|

LEGAL CONSIDERATION REGARDING AUDITING |

| << What is Reasonable Assurance |

| Appointment, Duties, Rights and Liabilities of Auditor >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

06

LEGAL

CONSIDERATION REGARDING

AUDITING

The

Audit Requirement

� Not

all limited companies are

required to have their financial

statements audited. Nor are

all

companies

required to produce financial statements in the same

formats as many exemptions

may

apply to

small and medium sized

companies.

� Broadly

speaking, small companies

are exempt from the audit

requirement, small and medium

sized

companies

may file abbreviated accounts

with the registrar of companies

and small companies

may

prepare

accounts with reduced

disclosures for their

members.

Appointment,

Duties, Rights and Liabilities of

Auditor

Appointment:

First

Auditors

a)

The

first auditors of a company shall be

appointed by the directors within 60

days of

incorporation

of the company [252(3)]

b)

The

first auditors will hold

office till the first annual

general meeting

[252(3)].

c)

If the

directors fail to appoint the

first auditors, the members

shall appoint the

first

auditors,

provided further that the auditors

such appointed shall not be

removed during

the

tenure expect through a

special resolution

[(252(6)].

d)

Where

the first auditors are not

appointed either by the directors or by the

members within

120

days of incorporation of the company, the

Securities & Exchange Commission

of

Pakistan

(Commission) will appoint the

auditor [252(6)].

Subsequent

Auditors

(a) At

each annual general meeting

the company (members) shall

appoint the auditors [252(1)].

(b)

The auditors shall hold

office from the conclusion of

that meeting till the

conclusion of

next

annual general meeting

[Section 252(1)].

(c) If

no auditors are appointed at annual

general meeting Commission

shall appoint an

auditor.

To

exercise this power the company must give

notice to Commission within one

week of

these

powers having become exercisable

[252(7)].

Note:

Provided

that an auditor or auditors appointed in

a general meeting may be

removed before

conclusion

of the next annual general

meeting through a special

resolution [252(1)].

Casual

Vacancy

a)

Any casual vacancy

shall be filled by directors.

[Sec 252(4)].

b)

Auditors so appointed shall

hold office till next

annual general meeting.[Sec

252(5)]

c) If

directors do not appoint auditors to

fill casual vacancy within

30 days, Commission

may

appoint

an auditor.[Sec 252(6)]

Commission's

powers to appoint auditors

[252(6)]

The

Securities & Exchange Commission of

Pakistan may appoint an

auditor if the following situations

arise:

a) First auditors

are not appointed within

120 days from

incorporation;

b)

Subsequent auditors are not

appointed in annual general

meeting;

c)

Casual vacancy is not filled

within 30 days; and

d)

Auditors appointed are

unwilling to act as

auditors.

To

exercise this power, the company must

give notice to Commission within one

week of its powers

becoming

exercisable.

15

Fundamentals

of Auditing ACC 311

VU

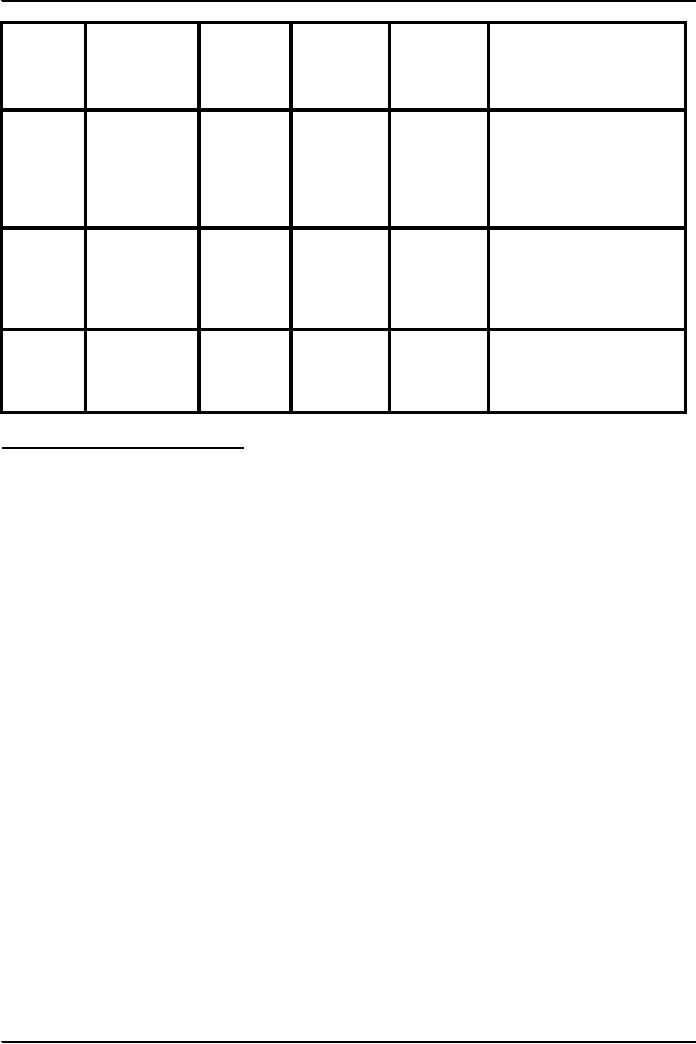

SUMMARY

Auditors

Time

of

Appointing

Term of

Appointing

Remarks

appointment

Authority

Office

Authority

in

default

First

1st

Within

60 days

Directors

Till

first

Members

Members

shall appoint 1st

Auditors

of

AGM

auditors at a

general meeting

Incorporation

within

120 days. After

120

days

SECP may make the

appointment.

Subsequent

AGM

Members

Till

next

SECP

If auditors

are not appointed

Auditors

AGM

in

Auditors AGM. AGM,

SECP

may appoint auditors.

Casual

Within

30 days

Directors

Till

next

SECP

After

30 days of vacancy.

Vacancy

of the

vacancy

AGM

Vacancy

of the vacancy

AGM

SECP may appoint

auditors.

Remuneration

of Auditors [252(8)]

Fixation

of remuneration of auditors depends upon the

authority appointing the auditors,

i.e.

i)

If auditors

are appointed by directors,

directors shall fix the

remuneration.

ii)

If auditors

are appointed by COMMISSION,

COMMISSION shall fix

remuneration.

iii)

In all

other cases, the members

(Company) shall fix the

remuneration.

Note:

Minimum

hourly rates are also

recommended by The Institute of

Chartered Accountants of Pakistan

(ICAP)

which is specified in members'

Handbook Volume II (Part II

ATR-14).

SUMMARY

Appointing

Authority Remuneration Fixed

by

a)

Directors

Directors

b)

Commission

Commission

c)

In all

other case Members

(Company)

Procedure

for Change of Subsequent

Auditors/ Removal of Auditors /

Appointment of New

Auditors

(Section-253)

New

auditors can be appointed in place of

retiring auditors if the following

requirements are

fulfilled.

a)

Notice

from a member is required for a

resolution at the AGM (253(1)).

b)

The

member shall give notice to the company

at least 14 days before the AGM that

he

intends to

propose the appointment of another person

as auditor (253(2)).

c)

On

receipt of the notice the company shall

send a copy of such notice to

the:

i)

retiring

auditor, forthwith

ii)

members,

at least seven days before the

AGM. (253(2))

d)

In

case of a listed company, notice

shall be published at least in one

issue of an English

and an

Urdu daily newspaper having circulation in the

province where the

stock

exchange(s)

is situate on which the shares of the

company are listed.

e)

The

retiring auditor can make

representations and the company

shall send a copy of

representation

to a member or it may be read at

AGM.

Provided

that the representation cannot be sent OR

read at the AGM if the Registrar does

not

permit

so on the application of the company or

any other person. (253

(3)).

f)

A

company within 14 days after the AGM

shall notify to the Registrar of

the

i)

appointment

of new auditors with their

consent letter. 253(5).

16

Fundamentals

of Auditing ACC 311

VU

ii)

retirement or

removal of auditors. Section

253(6)

Note:

Under

the Schedule-I Part-I of the Chartered

Accountant Ordinance, 1961 new

auditor accepting

the

appointment without communicating with

the previous auditor shall be deemed to

be guilty of

professional

misconduct. The Institute of

Chartered Accountant of Pakistan

has issued Auditing

Technical

release

(ATR-2) explaining what does the

word "Communication" means. Therefore, it

is necessary for the

new

auditors to communicate with the previous auditors

before accepting the appointment to

ascertain that

he has

no objection on professional grounds,

regarding the appointment. Clause 7 of

the Schedule requires

that

incoming auditor should ensure before

accepting the appointment, that

requirements of the Companies

Ordinance,

1984 regarding his

appointment have been

fulfilled.

Change

of Auditors - Checklist

Timing

Actions

Required

Notice

from a member from the date

of AGM

At

least 14 days

Send

Copy of the notice to:

a)

The

retiring auditor

forthwith

b)

Members

At

least 7 days before

The

date of AGM Publication of the fact in

newspapers anytime before the AGM. That

notice has been

received.

Representation by auditors Sent to

members before AGM or read at AGM.

Notification

of the change to the Registrar within 14

days after the date of

AGM.

Removal of

Auditors

i)

First

auditor appointed by the directors

may be removed by the members in a

general

meeting.

ii)

Another

person nominated by a member shall be

appointed in place of the

outgoing

auditor.

iii)

The

notice of nomination of the proposed

auditor should be given to the member's at

least

14

days before the general meeting

and all the procedure stated

above would be required to

be

followed in this case

also.

iv)

An

auditor or auditors appointed in an

annual general meeting may

be removed before

conclusion

of the next annual general

meeting through a special

resolution.

v)

In the

above case, SECP may

appoint the auditor(s) of the

company.

Qualification

& Disqualification of

Auditors

Qualification

254(1)

For

appointment as auditor

of:

a)

a Public

Company or

b)

a Private

Company which is a subsidiary of a Public

Company.

c)

a Private

Company having paid up capital of three

million rupees or

more.

The

person must be a Chartered

Accountant within the meaning of the

Chartered Accountants Ordinance,

1961.

Note:

For

listed companies an auditor

must have a satisfactory QCR

(quality control review) rating

issued

by

ICAP.

Disqualifications

254(3)

Following

persons are not qualified to

become auditors of a company:

i)

Present

directors, other officer or

employees of the company or who held

these offices

during

the last three years.

ii)

A partner or

employee of a director, other officer or

employee of the company.

iii)

A

spouse of a director.

17

Fundamentals

of Auditing ACC 311

VU

iv)

A

person who is indebted to the

company.

v)

A body

corporate.

vi)

A

person or his spouse or

minor children or in case of

firm all partners of such

firm who

holds

any shares of an audit

client or any of its

associated companies.

Provided

that if such a person holds

shares prior to his

appointment as auditors, whether as an

individual or

a partner in a

firm the fact shall be disclosed on

his appointment as auditor

and such person shall

disinvest

such

shares within ninety days of

such appointment.

vii)

A

person disqualified for appointment as an

auditor due to above reasons

is disqualified

from

holding the office of auditor of another

company which is a subsidiary or

holding

company

of that company

254(4).

18

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT