|

CONSIDERING THE WORK OF INTERNAL AUDITING |

| << STATISTICAL SAMPLING |

| AUDIT PLANNING >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

40

CONSIDERING

THE WORK OF INTERNAL

AUDITING

Introduction

(Meaning of Internal Audit)

Internal

audit is part of internal control, set by

the management, delegating

its supervisory functions

to

specially assigned staff,

with the objective to see that the

internal controls are in operation and

to

assist

them in fulfilling their

responsibilities such as

1.

safeguarding of the assets

2.

reliability of financial records

and

3.

efficiency in operation

Definition

"Internal

auditing" means an appraisal activity

established

within an entity as a service to the

entity.

Its

functions include, amongst other things,

examining, evaluating and

monitoring the adequacy

and

effectiveness

of the accounting and internal control

system.

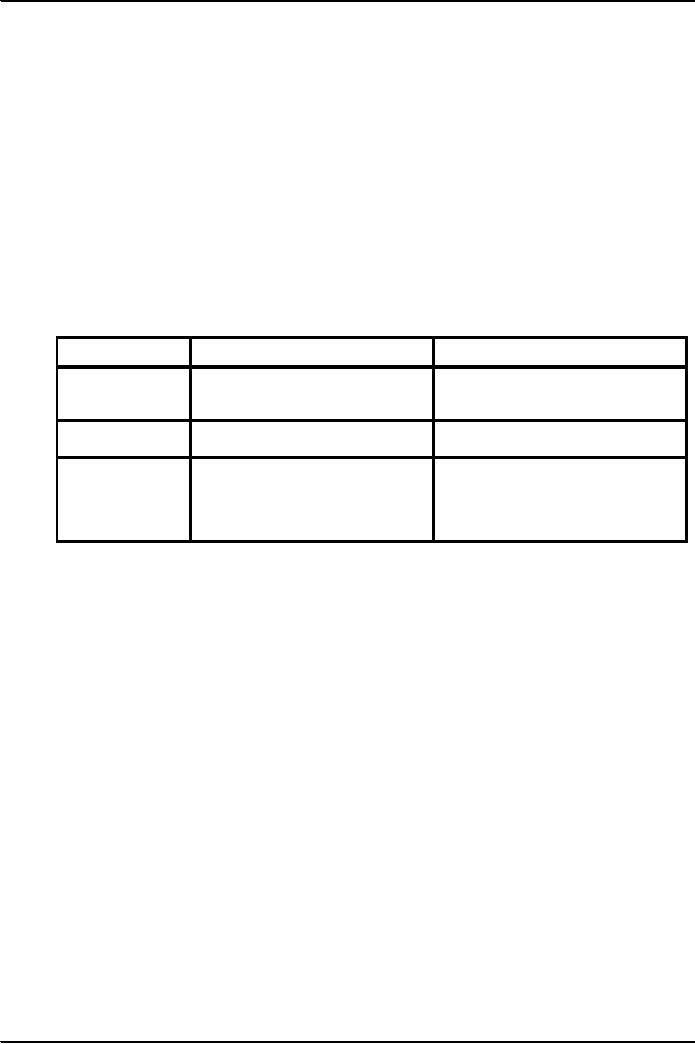

DIFFERENCE

BETWEEN INTERNAL AND EXTERNAL

AUDITORS

INTERNAL

AUDITOR

EXTERNAL

AUDITOR

Objective:

Accounting

system and internal Report on

Financial statements.

control

are operating efficiently.

Responsibility

Responsibility

to the management.

Responsibility

to the share holders.

Scope

of work

Determined by

management.

Determined by

the statute;

otherwise

determined

through mutual

agreement

between

auditor and the client.

Scope

and Objectives of the Internal

Audit Function

Although

the exact nature of internal audit

function is determined by the management,

however,

generally

the aims and objectives of

the internal audit function

are:

i)

Review

and assessment of the internal control

procedures and accounting

system.

ii)

Examination of

financial and operating information

for management, including

detailed

testing

of transactions and

balances.

iii)

Review

of efficiency, economy and

effectiveness of operation.

iv)

Review

of compliance with laws,

regulations, management policy and other

internal

requirements.

Relationship

between Internal Auditing and

the External Auditor

Management's

Requirements Vs Independent Report on

Financial Statements

Unlike

the internal auditor who is an

employee of the enterprise, the external

auditor is required to be

independent

of the enterprise, usually having a

statutory responsibility to report on the

financial

statements

giving an account of management's

stewardship.

Common

Means

Some

of the means adopted by both

the auditors to achieve

their respective objectives

are common,

e.g.

evaluation of internal control. Therefore, certain

aspect of internal auditing may be useful

in

determining the

nature, timing and extent of

external audit procedures.

Dependence

Vs Independence

Whatever

be the degree of autonomy

given by the management to internal

auditing it cannot enjoy

the

same degree of independence as

external auditors. Moreover,

the responsibility for the

report is

that of the

external auditor alone, and therefore is

indivisible and is not

reduced by the reliance

on

internal

auditing.

128

Fundamentals

of Auditing ACC 311

VU

As a

result, all final judgments

relating to matters which are

material to the financial statements

or

other

aspects on, which he is reporting, must be

made by the external auditor

himself.

Understanding

of Internal Auditing

The

external auditors should

obtain a sufficient understanding of internal audit

activities to assist in

planning the audit

and developing an effective audit

approach.

Effective

internal auditing will often allow a reduction in

the procedures performed by the

external

auditors

but cannot eliminate them

entirely. However, external auditor may

decide not to use

the

internal

auditor's work.

Preliminary

Assessment of Internal

Auditing

After

obtaining understanding of internal auditing, if it

appears that its work is

relevant for external

auditors,

the external auditor should, during

the course of planning perform

preliminary assessment

of internal

auditing function. An effective internal audit may

allow a modification in the nature,

timing

and

extent of procedures performed by external

auditors.

Criteria

while Obtaining Understanding and

Preliminary Assessment of Internal

Auditing

Before

relying on the work performed by the

internal auditor, it is necessary for the

external auditor

to

make an assessment of the

effectiveness and relevance of the

internal audit function by

considering

the

following:

Organizational

status: The internal

auditor is an employee of the entity and

therefore

i)

cannot

be independent, however the external

auditor should evaluate to what extent he

is

free

in performing his duties and

communicate with external

auditor and consider

any

constraints

placed upon his

work.

Ideally, internal

auditor should be reporting to the

highest level of management

and should

be

free from other operating

responsibility.

Scope

and Objectives of Internal

Audit Function: The

external auditor should

examine

ii)

the

range and aim of the

assignments assigned to internal auditors

by the management and

whether

management acts on internal audit

recommendations.

Technical

Competence: The

external auditor should ascertain

whether staff of the internal

iii)

audit

function has adequate

technical training and proficiency as

auditors.

Due

Professional Care: The

external auditor should consider

whether the internal auditor

iv)

has

performed his work with

reasonable care and skill

i.e. work is properly

planned,

supervised

and reviewed. He should also

consider existence of working

papers, work

programs,

audit manuals etc.

Liaison and

Coordination

The extent of

liaison would normally encompass

the following:

i)

Initial

planning to formulate a joint approach to

minimize the tests performed by

the two

auditors

i.e. tests level, sample

selection, documentation of work

performed, review and

reporting

procedures.

ii)

Regular

meetings between the internal and

external auditors during the

year.

iii)

Exchange

of knowledge between the two

auditors i.e. the external

auditors should be

informed

of any significant matter

that comes to the knowledge

of internal auditor which

he

believes may affect to work

of external auditor. Similarly the

external auditor should

inform

the internal auditor of any significant

matters which may affect his

work.

Evaluating

Internal Audit

Work/Review/Controlling

Where

the external auditor has

decided to place reliance on the

work of internal auditor, he

should

review

the working papers to

satisfy himself as

to:-

i)

Audit

programs are

adequate.

ii)

The

work is performed by trained staff and

the work of assistants is properly

supervised,

reviewed and

documented.

iii)

Sufficient

appropriate audit evidence was

obtained.

iv)

Conclusions

made are appropriate.

v)

Reports

prepared are based on the

work done.

129

Fundamentals

of Auditing ACC 311

VU

vi)

Exceptions

or unusual items have been

properly resolved. The external

auditor

should

record all the working he

has received. The external auditor

should also

test

the work of internal auditor.

Testing

the Work of Internal

Auditing

It can

be done in the following

ways:

i)

Re-performing

the work done by internal auditor, on

test basis, to ensure that

the same

results

are achieved;

ii)

Selecting

a few similar items and

perform independent test;

and

iii)

Observation of

internal auditing procedures.

130

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT