|

AUDITORS’ REPORT |

| << AN INTRODUCTION |

| Advantages and Disadvantages of Auditing >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

02

Fundamentals

of Auditing

Auditing

An Introduction

What

is an auditor's report?

The

primary aim of an audit is to enable the

auditor to say "these

accounts show a true and

fair view" or, of

course,

to say that "they do not

show a true and fair

view".

At the

end of his audit, when he has

examined the entity, its

record, and its financial

statements, the auditor

produces

a report addressed to the owners/stake

holders in which he expresses

his opinion of the truth

and

fairness,

and sometimes other aspects,

of the financial statements.

Standard

format of Auditor's Report as

per the Companies Ordinance

1984:

FORM

35A

AUDITORS'

REPORT

We

have audited the annexed balance

sheet of COMPANY NAME as at THE DATE

and the related

profit

and

loss account, cash flow

statement and statement of

changed in equity together with the notes

forming

part

thereof, for the year then

ended and we state that we

have obtained all the information

and

explanations

which to the best of our knowledge

and belief were necessary

for the purposes of our

audit.

It is the

responsibility of the company's management to

establish and maintain a system of

internal control

and

prepare and present the

above said statements in

conformity with the approved accounting

standards

and

the requirements of the Companies Ordinance,

1984. Our responsibility is to express an

opinion on

these

statements based on our

audit.

We

conducted our audit in

accordance with the auditing

standards as applicable in Pakistan.

These

standards

require that we plan and

perform the audit to obtain

reasonable assurance about whether

the

above

said statements are free of

any material misstatement. An

audit includes examining, on a test

basis,

evidence

supporting the amounts and

disclosures in the above said

statements. An audit also

includes

assessing

the accounting policies and significant

estimates made by management, as

well as evaluating the

overall

presentation of the above said

statements. We believe that

our audit provides a reasonable

basis for

our

opinion and, after due

verification, we report that:

a) In

our opinion, proper books of

accounts have been kept by

the company as required by the

Companies

Ordinance, 1984

b) In

our opinion:

i. The

balance sheet and profit

and loss account together

with the notes thereon have

been

drawn-up in

conformity with the Companies Ordinance,

1984, and are in agreement

with the

books of

account and are further in

accordance with accounting

policies consistently applied

ii.

The expenditure incurred during the year

was for the purpose of the

company's business;

and

iii.

The business conducted

investments made and the expenditure

incurred during the year

were

in

accordance with the objects of the

company.

c) In

our opinion and to the best

of our information and

according to the explanations given to us,

the

balance

sheet, profit and loss

account, cash flow statement

and statement of changes in equity

together

with

the notes forming part

thereof conform with approved

accounting standards as applicable

in

Pakistan

and, give the information required by the

Companies Ordinance, 1984, in the manner

so

required

and respectively give a true and

fair view of the state of the

company's affairs as at DATE

and

of the

profit/loss its cash flows

and changes in equity for the

year then ended;

and

d) In

our opinion Zakat deductible at

source under the Zakat and

Usher Ordinance, 1980 was

deducted by

the

company and deposited in the Central

Zakat Fund established under

Section 7 of that Ordinance.

Date

Signature

Place

(Name(s)

of Auditors)

3

Fundamentals

of Auditing ACC 311

VU

Standard

format of Auditor's Report as

per the International

Auditing Standards:

INDEPENDENT

AUDITOR'S REPORT

[Appropriate

Addressee]

Introductory

Paragraph

We

have audited the accompanying financial

statements of ABC Company,

which comprise the

balance

sheet

as at December 31, 20X1, and

the income statement, statement of

changes in equity and cash

flow

statement

for the year then ended,

and a summary of significant accounting

policies and other

explanatory

notes.

Management's

Responsibility for the Financial

Statements

Management

is responsible for the preparation and

fair presentation of these financial

statements in

accordance

with International Financial Reporting

Standards. This responsibility includes:

designing,

implementing

and maintaining internal control relevant

to the preparation and fair presentation of

financial

statements

that are free from

material misstatement, whether due to

fraud or error; selecting and

applying

appropriate

accounting policies; and making

accounting estimates that

are reasonable in the

circumstances.

Auditor's

Responsibility

Our

responsibility is to express an opinion on

these financial statements

based on our audit. We

conducted

our

audit in accordance with

International Standards on Auditing.

Those standards require that we

comply

with

ethical requirements and plan

and perform the audit to

obtain reasonable assurance whether

the

financial

statements are free from

material misstatement.

An

audit involves performing

procedures to obtain audit

evidence about the amounts and

disclosures in the

financial

statements. The procedures

selected depend on the auditor's judgment,

including the assessment

of the

risks of material misstatement of the

financial statements, whether due to

fraud or error. In making

those

risk assessments, the auditor considers

internal control relevant to the entity's preparation

and fair

presentation of the

financial statements in order to design

audit procedures that are

appropriate in the

circumstances,

but not for the purpose of

expressing an opinion on the

effectiveness of the entity's

internal

control.

An audit also includes evaluating the

appropriateness of accounting policies

used and the

reasonableness

of accounting estimates made by

management, as well as evaluating the

overall presentation

of the financial

statements.

We

believe that the audit

evidence we have obtained is sufficient

and appropriate to provide a basis

for our

audit

opinion.

Opinion

In our

opinion, the financial statements give a

true and fair view of (or"

present fairly, in all

material

respects,")

the financial position of ABC Company as

of December 31, 20X1, and of

its financial

performance

and its cash flows

for the year then ended in

accordance with International

Financial

Reporting

Standards.

Report on

Other Legal and Regulatory

Requirements

[Form

and content of this section of the auditor's

report will vary depending on the nature

of the auditor's

other

reporting responsibilities.]

[Auditor's

signature]

[Date

of the auditor's report]

[Auditor's

address]

What

stands for auditor's

opinion?

The

auditor, in his report, does

not say that the financial

statements do show a true

and fair view. He can

only

say that in his opinion the

financial statements show a true

and fair view. The reader or

user of

financial

statements will know from

his knowledge of the auditor whether or

not to rely on the auditor's

opinion.

If the auditor is known to be independent,

honest, and competent, then

his opinion will be

relied

upon.

4

Fundamentals

of Auditing ACC 311

VU

What

are the different types of

audit?

Three

types of audits are

discussed in general,

i.e.,

1. Financial

statement audits

2.

Operational audits

3.

Compliance audits

Financial

Statement Audits

An

audit of financial statements is

conducted to determine whether the

overall financial statements (the

quantifiable

information being verified) are

stated in accordance with

specified criteria. Normally, the

criteria

are the requirements of the applicable

International Financial Reporting

Standards (IFRSs) and

the

Companies

Ordinance 1984. The financial statements

most commonly comprises of the Balance

Sheet,

Income

Statement, Statement of Changes in

Equity, Cash Flow Statement,

and Notes to the

accounts.

The

assumption underlying an audit of

financial statements is that these

will be used by different

groups for

different

purposes. Therefore, it is more efficient

to have one auditor who

will perform an audit and

draw

conclusions

that can be relied upon by

all users than to have

each user perform his or

her own audit. If a

user

believes that the general

audit does not provide

sufficient information for

his or her purposes, the

user

has

the option of obtaining more

data. For example, a general

audit of a business may

provide sufficient

financial

information for a banker considering a

loan to the company, but a corporation

considering a

merger

with that business may

also wish to know the

replacement cost of fixed

assets and other

information

relevant to the

decision. The corporation

may use its own auditors to

get the additional

information.

Operational

Audits

An operational

audit is a review of any part of an

entity's operating procedures and methods

for the

purpose

of evaluating efficiency and effectiveness. At the

completion of an operational audit,

recommendations

to management for improving

operation are normally

expected.

An

example of an operational audit is evaluating the

efficiency and accuracy of processing

payroll

transactions

in a newly installed computer system. Another

example, where most

accountants would feel

less

qualified is evaluating the efficiency, accuracy,

and customer satisfaction in

processing the distribution

of

letters and parcels by a courier

company such as TCS.

Because

of the many different areas in

which operational effectiveness can be

evaluated, it is impossible to

characterize

the conduct of a typical operational audit. In one organization,

the auditor might evaluate

the

relevancy

and sufficiency of the information used

by management in making decisions to

acquire new fixed

assets,

while in a different organization the

auditor might evaluate the efficiency of

the paper flow in

processing

sales.

In operational

auditing, the reviews are not

limited to accounting. They can include

the evaluation of

organization

structure, computer operations, production

methods, marketing, and any

other area in which

the

auditor is qualified.

The

conduct of an operational audit and the reported

results are less easily

defined than for either of

the

other

two types of audits.

Efficiency and effectiveness of

operations are far more

difficult to evaluate

objectively

than compliance or the presentation of financial

statements in accordance with

accounting

conventions

and principles; and establishing criteria

for evaluating the quantifiable

information in an

operational

audit is an extremely subjective

matter.

In this

sense, operational auditing is more

like "management consulting"

than what is generally regarded

as

"auditing".

Operational auditing has

increased in importance in the past

decade.

Compliance

Audits

The

purpose of a compliance audit is to

determine whether the entity is following

specific procedures,

rules,

or

regulations set down by some

higher authority.

A

compliance audit for a

private business could include determining whether

accounting personnel

are

following

the procedures prescribed by the company

controller, reviewing wage rates

for compliance with

minimum

wage laws, or examining contractual

agreements with bankers and

other lenders to be sure

the

company

is complying with legal

requirements.

In the

audit of governmental units such as

districts school, there is

extensive compliance auditing

due to

extensive

regulation by higher government authorities. In virtually

every private and non

profit organization,

5

Fundamentals

of Auditing ACC 311

VU

there

are prescribed policies,

contractual agreements, and

legal requirements that may

call for compliance

auditing.

Results

of compliance audits are

typically reported to someone within the

entity being audited rather than

to

a broad

spectrum of users.

Management,

as opposed to outside users, is the

primary group concerned with the extent

of compliance

with

certain prescribed procedures

and regulations. Hence, a significant

portion of work of this type is

done

by auditors

employed by the entity itself.

There

are exceptions; when an organization

wants to determine whether individuals or

entities that are

obligated to

follow its requirements are

actually complying, the auditor is

employed by the entity issuing

the

requirements.

An

example is the auditing of taxpayers

for compliance with the

federal tax laws, where the

auditor is

employed

by the government to audit the taxpayers' tax

returns.

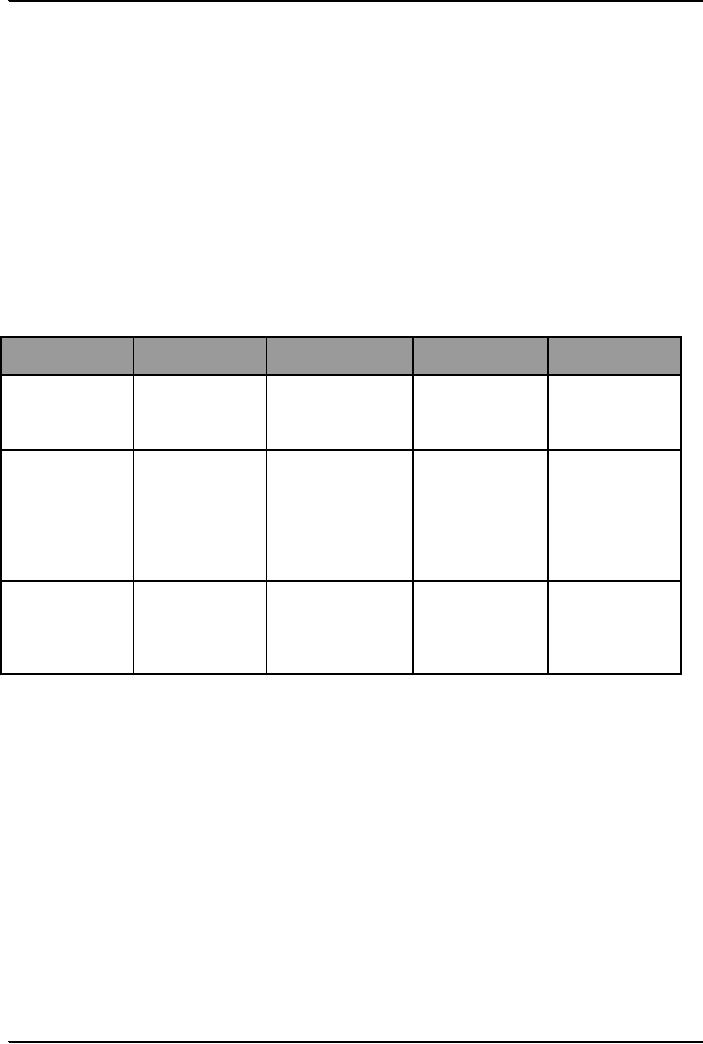

Following

table summarizes the three types of

audits and includes an

example of each type and

an

illustration

of three of the key parts of the

definition of auditing applied to each

type of audit.

Examples

of the Three Types of

Audits

TYPES

OF

EXAMPLE

QUANTIFIABLE

ESTABLISHED

AVAILABLE

AUDIT

INFORMATION

CRITERIA

EVIDENCE

Financial

Annual

Audit of

General

Motors

International

Documents,

Statement

Audit

General

Motors'

financial

statements

Financial

records,

and

financial

Reporting

outside

sources

statements

Standards

of

evidence

Operational

Evaluate

whether

Number

of payroll

Company

Error

reports,

Audit

the

computerized

records

processed

standards

for

payroll

records,

payroll

processing

in a

month, costs of

efficiency

and

and

payroll

for

subsidiary is

the department,

and

effectiveness

in

processing

costs

number of

errors

payroll

operating

made

department

efficiently

and

effectively

Compliance

Determine

if

Company

records

Loan

agreement

Financial

Audit

bank

provisions

statements

and

requirements

for

calculations

by

loan

continuation

the

auditor

have

been met

6

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT