax

year

2007 from the following

information/data:

Minimum

Time Scale

Rs.

20,000-2000-30,000

Basic

Salary@

Rs.

24,000 pm

Accommodation

provided by the employer. The employee is

entitled for house rent

allowance@50% of

MTS

Computer

Allowance

Rs.

1000 pm

Qualification

pay

Rs.

1000 pm

Solution

to Exercise 7:

Tax

payer: Mr. Umar

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

Salary

288,000

Nil

288,000

Accommodation

---

---

144,000

Refer

(note-1)

Computer

Allowance

12,000

Nil

12,000

Qualification

Pay

12,000

Nil

12,000

Total

456,000

Tax

liability:

Tax

rate of 3.50 percent as given at

serial #7 for taxable income

exceeding Rs.400,000 up to Rs

500,000

Income

tax payable:

456000

x 3.5%=Rs.15,960

Note

1:

Accommodation:

Amount that would have

been otherwise provided under

terms of employment but in no

case

less than 45% of MTS or

basic salary.

44

Taxation

Management FIN 623

VU

Exercise

8:

Computation

of taxable income and tax thereon in

respect of Mr. Yasir (a salaried

individual) for the tax

year

2007 from the following

information/data:

MTS

Rs20,000-2000-30000

Basic

Salary @

30,000pm

Accommodation

provided to Mr. Yasir by employer. He is

entitled for house rent

allowance @60% of

Basic

Salary

Motor

vehicle provided by the employer exclusively

for personal use. Cost of

vehicle is Rs.1

million.

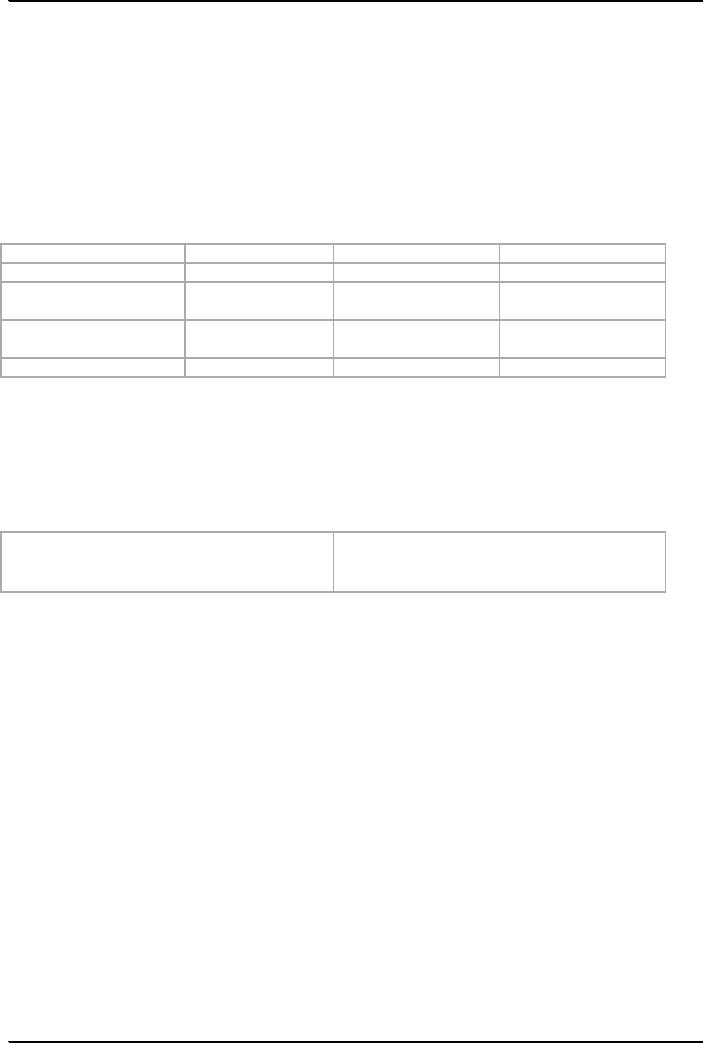

Solution

to Exercise 8:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

360,000

Nil

360,000

Accommodation

216,000

Nil

216,000

Refer

(note-1)

Motor

Vehicle for

---

---

100,000

personal

use, Refer (n-2)

Total

676,000

Tax

liability:

Tax

rate of 6% percent as given at serial #9

for taxable income exceeding

Rs 600,000 up to Rs 700,000

Income

tax payable:

676,000

x 6%= Rs.40,560

Note

1:

Accommodation -- Amount that

would have been otherwise

provided under terms of employment

but in

no case less than 45% of MTS

or basic salary.

Note

2:

Valuation

of Conveyance:

For

personal use only

10%

of

cost or 10%

of

FMV of Vehicle, in case

of

lease

45

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS