|

LIABILITIES OF AN AUDITOR |

| << Appointment, Duties, Rights and Liabilities of Auditor |

| BOOKS OF ACCOUNT & FINANCIAL STATEMENTS >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

08

LIABILITIES

OF AN AUDITOR

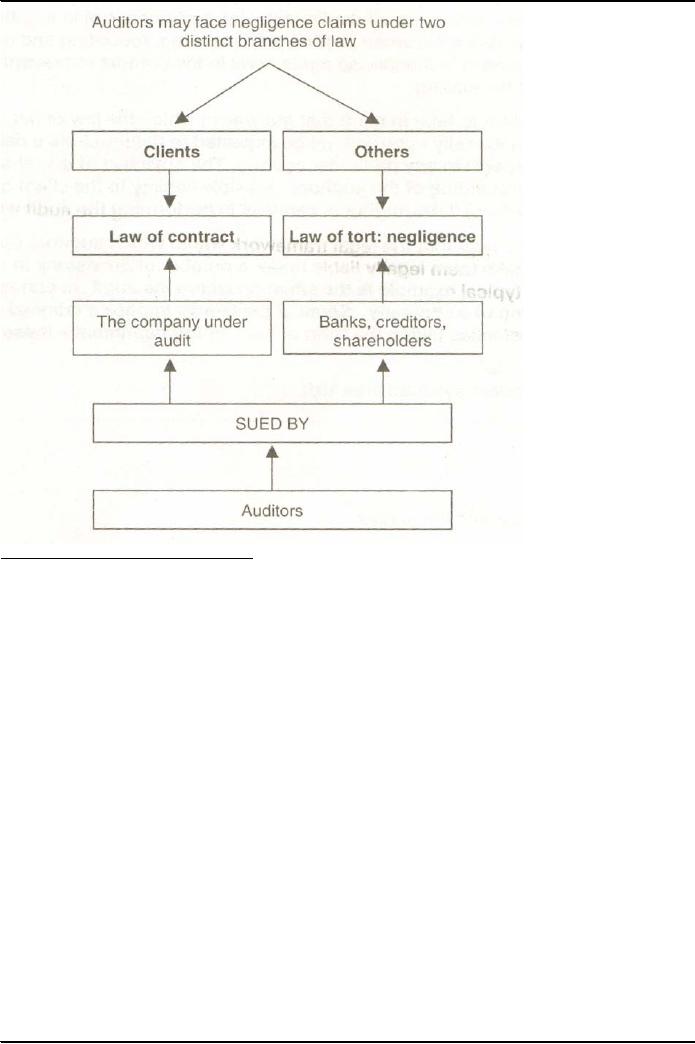

Auditors'

Liabilities

� Civil

Liabilities (arising from

law suits/Liability for

negligence)

� Under

law of contract (initiated by the audit

client)

� Under

law of tort (initiated by

other users of FS)

� Criminal

Liabilities

Under

sections 157, 255, &

257

Against

charges of forgery (evidence

created / documents forged

etc.)

Against

false statement (regarding

opinion in report)

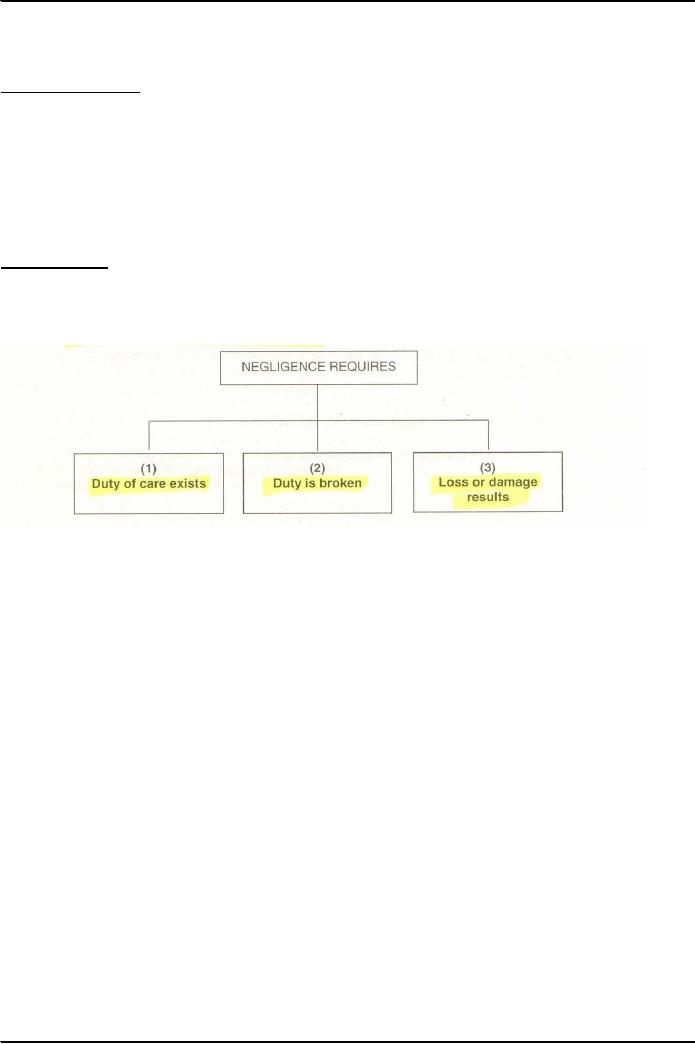

Civil

Liabilities

Civil

liabilities arise in the situation when

there is absence of reasonable

care and skill that

can be expected

of a

person in a set of

circumstances.

When

negligence of an auditor is being

evaluated, it is in terms of what other

competent auditors would

have

done in the same situation

21

Fundamentals

of Auditing ACC 311

VU

Jeb

Fasteners v Marks Bloom

(1980)

The

plaintiff acquired the share

capital of the company. The audited

accounts, due to the negligence of

the

auditors,

did not show a true and

fair view of the state of

affairs of the company. It was

accepted that at the

time of the

audit the defendant auditors did know of

the plaintiffs but did not

know that they were

contemplating a

take over bid.

HELD:

whilst recognizing that the auditors

owed a duty of care in this situation. It

was decided that the

auditors

were not liable because the

plaintiff had not suffered

any loss. It was proved

that the plaintiffs

would

have bought the share

capital of the company at the agreed

price whatever the accounts

had said.

Therefore, whether

or not a duty of care

existed was not directly relevant to the

decision.

How

to minimize the

liabilities

� Not

being negligent

� Following

the ISAs

� Agreeing the

engagement letter

� Defining

in report the work undertaken

� Defining

the purpose for the

report

� By

limiting liabilities to third

parties

� By

defining the scope of professional

competence

22

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT