|

Financial Consultation Case Study |

| << BALANCE SHEET AND INCOME STATEMENT RATIOS |

| ANALYSIS OF BALANCE SHEET & INCOME STATEMENT >> |

Financial

Statement Analysis-FIN621

VU

Lesson-43

CASE

STUDY

Assumption

The

company you have chosen has

hired you as a financial

consultant.

Assignment

Based

on your analysis of the firm's financial

statements and any

relevant

supplementary

information you can obtain

about the firm and its

operating environment, identify

areas

in

which the company is performing well

(strengths) and problem areas

(weaknesses); Also advise

management

of corrective measures for

improvement.

Data

The

time period for the analysis

should include five full

years or four years plus

interim

statements

for the most recent year. In

addition to the financial statements and

other material in the

annual

reports, you should review

relevant materials from outside

sources such as

newspapers,

periodicals

and investment resources.

Outline

The

following outline is provided

for guidance, but the analysis should be

adjusted, as

appropriate,

to conform to the individual

characteristics of the firm.

Suggested

Outline for the Financial

Statement Analysis

I.

Introduction

A.

Objective

of paper

B.

Summary of

Findings

II.

Firm,

Industry, and Environment

A.

Description

of firm and its

management

B.

Discussion of

competitive environment

C.

Economic

climate and outlook

D.

Other

factors, e.g. governmental regulations,

Labour relations,

Litigations.

III.

Evaluation

of Financial Statements

A.

Overview

B.

Short-term

liquidity

C.

Operating

efficiency

D.

Capital

structure and long-term

solvency

E.

Profitability

F.

Market

measures

IV.

Outlook,

Summary, and Conclusions

A.

Outlook

for performance, earnings

projection

B.

Summary and

Conclusions

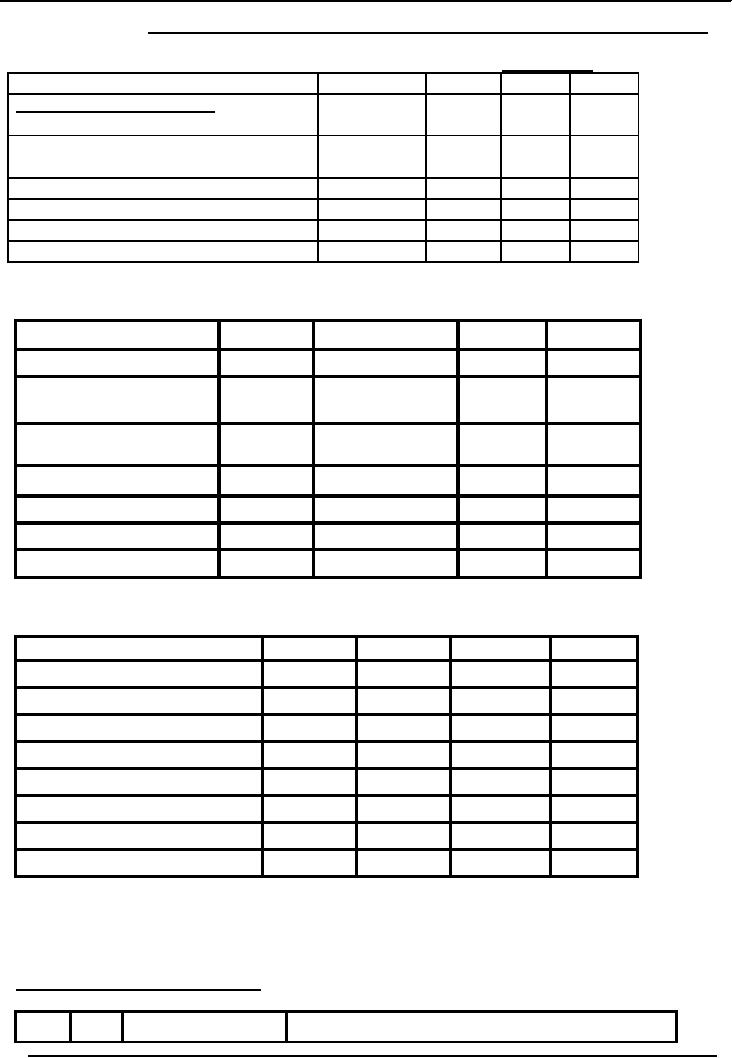

Table-1

XYZ

SUGAR

MILLS

154

Financial

Statement Analysis-FIN621

VU

BALANCE

SHEET

AS

ON

JUNE

30,

.

Rs.

in million

Year

1977

1978

1979

1980

CAPITAL

& LIABILITIES

Owners'

equity

Original

Investment by the

Controlling

10

10

10

10

Corporation

(CC)

Current

A/C with CC

55

59

65

71

Total

equity

65

69

75

81

Less

accumulated losses

66

82

94

114

(1)

(13)

(19)

(33)

Net

equity

Current

Liabilities

1977

1978

1979

1980

Short-term

borrowing

25

26

29

37

Trade

creditors (liabilities for

7

12

11

4

expenses)

Liabilities

for other finances 8

17

13

10

40

55

53

51

Fixed

Liabilities

Long-term

loans

10

13

15

20

49

55

49

38

Total

capital & Liabilities

Assets

Fixed

assets

16

15

14

14

Current

assets

-

Cash

5

4

3

2

-Receivable

from Bibo

12

13

15

17

-Other

Receivables

2

2

3

3

-Pre-paid

1

1

1

1

-

Inventory

13

20

13

1

Total

current assets

33

40

35

24

Total

Assets

49

55

49

38

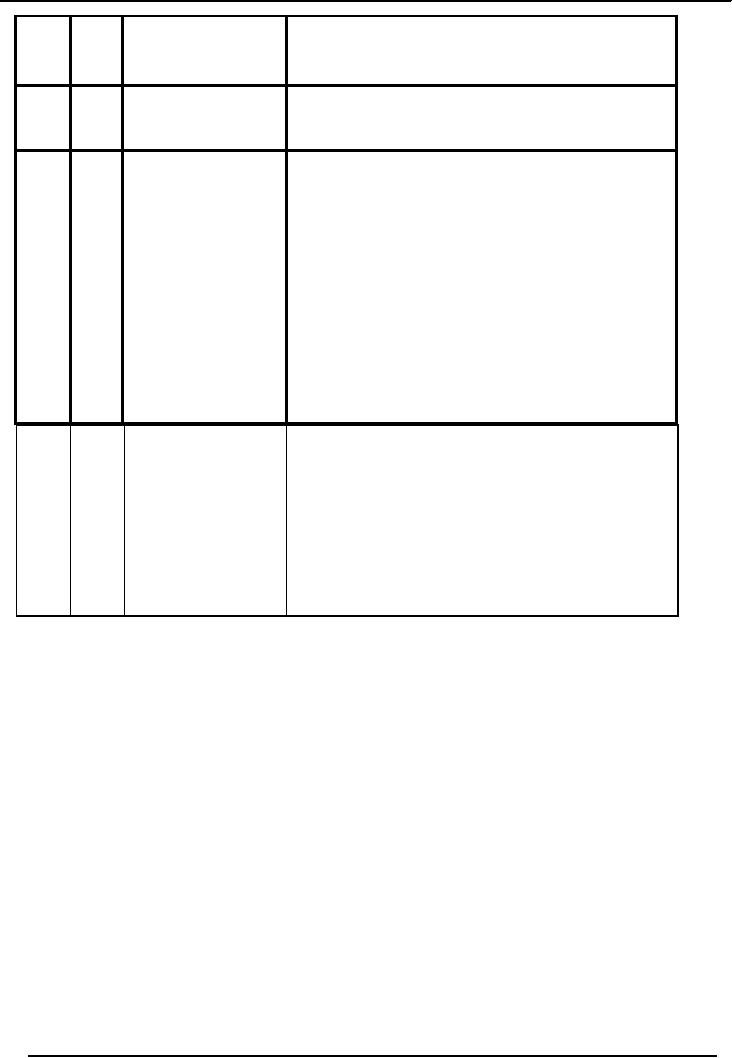

ANALYSIS

OF BALANCE SHEET

No.

Table

Data/Facts

Findings

155

Financial

Statement Analysis-FIN621

VU

1

1

Balance

Sheets for the

�

Accumulated

losses (Rs.114 million as at

June

year

1976-80

30,

1980)

�

Constantly

losing enterprise.

2

2

Accumulated

losses

�

Losses

increasing over the years.

over

the period.

3

1

Balance

Sheet

a)

Capital cost of the project

was Rs.26

million,

met

through:

-

Equity Fund from CC

Rs.10 million.

- Loans

from CC: Rs.16

million

b)

"Current account with "CC"

comprises, funds

given

by CC over the years as working

capital.

c)

Total equity as on

30.06.1980

=

Rs.81 million.

d)

Equity completely eroded by accumulated

loss of

Rs.114

million.

e)

Equity eroded since

1976-77

4

1

Borrowing

(short-

a) Increased

from Rs.35 million in

1976-77 to

term &

long term)

Rs.57

million in 1979-80.

b)

Debt burden increasing because of

unit's

inability

to repay the principal owing

to

persistent

losses.

c)

Vicious circle.

d)

Huge financial charges (Rs.8

million during

1979-80)

156

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS