|

Adjusting Entry to record Expenses on Fixed Assets |

| << Business transactions |

| Preparing Financial Statements >> |

Financial

Statement Analysis-FIN621

VU

Lesson-7

ACCOUNTING

CYCLE/PROCESS

(Continued)

e)

Making adjusting entries:

These

are the Entries required for

those transactions which

affect

revenues

or expenses of more than one accounting

period.

Immediate

recording of every event in

some cases is not practical

e.g. raw material,

office

supplies, depreciation. Journal entries of

such expenses are recorded at the end of

accounting

period

and are called adjusting entries.

Regular journal entries (chronological)

are recorded in blue and

adjusting

entries are recorded in red.

Adjusting

Entry to record Expenses on Fixed

Assets

The

expenditure use to acquire Fixed

Assets is spread over a number of

Accounting periods.

The

spreading of that expenditure over a

number of Accounting periods is called

Expense for

that

period.

Adjusting

entry is also required to record Prepaid

Costs.

Expenses

are the expired portion of

Assets.

Office

supplies and Raw material

are treated at the end of Accounting

period.

The

balance of Office supplies & Raw

materials is calculated as follows:

Opening

balance

Add:

Purchases

Less:

Closing

balance

Prepaid

Costs are initially taken as

Asset.

Pre

paid costs, if consumed

entirely during Accounting

period are charged directly

to expense

Types

of Adjusting Entries

i)

Entries

to distribute expenditure benefiting more

than one accounting

period

e.g.

fixed

assets, pre-paid costs (if

for more than one year).

Pre-paid costs are initially

taken

as Asset and

corresponding portion for an

accounting period is reduced there

from. In

the

case of office supplies, raw materials,

the formula is: - opening

balance + purchases-

closing

balance. This would give the

amount/extent of official supplies, raw

materials

consumed

during the accounting period. It

must also be noted that pre

paid costs, if

consumed

entirely during accounting

period, are charged directly

to expense.

Fixed

assets are

those which are used

for more than one Accounting

period.

ii)

Entries

to distribute un-earned revenue i.e. revenue

collected in advance

(deferred

revenue). It is

first recorded as liability, and is

gradually reduced in the

subsequent

accounting

period.

iii)

Entries

to record accrued expenses e.g. unpaid

salaries, interest payable, to be paid

in

the

subsequent accounting

period.

iv)

Entries

to record accrued revenues. These

are first recorded as Assets

i.e. Revenue

Receivable.

For example if rendering of

services/delivery of goods is spread

over a

number of

accounting periods, and billing is to be

done at the completion of

rendering

services

or delivering goods, then corresponding

adjusting entry for each

accounting

period

is made for Revenue Receivable,

but not yet

earned.

29

Financial

Statement Analysis-FIN621

VU

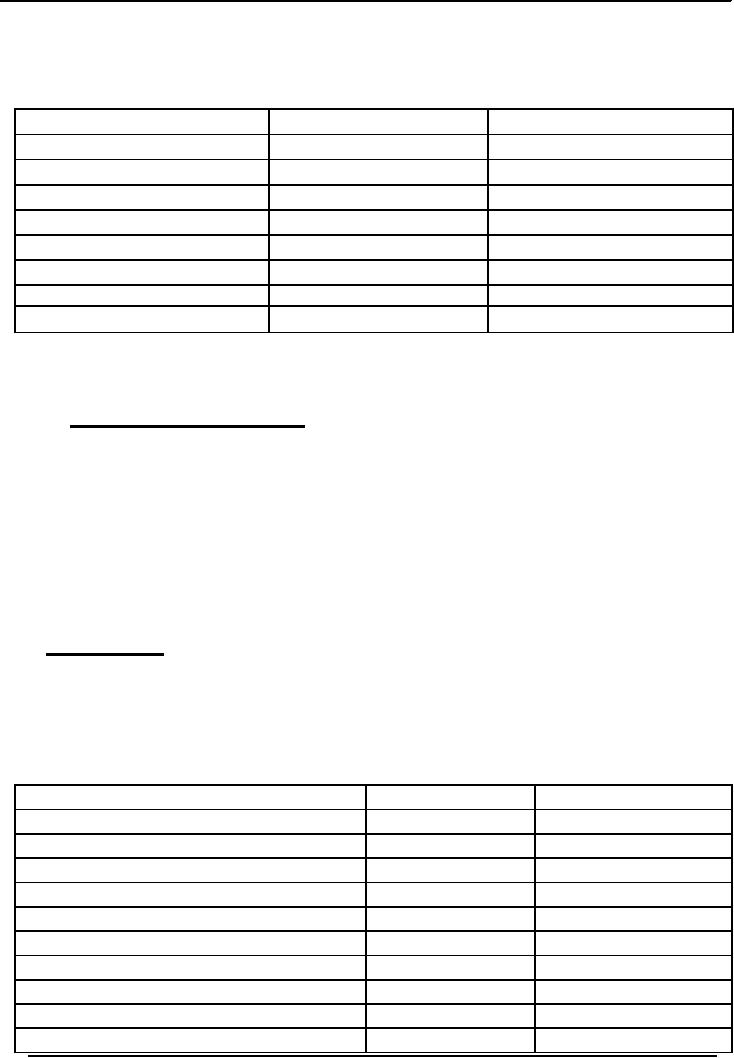

Khizr

Property dealer

Trial

Balance

For

the month of July

2006

Particulars

Rs.

Rs.

Cash

22,500

Accounts

Receivable

9,500

Land

130,000

Building

36,000

Office

Equipment

5,400

Accounts

Payable

23,400

Khizr,

Capital (owner's

equity)

180,000

Total

203,400

203,400

Adjusted

entries are all related to accrual

accounting, as would be seen

from the very description of

each

adjusting

entry given above.

f) Preparing

adjusted trial balance:

This

is the sixth step in Accounting

Cycle. In this, we take into

account the adjusting entries

made

earlier

in step 5 (e).

Adjusting

entries are journalized and posted,

i.e. recorded in journal and

posted in ledger.

Accumulated

depreciation would double

after second month, in the

example of adjusted trial

balance

given above. In the above example,

estimated life of building is taken as 20

years and that

of

office equipment as 10 years,

which makes the monthly

figure of the use of these

assets as

Rs.150

and Rs.45 respectively. Other

transactions during August

2006 changed balances of

cash,

A/Cs

Receivable, A/Cs payable.

Reverting to the earlier reference about

invisible expenses of

Rs.195, in the

Income Statement, these were depreciation

expenses of building amounting to

Rs.150

and

depreciation expenses of office

equipment amounting to

Rs.45.

The

adjusting

entries which

are recorded in Journal at the end of

Accounting period are adjusted

in,

Adjusted

Trial Balance.

Khizr

Property Dealer

Adjusted

Trial Balance

August

31,2006

Particulars

Dr.

Cr.

Cash.

16,105

Accounts

Receivable.

18,504

Land.

130,000

Building.

36,000

Accumulated

depreciation: building.

150

Office

equipment.

5,400

Accumulated

Dep: office

equipment.

45

Accounts

Payable.

23,814

Owner's

equity.

180,000

Sales

commission earned.

10,640

30

Financial

Statement Analysis-FIN621

VU

Advertising

expenses.

645

Salaries

expenses.

7,400

Telephone

expenses.

400

Depreciation

expenses: building.

150

Depreciation

expenses: office

equipment.

45

214,649

214,649

The

above is adjusted trial balance as on

August 31, 2006.

31

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS