|

Business transactions |

| << Preparing Balance Sheet from Trial Balance |

| Adjusting Entry to record Expenses on Fixed Assets >> |

Financial

Statement Analysis-FIN621

VU

Lesson-6

ACCOUNTING

CYCLE/PROCESS

(Continued)

Business

transactions during August,

2006

Now

let us suppose that

during the month of August, actual

business operations

commenced

and Khizr provided services

to clients at the agreed commission/fee rate of 2% of

rental

value

of property. Suppose rental

value of property during

August was Rs.532, 000.

Commission/fee

earned

at the rat of 2% comes to Rs.10,

640. Commission actually received

(in cash) during August

was

Rs.5,

000, the rest was to be paid

later.

Provided

services to clients at the agreed

commission/fee rate of 2% of rental value of

property.

Rental

value of property during

Aug:

Rs.532,

000

Rental

Value

= Rs.532,

000

Commission

(532,000 x 2%)

= Rs.

1 0,640

Actual

Cash Received

= Rs.

5,000

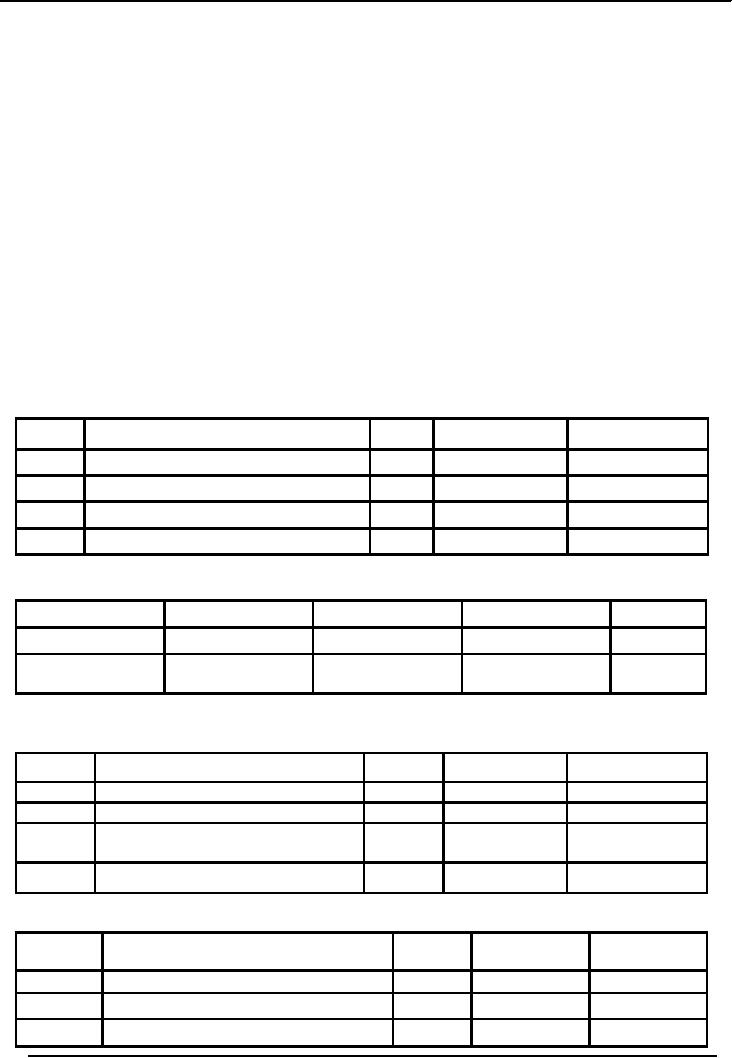

Date

Description

L/F

Dr.

Cr.

Aug

Cash

Account

5,000

Accounts

Receivable

5,640

Commission

Received

10,640

Commission

Income Received

Advertising

expenses (paid in advance) Rs.645.

Date

Description

L/F

Dr.

Cr.

Cash

Account

645

Advertising

expense

paid

�

Salaries

for Aug (to be paid in

September) Rs.7, 400.

Date

Description

L/F

Dr.

Cr.

Salaries

Expense

7,400

Salaries

Payables

7,400

Accrued

salaries for the month

of

August

Telephone

bill for Aug (to be

paid in September) Rs.400.

Date

Description

L/F

Dr.

Cr.

Utilities

Expense

400

Utilities

bill Payables

400

Accrued

telephone bill

26

Financial

Statement Analysis-FIN621

VU

Expenses

were:-

Advertising

expenses (paid in advance)

Rs.

645

Salaries

for Aug (to be paid in

September)

Rs.7,

400

Telephone

bill for Aug (to be

paid in September)

Rs.

400

The

above is incomplete list of Expenses.

There are certain invisible

expenses

amounting

to Rs.195 (in which no cash

is involved), which are recorded at the

end of accounting period.

Before

we take these up, let us

distinguish between Expenditure and

Expenses.

Expenditure Vs

Expenses

Expenditure:

It is the

cost benefiting or spreading over

two or more accounting periods.

Expense

is

the

portion

of Expenditure for one accounting

period only.

Examples:

Expenditure on fixed assets is

incurred in lump sum. Then

there are pre-paid costs

e.g.

insurance,

pre-paid rent, for more than

one year/accounting period. It may be

noted that expenditure

on

advertisements,

employees training, are directly

charged to expenses because in

these cases, the

number

of

accounting periods over which revenue is

likely to be produced (or increased)

because of these, are

not

readily estimable.

�

Incomplete

list of Expenses: Invisible

expenses (non cash

involved), recorded at the end of

accounting

period.

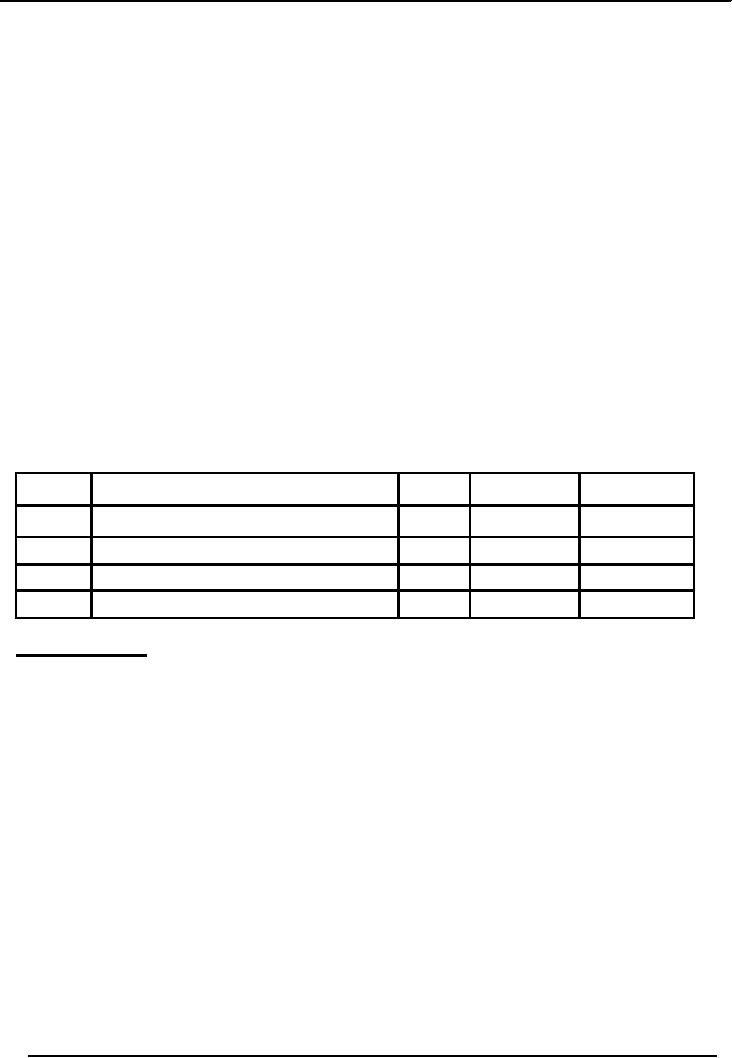

Date

Description

L/F

Dr.

Cr.

Depreciation

Expense-Building

150

Depreciation

Expense-Equipment

45

Accumulated

Depreciation

195

Depreciation

Expenses

Invisible

Expenses

Cost

value of Building

= Rs.

36,000

Estimated

useful life

= 20

years

Expense

for one month will be

calculated as follows:

=

36,000 x 1/240

= Rs.

150 per month

This

Rs.

150 is the

portion of expenditure of Rs.36,

000. This

expense is technically called

Depreciation

Note:

Land is not depreciated

Value

of Office Equipment

=

5,400

Estimated

useful life

= 10

years

The

calculation of expense on equipment

will be

Calculated

as follows:

=

5,400 X 1/120

= Rs.

45

This

Rs. 45 is technically called

depreciation

on

Office Equipment.

Pre-paid

costs e.g. Insurance,

Pre-paid rent, will be recorded as

follows:

27

Financial

Statement Analysis-FIN621

VU

Date

Description

L/F

Dr.

Cr.

Prepaid

Rent

12,000

Cash

Account

12,000

Rent

paid in advance

Rent

Expense

1,000

Prepaid

Rent

1,000

Recording

rent expense

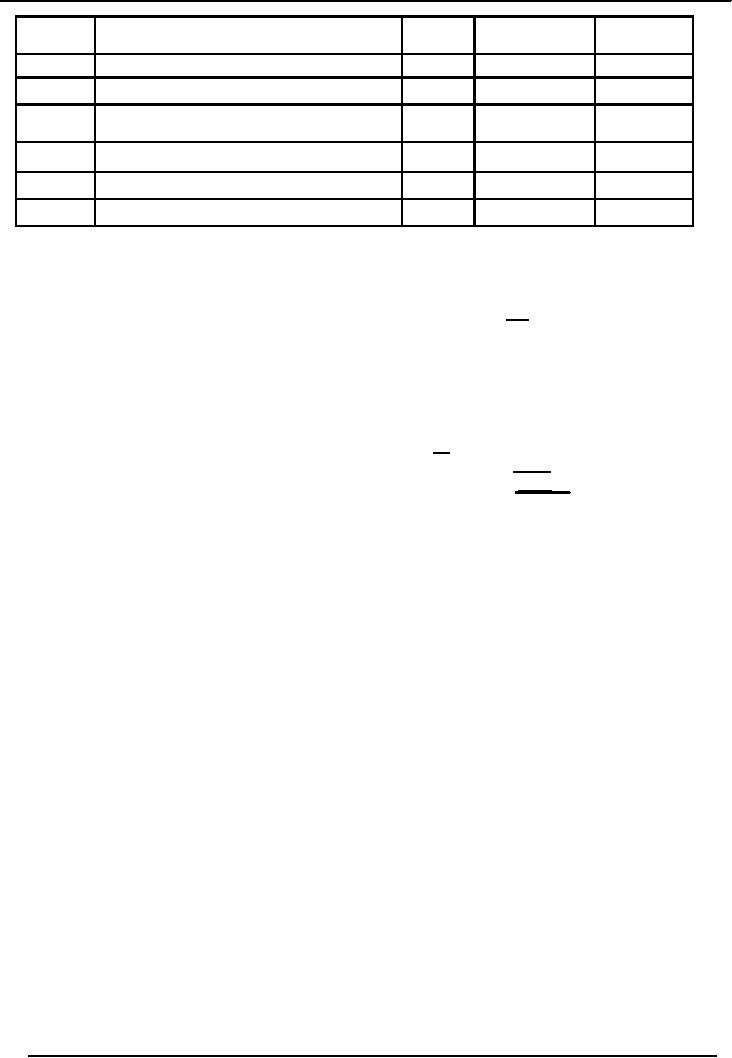

Income

Statement

For

the period ending August 31,

2006

Revenues

Rs.

Sales

Commission earned.

10,640

Expenses

Advertising

expenses.

645

Salaries

expenses.

7,400

Telephone

expenses.

400

Depreciation

expense: building

150

Depreciation

expense: office

equipment

45

Total

Expense

8,640

Net

Income

2000

With

this background, let us now

move on to the fifth step in the

Accounting Cycle.

28

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS