|

MODIFIED AUDITOR’S REPORT |

| << AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS |

Fundamentals

of Auditing ACC 311

VU

Lesson

45

MODIFIED

AUDITOR'S REPORT

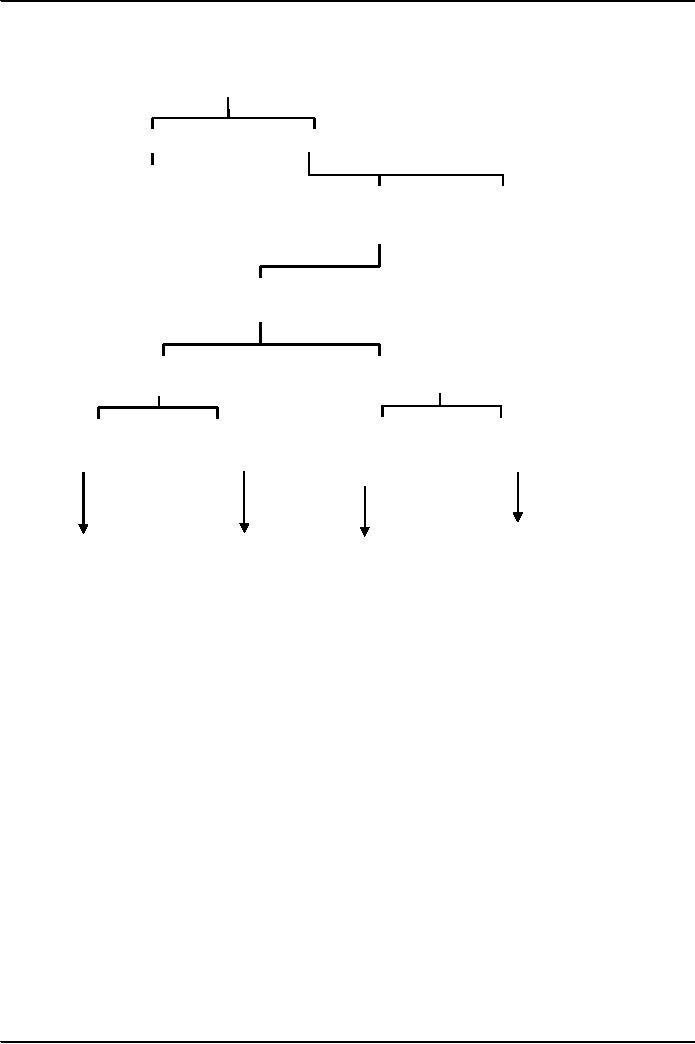

REPORTS/OPINIONS

TREE

STANDARD

MODIFIED

Unqualified

Affect

the

Do not

affect

Auditor's

opinion

auditor's

opinion

(Emphasis

of the matter)

DEPENDS

UPON NATURE

OF

CIRCUMSTANCES

LIMITATION

ON

DISAGREEMENT

SCOPE

OF WORK

WITH

MANAGEMENT

Material

but not so

Material

Material

but

Material

&

Material

& Pervasive

&

Pervasive

not so

material

Pervasive

and

Pervasive

Adverse

opinion

Qualified

Disclaimer

of opinion

Qualified

(Financial

statement

Opinion

(we do

not express an

opinion

do not

give a true

(Except

for)

opinion

on the financial

(Except

for)

and

fair view)

statements)

MODIFICATIONS

TO THE AUDITOR'S REPORT

(Effective

for auditor's reports dated

on or after December 31,

2006).

Here we

shall discuss the

circumstances when the independent

auditor's report should be

modified

and

the form and the content of

the modifications to the auditor's report

in those circumstances.

The

wording of auditor's report is

modified in the following

situations:

Matters that Do

Affect the Auditor's

Opinion

�

Qualified

opinion,

�

Disclaimer

of opinion, or

�

Adverse

opinion.

Matters that Do

Not Affect the Auditor's

Opinion

�

Emphasis

of matter

MATTERS

THAT DO AFFECT THE AUDITOR'S

OPINION

An

auditor may not be able to

express an unqualified opinion when

either of the following

circumstances

exists and, in the auditor's

judgment, the effect of the

matter is or may be material

to

the

financial statements:

(a)

There

is a limitation on the scope of

the auditor's work;

or

146

Fundamentals

of Auditing ACC 311

VU

(b)

There

is a disagreement with management

regarding the acceptability of

the accounting

policies

selected, the method of their application

or the adequacy of financial

statement

disclosures.

Limitation

on Scope

(a)

Imposed by

the entity

A

limitation on the scope of the auditor's

work may sometimes be

imposed by the entity

(for

example,

when the terms of the

engagement specify that the auditor

will not carry out an

audit

procedure

that the auditor believes is necessary).

However, when the limitation in

the terms of a

proposed

engagement is such that the auditor

believes the need to express

a disclaimer of opinion

exists;

the auditor would ordinarily

not accept such a limited

engagement as an audit engagement,

unless

required by statute. Also, a

statutory auditor would not

accept such an audit engagement

when

the

limitation infringes on the auditor's

statutory duties.

(b)

Imposed by

circumstances

A

scope limitation may be

imposed by circumstances (for

example, when the timing of

the auditor's

appointment is

such that the auditor is unable to

observe the counting of physical

inventories). It may

also

arise when, in the opinion

of the auditor, the entity's

accounting records are

inadequate or when

the

auditor is unable to carry

out an audit procedure believed to be

desirable. In these

circumstances,

the

auditor would attempt to

carry out reasonable

alternative procedures to obtain

sufficient

appropriate

audit evidence to support an unqualified

opinion.

When

there is a limitation on the scope of

the auditor's work that

requires expression of a qualified

opinion

or a disclaimer of opinion, the auditor's

report should describe the

limitation and indicate

the

possible

adjustments to the financial statements that

might have been determined

to be necessary had

the

limitation not

existed.

A

qualified opinion should

be expressed when the auditor concludes

that an unqualified opinion

cannot

be expressed but that the

effect of any limitation on

scope is not so material and

pervasive as

to

require a disclaimer of opinion. A

qualified opinion should be expressed as

being `except for'

the

effects

of the matter to which the qualification

relates.

A disclaimer

of opinion should

be expressed when the

possible effect of a limitation on

scope is so

material

and pervasive that the

auditor has not been

able to obtain sufficient appropriate

audit

evidence

and accordingly is unable to

express an opinion on the financial

statements.

Whenever

the auditor expresses an opinion

that is other than unqualified, a clear

description of all the

substantive

reasons should be included in

the report and, unless

impracticable, a quantification of the

possible

effect(s) on the financial statements.

Ordinarily, this information

would be set out in a

separate

paragraph preceding the opinion or

disclaimer of opinion on the financial

statements and

may

include a reference to a more

extensive discussion, if any, in a note

to the financial statements.

Illustrations

of these matters are set out

below.

Limitation

on Scope--Qualified Opinion

We

have audited........................

Management

is responsible .............................

Our

responsibility is to express an opinion on

these financial statements based o

our audit. Except as

discussed

in the following paragraph, we

conducted our audit in accordance

with

.................................

We did

not observe the counting of

the physical inventories as of December

31, 20X1, since that

date

was

prior to the time we were

initially engaged as auditors

for the Company. Owing to

the nature of

the

Company's records, we were

unable to satisfy ourselves as to

inventory quantities by other

audit

procedures.

In our

opinion, except for the

effects of such adjustments, if

any, as might have been

determined to

be

necessary had we been able

to satisfy ourselves as to physical

inventory quantities, the

financial

statements

give a true and fair view of

... (remaining words are

the same as illustrated in the

opinion

paragraph)

Limitation

on Scope--Disclaimer of Opinion

We

were not able to observe all

physical inventories and

confirm accounts receivable

due to

limitations

placed on the scope of our

work by the Company.)

147

Fundamentals

of Auditing ACC 311

VU

Because

of the significance of the matters

discussed in the preceding paragraph, we

do not express an

opinion

on the financial statements."

Disagreement

with Management

The auditor

may disagree with management

about matters such as the

acceptability of accounting

policies

selected, the method of their

application, or the adequacy of

disclosures in the financial

statements.

If such disagreements are

material to the financial statements,

the auditor should express

a

qualified or an

adverse opinion.

A

qualified opinion should

be expressed when the auditor concludes

that an unqualified opinion

cannot

be expressed but that the effect of

any disagreement with

management is not so material

and

pervasive

as to require an adverse opinion. A

qualified opinion should be expressed as

being `except

for'

the effects of the matter to which the qualification

relates.

An

adverse opinion should

be expressed when the effect

of a disagreement is so material

and

pervasive

to the financial statements that the auditor

concludes that a qualification of the

report is not

adequate

to disclose the misleading or

incomplete nature of the financial

statements.

Illustrations

of these matters are set out

below.

Disagreement

on Accounting Policies--Qualified Opinion

We

have audited........................

Management

is responsible .............................

Our

responsibility is to express an opinion on

these financial statements based o

our audit. Except as

discussed

in the following paragraph, we

conducted our audit in accordance

with

.................................

As

discussed in Note (Ref no.) to

the financial statements, no depreciation

has been provided in

the

financial

statements which practice, in our

opinion, is not in accordance

with International

Financial

Reporting

Standards. The provision for

the year ended December

31, 2007, should be Rs.___

based

on the

straight-line method of depreciation

using annual rates of x% for

the building and y% for

the

equipment.

Accordingly, the fixed assets should be

reduced by accumulated depreciation of

Rs. __

and

the loss for the year

and accumulated deficit

should be increased by Rs.__

and Rs.__,

respectively.

In our

opinion, except for the

effect on the financial statements of the

matter referred to in the

preceding

paragraph, the financial statements

give a true and fair view of

... (remaining words are

the

same

as illustrated in the opinion

paragraph)

Disagreement

on Accounting Policies--Inadequate Disclosure--Adverse

Opinion

"We

have audited ... (remaining

words are the same as

illustrated in the introductory

paragraph

Management

is responsible for ... (remaining

words are the same as

illustrated in the

management's

responsibility

paragraph

Our

responsibility is to ... (remaining words

are the same as illustrated in the

auditor's responsibility

paragraphs)

(Paragraph(s)

discussing the disagreement.)

In our

opinion, because of the effects of

the matters discussed in the

preceding paragraph(s), the

financial

statements do not give a true

and fair view of (or `do

not present fairly, in all

material

respects,')

the financial position of ABC Company as

of December 31, 2007, and of

its financial

performance

and its cash flows for

the year then ended in

accordance with International

Financial

Reporting

Standards."

MATTERS

THAT DO NOT AFFECT THE AUDITOR'S

OPINION

In

certain circumstances, an auditor's

report may be modified by

adding an emphasis of

matter

paragraph

to highlight a matter affecting the financial

statements which is included in a note to

the

financial

statements that more

extensively discusses the

matter.

The

addition of such an emphasis of

matter paragraph does not

affect the auditor's opinion.

The

paragraph

would preferably be included

after the paragraph containing the

auditor's opinion but

before the

section on any other reporting

responsibilities, if any. The emphasis of

matter paragraph

would

ordinarily refer to the fact

that the auditor's opinion is not

qualified in this respect.

For

example:

The auditor

should modify the auditor's

report by adding a paragraph to

highlight a material

matter

regarding

a going

concern problem.

148

Fundamentals

of Auditing ACC 311

VU

"Without

qualifying our opinion, we draw

attention to Note (Ref no)

in the financial statements

which

indicates that the Company

incurred a net loss of Rs.__

during the year ended

December 31,

2007

and, as of that date, the

Company's current liabilities exceeded

its total assets by Rs.__.

These

conditions,

along with other matters as

set forth in Note (Ref no),

indicate the existence of a

material

uncertainty

which may cast significant

doubt about the Company's ability to

continue as a going

concern."

The

auditor should consider

modifying the auditor's report by

adding a paragraph if there is

a

significant

uncertainty (other than a going concern problem), the

resolution of which is dependent

upon

future events and which may

affect the financial statements. An

uncertainty is a matter

whose

outcome

depends on future actions or

events not under the

direct control of the entity

but that may

affect

the financial statements.

An

illustration of an emphasis of matter

paragraph for a significant

uncertainty in an

auditor's

report

follows:

"Without

qualifying our opinion we draw attention

to Note X to the financial statements.

The

Company

is the defendant in a lawsuit alleging

infringement of certain patent rights

and claiming

royalties

and punitive damages. The

Company has filed a counter

action, and preliminary hearings

and

discovery

proceedings on both actions

are in progress. The ultimate outcome of

the matter cannot

presently

be determined, and no provision

for any liability that

may result has been

made in the

financial

statements."

The

addition of a paragraph emphasizing a

going concern problem or significant

uncertainty is

ordinarily

adequate to meet the

auditor's reporting responsibilities

regarding such matters.

However,

in

extreme cases, such as

situations involving multiple

uncertainties that are significant to the

financial

statements,

the auditor may consider it appropriate

to express a disclaimer of opinion

instead of

adding

an emphasis of matter

paragraph.

In

addition to the use of an emphasis of

matter paragraph for matters

that affect the financial

statements,

the auditor may also modify

the auditor's report by

using an emphasis of

matter

paragraph,

preferably after the paragraph containing

the auditor's opinion but before

the section on

any

other reporting responsibilities, if any, to

report on matters other than those

affecting the

financial

statements. For example, if an

amendment to

other information in a

document containing

audited

financial statements is necessary and

the entity refuses to make

the amendment, the

auditor

would

consider including in the auditor's

report an emphasis of matter

paragraph describing the

material

inconsistency.

"Without

qualifying our opinion we draw

attention to the fact that the

figures of dividend

proposed

and

earning per share appearing

in the director's report

being part of annual report

are incorrect and

in

conflict with those

disclosed in financial statements. The

matter has been brought to

the notice of

the

management but no corrective

action has been taken by

them in this regard."

149

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT