|

STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2 |

| << STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1 |

| BALANCE SHEET AND INCOME STATEMENT RATIOS >> |

Financial

Statement Analysis-FIN621

VU

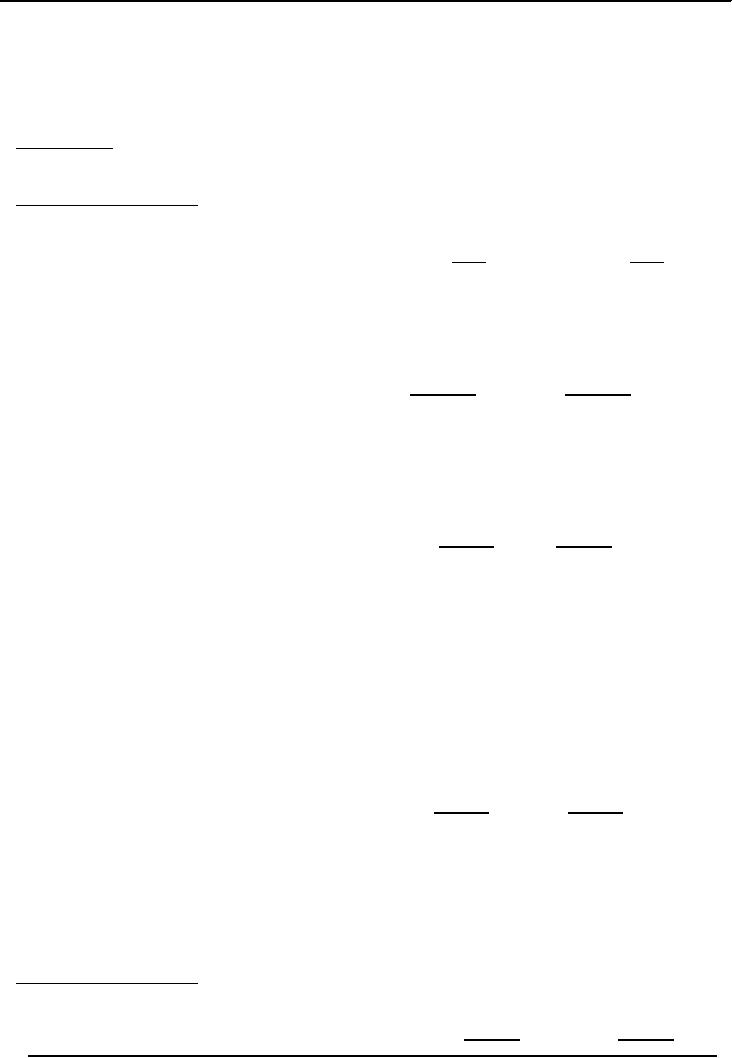

Lesson-41

STOCKHOLDERS'

EQUITY SECTION OF THE BALANCE

SHEET

(Continued)

Example

No:2

MOOSA

CORPORATION

Balance

Sheet as on June 30,

________

2006

2005

Cash

35,000

25,000

Accounts

receivable (net)

91,000

90,000

Inventory

160,000

140,000

Short-term

prepayments

4,000

5,000

Investment

in land

90,000

100,000

Equipment

880,000

640,000

Less:

Accumulated depreciation

(260,000)

(200,000)

Total

assets

Rs.1,

000,000

Rs.800,

000

======

=======

2005-06

2004-05

Accounts

payable

Rs.105,

000

Rs.46,

000

Income

taxes payable and

Other

accrued liabilities

40,000

25,000

Bonds

payable 8%

280,000

280,000

Premium on

bonds payable

3,600

4,000

Capital

stock Rs.5 par

165,000

110,000

Retained

earnings

406,400

335,000

Total

liabilities and stockholders'

equity

Rs.1,

000,000

Rs.800,

000

MOOSA

CORPORATION

Income

Statement for the

year

2005-06

2004-05

150

Financial

Statement Analysis-FIN621

VU

Sales

(net of discount and allowances)

Rs.2,

200,000

Rs.1,

600,000

Cost

of goods sold

1,606,000

1,120,000

Gross

profit on sales

Rs.

594,000

Rs.

480,000

Expenses

(including Rs.22, 400

Interest expense)

(336,600)

(352,000)

Income

taxes

(91,000)

(48,000)

________

________

Net

income

Rs.166,

400

Rs.80,

000

========

=======

2005-06

2004-05

1.

Quick ratio:

Rs.126,

000 �Rs.145, 000

0.9

to 1

Rs.115,

000 � Rs.71, 000

1.6

to 1

2.

Current

ratio:

Rs.290,

000 �Rs.145, 000

2 to

1

Rs.260,

000 �Rs.71, 000

3.7

to 1

3.

Equity

ratio:

Rs.571,400 �

Rs.1,000,000

57%

Rs.445,000 �

Rs.800,000

56%

4.

Debt

ratio:

Rs.428,600 �

Rs.1,000,000

43%

Rs.355,000 �

Rs.800,000

44%

151

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS