|

Flow Charts and Internal Control Questionnaires |

| << Benefits of Internal Control to the entity |

| Construction of an ICQ >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

18

EVALUATING

THE INTERNAL CONTROL SYSTEM

Flow

Charts and Internal Control

Questionnaires:

Use

of the major symbols in flow

charts

The

Document symbol

Each

document in the flowchart should have a vertical

flow-line. Such vertical flow-lines

represent a

movement in time

within a particular department. When the

document is moved to another

department, this

movement in position will be represented

by a horizontal line; departments

are

therefore listed

across the page.

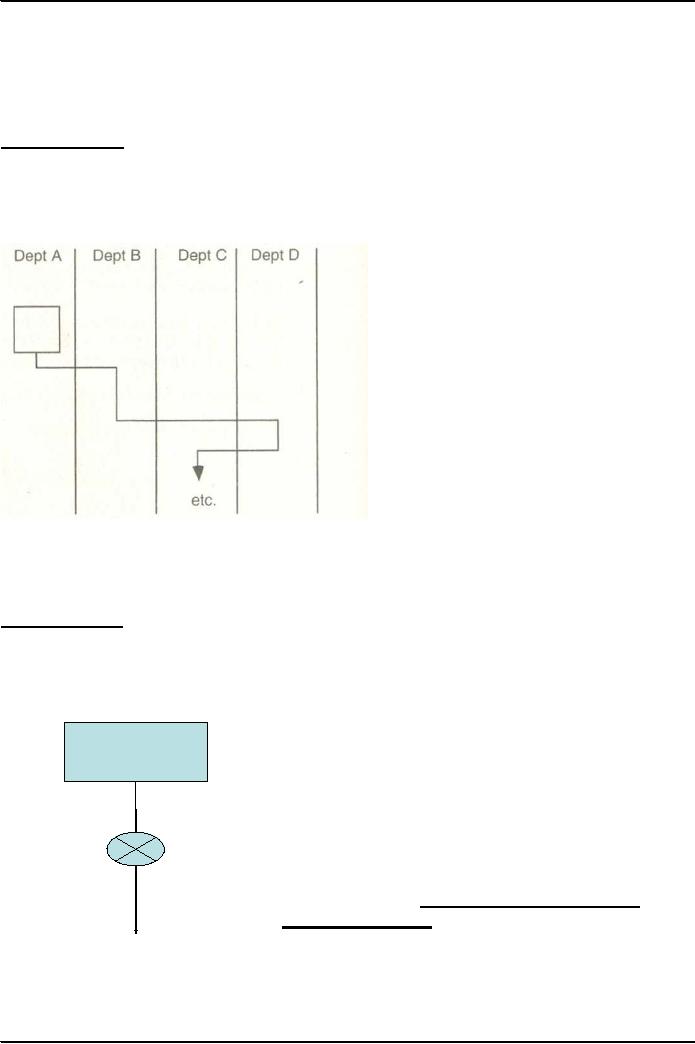

Here

the document is originated in Dept

A. It is moved to

Dept B, then Dept D and

then Dept C. Note

that only vertical and

horizontal lines are

used, never

diagonal lines.

The

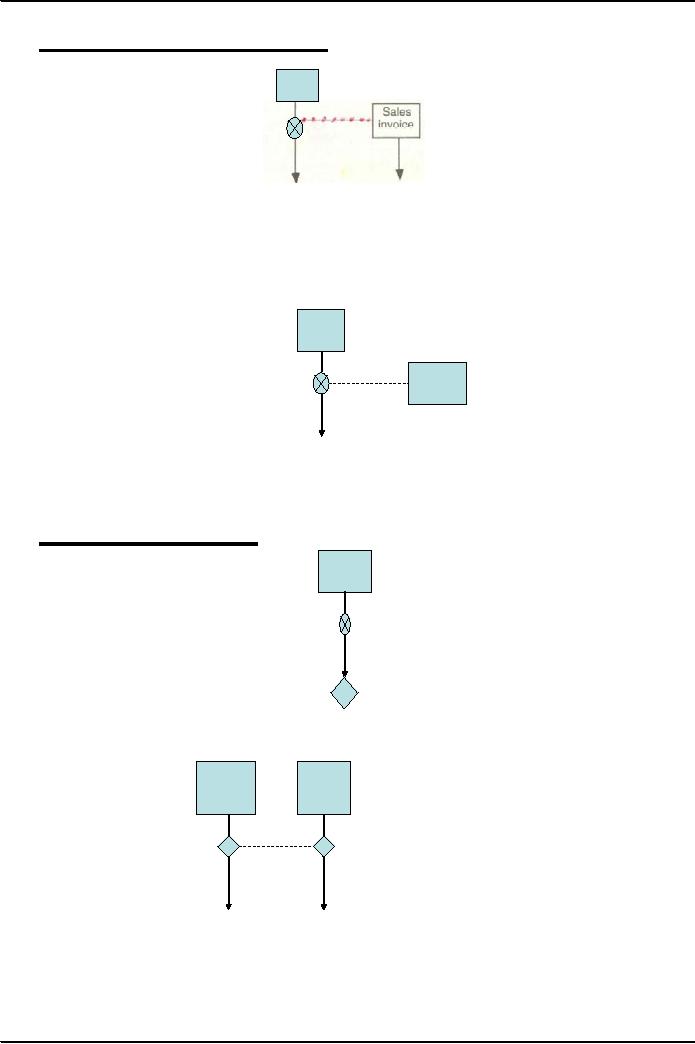

Operation symbol

Various

operations will be performed on a

document.

It

will, for instance: be

prepared, added up, used to

prepare other documents,

etc.

Any

operation, other than a

check function, is represented by the

cross symbol.

Each

operation symbol should be supported by a

brief narrative explaining the nature of

the operation.

Invoice

Kamran

totals the invoice

Note that

the operation symbol is

positioned on a

vertical

flow-line. It should never

appear on a

horizontal

flow-line since that would

suggest in this

case that

Kamran totals the invoice

while it is

etc.

moving

from one department to

another.

63

Fundamentals

of Auditing ACC 311

VU

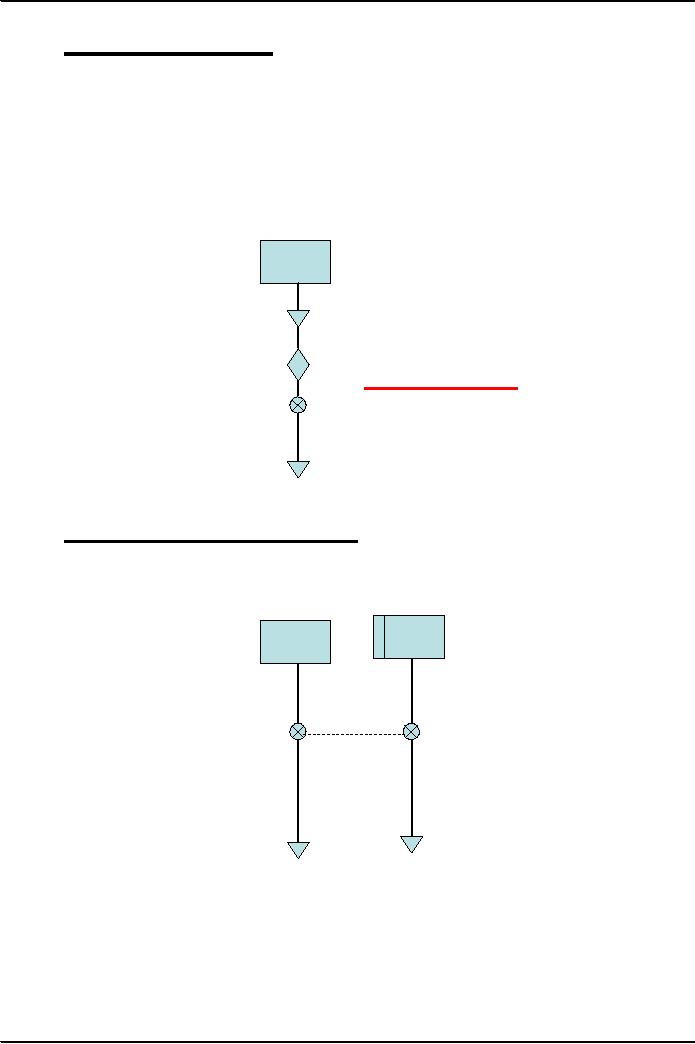

The

Information flow

symbol

Here one

document is

prepared

from

Sales

another.

order

The

movement of

Fauzia

prepares an invoice

information to

the

from the

sales order

sales

invoice is shown

by a dotted

line.

Such

information

flow-lines

are always

horizontal,

never

vertical.

Note that

flow-lines

then

continue for both

the order

and the

invoice.

This

example is wrong

because:

Sales

(a) no

narrative exists to

explain

order

the nature

of the operation;

(b) the

sales invoice has no

Sales

flow-line, it

disappears into

Invoice

thin

air.

The Check

symbol

Sales

Invoice

Sattar

totals the invoice

This

example

shows a

simple

check on a

single

Wajid

checks the totals

document.

This shows

a check

between

two

Delivery

Sales

documents.

Note

Invoice

Note the

use of the

Pasha

checks that all

information

flow-line

goods

dispatched have

again and

that both the

been

invoiced.

delivery

note and the

sales

invoice continue

with

vertical flow-lines

of their

own.

64

Fundamentals

of Auditing ACC 311

VU

The

filing symbol

Once

documents have been

processed they will often be

filed away.

Such files

are either permanent or

temporary.

The two

sorts of file are denoted by

the same symbol but

the

temporary

files are marked with a

letter `T'.

It will

often be useful to indicate

the order of filing either

numerically,

alphabetically

or in

chronological

order.

This can be done by

marking

the symbol with the

letter N, A, or D.

Purchase

Note that

with the temporary

Order

filing

symbol the

flow-line of the

document

must continue.

Filed

awaiting delivery of

goods.

TN

With the

permanent

filing symbol

the

flow-line stops since

the

Checked by

Zahoor

document

has reached its

(weekly) got late

delivery

ultimate

destination

When goods

are received

purchase

order initialed by

Safdar

N

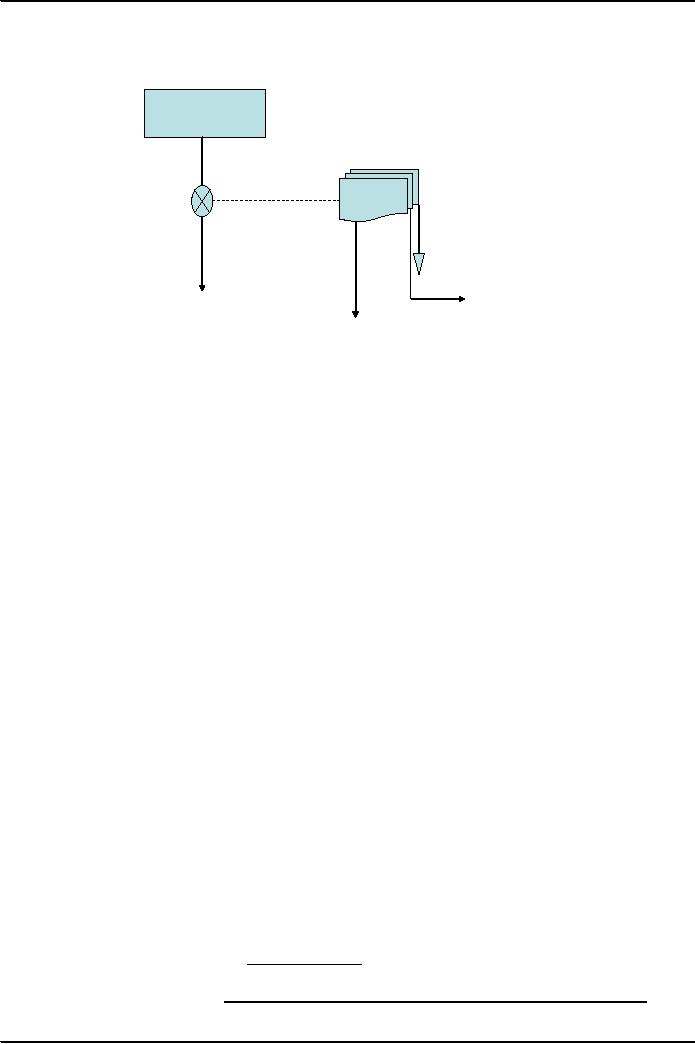

The

book of account

symbol

The

flowchart should use the

book symbol to show the

book which

is

already in

existence. It should

also show the book

being re-filed once

the

posting is

completed.

Sales

Sales

Daybook

Invoice

Sohail

posts invoices to the

SDB

D

Note that

the same

flow-line principles apply to

books as to documents. A vertical

flow-

line is

needed which ends with

the re-filing of the sales

day book which will be

kept

chronologically.

65

Fundamentals

of Auditing ACC 311

VU

Depicting

multi-part sets of documents

Requisition

Note

Purchase

Rauf

prepares

purchase

order sets

order

N

To

supplier

Note that

each part of the set

must have a flow-line

emanating from it. In

this

example;

PO1 is sent to the supplier,

PO2 goes off to another

department and PO3

is filed

numerically

Preliminary

Evaluation of the System

Having

ascertained,

confirmed and recorded the

system, the auditor now

needs to carry out a

preliminary

evaluation of the

system in order to make a

decision as to whether he will:

� Rely

on internal controls and adopt a

systems audit approach,

or,

� Perform

extensive substantive testing. Using a

verification approach to the

audit.

Internal

Control Questionnaire

Features:

� Used

in large company

audit

� Used

to place reliance on internal

controls

� Used

to design audit

approach

Definition:

An ICQ

is a formal and usually

standardized document which

comprises:

1. A

list of internal controls in existence

and

2.

Highlights any

weaknesses.

Objectives:

(i)

To ascertain

a clients

systems of accounting and

internal control

(ii)

To evaluate

the

control system thus

recorded, and hence

(iii)

To identify

those

controls which indicate strengths in the

system upon which the

auditor

will

seek to place reliance,

and

(iv)

To identify

those

areas over which there

are weak or no controls and

which therefore

must

be subjected to more extensive

substantive testing and

reported by inclusion in the

Management

Letter.

Construction of an

ICQ

I)

It is

good practice when designing

ICQs to state, as a brief

introduction:

i. A

list of control objectives

which each sub-system under consideration

should

seek

to achieve

ii.

Any business considerations

specific to the enterprise under review

which

should be taken

into account.

66

Fundamentals

of Auditing ACC 311

VU

The

reason for this is essentially to

highlight for the audit staff

key areas for their

consideration to the audit

staff.

II)

The questions in an ICQ should be

designed to ascertain whether the control

objectives are being

achieved

and should therefore cover such

aspects as:

a.

Instructions given to staff in the performance

of their duties

b.

Authorization procedures

c.

Documents and procedures

used to originate transactions

d.

Recording procedures

e.

Sequence of procedures

f.

Custody procedures

g.

Relative independence of the persons

involved at each

stage

of a

transaction (i.e. segregation of

duties).

III)

The questions should be framed

such that a Yes/No answer is

given, with a No answer

usually

indicating

a control weakness.

IV) An

ICQ should carry such basic

information as:

(a)

The name of the document

(ICQ)

(b) the

system to which it relates

(e.g. purchasing

cycle)

(c)

the client to whom it

relates

(d) the

accounting period under review

(e)

evidence of who has prepared

and reviewed the document

(f)

the provision of columns

for:

- Yes

and No answers

-

comments where neither Yes

or No are applicable

-

indicating the significance or otherwise

of apparent weaknesses

-

references to audit

programs

-

references to Management

Letters.

67

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT