|

Exercises on Determination of Income 2 |

| << Exercises on Determination of Income 1 |

| SALARY AND ITS COMPUTATION >> |

Taxation

Management FIN 623

VU

MODULE

5

LESSON

5.20

EXERCISES

ON RESIDENTIAL STATUS &

TAXATION

Exercise

3: Determine

Gross total income of Mr. A

in the light of following particulars

information

pertaining

to tax year 2006.

Interest

on Australian Bonds (one-third is

received in Pakistan)

24,000

Income

from agriculture in Australia, received

there but later on remitted to

Pakistan

50,000

Income

from property in London

received outside

Pakistan

20,000

Income

earned from business in

London which is controlled

through a PE in Pakistan

30,000

(Rs.10,000

is received in Pakistan)

Profit

on sale of an asset in Pakistan

but received in

Sydney

5,000

Pension

from Pakistan Government but

received in Sydney

20,000

Find

out gross total income of A,

if he is: (i) resident in

Pakistan and (ii)

nonresident

Solution

to Exercise 3:

Computation

of Gross total income of Mr. A

for tax year

2006

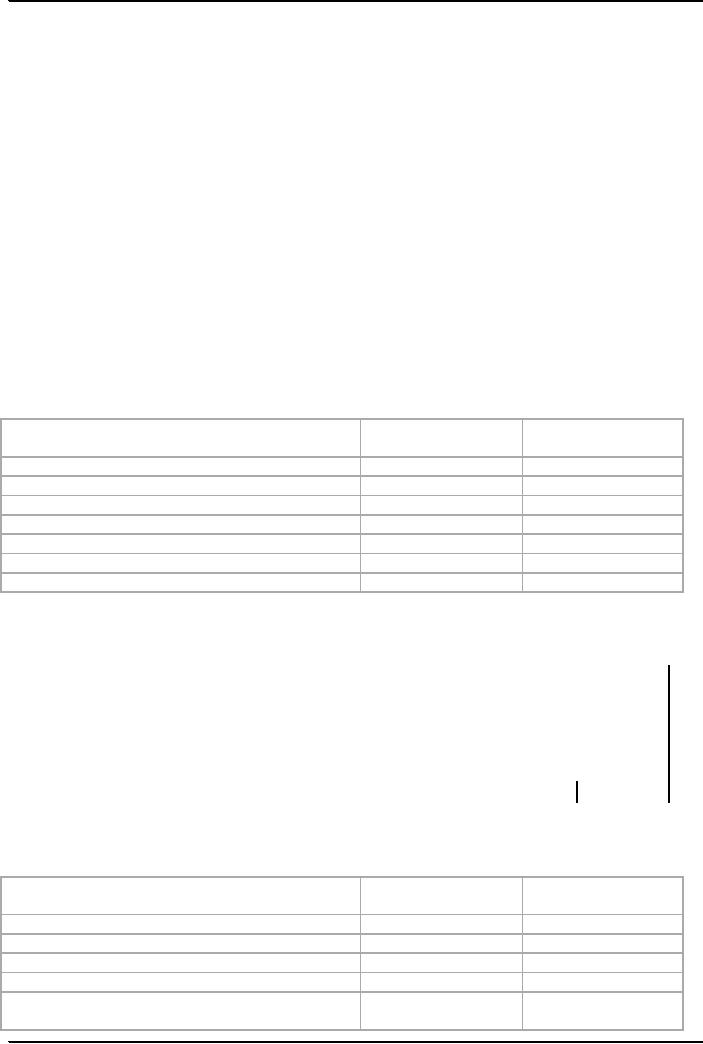

Particulars

Gross

total income if

Gross

total income

resident

if

non-resident

a.

Interest on bonds...

24,000

Nil

b.

Agriculture Income in Australia

50,000

Nil

c.

income from

property...

20,000

Nil

d.

income from business...

30,000

30,000

e.

Profit on sale of asset...

5000

5000

f.

Pension from Government of

Pakistan in Sydney..

20,000

20,000

Total

149,000

55,000

Exercise

4: Determine

Gross total income of Mr. A

in the light of following particulars

information

pertaining

to tax year 2006.

a.

Profit

on sale of plot at Sydney

(One-half received in

Pakistan)

250,000

b.

Profit

on sale of plot at Tokyo

(One-half received in

London)

150,000

c.

Salary

from a Pakistani company

received in London. (One-half is paid

for

350,000

rendering

service in Pakistan)

d.

Interest

on Australian Bonds (entire amount

received in London)

100,000

e.

Income

from property in Tokyo

received there.

400,000

f.

Agricultural

income in USA received in

London but later on remitted to

Pakistan.

100,000

Solution

to Exercise 4:

Computation

of Gross Total Income of Mr.

A for tax year

2006

Particulars

Gross

total income if

Gross

total income

resident

if

non-resident

a.

Sale of plot....

250,000

Nil

b.

Sale of plot....

150,000

Nil

c.

Salary from Pakistani

company...

350,000

175,000

d.

Interest on Australian

bond

140,000

Nil

e.

Income from property in

Tokyo

320,000

Nil

Rs

400,000 80,000

30

Taxation

Management FIN 623

VU

(1/5th Subtracted as allowance for

repairs

For

tax year 2006)

f.

Agricultural income in

USA....

100,000

Nil

Total

1,310,000

175,000

31

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS