|

BOOKS OF ACCOUNT & FINANCIAL STATEMENTS |

| << LIABILITIES OF AN AUDITOR |

| Contents of Balance Sheet >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

09

BOOKS

OF ACCOUNT & FINANCIAL

STATEMENTS

Books

of Account to be Kept by Company

[SECTION-230]

A

company should keep proper books of

account in respect

of:

a)

Cash

received and expended by the

company;

b)

Sales

and purchases of goods by the

company

c)

All

Assets and liabilities of the

company; and

d)

In

case of a company engaged in

production, processing, manufacturing, or

mining

activities,

a production record as may be required by the

Commission through a general

or

special

order;

Books of

account should be preserved for ten

years;

Books of

account are to be kept at the

registered office of the company. If

kept at any other place,

the

registrar

should be informed;

Books of

account should give a true and fair

view of the state of affairs of the

company and should contain

explanation of

transactions.

Directors

can inspect the books of account

during the business

hours.

If

company fails to comply with the above

provisions a director, including chief executive

and chief

accountant:

(a)

of

listed company is liable to imprisonment

for one year and a

fine of not less than

Rs.

20,000

not more than Rs.

50,000, and a further fine

of Rs. 5000 per day

during which the

default

continues; or

(b)

of

other companies is liable to imprisonment

for six months and with a

fine, which may

extend to

Rs. 10,000

Accounting

Cycle

� Transaction

� Document

� Voucher

� Books of

original entry/journal/day

book

� Books of

secondary entry/ledger

� Financial

statement

Transaction

Source

Document

Sale

Invoice

Issue

Purchase

Invoice

Receive

Sales

return

Credit

Note Issued

Purchases

return

Credit

Note Received

Cash

received

Receipt/Cash

Memo Issue

Cash

paid

Receipt/Cash

Memo Received

Lease/Hire

Purchase Agreement

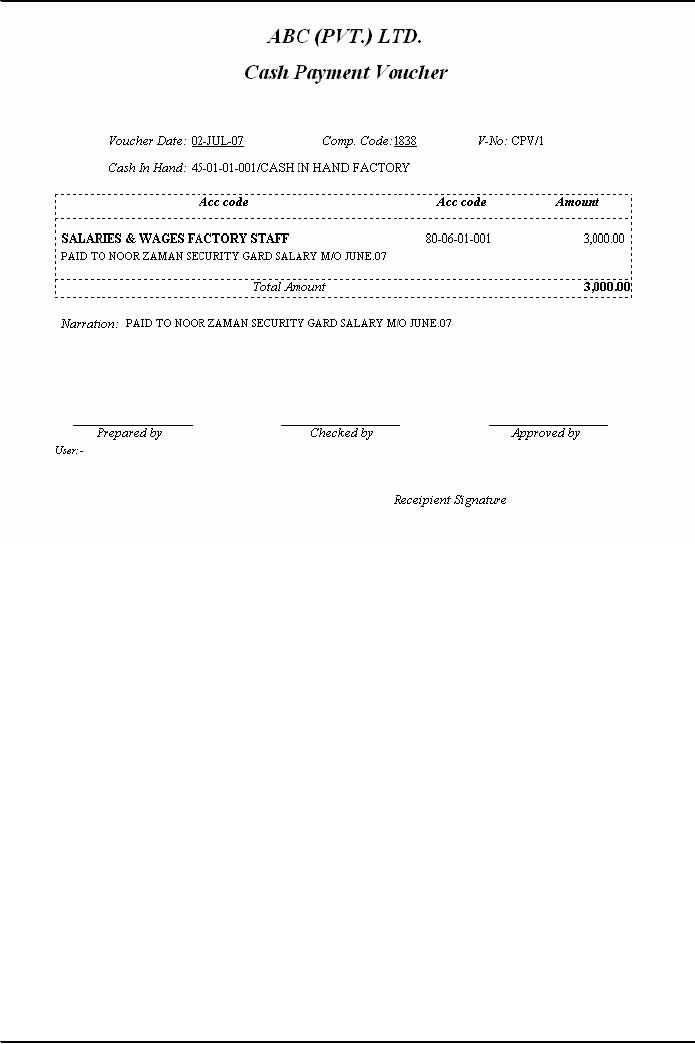

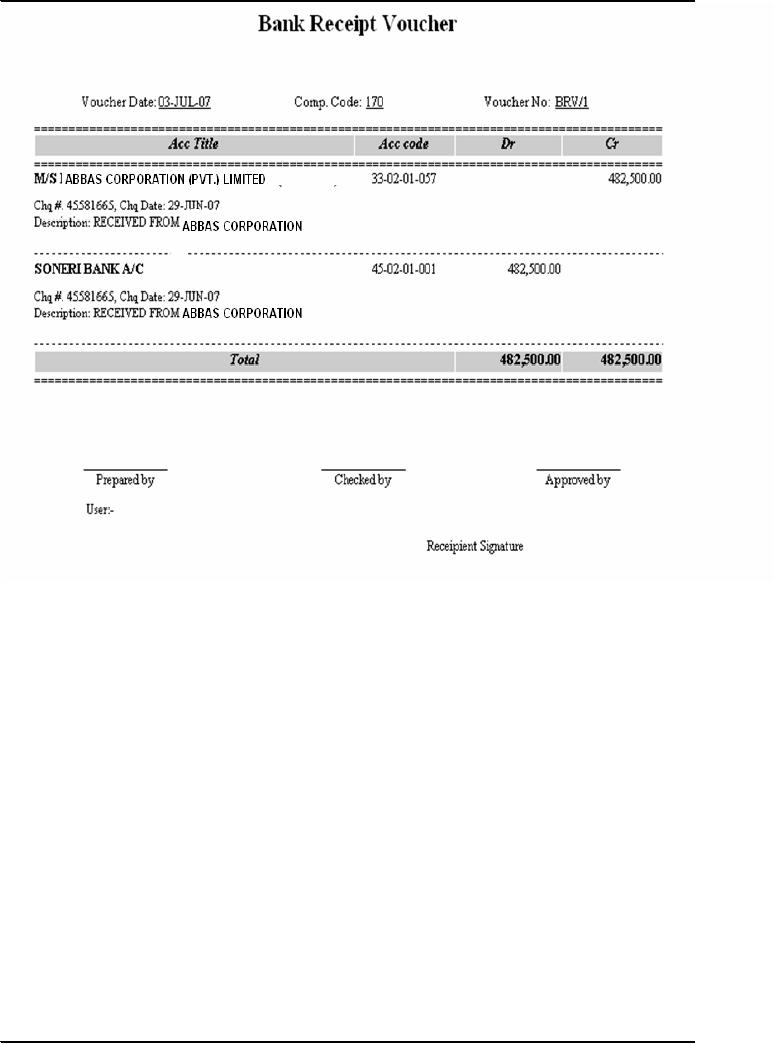

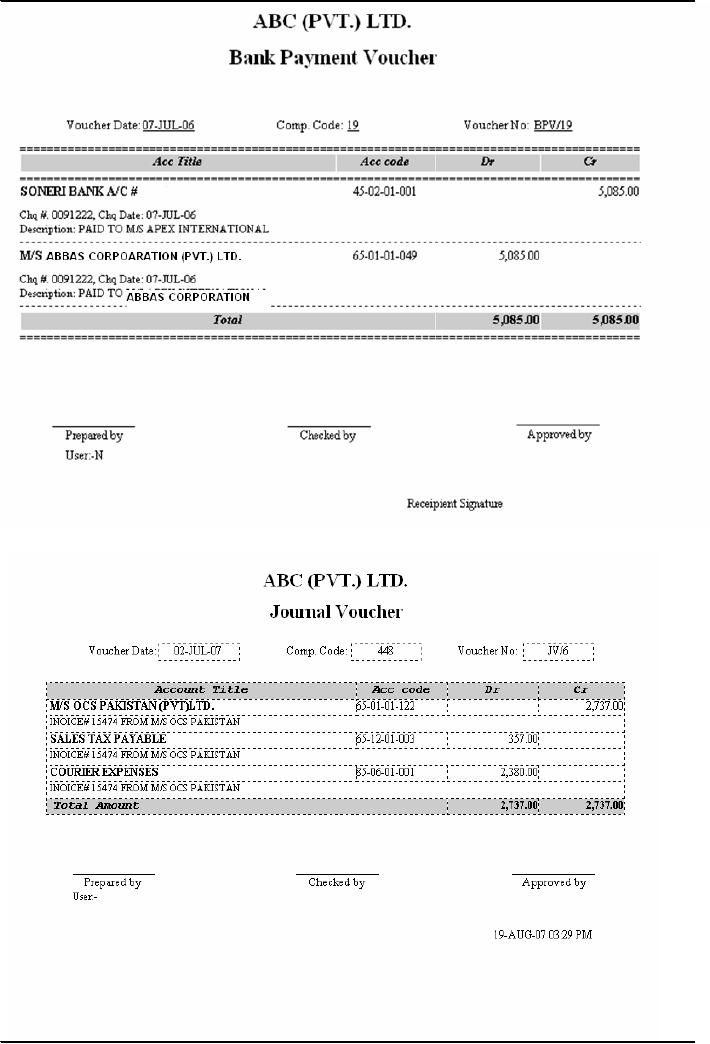

Voucher

� Receipt

voucher

� Payment

voucher

� Journal

voucher

� Petty

cash voucher

Books

of Original Entry

� Purchase

journal

� Sale

journal

� Purchase

return journal

� Sales

return journal

� Cash

book (two/three column)

� Petty

cash book

23

Fundamentals

of Auditing ACC 311

VU

� General

journal/ transfer

journal

Books

of Secondary Entry

� Main

ledger

� Subsidiary

ledger

Financial

Statement

� Balance

sheet

� Income

statement

� Statement

of changes in equity

� Cash

flow statement

� Notes

to the accounts

Recording

of Transactions from Source

Documents

To

enter into a transaction we

need approval

from

our responsible managers.

When, after having approval of

a

manager, transaction takes

place, such transaction should be

evidenced by a document.

Because, to record a

transaction

into the books of account, a bookkeeper

needs an evidence of proper approval of

transaction

and

authorization of documents, therefore, a

voucher

is

prepared on which all of the

descriptions of the

transaction

are written up and with

which all of the evidences of

approvals and authorized document

are

attached.

Such voucher is finally authorized by

accounts manager which is

then recorded in the books of

accounts

by a bookkeeper.

To

have a more clear understanding of the

above paragraph, lets have a

step by step example of

purchasing

an air

conditioning plant for

workshop.

1.

Production manager will send

a requisition

to

the general manager for air

conditioning the workshop

to

improve the working

environment.

2. The

general manager will approve

the requisition (if he

gets convinced that workshop is in

real need of

air

conditioning plant) and will

send this approval to the purchase

department.

3. The

purchase department will call a

tender

and

after having received several quotations

the

purchase

department

will place a purchase

order to the

vendor quoting lowest rate.

(All of the above

procedure

is

properly documented).

4. The

vendor company (supplier) will

send an invoice

(purchase

invoice) to the business along with

the

air

conditioning plant. Such air

conditioning plant will be

inspected

by the expert and

finally the invoice

will

be approved

for payment.

5. Now

all of the documents along with the

purchase invoice shall be

send to the bookkeeping

office

where

a voucher

will

be prepared and will also be

approved

by

the concerned manager for

recording

this

transaction in the books of

accounts.

Source

Documents:

Following

are the few examples of

source documents

which

are

required to support different types

of

transactions.

Sr.

No.

Transaction

Source

Documents

1

Sales

Sales

Invoice issued

2

Purchase

Purchase

Invoice received

3

Sales

Return

Credit

Note issued

4

Purchase

Return

Credit

Note received

5

Cash

received

Cash

Memo/receipt issued

6

Cash

paid

Cash

Memo/receipt received

7

Leases/Hire

purchase

Agreements

8

Staff

Salaries

Approved

Payrolls

9

Electricity,

Gas, Water, Tele.

Phone

Metered

Bills/Invoices.

Recording

in the Books

Approved

voucher are recorded in the books of

accounts, many businesses

now a days use computers

for

recording of

transactions. However, an understanding of

book of accounts is necessary

whether

transactions

are recorded manually or

electronically.

Basically,

there are two types of books

of accounts which are used

to record the business

transactions

24

Fundamentals

of Auditing ACC 311

VU

1. Books of

original entries.

2. Books of

secondary entries.

These

are further subdivided according to the

needs of the business and/or

complexity of the transaction.

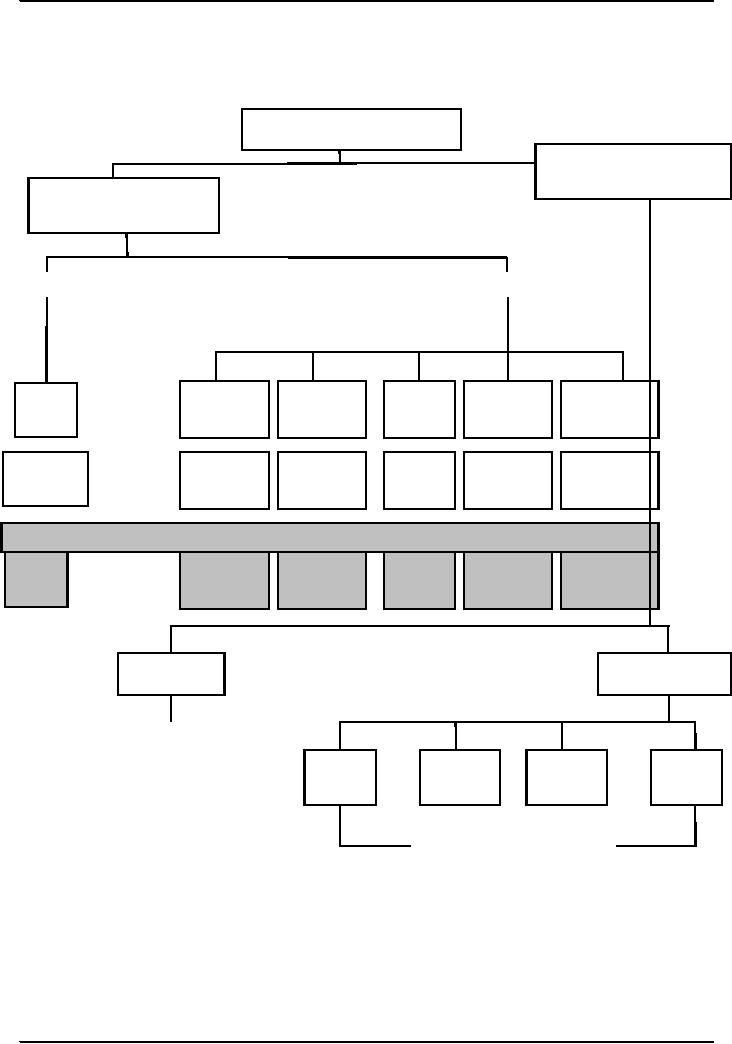

Following

diagram best describes the

different books of accounts which

are used in the business

for

recording

transactions.

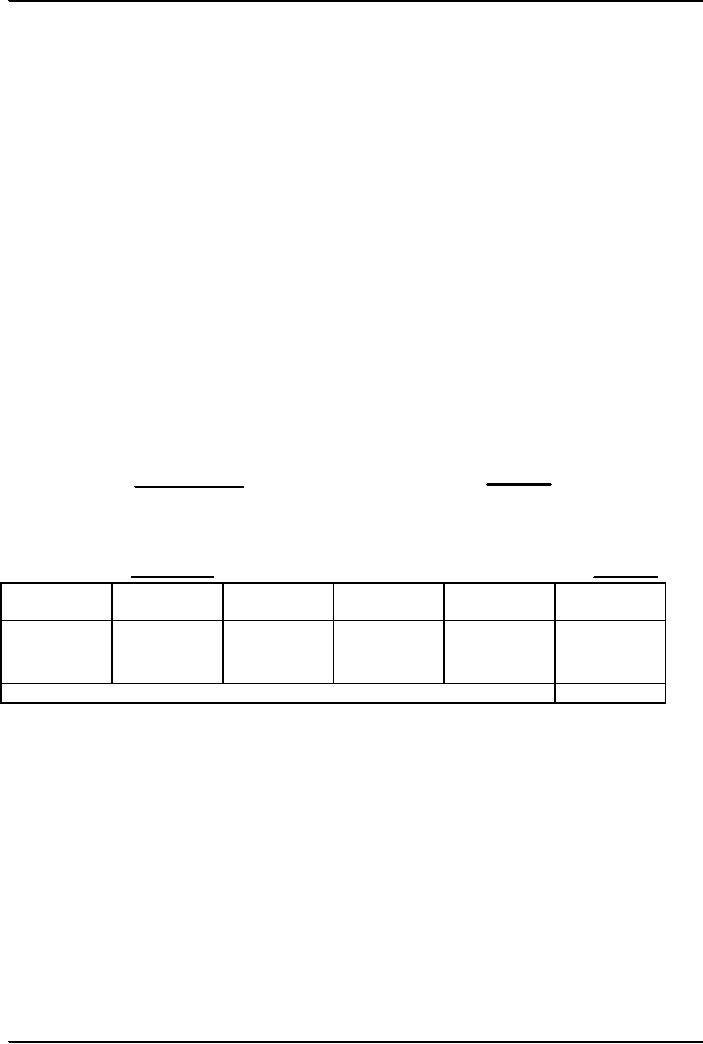

BOOKS

OF ACCOUNT

Books of

Secondary

Entries

(Ledger)

Books of

Original

Entries

(Journal)

To record

credit transaction

To record

cash transaction

Purchases

Returns

Returns

General

Sales

Journal

Cash

Inward

Outward

Journal

Book

Journal

Journal

Journal

For

credit

For

credit

For

sales

For

For

all other

For

cash

purchases

receipts

&

purchases

sales

return

transactions

return

payments

Source

Documents

Invoices

Invoices

Credit

Credit

Note

Depends

upon

Cash

Note

the

nature of

Received

Issued

Received

Memos

Issued

Transaction

Main

Ledger

Subsidiary

Ledger

To extract

trial balance and

to

prepare

financial statements

Debtors

Creditors

Materials

Other

Ledge

Ledger

Ledger

Ledger

To

keep memorandum

Figure

3.1

Just

after analyzing a transaction or event

for its debit and credit

effects it is required to record them in

a

systematic

way. So the books of accounts in which

Debit and Credit are

initially recorded in a

systematic

way

are known as books of original

entry (BOE). In accounting

system of business concern books

of

original

entries possess a very important

position.

25

Fundamentals

of Auditing ACC 311

VU

JOURNAL:

It

depends upon the complexity of

transactions and size of the

business that what books of original

entries

are

required to record the transactions. For

a very little business, having very few

cash and credit

transactions,

a general

purpose journal is

sufficient to record each type of

transactions.

Journal

is

the very first book of account in

which all of the business

transactions and events are

recorded. In

this

book transactions and events

are recorded in a chronological (date)

sequence. Both of the

accounting

effects

(Debit & Credit) are recorded in it

in a systematic way. Information

recorded in the journal for

a

transaction

or an event is known as journal

entry.

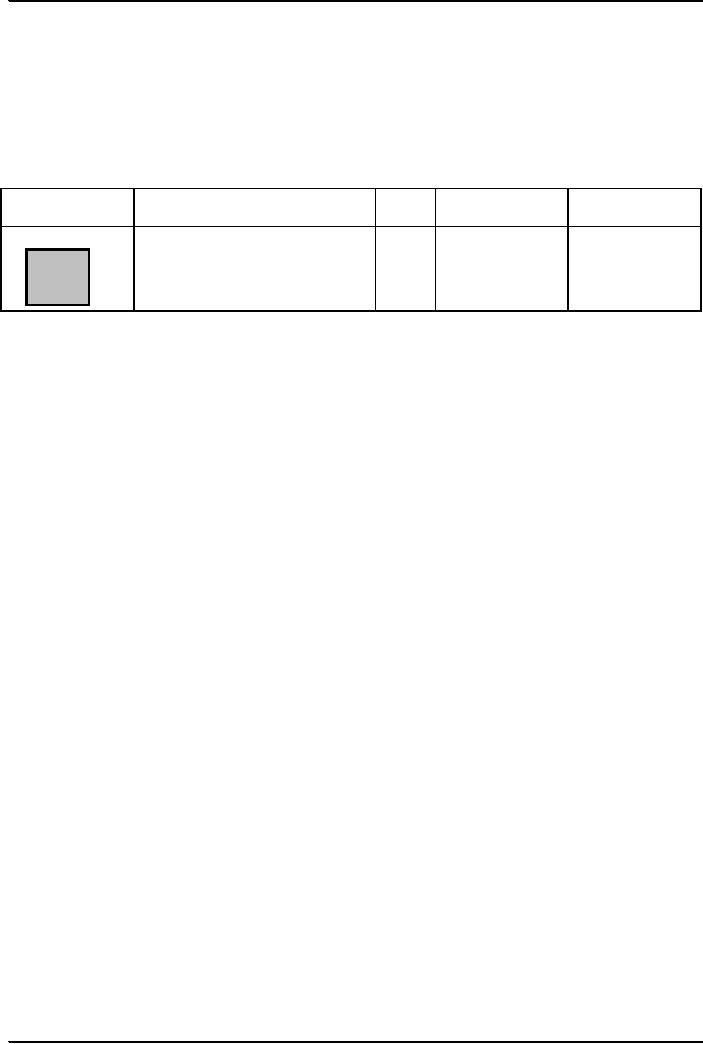

Sketch

of a Journal & Journal

Entry

Date

Particulars

Post

Debit

Credit

2003

Ref.

(Rs)

(Rs)

Jan.

10

Salaries

Account (Debit)

39

50,000

Cash

Account (Credit)

10

50,000

Cash

(Staff

salaries paid in cash).

Memos

Figure

3.2

From

the above illustration we can

understand that on 10th January 2003, business paid

cash Rs.50,000 as staff

salaries. It is

customary that the accounting

head analyzed as debit

is

written firstly in the particulars'

column

and

its amount is written in the debit column

whereas the accounting head

analyzed as credit

is

written under

the

debit accounting head but

after indenting a little space

from the left side, its

amount is written in the

credit column.

The column of post reference cannot be

very well understood without having knowledge

of

Ledger,

any how, the column post

reference shows page numbers

of the Ledger in which salaries

and cash

accounts

are posted. Words written

within the parenthesis in the particulars

column are known as

"Narration

of a transaction or event"; it is an integral

part of a journal entry. Narration

explains the

accounting

treatments to a layman.

Subdivision

of Journal:

As

discussed earlier in 1.2

that the journal is sub-divided based on

complexity of the transactions or size

of

business.

This happens only when there

are a number of cash transactions in a

day and also there

are so

many

transactions for credit purchases

and credit sales. This large

numbers of transactions create a

mess in

bookkeeping

office; therefore, separate bookkeeping

clerks are given responsibilities for

separate types of

transactions

along with separate journals. For

example,

For

cash transactions there is a

separate cash office in

which only cash transactions

are analyzed and

recorded

in a book named as cash

book.

For

purchases there is a purchase

journal in

which only and only credit

transactions for purchases

are

recorded.

In the same way sales

journal for

credit transaction of sales is

maintained. And if there are

a large

number of

returns then separate journals

for sales return and

purchase return are

also maintained.

Now

that, after having separate journals for credit

sales, credit purchases, sales &

purchases return and

cash

transactions,

all of the remaining transactions and

events like sale and

purchase of assets on credit, loss

by

fire

etc. shall be recorded in general

journal.

To

learn more about subdivision of

journal, firstly have a

re-look on figure

3.1.

SALES

JOURNAL:

Need

for Sales Journal

In

case of a small business,

there is very little number of

transactions of credit sales. As we can

have an

example

of a barber's shop, a tailor, a retailer

etc. they mostly sell their

services or goods on cash

terms. But

as

business expands, the sales of it

also grow in terms of cash as

well as in terms of credit. The

cash sales are

now

recorded in the cash book as a

receipt, and the credit sales

are recorded in a separate

journal named as

sales

journal (sales day book). In

sales journal, no other

transactions are recorded

except the transaction

for

sales

on credit terms.

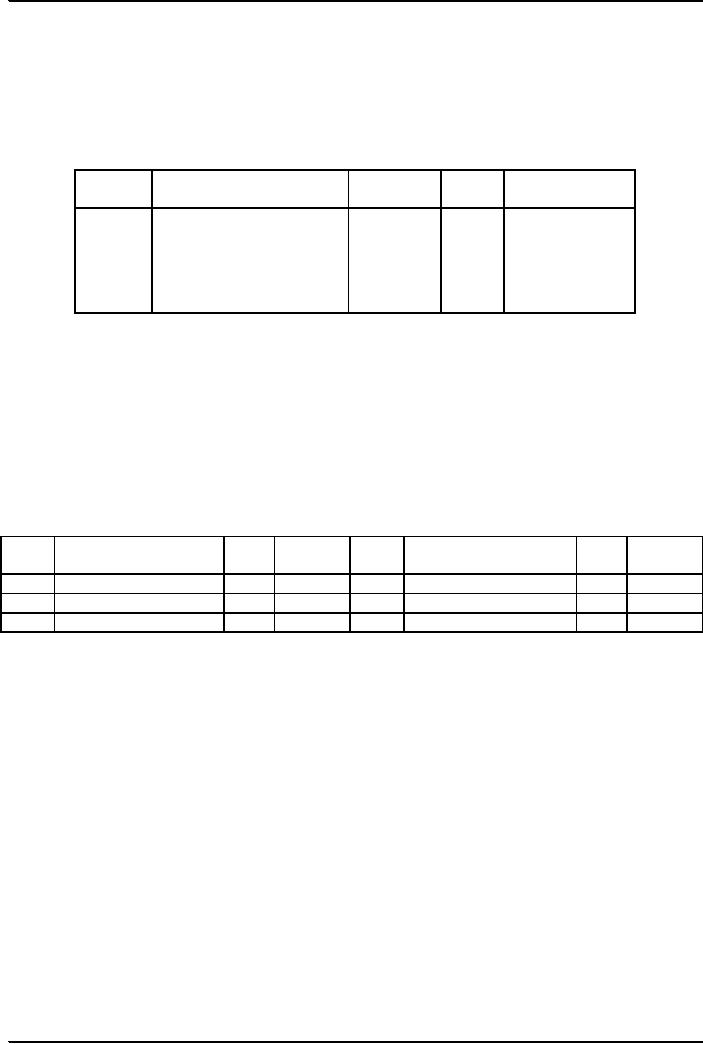

Supporting

Document:

As

shown in the figure 3.1 the

source document supporting credit sales

is sale

invoice. It is

made up in

duplicate or

triplicate (depending upon the accounting

systems developed for the recording of credit

sales)

26

Fundamentals

of Auditing ACC 311

VU

one of

these copies is sent to the

debtor (credit customer) along with the

goods/services sold. A

standard

format

of sales

invoice looks

like below;

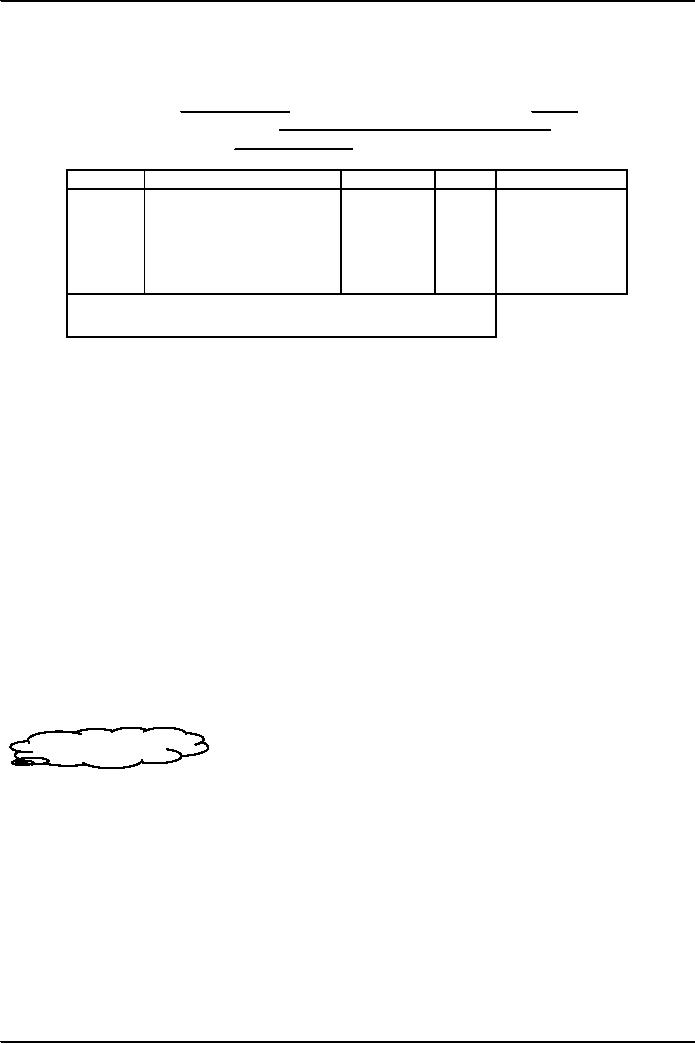

Name of

Vendor Co.

Address

of Vendor Co.

Sale

Invoice No.

Date:

Name &

Address of Customer

Purchase

Order Ref. No.

Sr.

No.

Particulars/Description

Quantity

Rate

Amount

***

Trade

discount

(***)

Total

***

Settlement

terms. 2/10,

n/30

Figure

3.3

Purchase

Order Reference

No:

When a

customer asks a vendor for

supply of some goods, such

order is evidenced through a

purchase

order

form. Purchase order form

discloses the quantity and

quality of goods ordered along with

its rates and

discounts

both trade and settlement.

Each purchase order has

its unique number which is put on the

sales

invoice

for reference.

Trade

Discount:

Amount

of trade discount is not required to be

recorded in the books of accounts.

Actually it is the

discount

which is agreed before entering into the

transaction of sales or purchase,

therefore, it is just

formally

show on the face of the invoice,

otherwise it has no other financial

effects.

Settlement

Terms:

It is

also known as prompt payment

terms. These terms are in

fact offered to lure the customer for

having

more

discounts by making payment for the

invoice earlier. In this term,

for example 2/10,

n/30, the

first

part

2/10

contemplates

that if customer pays cash

within 10 days of the invoice, he will be

offered a

discount of 2%, the

second part of it n/30

contemplates

that after 10 days there

will be no discount offer

but

the customer has to pay the amount of

invoice net of trade discount within the

thirty days of the date

of

invoice.

This

term sounds as two

ten net thirty (2/10,

n/30).

Brain

Storming

How

this will sound 5/20, n/60

and what do you understand by

this term?

Entering

the Transaction of Credit Sales in

Sale Journal:

In

case of credit sales the business is very

much interested in the name

and addresses of the credit

customer

(Debtor),

therefore, sales journal is so designed

to cover following

information;

Date---------------------

Date of

invoice

Name

of Debtor -------Mentioned

in the invoice

Invoice

number -------

It helps to trace the other

details of invoice.

Post

reference ---------Page

number of subsidiary ledger (will be

discussed later on)

Amount

of invoice ----

Net of Trade Discount

27

Fundamentals

of Auditing ACC 311

VU

Sketch

of Sales Journal

Date

Name

of Debtor

Invoice

Post.

Amount

No.

Ref.

Rs.

You

would have noticed in the sales

journal, there is only one

column for amount. It might have

created

confusion in

your mind that why we

are not having two columns

for amount, one for debit

and other for

credit,

like in journal. Remember,

here in sales journal all of

the transactions are of same

nature (credit sales)

and

the purpose of sales journal is

just to avoid over working

for recording the debits and

credits of each

transaction

again & again. So, the

role of sales journal in an

accounting system is to precise

all of the credit

transactions

of sales for a month or so

and give effect of debit to debtors

and credit to sales with

total

amount of

such period.

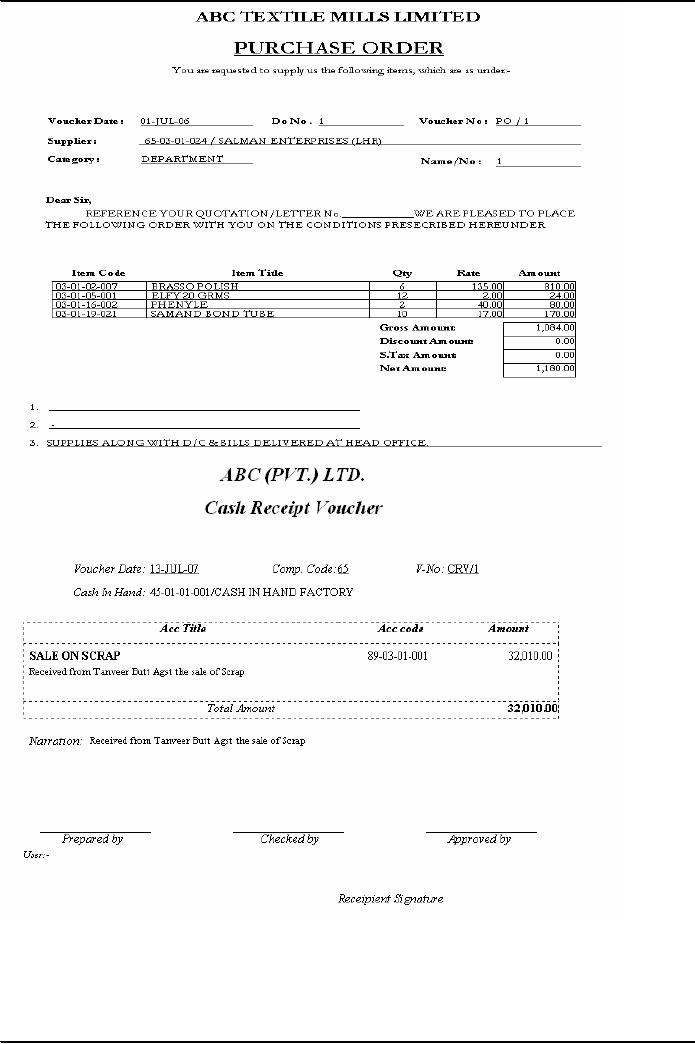

Purchase

Journal:

Need

for a Purchase

Journal

After

knowing the need of sales

journal (as discussed in previous

section) it will be very easy to

understand

that

for a large business having

frequent transactions of credit purchases

it is necessary to maintain a

separate

book for recording the transactions of

purchases on credit terms. This book is

named as purchase

day

book. Obviously like a sales

journal no cash transactions relating to

purchase shall be recorded in

this

book.

Supporting

Document:

As

shown in the diagram the supporting

document for transactions of credit

purchases is purchase invoice.

It is

exactly the same document as we looked

into the diagram of previous section.

Purchase invoice is in

fact

the copy of sales invoice in the

hands of customer. It is issued to the

purchaser by the

seller/vendor/supplier.

So from the stand point of a

purchasing business, the business after

having received

the

invoice will put an internal

number on it and will file it as

evidence of the transaction and

also for the

purpose

to remember that amount of this invoice

is still outstanding for payment

according to the

settlement

terms as discussed in

section.

Entering

the Transaction of Credit Purchases in

Purchase Journal:

The

basic contents of a purchase

journal are exactly the same

as discussed in the case of a sales

journal with

the exception of

one thing that now in the

second column there is the name of

Creditors instead of

Debtors.

Obviously, we remember the person

from whom goods are

purchased on credit is creditor of

the

business.

Sketch

of Purchase Journal

Date

Name

of creditor

Inv.

Post.

Amount

No.

Ref.

Rs

A

purchase journal is a list of

all credit purchases in a stipulated time

period. All of the credit

purchases

recorded

in a purchased journal during a

period is totaled and then

for such total amount debit

effect is

given to the

purchases account and credit effect is

given to the creditors account. You

noticed here that the

rules

of debit and credit remain

same all the time.

Sales

Return Journal: (Returns Inward

Journal)

Need

for Sales Return

Journal

As the

business expands the number of complaints

and returns inwards also

increases. Such return

inwards

can be

recorded in the sales journal as a

negative entry if these are

very little in number. But because of

its

reverse

nature it is recommended to maintain a

separate journal to record sales

return. Here one very

28

Fundamentals

of Auditing ACC 311

VU

important

concept should be remembered that in

sales return journal only

the returns against credit

sales

(from

Debtors) are recorded. Normally, it

doesn't happen that return

of goods sold against cash

are

accepted

by a business because certainly against

such return the business

would have to make refund

of

money

already received. That's why in

coming practice you will

not find any such

transaction. But

obviously if

you have any

example of such transaction in your

business, it will be recorded in cash

book as a payment.

Supporting

document:

When a

business receives back its

sold goods it issues a

"credit note" to the debtor

returning goods,

which

evidences

that we have received the returned

goods and accept that

money for such sales

will not be

received

in future. A "credit note"

issued is an evidence of reduction in

sales income and also in the

amount

of

debtors. It is also said

that a "credit note" is a

reversal document of an "invoice" which

cancels the effect

of it.

Like an "invoice", a credit note is

also given a number

and

also possesses a reference of

sales invoice against

which

such return were made.

Rest of the contents of credit note

are commonly understood, such

as:

Name

& Address of the business

(Seller)

Name

& Address of the customer

Date

Particulars

Quantity

Rate

Amount

Sketch

of Credit Note

Name

of Vendor Co.

Address

of Vendor Co.

Credit

Note No:

Date:

Customer's

Name

Customer's

Address

Ref.

Invoice No

Account

No:

Item

No.

Description

Quantity

Rate

Trade

Net

Amount

Discount

Total

Figure

3.6

Purchase

return journal: (Returns outward

journal)

Need

for a Purchase Return

Journal?

Purchase

return journal has the same

story as we just have

discussed in previous unit. The

only thing to

remember

is that it is also known as

return outward journal/daybook.

Obviously these transactions

(for

purchase

returns) could also be recorded in the

purchase journal as negative

entry but same as for

sales

return

journal it is required to have a separate

journal for purchase returns

because of its reverse

nature to

the

purchases. The total of

purchase return journal will

cause a reduction in the purchases

expenses and also

a

reduction in the amount of

creditors.

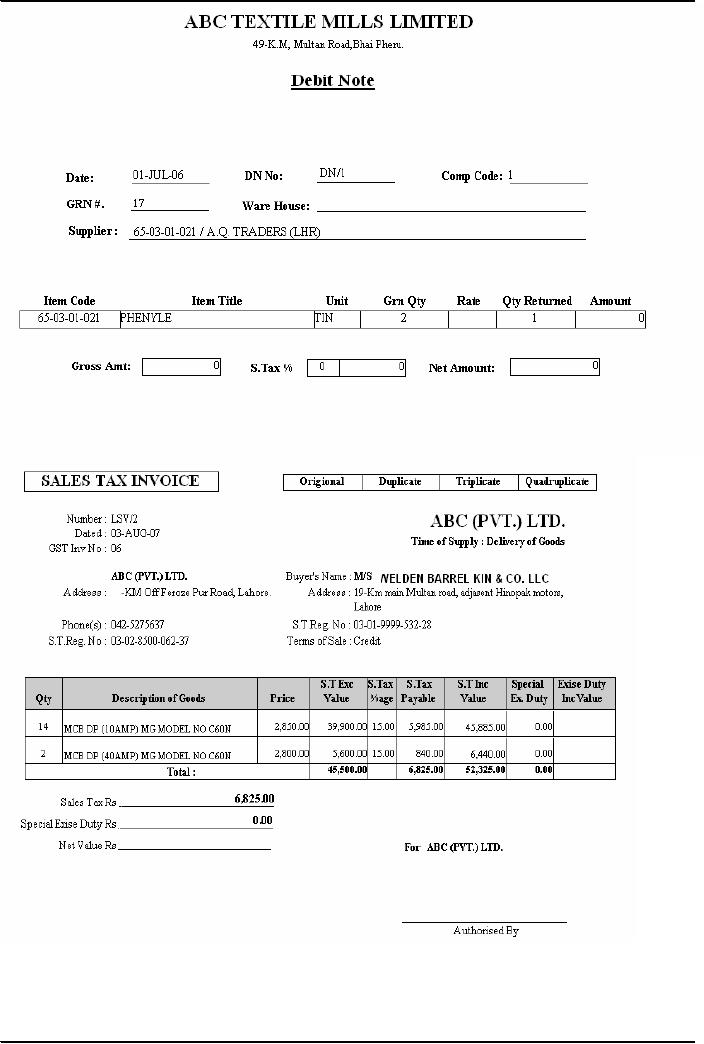

Supporting

document:

Although

purchase returns are

evidenced by a copy of credit

note received

from the seller, which is

treated as

a

reversal document against purchase

invoice. But here we shall

also discuss the need of a

"Debit

Note".

A

"debit

note" is in fact a

request, put to the seller by the

purchaser business, for

issuance of a credit

note. A

copy

of debit

note is

sent to the seller along with the

rejected goods, in which all

of the particulars of goods

rejected

and returned along with the reference of

relevant invoice number are entered.

Remember, a

business

cannot record purchases returns

considering a debit

note as a

supporting document because the

29

Fundamentals

of Auditing ACC 311

VU

effects

of purchase invoice are not

considered cancelled unless

acceptance of rejected goods is

received

from

the seller in shape of a copy of

credit

note.

Entering

Transactions in Purchases Return

Journal:

you

will find nothing new in

this section except the treatment of

total of purchase return

journal which is

debited to the

creditors account and

credited to the purchases return

account.

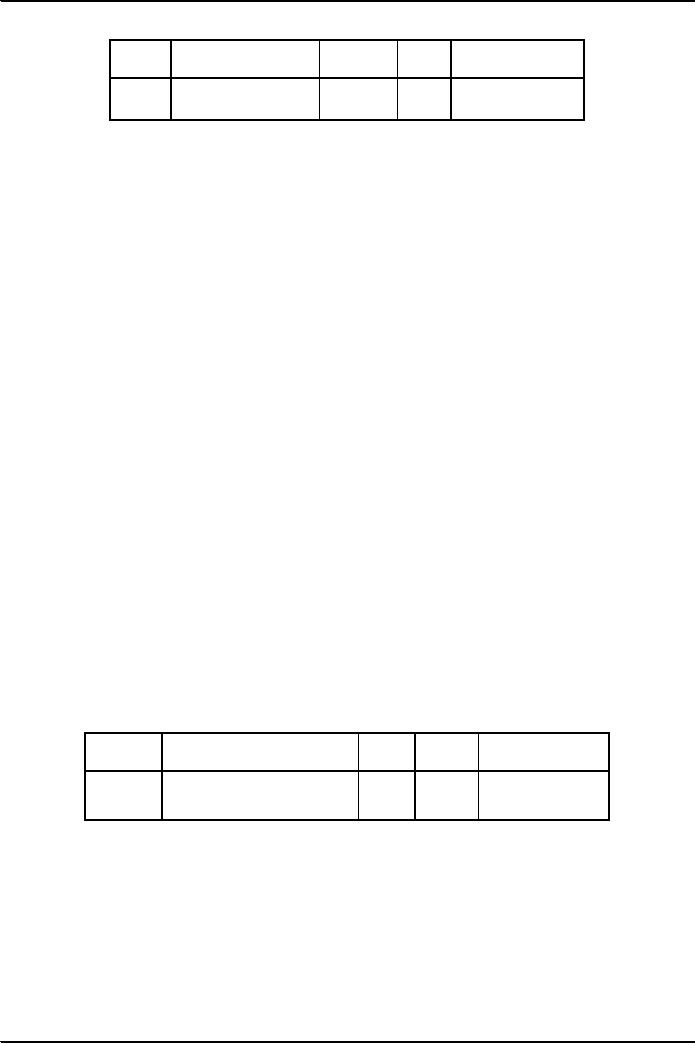

Sketch

of a Purchase Return

Journal

Date

Creditor

Name

Credit

Post.

Amount

Note

No.

Ref.

Figure

3.7

Cash

Book:

Cash

book is a book of original

entries in which all of the

cash transactions are

recorded very firstly. If we

refer to the

figure 3.1, we can notice

that the (books of original entry)

journal is subdivided for two

types of

transactions

i.e. credit transactions and

cash transactions. As discussed in

previous units, all credit

transactions

are recorded in different journals.

The cash transaction of a

concern needs a separate

book

named

as cash book.

A cash

book is divided into two

sections, one for cash

receipts and the other for

cash payments. Each

of

the

section is formatted for date,

particulars, post reference and

amount. See below

for its proper

sketch;

Cash

book

Date

Particulars

Post

Amount

Date

Particulars

Post

Amount

Ref.

Ref.

Figure

3.8

Left

hand side of a cash book is

known as receipt side and

right hand side is known as

payment side. In a

way,

we can say that within a

cash book, we prepare two

cash journals, one, cash

receipt journal and

second,

cash

payment journal.

Supporting

Documents:

For

Cash Receipts

All

cash receipts are evidenced

by a copy of cash memo/receipts retained

by the business. These

cash

memos/receipt

are already serially pre-numbered

and for each receipt of

cash, the cash office issues

an

original

copy of the cash memo/receipt to the

person making payment and

retains a carbon copy

or

counterfoil

of it within the office which

are used to record receipts

of cash in the cash

book.

For

Cash Payments

All

cash payments are evidenced

by an original copy of cash memo/receipts

issued by the recipient

business.

These are attached with a

cash voucher as evidence that

cash was paid to recipient who

issued this

cash

memo/receipt.

30

Fundamentals

of Auditing ACC 311

VU

31

Fundamentals

of Auditing ACC 311

VU

32

Fundamentals

of Auditing ACC 311

VU

33

Fundamentals

of Auditing ACC 311

VU

34

Fundamentals

of Auditing ACC 311

VU

35

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT