|

Steps in Accounting Cycle |

| << Rules of Debit and Credit |

| Preparing Balance Sheet from Trial Balance >> |

Financial

Statement Analysis-FIN621

VU

Lesson-4

ACCOUNTING

CYCLE/PROCESS

(Continued)

ACCOUNTING

CYCLE/PROCESS

It

mainly consists of Recording,

Classifying and Summarizing

financial transactions over an

accounting

period.

Steps

in Accounting Cycle

a)

Analyzing

financial transaction. The

purpose is to see which two

(or more) Accounts

(or

sub-Accounts) are affected by a

particular financial transaction.

b)

Recording

(chronologically)

in journal which is called

"book of original

entry".

this

step is also called

journalizing. Its practical

illustration is given

below.

c)

Posting

in

ledger which means

transferring debits and credits from

journal to

ledger

account. This is also called

ledgerising or classification.

d)

Preparing

trial balance,

this is done to prove the equality of

debits and credits in the

ledger

e)

Making

adjusting Entries

Compound

Entry. A

journal entry that has more

than one debit or credit

entry.

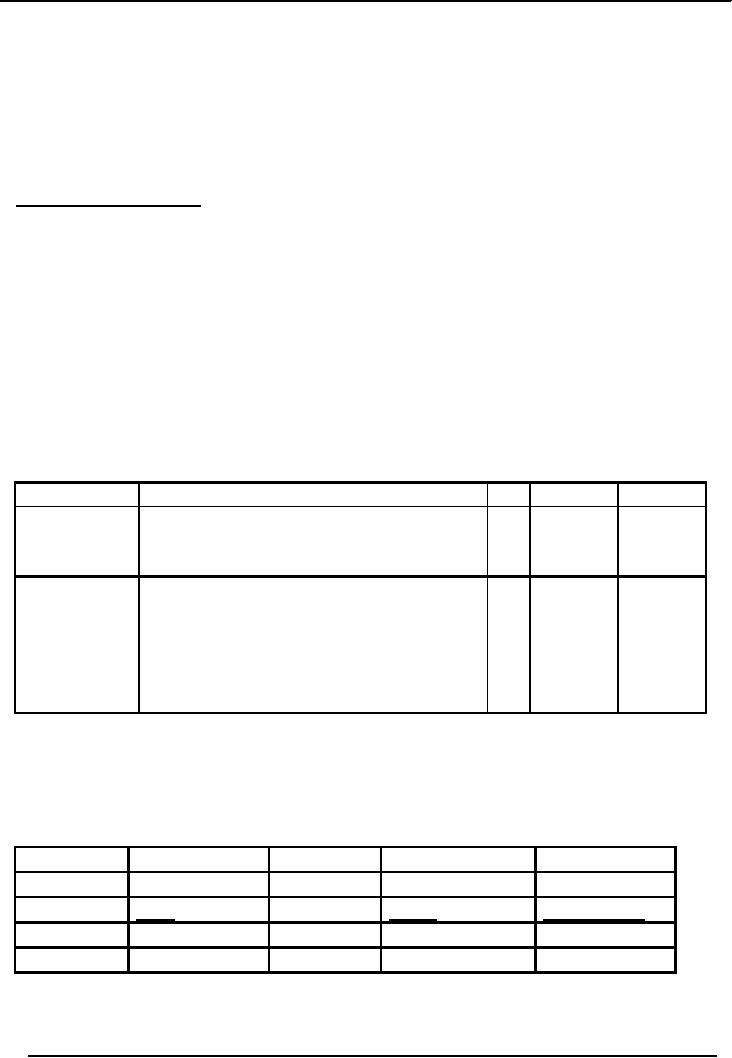

General

Journal

Date

Account

Title and explanation

LP

Dr.

Cr.

Cash

1

180,000

Khizr,

Capital

50

180,000

July,

2006 (1)

(Owner

invested cash in

business)

Building

36,000

Cash

15,000

July,

2006 (5)

Accounts

payable

21,000

(Purchase

building partly for cash

and

Partly

on credit)

"LP"

is reference account No: of the

particular ledger accounts.

For example cash account

has been

assigned

number 1 in ledger and capital account is

given number 50.

C)

Posting in

ledger which mean

transferring debits and credits from

journal to ledger account. This

is

also

called ledgerising or

classification

Date

Explanation

Ref

Dr.

Cr.

1-Jul

1

180,000

Khizr

1

Capital

Account

No:50

1-Jul

180,000

"Ref"

is reference to the page of journal i.e.

page 1. This shows that

there is cross-reference between

journal

and ledger through "LP" and

"ref" columns in journal and ledger

respectively.

14

Financial

Statement Analysis-FIN621

VU

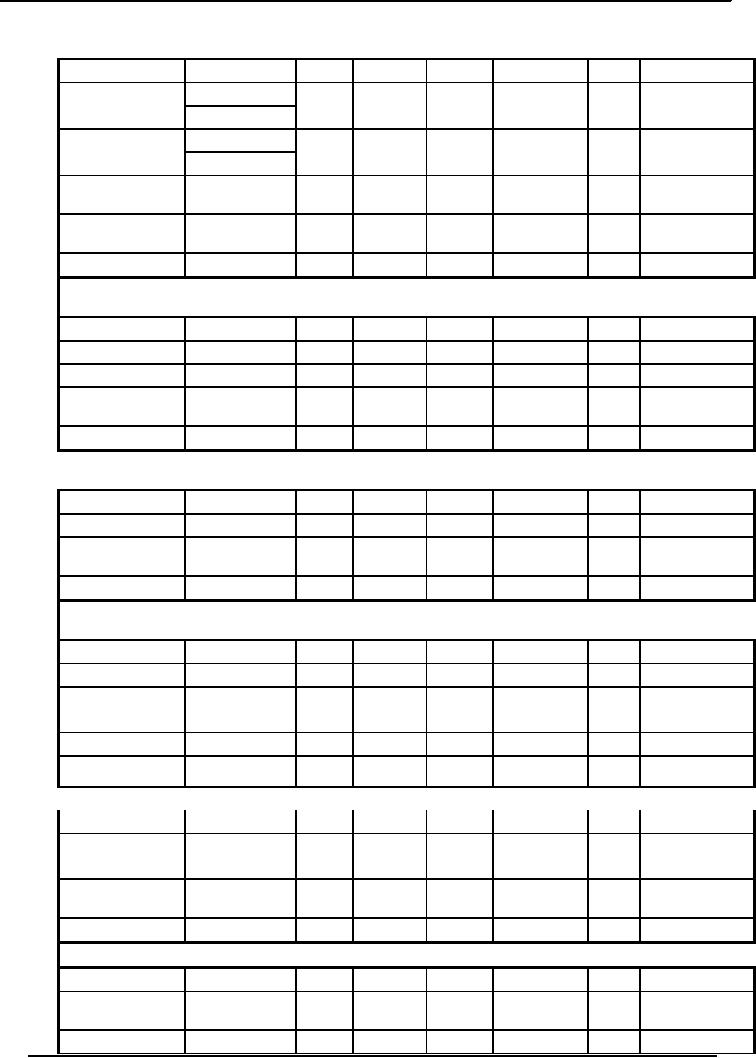

Cash

Ledger Account

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

1stJuly

Owners

180,000

3rd

Land

141,000

July

Equity

Accounts

5th

July

20th

July

1,500

Building

15,000

Receivables

31st

Jul

A/P

3,000

31st

July

Balance

c/f

22,500

Total

181,500

Total

181,500

Building

Account

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

5th

July

Cash

Account

15,000

5th

July

A/P

21,000

31st

July

Balance

c/f

36,000

Total

36,000

Total

36,000

Office

Equipment Account

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

14-Jul

A/P

5,400

31st

July

Balance

c/f

5,400

Total

5,400

Total

5,400

Accounts

Payable

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

31st

July

Cash

3,000

5thJul

Building

21,000

14th

Equipment

5,400

July

31st

July

Balance

c/f

23,400

Total

26,400

Total

26,400

Land

Account

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

3rd

July

Cash

141,000

10th

A/R

11,000

July

31st

July

Balance

c/f

130,000

Total

141,000

Total

141,000

Accounts

Receivable

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

10th

July

Land

11,000

20th

Cash

1,500

July

31st

Balance

c/f

9,500

15

Financial

Statement Analysis-FIN621

VU

July

Total

11,000

Total

11,000

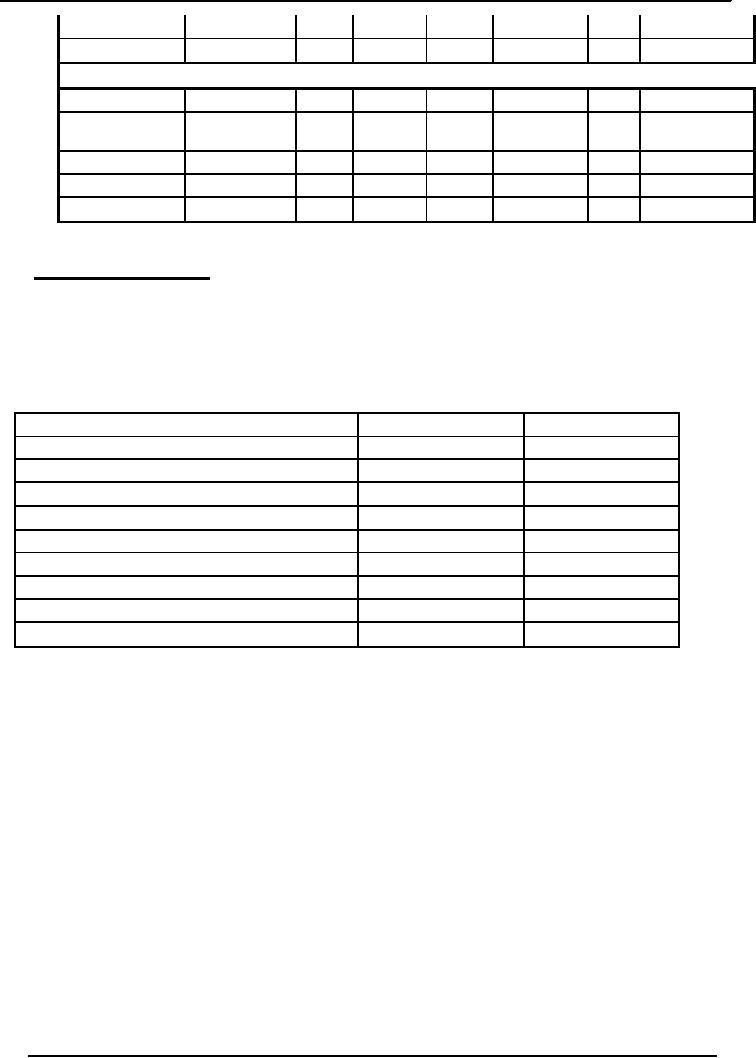

Owner's

Equity Account

Date

Particulars

L/F

Debit

Date

Particulars

L/F

Credit

1st

Cash

180,000

July

31st

July

Balance

c/f

180,000

Total

180,000

Total

180,000

d) Preparing

Trial balance:

This

is done to prove the equality of debits and credits in

the ledger.

KHIZR

PROPERTY DEALER

TRIAL

BALANCE

JULY

31, 2006

Dr.

Cr.

Rs.

Rs.

Cash

22,500

Accounts

Receivable

9,500

Land

130,000

Building

36,000

Office

Equipment

5,400

Accounts

Payable

23,400

Khizr

,capital (Owner's equity)

180,000

203,400

203,400

It is prepared in

the order of Accounting Equation

i.e. balance sheet. It

serves as a working paper

for

accountants.

It should however be noted

that it gives assurance only

as to equality of debit and

credit

amounts.

It does not assure accuracy.

For example if a transaction is

altogether omitted from

accounting

records,

debits and credits of other transactions so recorded

would be equal, but this

particular

transaction

which was omitted

altogether, would not be

detected by Trial balance.

�

At the end of

accounting period, a list of

all ledger balances is prepared.

This list is called

trial

Balance.

Trial

balance is a listing of the accounts in

your general ledger and their

balances as of a specified date.

A

trial balance is usually prepared at the

end of an accounting period and is

used to see if

additional

adjustments

are required to any of the

balances. Since the basic accounting

system relies on

double-

entry

bookkeeping, a trial balance

will have the same total

debit amount as it has total

credit amounts.

�

Both

sides of trial balance i.e.

Debit side and credit

side must be equal. If both

sides are not

equal,

there are some errors in the books of

accounts.

�

Trial

balance shows the mathematical accuracy

of the books of accounts.

16

Financial

Statement Analysis-FIN621

VU

Limitations

of Trial Balance

1.

Trial balance only shows the

mathematical accuracy of the

accounts.

2. If

both sides of trial balance

are equal, books of accounts

are considered to be correct. But

this

might

not be true in all the

cases.

3. If

any transaction is not recorded at all,

trial balance can not

detect the omitted transaction.

� If

any transaction is recorded in the wrong

head e.g. if an expense is debited to

an

assets

account. Trial balance will

not be able to detect that

mistake too

17

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS