|

SUMMARY OF FINDGINS |

| << ANALYSIS OF BALANCE SHEET & INCOME STATEMENT |

Financial

Statement Analysis-FIN621

VU

Lesson-45

SUMMARY

OF FINDGINS

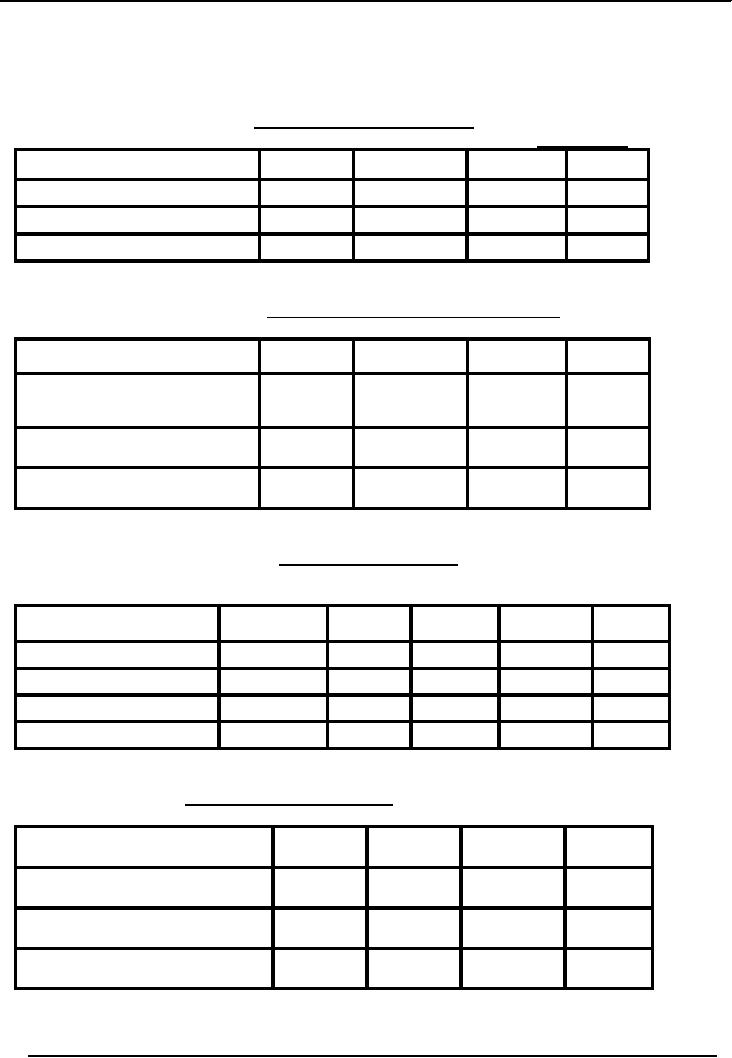

Table-9

COST OF

TRANSPORTATION

Rs.

in million

1976-77

1977-78

1978-79

1979-80

Cost

of cane purchased

22.26

24.51

13.81

2.60

Carriage

& incidentals

2.15

3.48

1.95

0.23

Carriage

as % of cost

10%

14%

14%

9%

Table-10

PER

TON COST OF TRANSPORTATION

1976-77

1977-78

1978-79

1979-80

Carriage

and incidentals (Rs. in

2.15

3.48

1.95

0.23

million)

Cane

procured (Tons)

140,292

166,271

93,731

14,375

Average

per ton cost (Rs)

15.32

20.92

20.80

16.00

Table-11

EMPLOYEE

STRENGTH

Actual

strength during the years

As per

PC1

1976-77

1977-78

1978-79

1979-80

Permanent

185

605

625

615

495

Seasonal

556

639

655

590

638

Total

741

1244

1280

1205

1133

%

increase

68%

73%

63

%

53%

Table-12

COST OF

ESTABLISHMENT

1976-77

1977-78

1978-79

1979-80

Cost

(Rs. in million)

7.72

9.11

8.90

8.51

Sugar

produced (tons)

11344

14015

8007

1206

Cost

per ton of sugar (Rs)

681

650

1112

7053

162

Financial

Statement Analysis-FIN621

VU

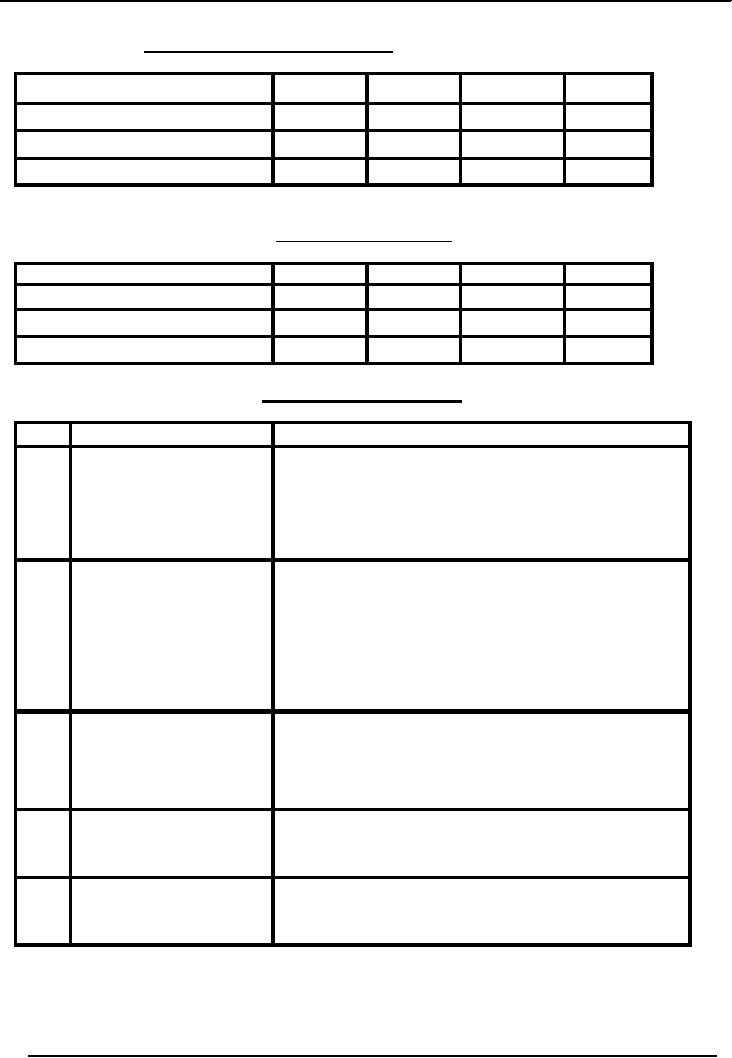

Table-13

PRODUCTIVITY

PER EMPLOYEE

1976-77

1977-78

1978-79

1979-80

Sugar

produced (Tons)

11344

14015

8007

1206

Employee-strength

1244

1280

1205

1133

Productivity

per person (Tons)

9.1

10.9

6.6

1.1

Table-14

FINANCIAL

EXPENSES

Rs.

in million

1976-77

1977-78

1978-79

1979-80

Financial

expenses

4.5

4.6

5.5

8.0

Sales

58

52

42

20

Financial

expenses as % of sales

8%

9%

13%

40%

SUMMARY

OF FINDGINS

No.

Area

Findings

1.

Finance:

�

Financial

position poor

�

Equity

eroded

�

Debt

burden: Rs.57 m

�

Financial

Charges: Rs.8 m

�

Poor

Liquidity

2.

Profitability:

�

Constantly

losing.

�

Losses

understand.

Reasons:

�

not

enough cane

�

high

transportation cost.

�

heavy

fixed costs.

�

vicious

circle of financial

charges

3.

Raw

Material:

�

Requires

185,000 tons cane.

�

Cane

from local area: 5-44%

only.

�

Bringing

cane from far off

places.

�

erroneous

PC1

4.

Production:

�

sugar

production capacity: 15,000

ton

�

Never

met target.

�

High

fixed cost of

production.

5.

Administration:

�

Excess

employees.

�

Excess

per ton cost of establishment.

�

Low

productivity.

163

Financial

Statement Analysis-FIN621

VU

OVERALL

ASSESSMENT

1.

The

unit has been a losing

concern over since 1965

when it became

operational.

Accumulated

loss as on June 30, 1980

was over Rs.114 million as

against equity of Rs.81

million.

Equity

thus stood completely eroded. The

unit is consequently dependent entirely on

debt, which

amounted to

Rs.57 million as on June 30,

1980. This involved annual

financial charges of Rs.8

million.

2.

The

feasibility of this unit had

been projected on the clear assurance

that abundant

sugar-cane

will be available in the vicinity.

These assurances proved

entirely erroneous. Supplies of

sugar-cane

from the vicinity were very inadequate.

The company has had to supplement procurement

by

additional

purchases from distant

areas. This involved

excessive cost of transportation.

Even then the

unit

could not manage to procure the

required quantity of cane.

Below capacity operations of the

plant

has,

therefore, been a crippling

constraint.

3.

A number of

steps are being taken at

unit and government level to

improve sugar-cane

availability.

This includes loans to growers for

seeds and fertilizers, and award of a

higher purchase

price

for sugar-cane above the controlled rate.

These measures are expected to

aid the project but it

may

not,

however, still be able to overcome

its financial

difficulties.

4.

The

unit could in fact procure

only 8% of its cane

requirement during 1979-80,

of

which

only 5% was procured locally, despite

award of a higher purchase price

for sugar-cane above the

controlled

rate. Inadequate cane availability

and heavy fixed costs (due

to excessive employee-strength

and

increasing burden of financial charges)

remain serious constraints.

5.

The

project therefore does not

seem to be a viable one. Prospects of

its dis-investment

and

privatization may be seriously

looked into.

164

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS