|

Exchange-Traded Funds (ETFs) |

| << What Is An Investment Company |

| COMMON STOCK: ANALYSIS AND STRATEGY >> |

Investment

Analysis & Portfolio Management

(FIN630)

VU

Lesson

# 21

INDIRECT

INVESTING Contd...

Exchange-Traded

Funds (ETFs):

A new

investing trend of increasing

importance is the exchange-traded

funds (ETFs). These

new

financial assets have some

characteristics of index mutual

funds, closed-end funds,

and

even

individual stocks.

An

ETF is a basket of stocks that

tracks a particular sector, investment

style, geographical

area,

or the market as a whole. As of

August 2002, there were

approximately 125 ETFs,

with

perhaps $100 billion in assets.

Although this, is tiny compared to

the assets in mutual

funds,

the growth rate in assets

for ETFs has been

impressive, as more and more

investors

discover

them.

Like

an index mutual fund, ETFs

to date are passive

portfolios (although actively

managed

ETFs

are under consideration)

that simply hold a basket of

stocks. Unlike a mutual

fund,

however,

and like a stock or a closed-end fund, an

ETF trades on an exchange

throughout

the

day, and can be bought on margin and

sold short. And like a

closed-end fund, ETFs

can

trade at

discounts and premiums, but to

date, the differences

between NAV and price

have

been

tiny, and this will almost

certainly continue to be the

case because of the

unique

mechanisms

that were developed to

create and liquidate ETF

shares.

Let's

consider some ETFs. Probably

the best-known ETF is the

"Spider" (Standard &

Poor's

Depositary

Receipts, SPDRs), which was introduced in 1993 to

reflect the S&P 500

Index.

SPDRs

are traded on the Amex, and

priced continuously during

the day Other ETFs

include

"Diamonds"

(the DJIA), "Cubes"

(Nasdaq-100 Index Tracking

Stock), and "Shares" (S&P

500 as

well as other S&P indexes

for small cap, mid-cap, and

growth and value

indexes,

various

Russell Indexes, various Dow

Jones Sector funds, and various

country funds), there

are

77 different Share ETFs.

Vanguard, the investment

company, created VIPERs to

track

the

entire stock market.

The

Required Rate of

Return:

The

required rate of return was the

discount rate for valuing

common stocks. The

required

rate of

return for a common stock,

or any security, is defined as

the minimum expected rate

of

return needed to induce an

investor to purchase it, is,

given its risk, a security

must offer

some

minimum expected return before par

investor can be persuaded to buy

it.

The

CAPM provides investors with

a method of actually calculating a

required (expected)

rate of

return for a stock, an

industry, or the market as a

Our interest, here is to think of

the

required

rate of return on an overall basis as it

after the strategies that

investors employ and

the

management of their portfolios.

|

What

do Investors require (expect)

when they invest? First of

all, investor's can earn a

riskless

rate of return by investing in riskless

assets such as Treasury

bills. This nominal

risk-free

rate of return is designated RF

throughout this text. It consists of a

real risk-free

rate of

interest and an expected inflation

premium. In summary, as an

approximation:

Risk-free

rate of .return =Real risk =

free value f Expected

Inflation

136

Investment

Analysis & Portfolio Management

(FIN630)

VU

In

addition to the risk-free rate of

return available from

riskless assets, rational

risk-averse

investors

purchasing a risky asset

expect to be compensated for

this additional risk.

Therefore,

risky assets must offer

risk premiums above and beyond

the riskless rate of

return

and the greater, the risk of

the asset, the greater the

promised risk premium must

be.

The

risk premium should reflect

all the uncertainty involved

in the asset. Thinking risk

in

terms

of its traditional sources, such

components as the business

risk and the financial

risk

of a

corporation would certainly

contribute to the risk

premium demanded by investor

for

purchasing

the common stock of the

corporation. After all, the

risk to the investor is

the

expected

income (return) will not be

realized because of unforeseen

events.

The

particular business that a

company is in will significantly affect

the risk to the

investor.

One

has only to look at the

textile and steel industries in the

last few years to

appreciate

business

risk which leads to an

understanding of why industry analysis is

important. And

the

financial decisions that a firm

makes (or fails to make)

also affect the riskiness of

the

stock.

Understanding

the Required Rate of

Return:

The

required rate of return any

investment opportunity can be expressed

as Equation. This

is,

in effect, CAPM

model.

Required

rate of return = Risk- free

rate + Risk

premium

It is

important to note that there

are many financial assets

and therefore many

different

required

rates of return. The average

required rate of return on bonds is

different from

average

required rate of return on preferred

stocks, and both are different

from the typical

required

rates of return for common

stocks, warrants, or puts and calls.

Furthermore

within

a particular asset category

such as common stocks, there

are many required

rates

of

return. Common stocks cover a

relatively wide range of risk

from conservative

utility

stocks to

small, risky high-technology

stocks.

137

Investment

Analysis & Portfolio Management

(FIN630)

VU

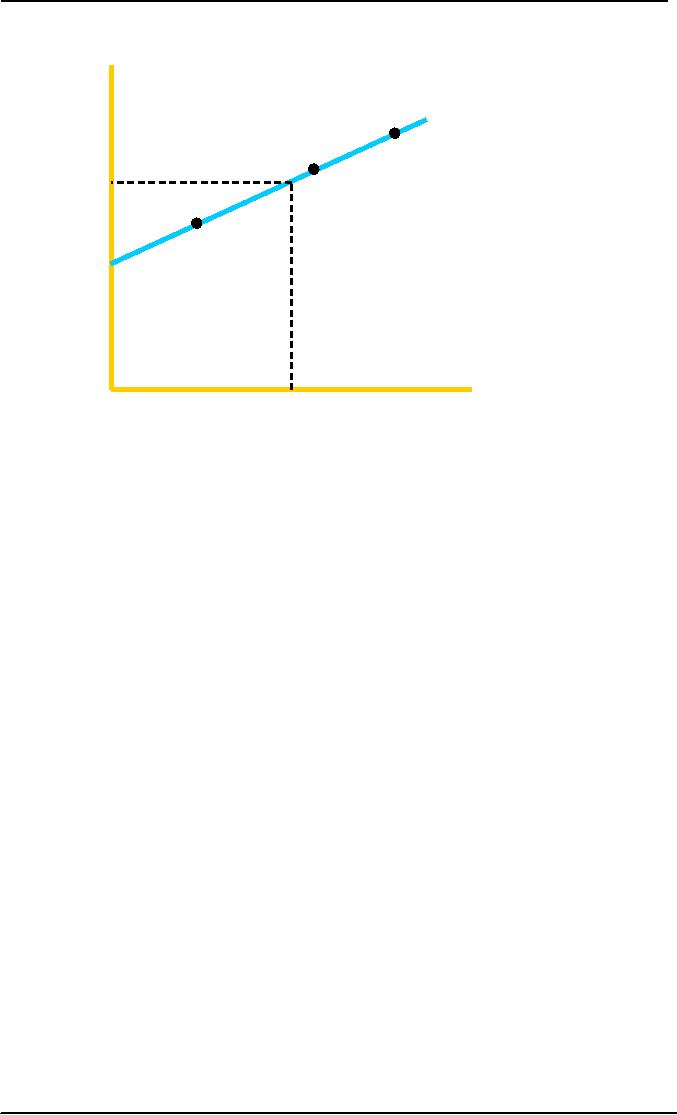

SML

E(R)

A

kM

B

C

kRF

0

0.5

1.0

1.5

2.0

BetaM

The

trade-off between the

required rate of return and risk is

linear arid upward sloping

that

is,

the required rate of return

increases as the risk,

measured by beta, increases;

the stock

market

taken as a whole has a beta

of 1.0, indicated by point M.

The required rate of

return

for,

all stocks is therefore kM. A stock with a beta

lower than 1.0 has a

required rate of

return

below kM, because its

risk (beta) is less than

that of the market. On the

other hand, a

stock

with a beta greater than 1.0

has a required rate of return greater

than that of the

market.

It is also

important to be aware that the

level of required rates of

return changes over

time.

For

example, required rates t of

return change as inflationary

expectations change, because

the

inflation premium is a component of

the risk-free rate of return,

which in turn is a

component

of the requited rate of return.

The level also changes as

the risk premiums

change.

Investor pessimism will increase the

risk premium and the

required rate investor

optimism

lowers both.

138

Table of Contents:

- INTRODUCTION OF INVESTMENT

- THE ROLE OF THE CAPITAL MARKETS

- THE NASDAQ STOCK MARKET

- Blue Chip Stocks, Income Stock, Cyclical Stocks, Defensive Stocks

- MARKET MECHANICS

- FUNDAMENTAL STOCK ANALYSIS

- BEYOND FUNDAMENTAL ANALYSIS

- What is Technical Analysis

- Indicators with Economic Justification

- Dow Theory

- VALUATION PHILOSOPHIES

- Ratio Analysis

- INVESTMENT RATIOS

- Bottom-Up, Top-Down Approach to Fundamental Analysis

- The Industry Life Cycle

- COMPANY ANALYSIS

- Analyzing a Company’s Profitability

- Objective of Financial Statements

- RESEARCH PHILOSPHY

- What Is An Investment Company

- Exchange-Traded Funds (ETFs)

- COMMON STOCK: ANALYSIS AND STRATEGY

- THE EFFICIENT MARKET HYPOTHESIS (EMH)

- Behavioral Finance

- MARKET INDEXES

- POPULAR INDEXES

- BOND PRINCIPLES

- BOND PRICING AND RETURNS

- Accrued Interest

- BOND RISKS

- UNDERSTANDING RISK AND RETURN

- TYPES & SOURCES OF RISK

- Measuring Risk

- ANALYZING PORTFOLIO RISK

- Building a Portfolio Using Markowitz Principles

- Capital Market Theory: Assumptions, The Separation Theorem

- Risk-Free Asset, Estimating the SML

- Formulate an Appropriate Investment Policy

- EVALUATION OF INVESTMENT PERFORMANCE

- THE ROLE OF DERIVATIVE ASSETS

- THE FUTURES MARKET

- Using Futures Contracts: Hedgers

- Financial Futures: Short Hedges, Long Hedges

- Risk Management, Risk Transfer, Financial Leverage

- OVERVIEW