|

VERIFICATION OF BANK BALANCES |

| << VERIFICATION OF EQUITY |

| VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

36

VERIFICATION

OF BANK BALANCES

Following

points should be considered during

verification of Bank

Balances:

i)

Agree

the balances with the bankbook,

and/or general ledger and

bank statement.

ii)

In

case of difference between bank

book and bank statement

obtain reconciliation for the

bank

accounts.

iii)

Check

that outstanding cheques

have been cleared with the

bank statement subsequent to the

year-end.

If cheques have not been

cleared subsequently ask for

any special reason why they

have

not

been cleared.

iv)

Check

that uncollected cheques

have been realized, with the

statement for subsequent

period.

v)

Scrutinize

the subsequent bank statement for

dishonored cheques in order to detect

worthless

cheques

deposited to conceal

shortages.

vi)

Investigate

any significant reconciling

items of an unusual

nature.

vii)

Investigate

about outstanding stale

cheques.

viii)

Obtain

direct bank confirmation.

Letter

of confirmation from bank.

The

purpose of this letter is to confirm

the bank balances and other

matters by the bank to the

auditor

directly.

The letter is

written by the Auditors to bank

requesting them to confirm the bank

balances and allied

matters

directly to

them.

It

contains the following

information:-

Requesting

bank to send following information

directly to them:-

(a)

Full

title of account and

balances thereon.

(b)

Accounts

closed during the period.

(c)

Interest

charged during the period.

(d)

Details

of security and

charges.

(e)

Details

of investments or document

held.

Standard

Letter of Request for Bank

Report

The

Manager

(Bank

Branch)

Date:

Dear

Sir,

(CLIENT'S

NAME)

STANDARD

REQUEST FOR BANK

REPORT

FOR

AUDIT PURPOSES

In

accordance with your above

named customer's instructions

given hereon, please send

DIRECT to us at the

above

address, as auditors of your

customer, the following

information relating to their

affairs at your

branch

as at

the close of business on ..............

(Balance sheet date) and, in

the case of items 2, 4 and

9, during the

period

since.............. (Opening date of the

period)

Please

state against each items

any factors which may limit

the completeness of your

reply; if there is

nothing

to report,

state `NONE'.

It is

understood that any replies given

are in strict confidence,

for the purposes of

audit.

BANK

ACCOUNTS

1.

Full

titles of all accounts together

with the account numbers and

balances thereon, including NIL

balances:

a)

Where

your customer's name is the

sole name in the

title;

b)

Where

your customer's name is

joined with that of other

parties;

c)

Where

the account is in a trade

name.

116

Fundamentals

of Auditing ACC 311

VU

NOTES

Where

the amount is subject to any

restriction (e.g. a garnishee order or

arrestment) or exchange

control

considerations

(e.g. `blocked account')

this information should be

stated.

2.

Full

titles and dates of closure

of all accounts closed during

the period.

3.

The

separate amounts accrued but

not charged or credited as at

the above date, of

a)

Interest

and

b)

Provisional

charges (including commitment

fees)

4.

The

amount of interest charged

during the period if not

specified separately in the

customer's

statement

of account.

5.

Particulars

(i.e. date, type of document

and accounts covered) of any

written acknowledgment of

set-

off,

either by specific letter of set-off, or incorporated in

some other document or

security.

6.

Details

of loans, overdrafts, cash

credits and facilities,

specifying agreed limits and in

the case of term

loans,

date for repayment or

review.

7.

a)

SECURITY:

Please given:

(i)

Details of any security

formally charged to the

bank, including the date and

type of charge, (e.g.

pledge,

hypothecation etc.)

(ii)

Particulars

of any undertaking to assign to the bank

any assets. If a security is

limited to any

borrowing,

or if there is a prior, equal or

subordinate charge, please

indicate.

b)

Investments,

bills of exchange, documents of title or

other assets held but not

charged.

Please

give details.

CONTINGENT

LIABILITIES

8.

All

contingent liabilities, viz.:

i)

Total

of bills discounted for your

customer, with

recourse;

ii)

Details

of any guarantees, bonds or

indemnities given to you by the

customer in favor of

third

parties;

iii)

Details

of any guarantees, bonds or

indemnities given by you, on

your customer's

behalf,

stating

where there is recourse to

your customer and/or to its

holding, parent or

any

other

company within the

group.

iv)

Total

of acceptances;

v)

Total

of forward exchange

contracts;

vi)

Total

of outstanding liabilities under

documentary credits;

vii)

Other

- please give

details.

9.

A list of

other banks, or branches of

your bank, where you are

aware that a relationship has

been

established

during the period.

Yours

faithfully,

DISCLOSURE

AUTHORISED

For

and on behalf of

(CUSTOMER'S

NAME)

Signed

in accordance with the

terms

and

conditions for the conduct of

the

customer's

bank account.

117

Fundamentals

of Auditing ACC 311

VU

Verification

of Debtors Balances

Following

points should be considered during

verification of Debtors Balance:

i)

Obtain

confirmation from

debtors.

ii)

Verify

debts with reference to cash

received since

year-end.

iii)

Check

accuracy and completeness of

debtors' listing.

iv)

Check

book-keeping in small sample of ledger

accounts.

v)

Check

postings and enquire into

unusual entries in the

control account.

vi)

Verify

nature, amount and

classification of credit

balance.

vii)

Check

transaction of foreign currency

balances.

viii)

Review

post year-end credit

notes.

ix)

Enquire

into debtor balances cleared by

journal entries after the

year-end

x)

Consider

un-provided claims, enquire

and review

correspondence.

xi)

Check

credit note cut-off, if

material.

xii)

Consider

adequacy and check bases

and calculations of provisions

for rebates

xiii)

Verify

existence and title to bills

receivable, trace

proceeds.

xiv)

Consider

whether results of work on

cutoff affect

debtors.

xv)

Review

audit work on income.

Confirmation

from Debtors:

Through

verification of debtor's balances by

direct communication the

auditor obtains information

regarding:

(i)

Adequacy

of the system of internal control over

sales, debtors, and

collections;

(ii)

Accuracy

of accounting records in general

and of cut-off procedures

for balance sheet

purposes

in

particular; and

(iii)

Irregularities

such as teeming and lading,

overdue balances & incorrect

balances.

The

above information helps an

auditor to form an opinion

regarding:

(a)

Reliability of

debtors balances; and

(b)

Quantum

and nature of disputes

existing between the company

and its customer.

Methods

of obtaining Debtors Confirmation

(i)

Positive

Method.

Under

positive method the company requests the

debtor to confirm his

indebtedness

to the company direct to the auditor

and in case of disagreement he is

also required to

state

the balance as per his

records and provide the

auditor with full particulars of

the difference.

(ii)

Negative

Method.

Under negative method the

company requests the debtor to

communicate with

the

auditor only if he disagrees with the

balance. If no communication is received

within specified

time

the auditor may assume that

the balance is

agreed.

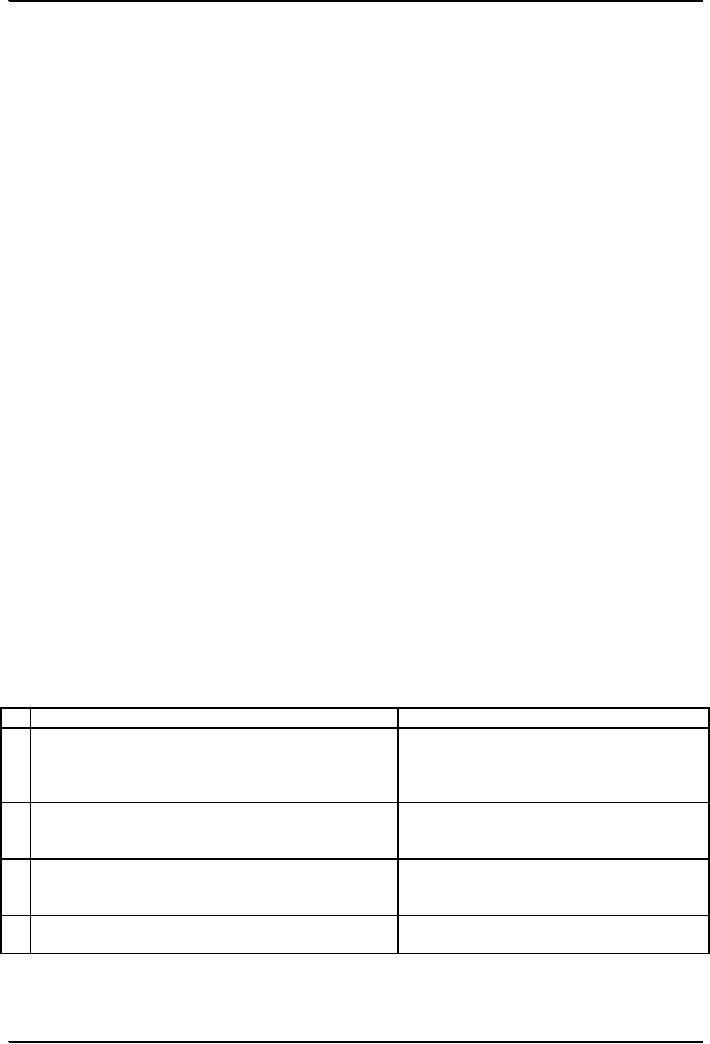

Distinguish

between Positive and Negative

Confirmation

Positive

Confirmation

Negative

Confirmation

a) In

positive confirmation company request,

the debtor

In

negative confirmation company

request, the

to

confirm the balance direct to

the auditor whether he

debtor to

confirm the balance to auditor

only

agrees

while or not.

if he

disagree with

balance.

b) In positive

confirmation if no reply is received

the

In

negative confirmation if no reply is

received

auditors

have to adopt other procedures to

verify those

the

auditor may assume that the

balance is

balances.

agreed.

c)

Positive confirmation is preferred

when the internal

Negative

confirmation is preferred when

the

control

system is not

satisfactory.

internal

control system is satisfactory or

when

confirming

a large number of small

balances.

d)

Confirming significant balances

due from debtors

under

Confirming

a large number of small

balances

positive

confirmation.

under

negative confirmation.

118

Fundamentals

of Auditing ACC 311

VU

Other

procedures if reply is not

received to Positive

Confirmation

When

no reply is received to a positive confirmation the

auditor should carry out the

following procedures:

i)

Check

the outstanding balances as of balance

sheet date have been

subsequently received.

ii)

If

subsequently not received then

examine sale order, dispatch

note, invoices and

relevant

documents

and correspondence with

concerned debtors.

119

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT