|

Depreciation Accounting Policies |

| << First-in-First - out (FIFO), Last-in-First-Out (LIFO) |

| Accelerated-Depreciation method >> |

Financial

Statement Analysis-FIN621

VU

Lesson-21

NOTES

TO FINANCIAL STATEMENTS

(Continued)

Depreciation

Accounting Policies.

Depreciation

is the expired or used portion of a

fixed asset during an

accounting period.

This

is taken into account to achieve the

matching principle of matching

revenues earned during

an

accounting

period with the expenses

incurred during that period.

Since plant assets have useful

life

spreading

over a number of accounting periods, the

portion used in one accounting

period is charged to

Income

Statement of that accounting

period in the form of Depreciation

Expense.

Land

is recorded at cost, other fixed

assets are recorded at Book

Value i.e. cost

less

accumulated

depreciation. For this,

separate Depreciation Expense

and Accumulated

Depreciation

Accounts

for different plant assets

are maintained. It must also

be noted that depreciation is a

process of

cost

allocation and not a process of

valuation as such.

Computing

Depreciation

Different

methods are available for

computing depreciation of fixed

assets. Different

methods

can be used for different

assets. However, comparison among firms

with different

depreciation

methods

becomes difficult because of the

fact that each firm

uses different methods for

calculating

depreciation,

which ultimately affect its

net income and balance sheet.

Methods of

Computing Depreciation

Straight-line

method: In

this, the depreciation expenses

are spread evenly

over

i)

periods.

Assume that a plant asset is

acquired for Rs.17, 000. It

is estimated that its

useful

life is five years and

residual value (salvage value) at the end

of five years is

Rs.2,

000.

Depreciation

is a systematic allocation of the cost of

a depreciable asset to expense over

its useful life. It

is a

process of charging the cost of

fixed asset to profit &

loss account.

Fixed

Assets are

those assets which

are:

� Of

long life

� To be

used in the business to generate

revenue

� Not

bought with the main purpose

of resale.

Fixed

assets are also called

"Depreciable Assets"

When

an expense is incurred, it is charged to

profit & loss account of the

same accounting period

in

which

it has incurred. Fixed

assets are used for

longer period of time. Now,

the question is how to

charge

a fixed asset to profit &

loss account. For this

purpose, estimated life of the

asset is determined.

Estimated

useful life is the number of years in

which a fixed asset is expected to be

used efficiently. It is

the

life for which a machine is estimated to

provide more benefit than the

cost to run it. Then,

total cost

of the

asset is divided by total number of

estimated years. The value, so

determined, is called

`depreciation

for the year' and is charged to

profit & loss account. The

same amount is deducted from

total

cost of fixed asset in the

financial year in which

depreciation is charged. The net amount

(after

deducting

depreciation) is called `Written

down Value'.

WDV =

Original cost of fixed asset

Accumulated Depreciation

79

Financial

Statement Analysis-FIN621

VU

Accumulated

Depreciation is the depreciation that

has been charged on a

particular asset from the

time

of

purchase of the asset to the present

time. This is the amount

that has been charged to

profit and loss

account

from the year of purchase to the

present year.

Depreciation

accumulated over the years is called

accumulated

depreciation.

Useful

Life

�

Useful Life or Economic

Life is the time period for

machine is expected to operate efficiently.

� It is the

life for which a machine is estimated to

provide more benefit than the

cost to run it.

Grouping

of Fixed Assets

Major

groups of Fixed Assets:

� Land

� Building

� Plant

and Machinery

� Furniture

and Fixtures

� Office

Equipment

� Vehicles

No

depreciation is charged for

`Land'. In case of `Leased

Asset/Lease Hold Land' the amount

paid for it

is

charged over the life of the

lease and is called Amortization.

Journal

entries for recording

Depreciation

Purchase

of fixed asset:

Debit:

Relevant

asset account

Credit:

Cash,

Bank or Payable Account

For

recording of depreciation, following

two heads of accounts are

used:

� Depreciation

Expense Account

� Accumulated

Depreciation Account

Depreciation

expense account contains the depreciation

of the current year. Accumulated

depreciation

contains the

depreciation of the asset from the

financial year in which it

was bought up to the

present

financial

year. . Depreciation of the following

years in which asset was

used is added up in this

account.

In

other words, this head of

account shows the cost of

usage of the asset up to the current

year.

Depreciation

account is charged to profit &

loss account under the heading of

Administrative Expenses.

In the

balance sheet, fixed assets

are presented at written

down value i.e.

WDV =

Actual cost of fixed asset

Accumulated Depreciation.

Journal

entry for the depreciation is

given below:

Debit:

Depreciation

Expenses Account

Credit:

Accumulated

Depreciation Account

Presentation

of Depreciation

Charging

depreciation to any head in

profit & loss account

depends upon the nature of work

performed

by the

asset. Consider an organization has

purchased computers. If computers

are being used by the

management,

this means that

administrative work is done by computers.

So, depreciation of

computers

will

be charged to Administrative Expenses. On

the other hand, if machines working in

the factory are

80

Financial

Statement Analysis-FIN621

VU

computerized.

The value of depreciation of the

computers attached with the

machines will be charged

to

cost

of goods sold. The reason

being, the computers are the

part of manufacturing process

&

depreciation

of computers will be charged to the

cost of production. Again consider the

selling

department of the

business is very large.

Depreciation of computers used in

selling department will be

charged

to selling expenses.

You

can see that computer is a

single asset and its

depreciation is charged in three

different heads

depending

upon the nature of work done by the

computer.

Depreciation

for the year is charged

to:

i.

Cost

of Goods Sold

ii.

Administrative

Expenses

iii.

Selling

Expenses

In

balance sheet Fixed Assets

are shown at Cost less

Accumulated Depreciation i.e.

written Down Value

(WDV).

Methods

of calculating Depreciation

There

are several

methods for calculating

depreciation. At this stage, we

will discuss only two of

them

namely:

� Straight

line method or Original cost method or

Fixed installment method

� Reducing

balance method or Diminishing balance

method or written down

method.

Straight

Line Method

Under

this method, a fixed amount is

calculated by a formula. That

fixed amount is charged every

year

irrespective

of the written down value of the

asset. The formula for

calculating the depreciation is

given

below:

Depreciation

= (cost Residual value) / Expected

useful life of the

asset

Residual

value is the

cost of the asset after the

expiry of its useful

life.

Under

this method, at the expiry of asset's

useful life, its written

down value will become

zero. Consider

the

following example:

�

Cost

of the Asset

=

Rs.100,000

�

Life

of the Asset

= 5

years

�

Annual

Depreciation

= 20 % of

cost or Rs.20,000

Written

down value method

�

Cost

of the Asset

= Rs.

100,000

�

Annual

Depreciation

=

20%

Year

1 Depreciation

= 20 % of

100,000

=

20,000

Year

1 WDV

=

100,000 20,000

=

80,000

Year

2 Depreciation

= 20 % of

80,000

=

16,000

Year

2 WDV

=

80,000 16,000

=

64,000

Illustration:

Cost

of an asset:

Rs.

120,000

Residual

value: Rs. 20,000

Expected

life: Rs. 5 years

81

Financial

Statement Analysis-FIN621

VU

Calculate

depreciation and the written

down value of the asset for

five years.

Solution

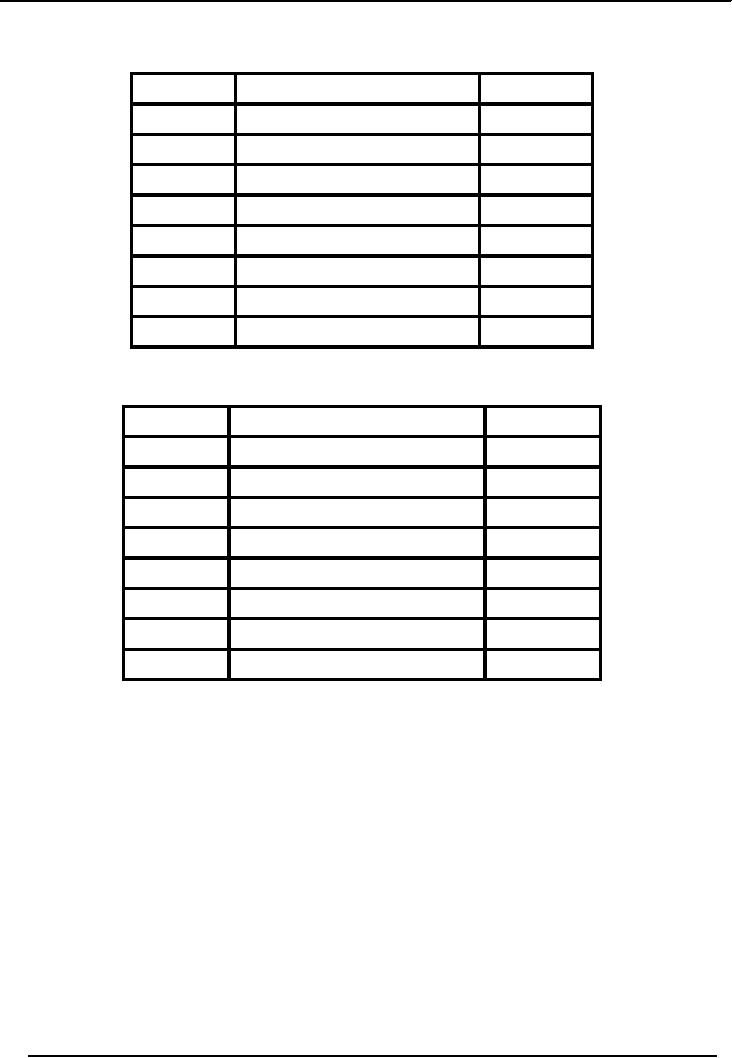

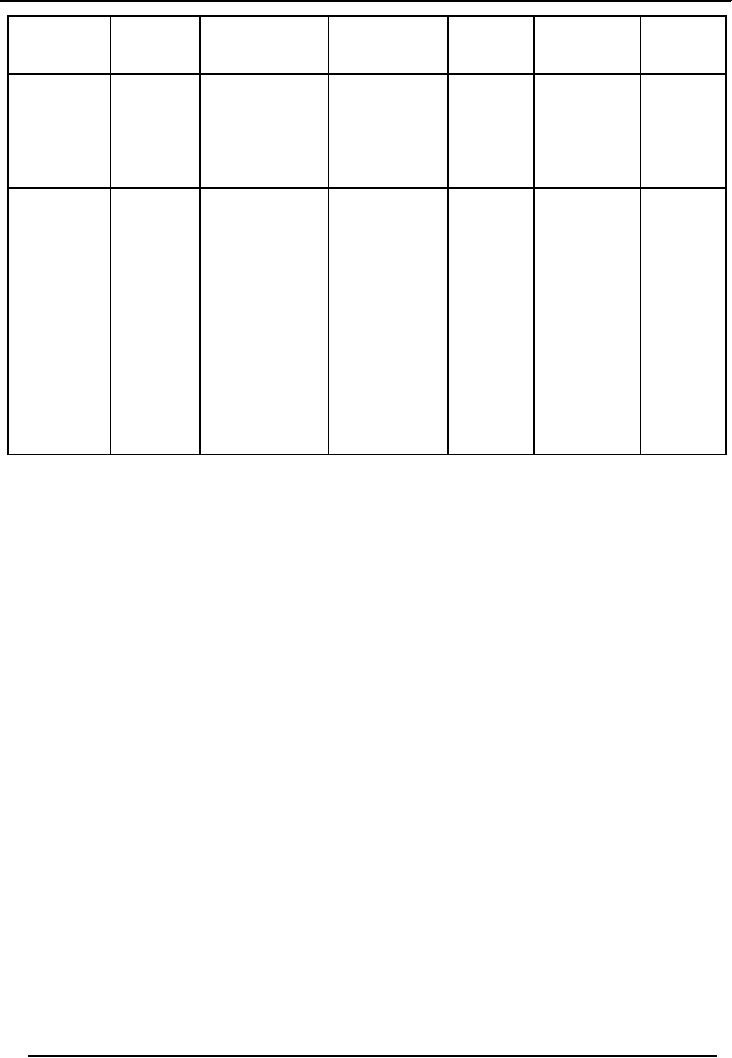

Straight

line method

Depreciation

= (120,000 20,000) / 5 = Rs.

20,000

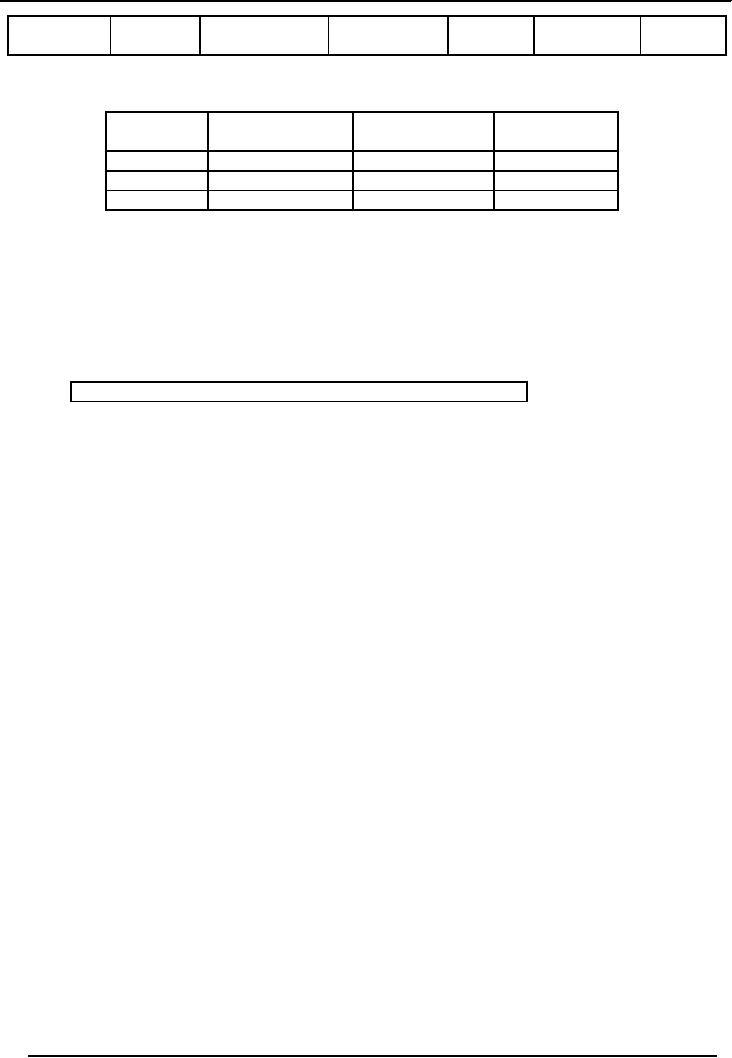

Particulars

Depreciation

Written

(Rs)

Down

Value

(Rs.)

100,000

Depreciable

cost

Dep.

Of the 1st year

80,000

(20,000)

Dep.

Of the 2nd year

60,000

(20,000)

Dep.

Of the 3rd year

40,000

(20,000)

Dep.

Of the 4th year

20,000

(20,000)

Dep.

Of the 5th year

0

(20,000)

Reducing

Balance Method

Under

this method, depreciation is

calculated on written down

value. In the first year,

depreciation is

calculated on

cost. Afterwards written

down value is calculated by

deducting accumulated depreciation

from

the cost of that asset(cost

accumulated depreciation) and depreciation is

charged on that value.

In

this

method, the value of asset never

becomes zero. Consider the following

example:

Cost

of an asset

Rs.

100,000

Expected

life

Rs. 5

years

Depreciation

rate

20%

Solution

Particulars

Depreciation

Accumulated

Written

(Rs)

Depreciation

Down

(Rs.)

Value

(Rs.)

100,000

Depreciable

cost

Dep.

Of the 1st year

80,000

20,000

20,000

100,000

x 20%

Dep.

Of the 2nd year

64,000

36,000

16,000

80,000

x 20%

Dep.

Of the 3rd year

51,200

48,800

12,800

64,000

x 20%

Dep.

Of the 4th year

40,960

59,040

10,240

51,200

x 20%

Dep.

Of the 5th year

32,768

67,232

8,192

40,960

x 20%

You

see, at the end of five years, WDV of the

asset is Rs. 32,768, not

zero. But in case of

straight line

method, the

WDV, after five years

was zero. So, in the opinion

of some people, reducing

balance

82

Financial

Statement Analysis-FIN621

VU

method is

better than that of straight

line method, but both

methods are effective. It is the

management

that

has to decide, which method is best

suited to their business.

Once

an asset has been fully

depreciated, no more depreciation should be recorded

on it, even though

the

property may be in good

condition and may be in use.

The objective of depreciation is to

spread the

cost

of an asset over the periods of its

usefulness; in no case can

depreciation be greater than the

amount

paid

for the asset. When a fully

depreciated asset is in use beyond the

original estimate of useful

life, the

asset

account and the accumulated depreciation

account should remain in the

accounting records

without

further entries until the asset is

retired.

Reducing

Balance Method

In

this method, depreciation is calculated

on written down value. In the

first year, depreciation

is

calculated on

cost. Afterwards written

down value is calculated by

deducting accumulated depreciation

from

the cost of that asset (cost

accumulated depreciation) and depreciation is

charged on that

value.

Cost of

Asset Price at which

the asset was initially

recorded

Written

Down Value / Book Value

Cost minus Accumulated

Depreciation.

In

reducing balance method, a formula is

used for calculation the

depreciation rate i.e.

Rate

= 1

n RV /

C

Where:

"RV" =

Residual Value

"C" =

Cost

"n" =

Life of Asset

Calculate

the rate if:

Cost

=

100,000

Residual

Value (RV)

=

20,000

Life

= 3

years

Rate

=

13

20000/100000

= 42%

Year

1

Cost

100,000

Depreciation

100,000 x 42%

(42,000)

WDV

(Closing Balance)

58,000

Year

2

WDV

(Opening Balance)

58,000

Depreciation

58,000

x 42%

(24,360)

WDV

(Closing Balance)

33,640

Year

3

WDV

(Opening Balance)

33,640

Depreciation

33,640

x 42%

(14,128)

WDV

(Closing Balance)

19,511

Disposal

of Asset

83

Financial

Statement Analysis-FIN621

VU

Cost

of Asset

=

100,000

Life

of the Asset

= 5

Years

Depreciation

Method

=

Straight Line

Residual

Value

=

Rs.10000

Sale

Price after Five

Years

=

Rs.15000

Depreciation

per year = (100000-10000) / 5

= Rs.5000 per

year

Total

Depreciation in Five

Years

=

18,000 x 5

=

90,000

Book

Value after Five

Years

=

100,000- 90,000

=

10,000

Profit

on Disposal

=

15,000 10,000

=

Rs.5000

Recording

of Disposal

Debit

Fixed

Asset Disposal A/c

100,000

Credit

Fixed

Asset Cost A/c

100,000

(With

the cost of asset)

Debit

Accumulated

Dep. A/c

90,000

Credit

Fixed

Asset Disposal A/c

90,000

(With

the depreciation accumulated to date)

Debit

Cash

/ Bank / Receivable

A/c

15,000

Credit

Fixed

Asset Disposal A/c

15,000

(With

the price at which asset is

sold)

[Note:

one group to appear at a

time]

Disposal

of Asset Account

Fixed

Asset Disposal Account

Debit

Credit

Cost

Account

100,000

Acc.

Dep. Account

90,000

Cash

/ Bank

15,000

P & L

Account

5000

(

Balancing Figure)

Total

105000

Total

105000

Policy

for Depreciation

84

Financial

Statement Analysis-FIN621

VU

The

management of the business selects the

policy for charging

depreciation. There is no law

binding on

the

management. The management is

free to choose method of depreciation and

policy of charging

depreciation.

Normally two policies are

commonly used:

� Depreciation

on the basis of use

� In the

year of purchase, full

year's depreciation is charged; where as,

in the year of sale no

depreciation

is charged.

Now

it is up to the management to decide, what method

and what policy is better

and effective for

their

business.

Disposal

of Fixed Asset

When

depreciable asset is disposed off at

any time during the

financial year, an entry

should be made to

give

effect of the disposal. Since, the residual

value of asset is only estimated; it is

common for asset to

be

sold at price that differs

from its book value at the

date of disposal. When asset is

sold, any profit or

loss

is computed by comparing book value

with the amount received

from sale. As you know,

book

value

is obtained by deducting accumulated

depreciation from original

cost of the asset. A sale

price in

excess

of the book value produces

profit; a sale price below

the book value produces

loss. This profit or

loss

should be shown in the profit & loss

account.

Entries

for Recording Disposal

Debit

Fixed

Asset Disposal A/c

Credit

Fixed

Asset Cost A/c

(With

the cost of asset)

Debit

Accumulated

Dep. A/c

Credit

Fixed

Asset Disposal A/c

(With

the depreciation accumulated to date)

Debit

Cash

/ Bank / Receivable

A/c

Credit

Fixed

Asset Disposal A/c

(With

the price at which asset is

sold)

Example

�

An

asset is purchased for Rs.

500,000 on Nov. 01,

2001.

�

Depreciation

rate is 10% p.a.

�

The

Asset is sold on Apr. 30,

2004.

�

Financial

Year is July 1 to June

30

Question

� Calculate

the WDV For both

policies

85

Financial

Statement Analysis-FIN621

VU

Depreciation is

charged on the Basis of

Use

Year

On the

Basis of Use

Rs.

1-11-2001

Cost

500,000

2001-2002

Dep.

500,000 x 10% x 8 / 12

(33,333)

30-6-2002

WDV

466,667

2002-2003

Dep.

466,666 x 10%

(46,667)

30-6-2003

WDV

420,000

2003-2004

Dep.

420,000 x 10% x 10 / 12

(35,000)

30-4-2004

WDV

385,000

Full

Depreciation in the Year of

Purchase

Year

Full

Dep. in year of

Purchase

Rs.

1-11-2001

Cost

500,000

2001-2002

Dep.

500,000 x 10%

(50,000)

30-6-2002

WDV

450,000

2002-2003

Dep.

450,000 x 10%

(45,000)

30-6-2003

WDV

405,000

2003-2004

Dep.

00 in the year of sale

00

30-6-2004

WDV

405,000

Contents

of Fixed Assets Register

�

Different record for each

class of assets

� Date of

purchase

�

Detailed particulars of

asset

�

Location of asset

� Record of

depreciation

Illustration

Cost

of asset

Rs.

200,000

Life

of the asset

5

years

Depreciation

method

Straight

line

Residual

value

Rs.

20,000

Sale

price after 5 years

30,000

Calculate

profit/Loss on the sale of the

asset?

86

Financial

Statement Analysis-FIN621

VU

Solution

Written

down value = 200,000

20,000 = 180,000

Depreciation/year

= 180,000/5 = 36,000 (Straight

line method)

Particulars

Depreciation

(Rs)

Written

Down

Value

(Rs.)

200,000

Depreciable

cost

Dep.

Of the 1st year

164,000

(36,000)

Dep.

Of the 2nd year

128,000

(36,000)

Dep.

Of the 3rd year

92,000

(36,000)

Dep.

Of the 4th year

56,000

(36,000)

Dep.

Of the 5th year

20,000

(36,000)

Book

value after five

years

Rs.

20,000

Sale

price

Rs.

30,000

Profit

on sale

Rs.

10,000 (30,000

20,000)

Same

illustration is solved by reducing

balance method

Cost

of asset

Rs.

200,000

Residual

value

Rs.

20,000

Estimated

useful life

5

years

Calculation

of depreciation rate

____

n

Depreciation

Rate = 1 √Rv/c

_____________

5

= 1 - √20,000/200,000

=

37%

Allocation

of depreciation is given

below:

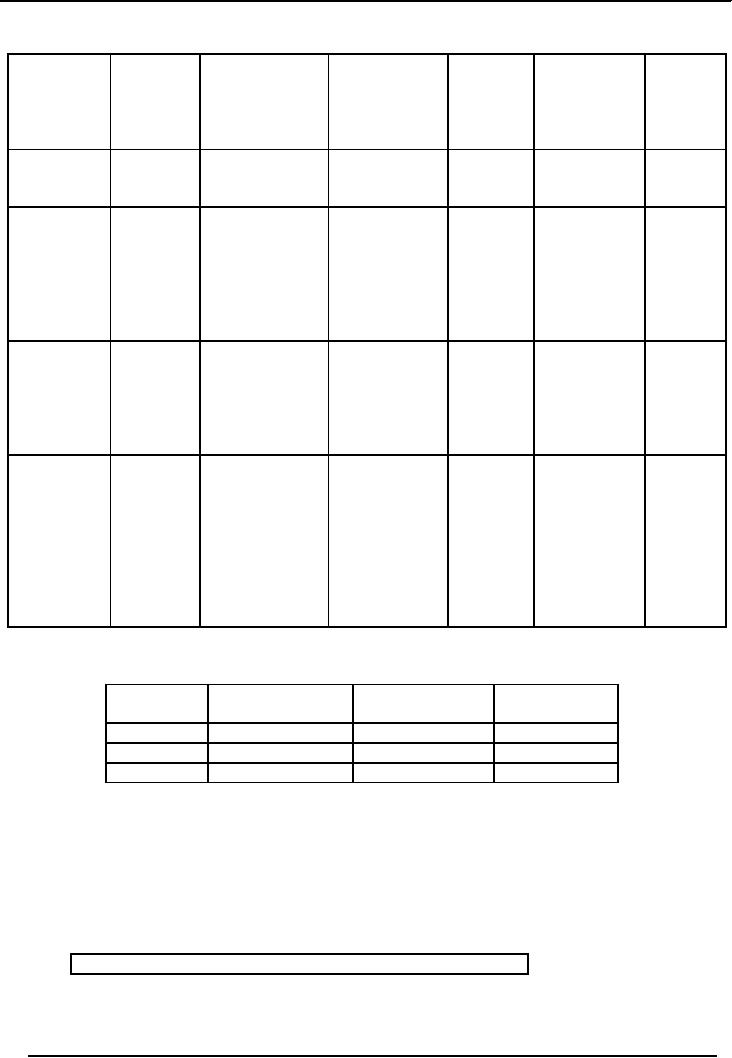

Particulars

Depreciation

(Rs)

Accumulated

Written

Down

Depreciation

Value

(Rs.)

(Rs.)

200,000

Depreciable

cost

Dep.

Of the 1st year

126,000

74,000

74,000

200,000

x 37%

Dep.

Of the 2nd year

79,380

120,620

46,620

126,000

x 37%

Dep.

Of the 3rd year

50,009

149,991

29,371

79,380

x 37%

Dep.

Of the 4th year

31,506

168,494

18,503

50,009

x 37%

Dep.

Of the 5th year

19,849

180,151

11,657

31,506

x 37%

Book

value after five

years

Rs.

19,849

Sale

price

Rs.

30,000

Profit

on sale

Rs.

10,151 (30,000

19,849)

87

Financial

Statement Analysis-FIN621

VU

If an

asset is not completed at that

time when balance sheet is

prepared, all costs incurred on

that asset

up to the

balance sheet date are

transferred to an account called Capital

Work in Progress

Account.

This

account is shown separately in the balance

sheet below the fixed asset.

Capital work in

progress

account

contains all expenses incurred on the

asset until it is converted

into working condition. All

these

expenses

will become part of the cost

of that asset. When an asset

is completed and it is ready to

work,

all

costs in the capital work in

progress account will transfer to

the relevant asset account

through the

following

entry:

Debit:

Relevant

asset account

Credit:

Capital

work in progress

account

Illustration

# 1

A machine is

purchased for Rs. 400,000.

Its useful life is estimated to be

five years. Its residual

value is

Rs.

25,000. After four years, it

was sold for Rs.

40,000. For the purpose of

WDV, its depreciation rate

is

40%.

You

are required to show calculation of

depreciation for four years.

Also calculate profit or loss

on

disposal.

Solution

Calculation

of depreciation and profit & loss on

the basis of straight line

method:

Depreciation/year

= (400,000 25,000)/5 = 75,000

(Straight line

method)

As,

machine was sold after four

years but its useful

life was estimated for five

years, when we calculate

depreciation

of the asset under straight

line method, we will divide

its WDV over five years,

not on four

years.

Particulars

Depreciation

(Rs)

Written

Down Value

(Rs.)

375,000

Depreciable

cost

Dep.

Of the 1st year

300,000

(75,000)

Dep.

Of the 2nd year

225,000

(75,000)

Dep.

Of the 3rd year

150,000

(75,000)

Dep.

Of the 4th year

75,000

(75,000)

Book

value after four

years

Rs.

75,000

Sale

price

Rs.

40,000

Profit/(loss)

on sale

Rs.

(35,000) i-e.(40,000

75,000)

88

Financial

Statement Analysis-FIN621

VU

Calculation

of depreciation and profit & loss on

the basis of reducing

balance method:

Depreciation

rate = 40%

Particulars

Depreciation

Accumulated

Written

(Rs)

Depreciation

Down

(Rs.)

Value

(Rs.)

400,000

Depreciable

cost

Dep.

Of the 1st year

240,000

160,000

160,000

400,000

x 40%

Dep.

Of the 2nd year

144,000

256,000

96,000

240,000

x 40%

Dep.

Of the 3rd year

86,400

313,600

57,600

144,000

x 40%

Dep.

Of the 4th year

51,840

348,160

34,560

86,400

x 40%

Book

value after four

years

Rs.

51,840

Sale

price

Rs.

40,000

Profit/

(loss) on sale

Rs.

(11,840) i-e. (40,000

51,840)

Illustration

# 2

Following

information of machinery account is

available in Year

2004:

� Machine

# 1 is purchased on September 1, 2000

for Rs. 100,000

� Machine

# 2 is purchased on January 31, 2002

for Rs. 200,000

� Machine

# 3 is purchased on July 1, 2003

for Rs. 50,000

� Machine

# 1 is disposed on March 31,

2004

Depreciation

is charged @ 25% reducing

balance method. Financial year is

closed on June 30

every

year.

Show

the calculation of depreciation on

machinery for four years

using the following

policies:

� Depreciation

is charged on the basis of

use

� Full

depreciation is charged in the year of

purchase and no depreciation is charged

in the year

of

disposal.

Solution

Depreciation on

the basis of use

Depreciation

Accumulated

Total

Written

Total

Date

Purchase

(Rs.)

depreciation

Accum.

Down

Value Written

of

(Rs.)

Dep.

(Rs.)

Down

machine

Value

(Rs.)

(Rs.)

01-09-2000

100,000

Machine

# 1

Machine

# 1

20,833

Machine

# 1 79,167

100,000

x 25%

20,833

79,167

x10/12=20,833

238,542

61,458

Machine

# 1

Machine

# 1

Machine

# 1

2001-2002

59,375

40,625

79,167x25%

= 19,792

Machine

# 2

Machine

# 2

Machine

# 2

200,000

31-01-2002

89

Financial

Statement Analysis-FIN621

VU

200,000x25%x5

20,833

179,167

/12=20,833

178,906

121,094

Machine

# 1

Machine

# 1

2002-2003

Machine

# 1

44,531

55,469

59,375x25%

= 14,844

Machine

# 2

Machine

# 2

Machine

# 2

134,375

65,625

179,167x25%

=44,792

175,538

Machine

# 1

138,281

Machine

# 1

Machine

# 1

2003-2004

63,819

44,531x25%x

(36,181)

9/12=

8,350

(sold)

Machine

# 2

Machine

# 2

Machine

# 2

99,219

100,781

134,375x25%

= 33,594

Machine

# 3

Machine

# 3

Machine

# 3

50,000

01-07-2003

12,500

37,500

50,000x25%

= 12,500

Figure

in blue color is the written

down value of machine # 1, which is

disposed of by the management.

90

Financial

Statement Analysis-FIN621

VU

Full

year depreciation in the year of

purchase and no depreciation in the

year of sale:

Date

Purchase

Depreciation

Accumulated

Total

Written

Total

of

(Rs.)

depreciation

Accum.

Down

Value Written

machine

(Rs.)

Dep.

(Rs.)

Down

(Rs.)

Value

(Rs.)

01-09-2000

100,000

Machine

# 1

Machine

# 1

25,000

Machine

# 1

75,000

100,000

x 25%

25,000

75,000

=25,000

206,250

93,750

Machine

# 1

Machine

# 1

Machine

# 1

2001-2002

56,250

43,750

75,000x25%

= 18,750

Machine

# 2

Machine

# 2

200,000

Machine

# 2

31-01-2002

150,000

50,000

200,000x25%

=50,000

154,687

145,313

Machine

# 1

Machine

# 1

2002-2003

Machine

# 1

42,187

57,813

56,250x25%

= 14,063

Machine

# 2

Machine

# 2

Machine

# 2

112,500

87,500

150,000x25%

=37,500

121,875

185,935

Machine

# 1

Machine

# 1

Machine

# 1

2003-2004

42,187

57,813

0

(sold)

(sold)

Machine

sold

Machine

# 2

Machine

# 2

Machine

# 2

84,375

115,625

112,500x25%

= 28,125

Machine

# 3

Machine

# 3

Machine

# 3

50,000

01-07-2003

37,500

12,500

50,000x25%

= 12,500

If an

asset is not completed at that

time when balance sheet is

prepared, all costs incurred on

that asset

up to the

balance sheet date are

transferred to an account called Capital

Work in Progress

Account.

This

account is shown separately in the balance

sheet below the fixed asset.

Capital work in

progress

account

contains all expenses incurred on the

asset until it is converted

into working condition. All

these

expenses

will become part of the cost

of that asset. When any

expense is incurred or paid, it is

included

in the

Capital Work in Progress

Account through the following

entry:

Debit:

Work

in Progress Account

Credit:

Cash/Bank/Payable

Account

When

an asset is completed and it is ready to

work, all costs will

transfer to the relevant asset

account

through

the following entry:

Debit:

Relevant

asset account

Credit:

Capital

work in progress

account

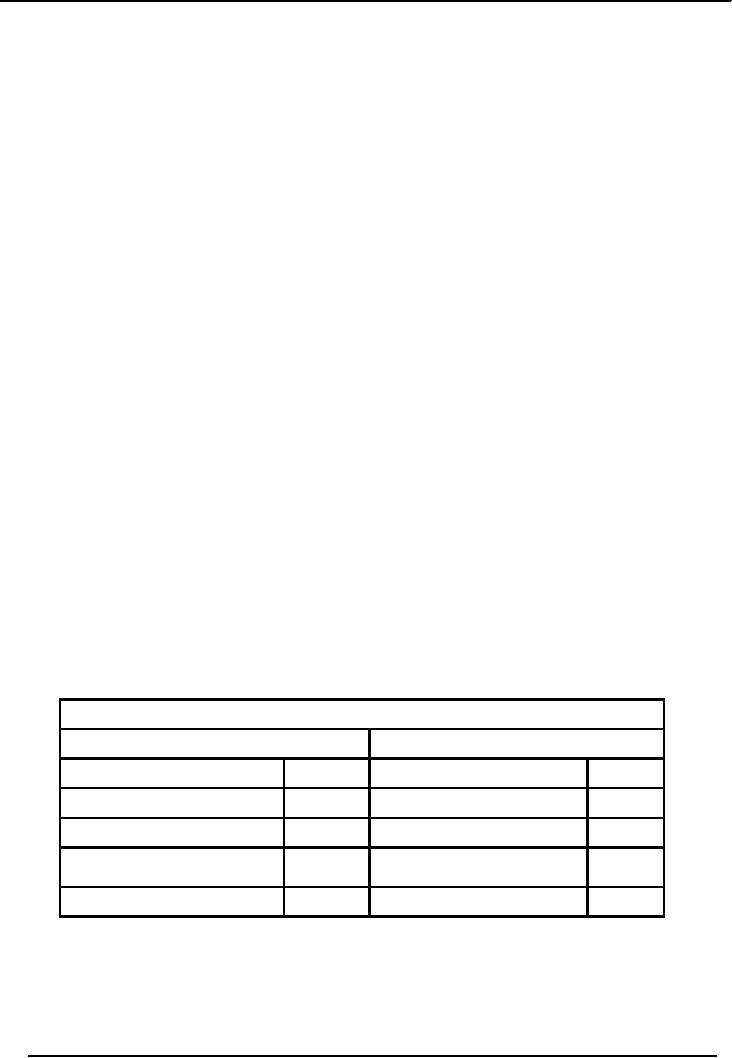

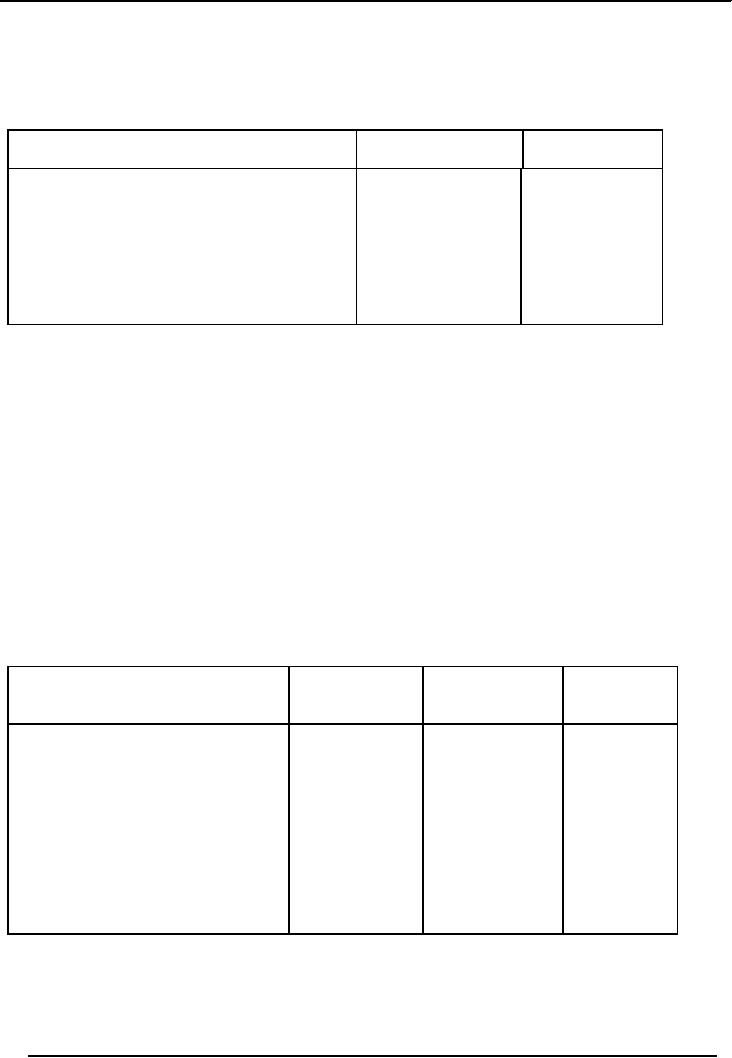

Presentation

It is

already mentioned that Work

in Progress Account is shown separately in the

balance sheet below

the

fixed asset. i-e.

91

Financial

Statement Analysis-FIN621

VU

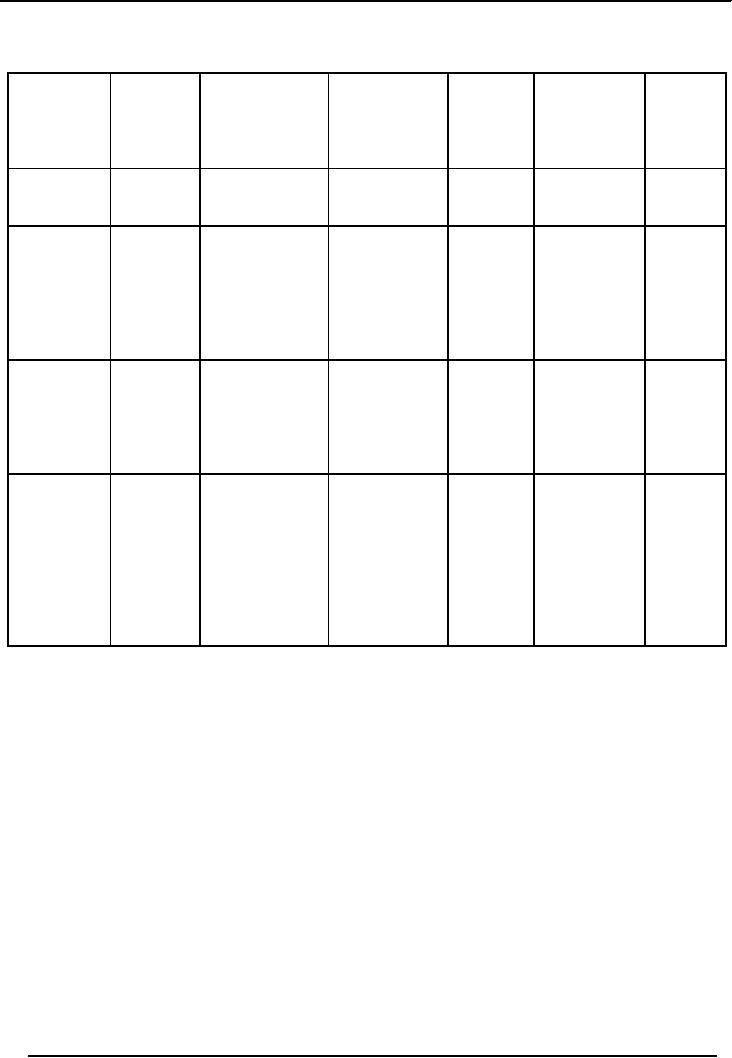

Name

of the Entity

Balance

Sheet

As

At..........

Particulars

Amount

Amount

Rs.

Rs.

Assets

Fixed

Assets

xyz

Capital

Work in Progress

xyz

Other

Long Term Assets

xyz

Current

Assets

Total

Xyz

Liabilities

Capital

xyz

Profit

xyz

Xyz

Long

Term Liabilities

Xyz

Current

Liabilities

Total

Xyz

Consider the

solved illustration in the previous

lecture:

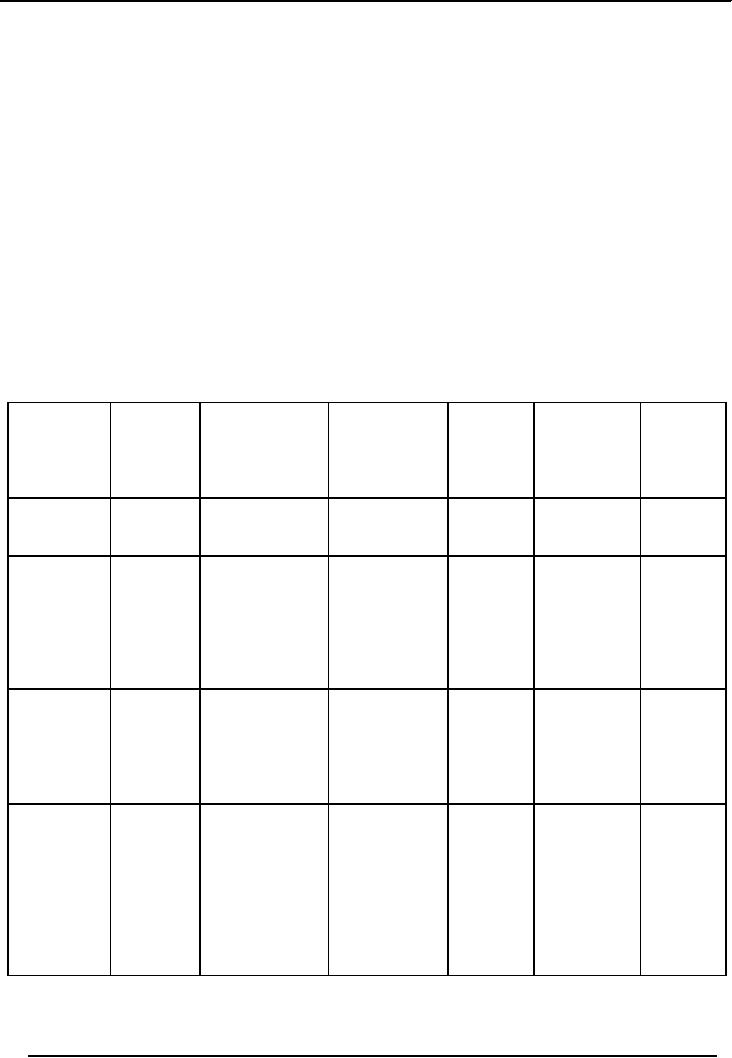

Depreciation on

the basis of use

Depreciation

Accumulated

Total

Written

Total

Date

Purchase

(Rs.)

depreciation

Accum.

Down

Value Written

of

(Rs.)

Dep.

(Rs.)

Down

machine

Value

(Rs.)

(Rs.)

01-09-2000

100,000

Machine

# 1

Machine

# 1

20,833

Machine

# 1 79,167

100,000

x 25%

20,833

79,167

x10/12=20,833

238,542

61,458

Machine

# 1

Machine

# 1

Machine

# 1

2001-2002

59,375

40,625

79,167x25%

= 19,792

Machine

# 2

Machine

# 2

Machine

# 2

200,000

31-01-2002

179,167

20,833

200,000x25%x5

/12=20,833

178,906

121,094

Machine

# 1

Machine

# 1

2002-2003

Machine

# 1

44,531

55,469

59,375x25%

= 14,844

Machine

# 2

Machine

# 2

Machine

# 2

134,375

65,625

179,167x25%

=44,792

138,281

175,538

Machine

# 1

Machine

# 1

Machine

# 1

2003-2004

(36,181)

63,819

44,531x25%x

(sold)

9/12=

8,350

Machine

# 2

Machine

# 2

Machine

# 2

100,781

99,219

134,375x25%

= 33,594

Machine

# 3

Machine

# 3

Machine

# 3

50,000

01-07-2003

92

Financial

Statement Analysis-FIN621

VU

50,000x25%

12,500

37,500

= 12,500

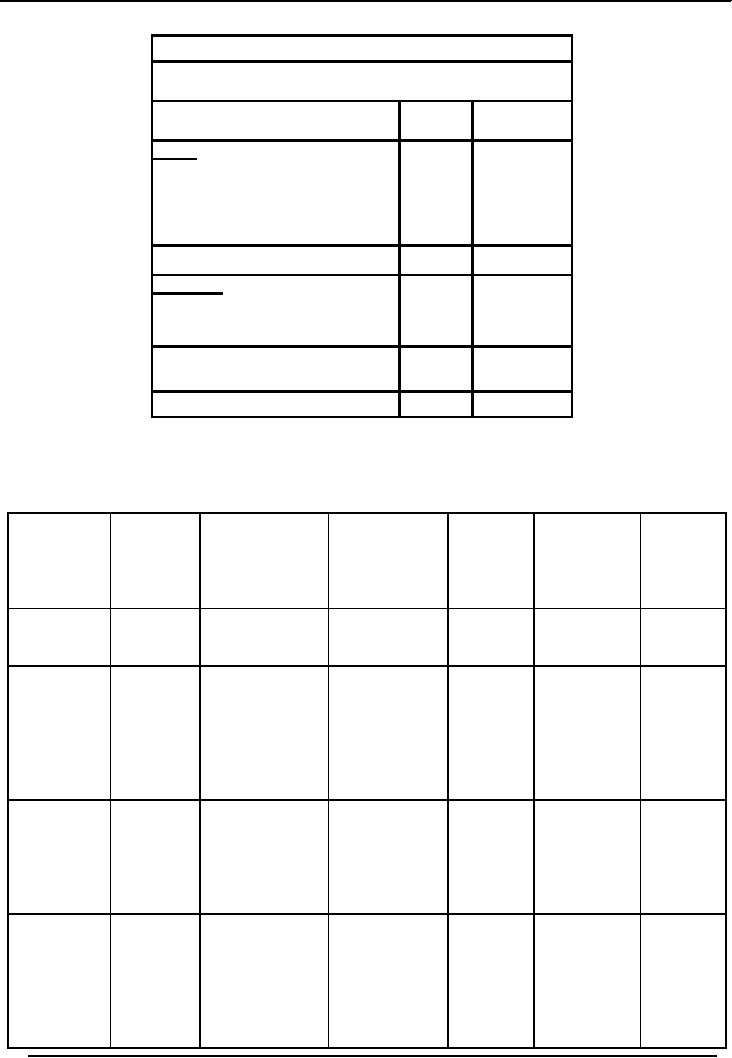

Presentation

in Balance Sheet

Year

Cost

of Machinery

Accumulated

Written

Down

Depreciation

Value

2000-2001

100,000

20,833

79,167

2001-2002

300,000

61,458

238,542

2002-2003

300,000

121,094

178,906

Written

down Value of the year

2003-2004

Opening

Written Down Value:

178,906

Add:

Cost of machine purchased:

50,000

Less:

Depreciation of Machine # 1 in

2003-2004:

(8,350)

Less:

Depreciation of other

assets:

(46,094)

Less:

Written Down Value of machine

disposed:

(36,181)

Closing

Written Down Value:

138,281

93

Financial

Statement Analysis-FIN621

VU

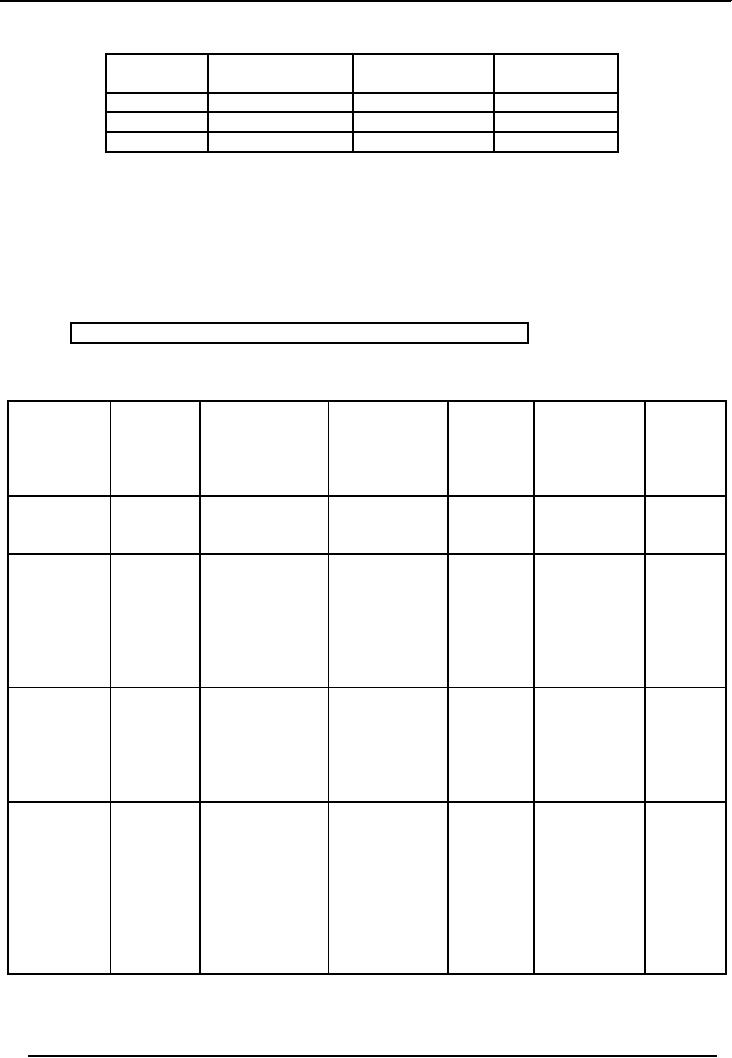

Full

year depreciation in the year of

purchase and no depreciation in the

year of sale:

Date

Purchase

Depreciation

Accumulated

Total

Written

Total

of

(Rs.)

depreciation

Accum.

Down

Value Written

machine

(Rs.)

Dep.

(Rs.)

Down

(Rs.)

Value

(Rs.)

01-09-2000

100,000

Machine

# 1

Machine

# 1

25,000

Machine

# 1

75,000

100,000

x 25%

25,000

75,000

=25,000

206,250

93,750

Machine

# 1

Machine

# 1

Machine

# 1

2001-2002

56,250

43,750

75,000x25%

= 18,750

Machine

# 2

Machine

# 2

Machine

# 2

200,000

31-01-2002

150,000

50,000

200,000x25%

=50,000

154,687

145,313

Machine

# 1

Machine

# 1

2002-2003

Machine

# 1

42,187

57,813

56,250x25%

= 14,063

Machine

# 2

Machine

# 2

Machine

# 2

112,500

87,500

150,000x25%

=37,500

121,875

185,935

Machine

# 1

Machine

# 1

Machine

# 1

2003-2004

42,187

57,813

0

(sold)

(sold)

Machine

sold

Machine

# 2

Machine

# 2

Machine

# 2

84,375

115,625

112,500x25%

= 28,125

Machine

# 3

Machine

# 3

Machine

# 3

50,000

01-07-2003

37,500

12,500

50,000x25%

= 12,500

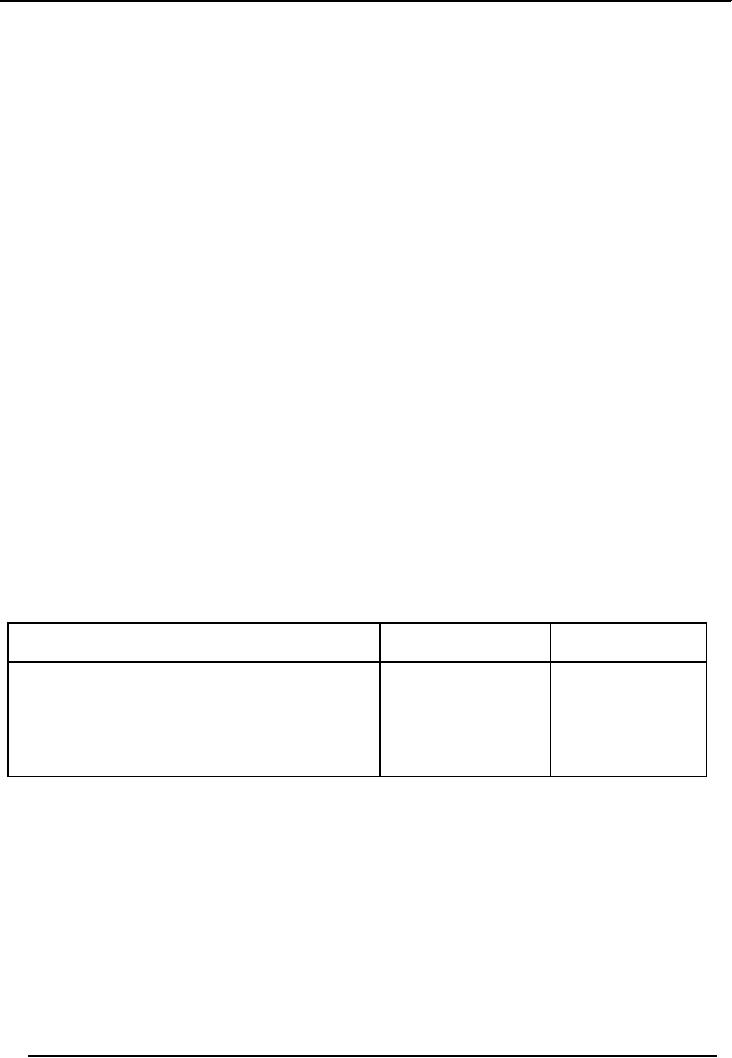

Presentation

in the Balance

Sheet

Year

Cost

of Machinery

Accumulated

Written

Down

Depreciation

Value

2000-2001

100,000

25,000

75,000

2001-2002

300,000

93,750

206,250

2002-2003

300,000

145,313

154,687

Written

down Value of the year

2003-2004

Opening

Written Down Value:

Rs.

154,687

Add:

Cost of machine purchased:

Rs.

50,000

Less:

Depreciation of Machine # 1 in

2003-2004:

0

Less:

Depreciation of other

assets:

(40,625)

Less:

Written Down Value of machine

disposed:

(42,187)

Closing

Written Down Value:

Rs.

121,875

94

Financial

Statement Analysis-FIN621

VU

Illustration

# 2

Following

information of machinery account is

available in Year

2004:

� Machine

# 1 is purchased on

August

1, 2000 for Rs.

50,000

� Machine

# 2 is purchased on April 1, 2002

for Rs. 100,000

� Machine

# 3 is purchased on March 1, 2004

for Rs. 150,000

� Machine

# 1 is disposed on May 31,

2004

Depreciation

is charged @ 20% reducing

balance method. Financial year is

closed on June 30

every

year.

Show

the calculation of depreciation on

machinery for four years

using the following

policies:

� Depreciation

is charged on the basis of

use

� Full

depreciation is charged in the year of

purchase and no depreciation is charged

in the year

of

disposal,

Solution

Depreciation on

the basis of use

Written

Total

Total

Date

Purchase

Depreciation

Accumulated

Down

Value Written

(Rs.)

depreciation

Accum.

of

Dep.

(Rs.)

Down

(Rs.)

machine

Value

(Rs.)

(Rs.)

01-08-2000

50,000

Machine

# 1

Machine

# 1

9,167

Machine

# 1 40,833

50,000

x 20%

9,167

9,167

x11/12=9,167

Machine

# 1

22,334

Machine

# 1

127,666

Machine

# 1

2001-2002

17,334

32,666

40,833x20%

Machine

# 2

= 8,167

5,000

Machine

# 2

100,000

Machine

# 2

01-04-2002

95,000

100,000x20%x3

/12=5,000

2002-2003

Machine

# 1

Machine

# 1

47,867

Machine

# 1

102,133

32,666x20%

23,867

26,133

= 6,533

Machine

# 2

Machine

# 2

Machine

# 2

95,000x20%

24,000

76,000

=19,000

200,800

77,858

Machine

# 1

Machine

# 1

Machine

# 1

2003-2004

(21,342)

28,658

26,133x20%x

(sold)

11/12=

4,791

Machine

# 2

Machine

# 2

Machine

# 2

60,800

39,200

76,000x20%

= 15,200

Machine

# 3

Machine

# 3

Machine

# 3

150,000

01-03-2004

140,000

10,000

150,000x20%x

4/12=

10,000

95

Financial

Statement Analysis-FIN621

VU

Presentation

in the Balance

Sheet

Year

Cost

of Machinery

Accumulated

Written

Down

Depreciation

Value

2000-2001

50,000

9,167

40,833

2001-2002

150,000

22,334

127,666

2002-2003

150,000

47,867

102,133

Written

Down Value of the year

2003-2004

Opening

Written Down Value:

Rs.

102,133

Add:

Cost of machine purchased:

Rs.

150,000

Less:

Depreciation of Machine # 1 in

2003-2004:

(4,791)

Less:

Depreciation of other

assets:

(25,200)

Less:

Written Down Value of machine

disposed:

(21,342)

Closing

Written Down Value:

Rs.

200,800

Full

year depreciation in the year of

purchase and no depreciation in the

year of sale:

Depreciation

Accumulated

Total

Written

Total

Date

Purchase

(Rs.)

depreciation

Accum.

Down

Value Written

of

(Rs.)

Dep.

(Rs.)

Down

machine

Value

(Rs.)

(Rs.)

01-08-2000

50,000

Machine

# 1

Machine

# 1

10,000

Machine

# 1

40,000

50,000

x 20%

10,000

40,000

=10,000

112,000

38,000

Machine

# 1

Machine

# 1

Machine

# 1

2001-2002

32,000

18,000

40,000x20%

= 8,000

Machine

# 2

Machine

# 2

100,000

Machine

# 2

01-04-2002

80,000

20,000

100,000x20%

=20,000

89,600

60,400

Machine

# 1

Machine

# 1

2002-2003

Machine

# 1

25,600

24,400

32,000x20%

= 6,400

Machine

# 2

Machine

# 2

Machine

# 2

64,000

36,000

80,000x20%

=16,000

171,200

103,200

Machine

# 1

Machine

# 1

Machine

# 1

2003-2004

(25,600)

24,400

0

(sold)

(sold)

Machine

sold

Machine

# 2

Machine

# 2

Machine

# 2

51,200

48,800

64,000x20%

= 12,800

Machine

# 3

Machine

# 3

Machine

# 3

150,000

01-03-2004

120,000

30,000

150,000x20%

= 30,000

96

Financial

Statement Analysis-FIN621

VU

Presentation

in the Balance

Sheet

Year

Cost

of Machinery

Accumulated

Written

Down

Depreciation

Value

2000-2001

50,000

10,000

40,000

2001-2002

150,000

38,000

112,000

2002-2003

150,000

60,400

89,600

Written

Down Value of the year

2003-2004

Opening

Written Down Value:

Rs.

89,600

Add:

Cost of machine purchased:

Rs.

150,000

Less:

Depreciation of Machine # 1 in

2003-2004:

0

Less:

Depreciation of other

assets:

(42,800)

Less:

Written Down Value of machine

disposed:

(25,600)

Closing

Written Down Value:

Rs.

171,200

Revaluation of Fixed

Assets

Fixed

assets are purchased to be

used for longer period. In

the subsequent years, the value of

asset could

be

higher or lower than its

present book value due to

inflationary condition of the economy.

Assets are

valued

at Historical Cost in the books of

accounts. Historical Cost is the

original cost of the asset

at

which

it was purchased plus

additional costs incurred on the

asset to bring it in working

condition.

Sometimes,

the management of the business, if it

thinks fit, revalues the asset to

present it on current

market

value. Once the asset is

revalued to its market

value, then its value

has to be constantly

monitored

to reflect the changes in the market

value.

If an

asset is revalued at higher

cost than its original

cost, the excess amount will be treated

as profit on

revaluation

of fixed assets and it is credited to

Revaluation Reserve

Account.

On the

other hand, if an asset is revalued at

lower cost than its

original cost, the balance amount

will be

treated as

loss on revaluation of fixed

assets and it is shown in the profit &

loss account of that year

in

which

asset was revalued.

97

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS