|

First-in-First - out (FIFO), Last-in-First-Out (LIFO) |

| << Charging Costs of Inventory to Income Statement |

| Depreciation Accounting Policies >> |

Financial

Statement Analysis-FIN621

VU

Lesson-20

NOTES

TO FINANCIAL STATEMENTS

(Continued)

In

cost-flow assumptions, three methods

for measuring "cost of good

sold", under GAAP are

used.

In

these three methods, assumptions

are made as to the sequence in

which units were

withdrawn

from inventory. The three

flow assumptions are:-

i)

Average

cost: Values

all merchandise (units sold

and in balance) at the

Average

per-unit cost, under the assumption of

random withdrawal of inventory

units.

Average

cost in the above example: Rs.23,

000 per AC. That would be

the cost of goods

sold.

Ending Inventory to be recorded on

balance sheet would also

take into account

this

figure

of reduction in Inventory.

ii)

First-in-First

- out (FIFO): goods

sold are assumed to be the

first units

that

were purchased.

iii)

Last-in-First-Out

(LIFO): units

sold are assumed to be those

which were most

recently

acquired.

During

Inflation, FIFO shows less

expense on income statement

and higher inventory

valuation

on balance sheet and values ending

inventory at current cost, whereas

LIFO shows higher

expenses

on income statement and lower

inventory valuation on balance

sheet.

It

should be noted that

Inventory valuation significantly affects

both b/sheet and

income

statements.

Each valuation method/cost-assumption

produces different results in

financial statements

and

tax returns.

Valuation

of Stock

Any

manufacturing organization purchases

different material through

out the year. The prices

of

purchases

may be different due to inflationary

conditions of the economy. The question

is, what item

should

be issued first & what

item should be issued later

for manufacturing. For this

purpose, the

organization

has to make a policy for

issue of stock. All the issues for

manufacturing and valuation of

stock

are recorded according to the policy of

the organization. Mostly these three

methods are used

for

the

valuation of stock:

�

First

in first out (FIFO)

�

Last

in first out (LIFO)

�

Weighted

average

First

in first out (FIFO)

The

FIFO method is based on the assumption

that the first merchandise

purchased is the first

merchandised

issued. The FIFO uses actual

purchase cost. Thus, if merchandise

has been purchased at

several

different costs, the inventory

(stock) will have several different

cost prices. The cost of

goods

sold

for a given sales transaction

may involve several different

cost prices.

Characteristics

�

This

is widely used method for

determining values of cost of goods

sold and closing stock.

74

Financial

Statement Analysis-FIN621

VU

�

In the

FIFO method, oldest available purchase

costs are transferred to cost of

goods sold. That

means

the cost if goods sold has a

lower value and the profitability of the

organization becomes

higher.

�

As the

current stock is valued at recent

most prices, the current

assets of the company have the

latest

assessed values.

Last in

first out (LIFO)

As the

name suggests, the LIFO method is

based on the assumption that the

recently purchased

merchandise

is issued first. The LIFO

uses actual purchase cost. Thus, if

merchandise has been

purchased

at several different costs, the inventory

(stock) will have several different

cost prices. The

cost

of goods sold for a given

sales transaction may involve several

different cost prices.

Characteristics

�

This

is alternatively used method for

determining values of cost of goods

sold and closing stock.

�

In the

LIFO method recent available

purchase costs are transferred to

cost of goods sold.

That

means

the cost of goods sold has a

higher value and the profitability of the

organization

becomes

lower.

�

As the

current stock is valued at oldest prices, the

current assets of the company have the

oldest

assessed

values.

Weighted

average method

When

weighted average method is in use, the

average cost of all units in

inventory, is computed after

every

purchase. This average cost

is computed by dividing the total cost of

goods available for sale

by

the number of

units in inventory. Under the

average cost assumption, all items in

inventory are

assigned

the

same per unit cost. Hence, it

does not matter which units

are sold; the cost of goods

sold is always

based

on current average unit

cost.

Characteristics

�

Under

the average cost assumption, all items in

inventory are assigned same

per unit cost (the

average

cost). Hence it does not matter

which units are sold

first. The cost of goods

sold is

always

on the current average unit

cost.

� Since

all inventories are assigned

same cost, this method does

not make any effect on

the

profitability

and does not

increase/decrease any asset in the

financial statements.

� This

is the alternatively used method for

determining values of cost of goods

sold and closing

stock.

Example

�

Receipts:

01

Jan 20--,

10

units @ Rs. 150 per

unit

02

Jan 20--,

15

units @ Rs. 200 per

unit

10

Jan 20--,

20

units @ Rs. 210 per

unit

�

Issues:

05

Jan 20--,

05

units

06

Jan 20--,

10

units

15

Jan 20--,

15

75

Financial

Statement Analysis-FIN621

VU

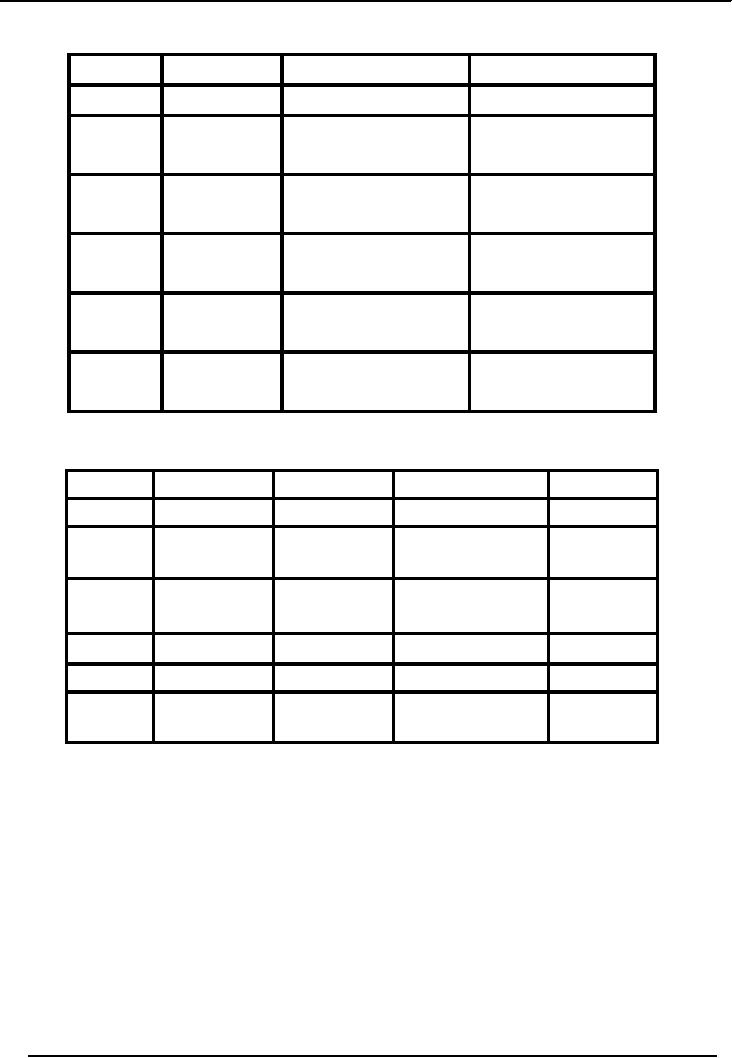

FIFO

Method of Stock

Valuation

Date

Receipts

Issues

Value

of Stock

01-01-20--

10 @

Rs. 150

10 x

150 = 1500

02-01-20--

15 @

Rs. 200

10 x

150 = 1500

15 x

200 = 3000

4500

05-01-20--

5 @

150 = 750

750

5 x

150 = 750

15 x

200

=

3000

3750

06-01-20--

5 @

150 = 750

0 x

150 =

0

5 @

200 = 1000 1750

10 x

200

=

2000

2000

10-01-20--

20 @

Rs. 210

10 x

200 = 2000

20 x

210

=

4200

6200

15-01-20--

10 @

200 = 2000

0 x

200 =

0

5 @

210 = 1050 3050

15 x

210

=

3150

3150

Weighted

Average Method of Stock

Valuation

Date

Receipts

Issues

Value

of Stock

Average

Cost

01-01-20--

10x150 = 1500

1500

1500/10=150

02-01-20--

15x200 = 3000

1500

+ 3000 = 4500

4500/25=180

05-01-20--

5x180

= 900

4500

900 = 3600

3600/20=180

06-01-20--

10x180

= 1800

3600

1800 = 1800

1800/10=180

10-01-20--

20x210 = 4200

1800

+ 4200 = 6000

6000/30=200

15-01-20--

15x200

= 3000

6000

3000 = 3000

3000/15=200

Effects

of valuation method on profit

FIFO

Method

�

Cost of Sales

= 750

+ 1750 + 3050

=

5,550

Gross

Profit

=

7500 5550

=

1,950

Weighted

Average Method

�

Cost of Sales = 900 +

1800 + 3000

=

5,700

Gross

Profit

=

7500 5700

=

1,300

76

Financial

Statement Analysis-FIN621

VU

Illustration

XYZ

Company is a manufacturing concern.

Following is the receipts & issues record

for the month of

May,

2002

Date

Receipts

Issues

May

7

200

units @ Rs. 50/unit

May

9

60

units

May

13

150

units @ Rs. 75/unit

May

18

100

units @ Rs. 60/unit

May

22

150

units

May

24

100

units

May

27

100

units @ Rs. 50/unit

May

30

200

units

Calculate

the value of closing stock by

� FIFO

Method

� Average

Method

Solution

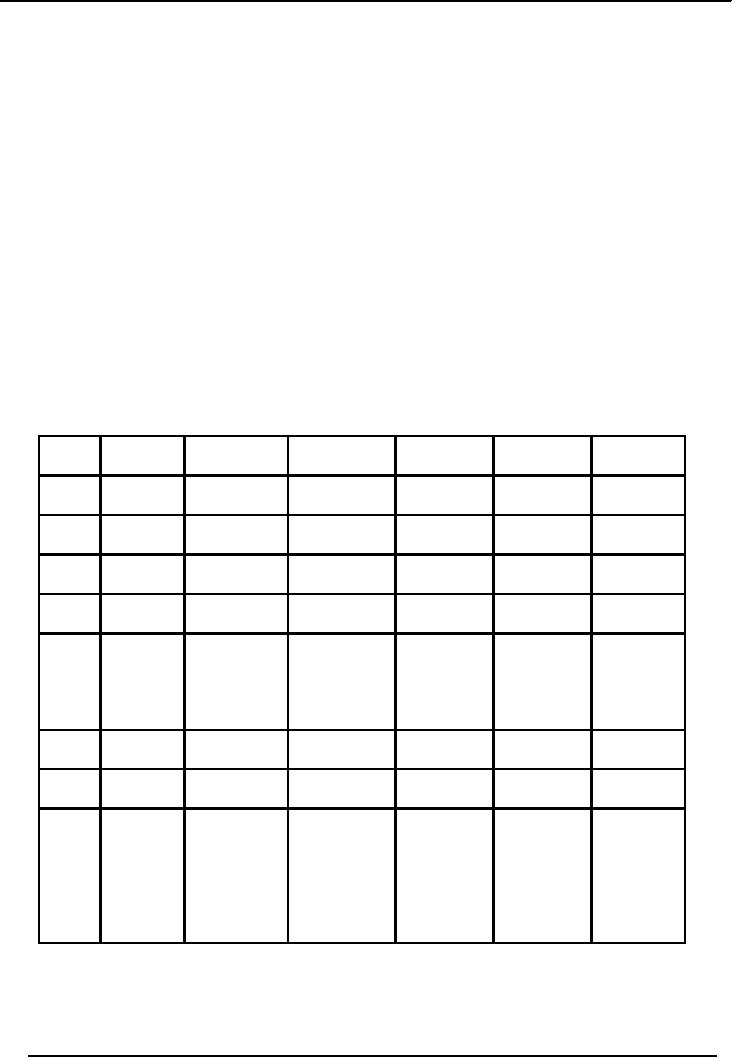

Valuation

of Stock by FIFO

Method

Date

Receipts

Issues

Value

of Stock Total

Remaining

Net

Balance

Amount

No. of

units

May

7

200

units @

200 x

50 = 10,000

200

10,000

Rs.

50/unit

10,000

May

9

60

units @ Rs. 60 x 50 = 3,000

(3,000)

140

7,000

50/unit

May

13

150

units @

75 x

150 = 11,250

290

18,250

Rs.

75/unit

11,250

May

18

100

units @

60 x

100 = 6,000

390

24,250

Rs.

60/unit

6,000

140

units @ 50 x 140 =

(7,750)

240

16,500

May

22

Rs.

50/unit

7,000

10

units @ Rs.

75/unit

10 x 75

=

750

May

24

100

units @ 75

x

100

(7,500)

140

9,000

Rs.

75/unit

=7,500

May

27

100

units @

50 x

100 = 5,000

240

14,000

Rs.

50/unit

5,000

40

units @ Rs. 75 x 40 = 3,000

(12,000)

40

2,000

May

30

75/unit

100

units @ 60 x 100 =

6,000

Rs.

60/unit

60

units @ Rs.

50 x 60 =

3,000

50/unit

77

Financial

Statement Analysis-FIN621

VU

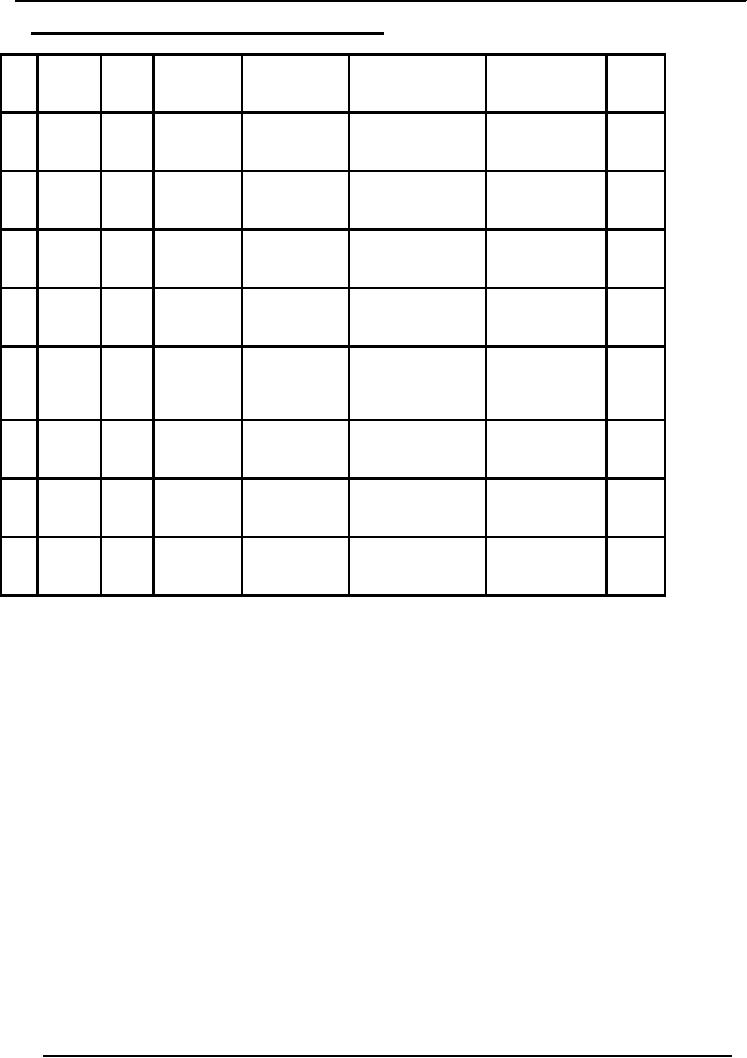

Valuation

of Stock by Weighted Average

Method:

Date

Receipts Issues

Value

of

Total

Total

Units

Average

Net

Stock

Amount(Rs.)

Cost(Rs.)/unit

Balance

(Rs.)

May

200 units

200 x

50

10,000

200

50

10,000

7

@

Rs.

=

50/unit

10,000

May

60

60 x

50

(3,000)

140

7,000

9

units

=

3,000

May

150 units

150 x

75

7,000+11250

140+150=290

18250/290=62.9 18,250

13

@

Rs.

=

=

75/unit

11,250

18250

May

100 units

100 x

60

18250+6000

290+100

24250/390

24,250

18

@

Rs.

=

=

=

=

60/unit

6,000

24250

390

62.2

May

150

150 x

62.2

(9,330)

390-150

14,920

22

units

=

=

9330

240

May

100

100 x

62.2

(6,220)

240-100

8,700

24

units

=

=

6220

140

May

100 units

100 x

50

8,700+5,000

140+100

13700/240

13,700

27

@

Rs.

=

=

=

=

50/unit

5,000

13,700

240

57.1

May

200

200 x

57.1

(11,420)

240-200

2,280

30

units

=

=

11,420

40

78

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS