|

Contents of Balance Sheet |

| << BOOKS OF ACCOUNT & FINANCIAL STATEMENTS |

| ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

10

BOOKS

OF ACCOUNT & FINANCIAL

STATEMENTS

1.

Books

of Account to be kept by Company

[Section-230]

1.1

A

company should keep proper books of

account in respect

of:

e)

Cash received and expended

by the company;

f)

Sales and purchases of

goods by the company;

g) All

Assets and liabilities of the

company; and

h) In

case of a company engaged in

production, processing, manufacturing, or

mining activities, a

production

record as may be required by the

Commission through a general or

special order;

1.2

Books of

account should be preserved for ten

years;

1.3

Books of

account are to be kept at the

registered office of the company. If

kept at any other

place,

the

registrar should be informed;

1.4

Books of

account should give a true and fair

view of the state of affairs of the

company and should

contain explanation

of transactions.

1.5

Directors

can inspect the books of account

during the business

hours.

1.6

If

company fails to comply with the

above provisions a director, including chief

executive and chief

accountant:

(a) of

listed company is liable to imprisonment for

one year and a fine of

not less than Rs.

20,000

not

more than Rs. 50,000,

and a further fine of Rs.

5000 per day during

which the default

continues;

or

(b) of

other companies is liable to imprisonment

for six months and with a

fine, which may

extend

to Rs.

10,000

2.

Annual

Accounts and Balance Sheet [Section

233]

2.1

First

annual accounts of a company

must be presented before the AGM within

eighteen months

from

the date of incorporation.

2.2

A

subsequent annual accounts should be

presented once at least in

every calendar year before

an

AGM.

In other words, the accounts should be

presented in the AGM within three months

of the

date

of balance sheet. However, in the

case of a listed company the

Commission and in other

cases

the

registrar can extend this period

for a term not exceeding two

months.

2.3

The

accounts should be made up, in the case

of first accounts, from the

date of incorporation,

and

in the

case of subsequent accounts,

from the date of the preceding

accounts to a date not

earlier

than the

date of the meeting by more

than four months.

2.4

The

accounts shall be prepared

for a period not exceeding

12 months, except in case

where

permission

is granted by the registrar for

preparation of accounts for a longer

period.

2.5

Profit

and Loss account and

Balance Sheet shall be audited by the

auditor and auditor's

report

should be

attached thereto.

2.6

Copy of

accounts, auditor's report and directors'

report should be sent to every

member at least

twenty-one

days before the Annual General Meeting

(AGM).

2.7

Listed

companies are required to send

five copies of their audited

accounts to the registrar, the

Commission

and the stock exchange

within 30 days.

3.

Contents

of Balance Sheet [Section

234]

General:

3.1

a)

Balance Sheet and Profit

& Loss Account should give a true and

fair view of the state of

the

company's

affairs and of the profit or

loss of the company.

b) An item of

expenditure fairly chargeable to income

shall be brought into

account.

c) Any

expenditure which in fairness can be

distributed over several

years but is incurred in

one

year

should be so distributed and reasons

for doing so should be given.

3.2

For

Listed Companies and Private or Non Listed

Public Companies Which is a

Subsidiary

of a Listed

Company:

a)

Balance

Sheet and profit and

loss account should be prepared in

accordance with

Fourth

Schedule;

36

Fundamentals

of Auditing ACC 311

VU

b)

A

statement of changes in equity and

cash flow statement.

c)

Accounting

policies should be stated and,

where there is any change in

accounting polices

the

auditor shall report whether he

agrees with the

change.

d)

International

Financial Reporting Standards as adopted by

SECP should be followed in

preparation of

accounts.

For

Other Companies:

3.3

a)

Balance

Sheet and profit and

loss account shall be

prepared in accordance with

the

Fifth

Schedule;

b)

A

statement of changes in equity and

cash flow statement.

c)

Accounting

policies should be stated and,

where there is any change in

accounting

polices

the auditor shall report whether he

agrees with the

change.

d)

International

Financial Reporting Standards as adopted by

SECP should be

followed

in preparation of accounts.

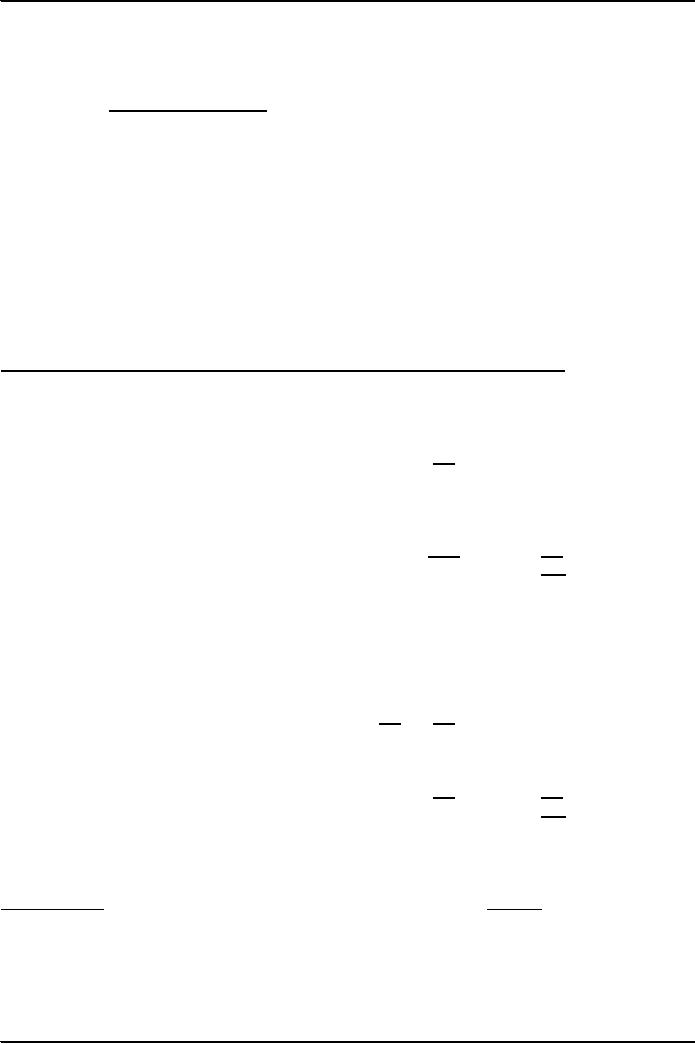

Limited

Liability Company

Balance

Sheet

As on December

31, 2006

Rs.

Rs.

Assets

Non

Current Assets

Fixed

Assets

Tangible

Assets

***

***

Intangible

Assets

***

Long

Term Investments

***

Long

Term Advances, Deposits &

Prepayments

***

Deferred

Cost

***

Current

Assets

***

***

Current

Liabilities

(***)

Capital

Employed

***

Financed

By

Owners'

Equity

Ordinary

Share Capital

***

Reserves

Capital

Reserves

***

***

***

Revenue

Reserves

***

Non

Current Liabilities

Loan

Stocks/Term Finance

Certificates

***

Loan

from financial institutions

***

***

Finance

lease liability

***

***

Director

Chief

Executive

37

Fundamentals

of Auditing ACC 311

VU

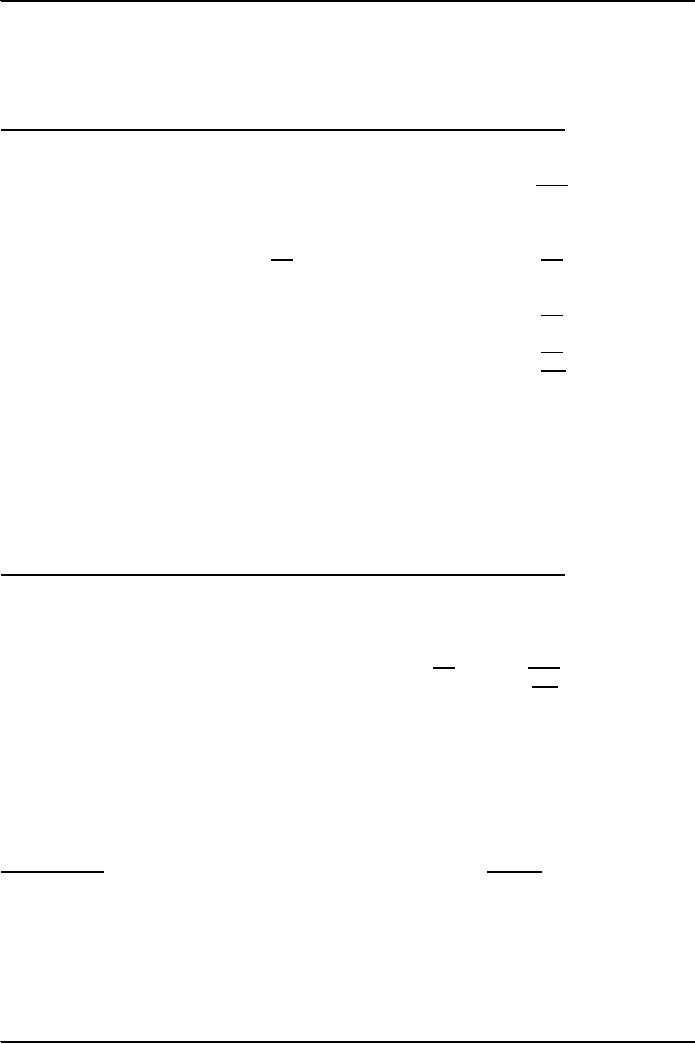

Limited

Liability Company

Income

Statement

For

the Year ended December 31,

2006

Rs.

Rs.

Sales

***

Cost

of goods sold

(***)

Gross

profit

***

Operating

expenses

Administrative

expense

***

***

Selling

& Marketing expenses

***

Profit

from operations

***

Other

income

***

Financial

expenses

***

Profit

before tax

***

Income

tax expense

***

Profit

after tax

***

Limited

Liability Company

Statement

of changes in equity

For

the year ended December 31,

2006

Rs.

Rs.

Retained

profits b/f

***

Profit

after tax

***

Dividend

paid

***

(***)

Transfer to

reserves

***

Retained

profits c/f

***

Director

Chief

Executive

38

Fundamentals

of Auditing ACC 311

VU

4. Treatment

of Surplus Arising on Revaluation of

Fixed Assets [Section

235]

4.1

Any

surplus on revaluation of fixed assets

should be transferred to an account named

"Surplus on

revaluation of

fixed assets account".

4.2

This

account should be shown in the balance

sheet after capital and

reserves;

4.3

Surplus

on revaluation shall not be set

off or reduced

except:

a)

For

setting of any decrease in revaluation of

asset; or

b)

When

revalued asset is disposed

of, surplus relating to it can be

adjusted or set off.

4.4

Depreciation

on assets which are revalued

shall be determined with reference to the

value assigned

to

such assets on revaluation and

depreciation charge for the period

shall be taken to the Profit

and

Loss

Account;

4.5

An amount

equal to incremental depreciation for the

period shall be transferred

from "Surplus on

Revaluation of

Fixed Assets Account" to

un-appropriated profit / accumulated

loss through

Statement

of Changes in Equity to record

realization of surplus to the extent of the

incremental

depreciation

charge for the

period;

4.6

An amount

equal to incremental depreciation charged

in previous years may be transferred

from

"Surplus on

Revaluation of Fixed Assets Account" to

un-appropriated profit / accumulated

loss

through

Statement of Changes

Equity.

5.

Director's

Report [Section 236]

5.1

Director's

report shall be attached to the

Balance Sheet.

5.2

It

shall state business

affairs, proposed dividend, if

any, amounts set aside to

reserve, if any.

5.3

In the

case of a public company or a

private company which is a

subsidiary of a public

company

director's

report shall also

include:-

a)

Disclosure

of any material changes and

commitments affecting the financial

position which

have

occurred between the year

end and the date of

report;

b)

Disclosure

of any material changes in the

nature of business etc., which

have occurred

during

the year, if the disclosure is necessary

for understanding the state of the

company's

affairs.

c)

Explanation

to any qualification in auditor's

report.

d)

Pattern of

holding of shares (percentage of

shares held by the parties).

e)

Name

and country of incorporation of

holding company if any,

where such holding

company

is established outside

Pakistan.

f)

The

earning per share.

g)

Reasons

for incurring loss and

reasonable indication of future

prospects of profit, if

any.

h)

Information

about defaults in payment of

debts, if any, and reasons

thereof.

5.4

The

directors of a holding company required

to prepare consolidated financial

statements under

section

237 shall make out

and attach to consolidated financial

statements, a report with

respect to

the

state of group's affairs and

all provisions of subsection (2),

(3) and (4) shall apply to

such

report.

5.5

Director's

Report shall be signed by the chairman or

the chief executive, if so authorized by the

directors;

otherwise by the chief executive and a

director.

6.

Balance

Sheet of Holding Companies [Section

237]

6.1

Consolidated

Financial Statements

(1)

There

shall be attached to the financial

statements of a holding company having

a

subsidiary

or subsidiaries, at the end of the financial

year at which the holding

company's

financial

statements are made out,

consolidated financial statements of the

group presented

as

those of a single enterprise

and such consolidated financial

statements shall comply

with

the

disclosure requirement of the Fourth

Schedule and International

Accounting Standards

notified

under sub-section (3) of section

234.

(2)

Where

the financial year of a subsidiary

precedes the day on which the

holding company's

financial

year ends by more than

three months, such subsidiary

shall make an interim

closing

on the day on which the holding

company's financial year ends,

and prepare

financial

statements for consolidation

purposes.

39

Fundamentals

of Auditing ACC 311

VU

(3)

Every

auditor of a holding company

appointed under section 252

shall also report on

consolidated

financial statements and exercise

all such powers and

duties as are vested

in

him

under section 255.

(4)

All

interim financial statements of a

subsidiary as required under sub-section

(3) shall be

reviewed

by the auditors of that subsidiary

appointed under section 252

who shall report

on

such financial statements in the

prescribed form.

(5)

There

shall be disclosed in the consolidated

financial statements,-

(a)

any qualifications contained in the auditors' reports on the

accounts of subsidiary or

subsidiaries

for the financial year ending with or

during the financial year of the

holding

company; and

(b)

any material note or explanation on a

qualification, regarding to but

not covered in the

financials

statements of a parent company.

(6)

Every

consolidated financial statement

shall be signed by the same

persons by whom the

individual

balance sheet and the profit

and loss account or income

and expenditure

account

of the holding company are required to be

signed under section

241.

(7)

All

provisions of sections 233, 242,

243, 244 and 245

shall apply to a holding

company

required to

prepare consolidated financial statements

under this section as if for the

word

"company"

appearing in these section, the

words "holding company" were

substituted.

(8)

The

Commission may, on an application or

with the consent of the directors of a

holding

company,

direct that in relation to any

subsidiary, the provisions of this section

shall not

apply to

such extent only as may be

specified in the direction.

(9)

If a

holding company fails to comply

with any requirement of this section,

every officer of

the

holding company shall be

punishable with fine which

may extend to fifty

thousand

rupees

in respect of each offense

unless he shows that he took

all reasonable steps

for

securing

compliance by the holding company of

such requirements and that

the non-

compliance

or default on his part was

not willful and

intentional".

6.2

The

directors shall ensure that

year-end of the holding and

its subsidiary companies

shall coincide

except

where there are good

reasons against it. The

SECP shall facilitate the companies in

this

regard

by allowing them to prepare accounts of

extended period, hold AGM

accordingly and file

annual

return after the holding of extended

AGM. [Section 238]

7.

Balance

Sheet of Modaraba Company

[Section 240]

Modaraba

companies are required to attach

financial statements and other reports

circulated to

Modaraba

certificate holders with their financial

statements.

8.

Authentication

of Balance Sheet [Section-

241]

8.1

Accounts should be

approved by the Board of Directors.

8.2

Balance

Sheet shall be signed by the chief

executive and one director. If chief

executive is out of

Pakistan

for the time being then it shall be

signed by two directors and

a statement shall be given by

the

directors explaining reasons

thereof.

9.

Copy

of Balance Sheet to be forwarded to

the Registrar (Section

242)

9.1

Three

copies of listed company's audited

accounts and the auditor's report

duly signed by the

management

and auditors should be filed with the

registrar within thirty days

from the AGM.

9.2

In

other cases two copies

are required.

9.3

Private

Companies are not required to

file their accounts with the

registrar.

10.

Right

of Members/Debenture-Holders of Company to

Copy of the Accounts and

the

Auditor's

Report [Section-243 & 247]

Members

have the right to get copy

of annual accounts etc. of

company on payment. The

same

rights

are available to debenture-holders or

trustees for

debenture-holders.

11.

Quarterly

Accounts of Listed Companies [Section

(245)]

All

listed companies shall

within one month of the

close of every quarter of their

year of account,

prepare

and transmit to the members and the

stock exchange(s) on which

their shares are listed,

a

40

Fundamentals

of Auditing ACC 311

VU

profit

and loss account for,

and balance sheet as at the

end of that quarter, whether audited

or

otherwise.

They shall file with the

registrar and the Commission

three copies thereof.

Quarterly

accounts shall be circulated

for the 1st, 2nd and 3rd

quarter within

one month of the

close

of

that quarter.

Approval

of the board of directors will be mandatory

for circulation of the quarterly

accounts.

If a

company fails to comply with any of the

requirements of this section, every

director including

chief

executive and chief accountant of the

company who has knowingly by

his act or omission

been

the cause of such default

shall be liable to a fine of not

exceeding one hundred

thousand

rupees

and to a further fine of not

exceeding one thousand

rupees per day during

which default

continues.

12.

Additional

Statement of Accounts and Reports

[Section 246]

12.1

The

SECP may by general or

special order, require companies, or a

class of companies or

any

particular

company, to prepare and send

to the members, the registrar, the SECP,

a stock exchange

and

any other person such

periodical statements of accounts,

information or other reports in

such

form

and manner and within

such time, as may be specified in the

order.

12.2

The

Securities and Exchange

Commission of Pakistan vide

circular No. 23/2005, has

directed to all

listed

companies and their

subsidiaries to provide: -

a)

Other Information contained in their

annual report, as such term is

defined in International

Standard

on Auditing 720 (Other

Information in the Documents Containing

Audited Financial

Statements),

to their external auditor (s);

and

b)

Sufficient time to their external auditor

(s) to review and comment

upon any "material

inconsistencies"

found in such Other

Information where the other

information may contradict the

information

contained in the audited financial statements. Listed

companies and their

subsidiaries

are

required to comply with this directive from the

period commencing 1st January 2006.

Auditor's

interest in the statutory

books

The

auditor is interested in the statutory books

because:

They

are directly concerned with the

Accounts

They

are audit evidence to be

used in verifying detailed items in the

accounts; for example

the

total

share capital shown by the

sum of the individual share holdings in

the register of members

must

agree with the share capital

recorded in the books of accounts

Failure to

maintain proper records of any

sort casts doubt upon the

accuracy and reliability

of

the

records generally.

41

Table of Contents:

- AN INTRODUCTION

- AUDITORS’ REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entity’s Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITOR’S REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITOR’S REPORT