|

BEYOND FUNDAMENTAL ANALYSIS |

| << FUNDAMENTAL STOCK ANALYSIS |

| What is Technical Analysis >> |

Investment

Analysis & Portfolio Management

(FIN630)

VU

Lesson

# 7

BEYOND

FUNDAMENTAL ANALYSIS

Few

facets of the investment discipline

generate as much controversy as

technical analysis.

Some

professional investors are

convinced the activity is a

complete waste of time and a

disservice

to brokerage clients. An equal number

are certain that technical

analysis is

mandatory

for every one who seeks

above average investment results.

Some fundamental

analysts

will say they use technical

analysis to confirm their

opinions but not as a

stand-

alone

technique.

CHARTING:

In

the mind of some people, elaborate

wall charts are the classic

symbol of the stock

picker's

art. The experience eye can

divine ups and down in the

same way a soothsayer

can

read

tea leaves are astrological signs or so

the folklore goes. Charting

is a controversial part

of

finance. Future research is

likely to uncover things

about charting that would

surprise us

today.

Still, even people who

vehemently oppose the

practice should be familiar

with the

basic

tents.

Much

about technical analysis

remains a puzzle.

The

Underlying logic:

Charts

are an important tool of the

technical analyst. He or she

believes the supply

and

demand

determine prices that changes in

supply or demand will change prices and

that

charts

can be used to predict changes in

supply and demand and in investor

behavior. This

logic

seems reasonable to many people,

but it is also why charting is a trouble

topic to the

fundamental

analyst.

The

weak link in this reasoning

lies in the last point:

charts can be used to predict

changes

in

supply and demand. The stock

market seldom waits for

things to completely

unfold.

Market

participants are continually

anticipating future events

are frequently err in

their

anticipation.

Imagine

an investment whose value is

determined by a prior series of

ten coins flips. A

person can

buy the investment at any

time, with the purchase

price a function of

the

previous

ten coin flips. Suppose a

large payoff is associated

with a series of five

consecutive

heads

followed five consecutive

tails. How will the

marketplace value the

investment if the

previous

eight flips were five

head followed by three

tails? Clearly, investors will

bid up the

price

because of the increased

likelihood of the windfall

gain. By so doing, they reduce

the

potential

profit, because a rising

price means a lower expected

return, everything else

being

equal.

An

interesting side note to

this example occurs if the

investment reaches a maximum

value

following

a series of five heads and

five tails. Once an

investment reaches its

maximum

possible

value, why would anyone buy

it? Logically it can only

decline from its peak

value.

Thus,

a interesting interplay takes place

between would-be sellers and

potential buyers as

the

pattern develops.

The

technical analyst believes

charts can be used to predict

changes in supply and

demand.

55

Investment

Analysis & Portfolio Management

(FIN630)

VU

Market

participants try to anticipate events

rather than merely react to

them.

Types

of Charts:

Three

principal types of charts

are used by the technical

analyst: line charts. Bar

charts and

point

and figure charts. A forth

type, the candlestick chart,

has recently gained favor

and

may

eventually become

common.

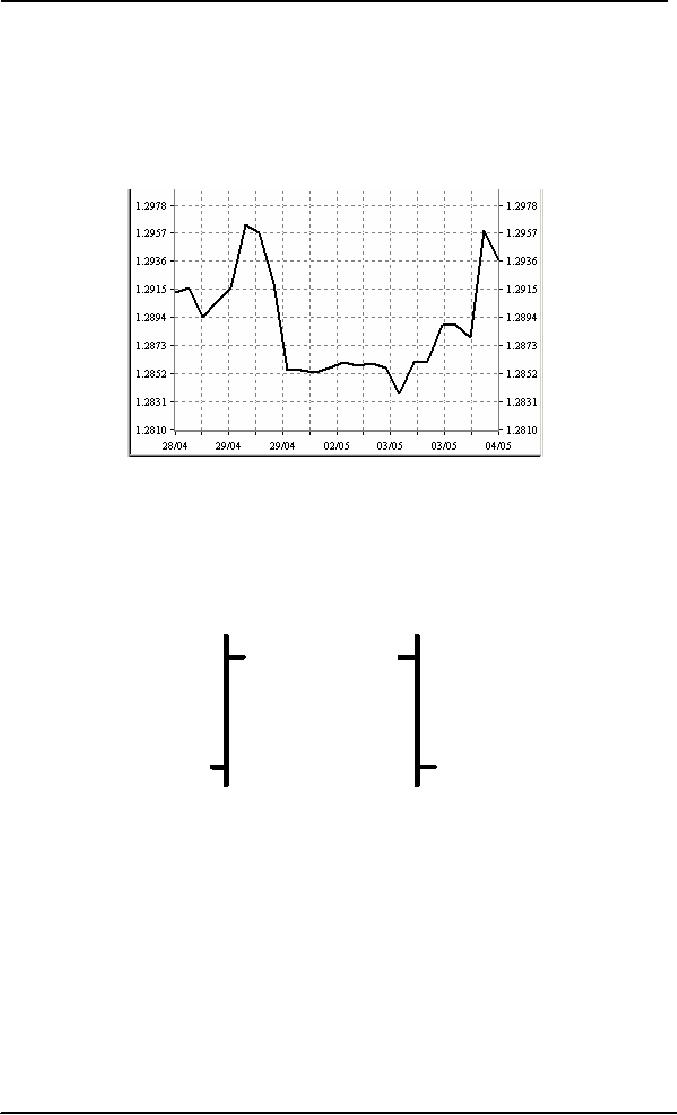

Line

Chart:

The

line chart is the simplest

and most familiar. It consists of a line

connecting a series of

data

points. It may be drawn on

either a linear or a logarithmic scale.

Logarithmic scales

are

appropriately

when the data move

through wide ranges. This

keeps the plot from

going off

the

chart.

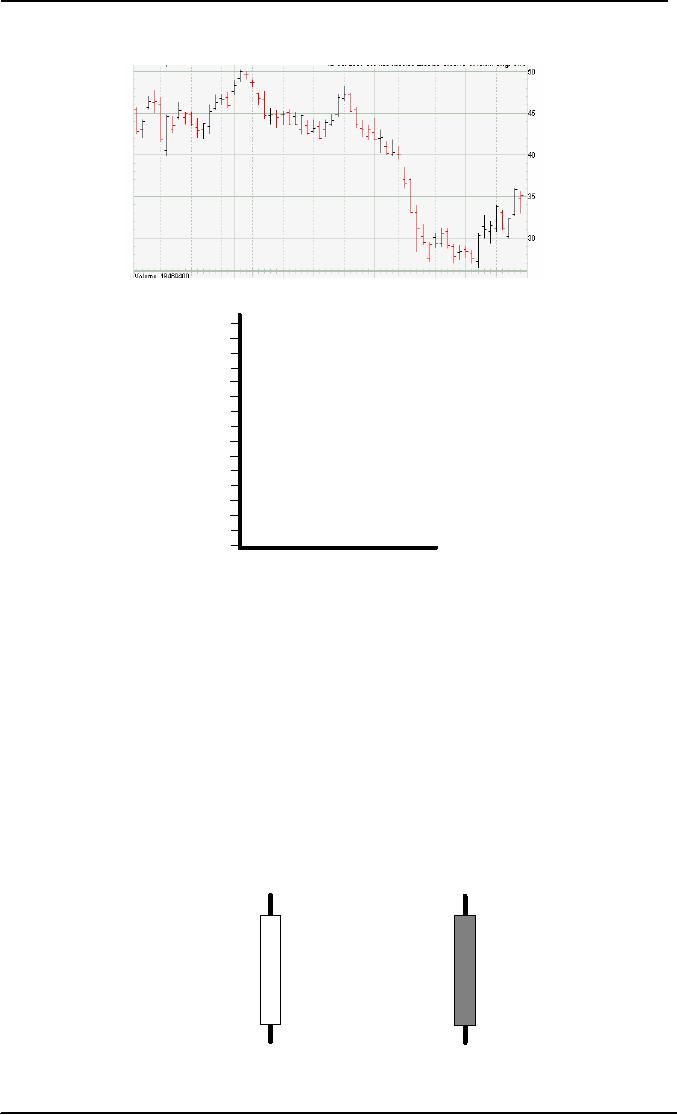

Bar

Charts:

High

High

Close

Open

Open

Close

Low

Low

Standard

Standard

Bar

Chart

Bar

Chart

The

technical analyst's bar chart is

different from the bar chart

commonly used to present

economic

data. This chart shows

the periodic high, low and

closing prices of a security. A

vertical

line connects the period's

high and low prices, with a

cross mark indicating

the

price

at the close of the period.

Bar charts are efficient in

showing more detail about

daily

trading

than just the closing prices

from a line chart.

56

Investment

Analysis & Portfolio Management

(FIN630)

VU

Point and

Figure Charts

X

X

X XO

X XO

XO O

XO O

This

exotic chart impresses many

a brokerage firm customer. The

scattered X's and O's

make

the document look like a

football coach's play

diagram. The layperson

typically does

not

understand what they present

but the chart attracts

attention.

Unlike

most other charts, only

significant price movement

appears. The X represents

the

prices

increase and the O represents

the price decline. Notice

that Xs and Os never occur

in

the

same column. Once a price

reversal of significant magnitude

occurs, the analyst moves

a

column

to the right for the

next entry.

An

old feature of this chart is

the fact that the

horizontal axis has no

units. Moving left to

right

reflects the passage of time

but data points are

not plotted at regular

interval. Only

when

the price change is sufficient

does a new data

appear.

Some

technical analyst will superimpose time

information the

chart.

The

horizontal axis on a point and figure

chart has no units.

Candlestick

Chart

Japanese

Japanese

Candlestick

Candlestick

57

Investment

Analysis & Portfolio Management

(FIN630)

VU

A

Candlestick Chart is an enhanced version

of bar chart. These charts

began to appear in

the

United

States in the mid 1980's

but have been used in

China for over 500 years.

Such a

chart

shows a stock's open, close,

high and low in a modified

three dimensional format.

The

vertical

axis shows the stock

price while a horizontal

axis reflects the passage of

time. The

principle

difference between a daily

candlestick chart and a bar chart is

the white and black

candles

augmenting the daily trading

range lines. White candles represent

stock advances,

with

black candle representing

declines. The thick portion

of an entry is called the

real

body,

with the vertical line

representing the wick.

Various clusters of candles have

exotic

names,

such as dark cloud cover,

doji star, hanging man,

harami cross, and two-day

tweezer

tops.

Other

Charts Annotations:

Support

Resistance

A support

level is a

subjective assessment of the

price level below which

the stock seems

disinclined

to fall. A

resistance level is an apparent

upper bound on stock prices or a

level

presenting

a barrier to further price

appreciation. Both concepts are

purely subjective and

cannot

be calculated. A

congestion area is a

region of the chart of the

chart where a great

many

data points appear. When

the stock price leaves the

congestion area and pierces

either

a

support level or a resistance

level, it is called breakout. A rise

through a resistance

level

is a

breakout on the upside; a

fall through a support level

is a breakout on the

downside.

When

someone says "the stock

broke" they often refer to a

decline through a support

level.

Breakout

on the upside are bullish;

breakout on the downside a bearish.

Once a breakout

occurs,

the technical analyst will

search for new resistance

and support level. The

institution

behind

these levels is easy to

develop.

Chartists

believe investors remember

missed opportunities and look

for them to

return.

58

Table of Contents:

- INTRODUCTION OF INVESTMENT

- THE ROLE OF THE CAPITAL MARKETS

- THE NASDAQ STOCK MARKET

- Blue Chip Stocks, Income Stock, Cyclical Stocks, Defensive Stocks

- MARKET MECHANICS

- FUNDAMENTAL STOCK ANALYSIS

- BEYOND FUNDAMENTAL ANALYSIS

- What is Technical Analysis

- Indicators with Economic Justification

- Dow Theory

- VALUATION PHILOSOPHIES

- Ratio Analysis

- INVESTMENT RATIOS

- Bottom-Up, Top-Down Approach to Fundamental Analysis

- The Industry Life Cycle

- COMPANY ANALYSIS

- Analyzing a Company’s Profitability

- Objective of Financial Statements

- RESEARCH PHILOSPHY

- What Is An Investment Company

- Exchange-Traded Funds (ETFs)

- COMMON STOCK: ANALYSIS AND STRATEGY

- THE EFFICIENT MARKET HYPOTHESIS (EMH)

- Behavioral Finance

- MARKET INDEXES

- POPULAR INDEXES

- BOND PRINCIPLES

- BOND PRICING AND RETURNS

- Accrued Interest

- BOND RISKS

- UNDERSTANDING RISK AND RETURN

- TYPES & SOURCES OF RISK

- Measuring Risk

- ANALYZING PORTFOLIO RISK

- Building a Portfolio Using Markowitz Principles

- Capital Market Theory: Assumptions, The Separation Theorem

- Risk-Free Asset, Estimating the SML

- Formulate an Appropriate Investment Policy

- EVALUATION OF INVESTMENT PERFORMANCE

- THE ROLE OF DERIVATIVE ASSETS

- THE FUTURES MARKET

- Using Futures Contracts: Hedgers

- Financial Futures: Short Hedges, Long Hedges

- Risk Management, Risk Transfer, Financial Leverage

- OVERVIEW