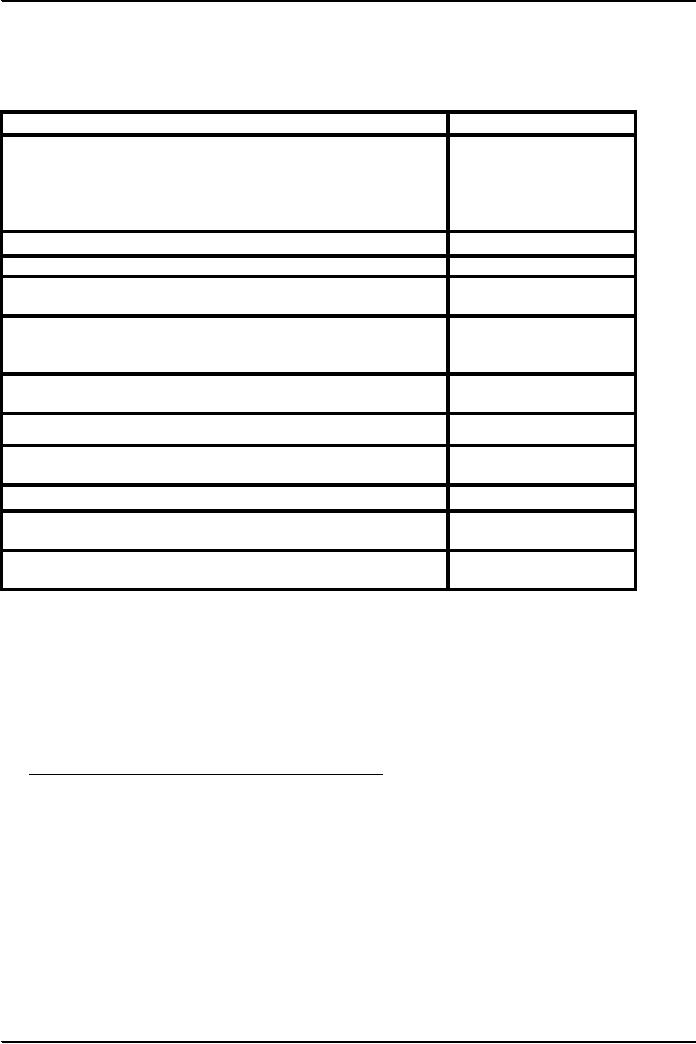

|

Significant points regarding Salary |

| << Definition of Salary |

| Tax credits on Charitable Donations >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.23

SALARY

AND ITS COMPUTATION

Significant

points regarding

Salary:

Reimbursement

of expenditure by the employer

Taxable

Taxable

Profits

in lieu of salary received

as:

� Consideration

for a person's agreement to

enter into an

employment

relationship

� On

termination of employment/ Golden

handshake

payments

Provident

fund payments, only Employers

contribution

Taxable

Computation

of value of perquisites (Sec

13)

Motor

vehicle

As

prescribed in IT rules

2002

Services

of house keeper, driver,

gardener, other domestic

servant

Amount

provided by

employer

added back to

employee's

salary.

Add

FMV of utilities as reduced by any amount

paid by

employee

Loan

below benchmark rate for tax

year 2007 is 9% PA

Add

back

In

case, Conessional loan as

above used for construction of

house or No

Add back

purchase

of house

Obligation

of employee waived off by

employer.

Add

back

Any

property transferred to

employee.

FMV of

property to be

added

back

Accommodation

or housing provided.

As

prescribed in IT rules

2002

According

to sub section14 of Section

13:

� Bench

mark rate means rate of

5%PA

For

tax year 2003 and increase

by 1% for succeeding tax

years.

� Services

include any facility

provided.

� Utilities

include electricity, gas, water, and

telephone.

Employee

share schemes (sec

14)

Treatment of

value of a right or option

vested in an employee.

Formula:

AB

When

Commissioner can tax "salary" on due

basis:-

In

certain cases, the Commissioner

has been given powers to tax

salary on due basis. Section

110 reads as

under:

"Salary

paid by Private

Companies":

where,

in any tax year, salary is paid by a

private company to an employee of the

company for services

rendered

by the employee in an earlier tax year

and the salary has not

been included in the employee's

salary

chargeable

to tax in that earlier year, the

Commissioner may, if there

are reasonable grounds to

believe that

payment

of the salary was deferred, include the

amount in the employee's income under the

head "Salary"

in the

earlier year.

Leave

Salary:

This

is taxable whenever received or

right to receive is exercised by the

employee. Leave encashment

on

retirement falls in

this category. The only

exemption available is for the

members of the Armed Forces

of

Pakistan,

employees of the Federal Government

and Provincial Governments.

35

Taxation

Management FIN 623

VU

Under

clause (19), Part I of Second

Schedule

to the Ordinance any sum representing

encashment of leave preparatory to retirement in

their case

is

exempt.

▪ Salary

in lieu of notice:

Taxable

▪ Fee

and Commission:

Taxable

▪ Bonus:

Taxable

▪ Remuneration

for extra duties:

Taxable

▪ Voluntary

payments to employees:

Taxable

Flying

Allowance

Any

amount received as flying allowance

by:

a)

pilots, flight engineers and

navigators of Pakistan Armed

forces, Pakistani Airline or

Civil Aviation

Authority;

and

b)

Junior commissioned officers of Pakistan

Armed Forces.

Shall

be taxed @ 2.5% as a separate

block of income

Deductible

Allowance:

The

person shall be entitled to a deductible

allowance for any Zakat

paid by the

person in a tax year

according

to provisions of sec.60, for the amount of

any Workers'

Welfare Fund paid by the

person in a

tax

year under Sec 60-A, for the amount of

any Workers'

Participation Fund paid by the

person in a tax

year

under section 60-B.

36

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS