|

Liquidity of Receivables |

| << ACTIVITY RATIOS |

| LEVERAGE, DEBT RATIOS >> |

Financial

Statement Analysis-FIN621

VU

Lesson-35

ACTIVITY

RATIOS

(Continued)

(B)

Liquidity

of Receivables: It

shows have quickly Accounts Receivables

are

collected

i.e. converted into cash. It

is determined by Receivable Turnover

Ratio

(RTO).

It is number of times "Receivables" are

converted into cash during

the year.

=

net

sale for the year

= 100

= 10

Average

Receivables during the year.

10

Ideally

RTO = net credit

sales______________

Monthly

average of Receivables

The

higher the RTO, the more liquid the

company's Receivables.

Days

required to collect Receivables

i.e.

Converting

"Receivable" into cash = 365

or 300 = 36 or 30

Normal

credit terms: 30 to 60

days.

Length

of operating cycle: A+ B (158,

130) days.

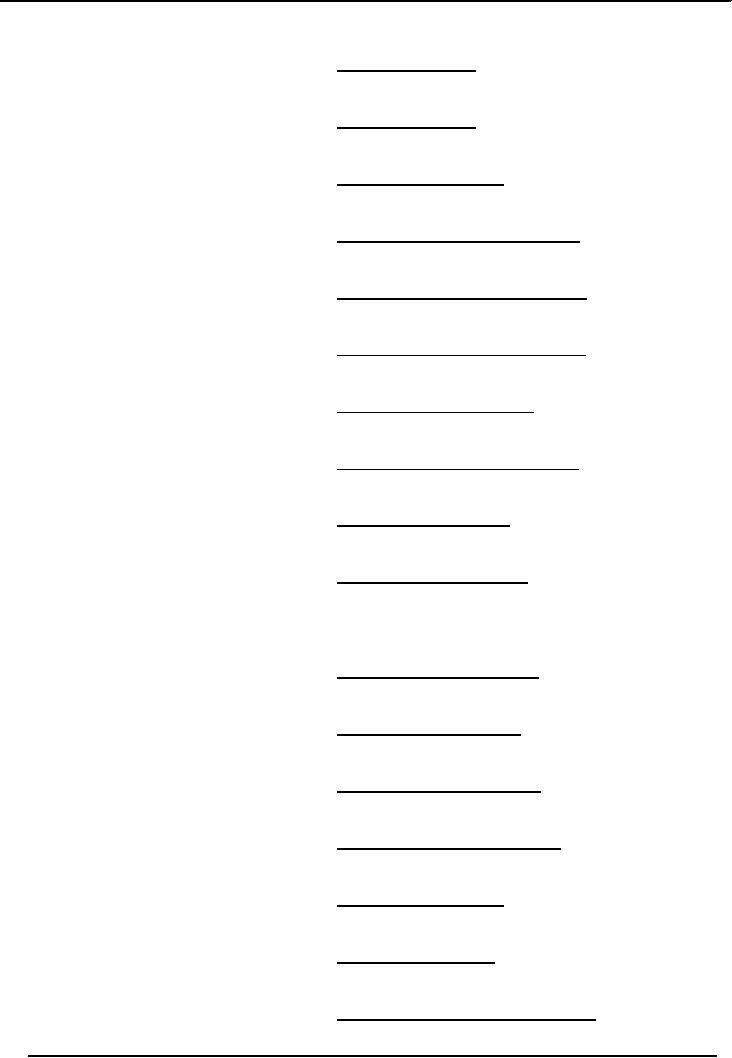

RATIOS

Gross

Profit

x

100

Gross

profit ratio

Net

sales

Net

Profit

x

100

Net

Profit ratio

Net

sales

Operating

Profit x

100

Operating

Profit ratio

Net

sales

Individual

Expenses

x

100

Expenses

ratios

Net

sales

Operating

cost

x

100

Operating

(Cost) Ratio

Net

sales

Net

Profit after inteerest and

tax

x

100

Net

Profit to net worth

ratio

Net

sales

Net

Profit before interest,

tax

x

100

Return

on capital employed

(ROI)

Capital

employed

Net

profit avaiable for equity

shareholders

Earning

per share

Number

of equity shares

Dividends

per share

______Dividend

amunt______

133

Financial

Statement Analysis-FIN621

VU

Number

of equity shares

___Cost or

sales ___

Capital

employed turnover

ratio

Capital

employed

Cost

of sales or sales

Fixed

assets turnover ratio

Fixed

assets

Cost

of sales or Net sales

Working

capital turnover

ratio

Net

working capital

_____Cost of

goods and sold______

Inventory

turnover ration

Average

accounts receivables

______Annual

net credit sales______

Debtors

(receivables) turnover ratio

Average

accounts receivables

_______Accounts

receivables______

Debtors

(receivables) collection

period

Average

accounts receivables

____Net

credit pruchases ___

Creditors

turnover ratio

Average

creditors

____Average

accounts payables ___

Average

credit period

Net

credit purchase per

day

_____Current

aeests ____

Current

ratio

Current

liabilities

_______Quick

assets______

Quick

ratio/Acid test ratio

Current

liabilities

Debt-equity

ratio:

____Total

long term debt____

(i)

Debt

to net worth

Shareholder's

funds

______External

equity____

(ii)

External-internal

equity

Internal

equity

____Total

long term debts ___

(iii)

Debt

vs. funds

Total

long term funds

Earnings

before interest and taxes

Debt

service ratio

Fixed

interest charges

____Net

fixed assets ___

Fixed

assets ratio

Long-term

funds

Solvency

(Debt to total funds)

____Total

liabiities ___

ratio

Total

assets

____________

Equity _____________

Capital

gearing ratio

fixed

interest bearing securities

134

Financial

Statement Analysis-FIN621

VU

Proprietor's

funds

Proprietary

ratio

Total

assets

135

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS