|

Dual Aspect of Transactions |

| << ACCOUNTING & ACCOUNTING PRINCIPLES |

| Rules of Debit and Credit >> |

Financial

Statement Analysis-FIN621

VU

Lesson-2

ACCOUNT

AND ACCOUNTING

CYCLE/PROCESS

Account

An

accounting system keeps

separate record of each item

like assets, liabilities,

etc. For example, a

separate

record is kept for cash that

shows increase and decrease in

it.

This

record that summarizes movement in an

individual item is called an

Account.

Each

element/sub-element of the balance sheet is

named as "Account",

having

three parts

viz

title, left side (Debit or

Dr) and a right side

(Credit or Cr). Technically,

these are also called

`Ledger

Accounts'.

The same is true of Income

Statement, which would be discussed

later.

The

Ledger Accounts are also

called T-account, because

these are in the shape of the

alphabet `T' as

shown

below:-

Dr

Title

Cr

!

!

!

!

!

Account

Payable:An amount

owed to a supplier for good

or services purchased on credit;

payment is

due

within a short time period,

usually 30 days or

less.

Notes

Payable: A

liability expressed by a written promise

to make a future payment at a

specific time,

OR

are obligations (short term debt)

evidenced by a promissory note? The

proceeds of the note are

used

to

purchase current assets

(inventory & receivables).

Dual

Aspect of Transactions

For

every debit there is an equal

credit. This is also called

the dual

aspect of the transaction

i.e.

every

transaction

has two aspects, debit and

credit and they are always

equal. This means that

every

transaction

should have two-sided effect.

For example Mr. A starts his

business and he initially invests

Rupees

100,000/- in cash for his

business. Out of this cash

following items are purchased in

cash;

A

building for Rupees

50,000/-;

o

Furniture

for Rupees 10,000/-;

and

o

A

vehicle for Rupees

15,000/-

o

This

means that he has spent a

total of Rupees 75,000/- and

has left with Rupees

25,000 cash. We will

apply

the Dual Aspect Concept on these

events from the viewpoint of

business.

When

Mr. A invested Rupees 100,000/-, the

cash account benefited from

him. The event will

be

recorded in the

books of business as,

Debit

Cash

Rs.100,

000

Credit

Mr.

A

Rs.100,

000

Analyse

the transaction. The account that

received the benefit, in this

case is the cash account,

and the

account that provided the

benefit is that of Mr. A.

Building

purchased The building

account benefited from cash

account

�

Debit

Building

Rs.50,

000

Credit

Cash

Rs.50,

000

6

Financial

Statement Analysis-FIN621

VU

�

Furniture

purchased The furniture

account benefited from cash

account

Debit

Furniture

Rs.10,

000

Credit

Cash

Rs.10,

000

�

Vehicle

purchased The vehicle

account benefited from cash

account

Debit

Vehicle

Rs.15,

000

Credit

Cash

Rs.15,

000

Basic

Principle of Double

Entry

We

can devise the basic principle of

double entry book-keeping

from our discussion to this

point "Every

Debit

has a Credit" which means

that "All Debits are always

equal to All Credits".

Assets

Assets

are the properties

and possessions of the

business.

Properties

and possessions can be of

two types:

o Tangible

Assets that

have physical existence ( are further

divided into Fixed Assets

and

Current

Assets)

o Intangible

Assets that

have no physical existence

Examples of

both are as follows:

o Tangible

Assets Furniture, Vehicle

etc.

o Intangible

Assets Right to receive

money, Good will

etc.

Accounting

Equation

From

the above example, if the debits and credits

are added up, the situation

will be as follows:

Debits

Cash

Rs.100,

000/-

Building

50,000/-

Furniture

10,000/-

Vehicle

15,000/-

Credits

Mr.

A

Rs.100,

000/-

Cash

75,000/-

The

total Equation

becomes:

�

DEBITS

=

CREDITS

Cash

+ Building + Furniture +

Vehicle

=

Cash

+ Mr. A

100000

+ 50000 + 10000

+

15000

=

75000

+ 75000

Cash

on Left Hand Side is Rupees

100,000/- and on Right Hand Side it is

Rs.75, 000/-. If it is gathered

on the

Left Hand Side it will

give a positive figure of

Rupees 25,000/- (which you

will notice is our

balance

of cash in hand). Now the

equation becomes:

7

Financial

Statement Analysis-FIN621

VU

DEBITS

=

CREDITS

Cash

+ Building

+

Furniture+ Vehicle

=

Mr.

A

25,000+

50,000 + 10,000 +

15,000

=

100,000

Keeping

the entity concept in mind we

can see that the business

owns the building, furniture,

vehicle

and

cash and will obtain benefit

from these things in future.

Any thing that provides

benefit to the

business

in future is called `Asset'.

Similarly the business had obtained the

money from Mr. A and

this

money

will have to be returned in form of

either cash or benefits. Any

thing for which the business

has

to

repay in any form is called

`Liability'. So

cash, building, furniture

and vehicle are the assets

of the

business

and the amount received from Mr. A for

which the business will have to

provide a return or

benefit

is the liability of the business.

Therefore, our equation

becomes:

Assets

=

Liabilities

The

liabilities of the business can be

classified into two major

classes i.e. the amounts

payable to

`outsiders'

and those payable to the

`owners'. The liability of the

business towards its owners is

called

`Capital'

and amount

payable to outsiders is called liability.

Therefore,

our accounting equation

finally

becomes:

Assets

=

Capital

+

Liabilities

Business

or Commercial Accounts are

based upon Double entry

accounting involving Debit

and

credit

entries. Rule for Dr. & Cr entries to

record changes in balance sheet

Accounts or Accounting

Equation

is: increase in assets are

debited (since Assets are on

left side of Accounting

Equation) and

increase

in liabilities and Owner's Equity

are credited because these

are on the right side of

Accounting

Equation.

Correspondingly, decrease in Assets is

credited and decrease in

liabilities and Owners

Equity

are

debited.

Dr+

↑

Assets

= Liabilities + Owner's

equity

Cr↓_

Cr ↑ + ↓ _ Dr ↑+Cr

↓_

Dr.

Rule

for Income Statement items is

that Revenues are credited

and expenses are

debited.

The basis of this rule is

that income statement shows

the effect of Revenues & Expenses

on

owner's

equity. Difference of Revenues and

Expenses causes difference in

owner's equity. Since

Revenues

increase owner's equity,

these are credited.

Correspondingly, since expenses

ultimately

reduce

owner's equity, these are

debited.

It

would thus be seen that

normal balances in Assets

Accounts would be debit and

those in

Liability

and Owner's Equity Accounts

would be credit. Orderly arrangement of

Accounts is to be

maintained.

Numbering of Accounts is also done to

facilitate proper record-keeping

and cross-

references.

When the business is large, a

Chart of Accounts is maintained

which lists the

various

Accounts

giving details of their

titles and numbers.

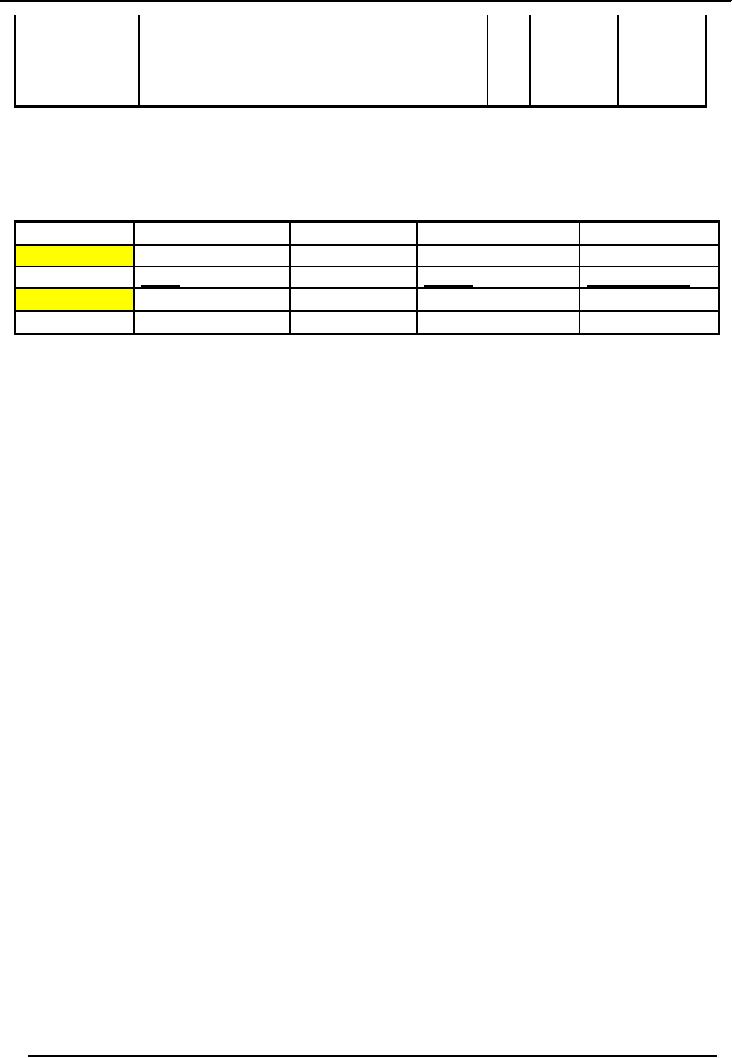

Compound

Entry. A

journal entry that has more

than one debit or credit

entry.

General

Journal

Date

Account

Title and explanation

LP

Dr.

Cr.

Cash

1

180,000

Khizr,

Capital

50

180,000

July,

2006 (1)

(Owner

invested cash in

business)

July,

2006 (5)

Building

36,000

Cash

15,000

8

Financial

Statement Analysis-FIN621

VU

Accounts

payable

21,000

(Purchase

building partly for cash

and

Partly

on credit)

"LP"

is reference account No: of the

particular ledger accounts.

For example cash account

has been

assigned

number 1 in ledger and capital account is

given number 50.

C)

Posting in

ledger which mean

transferring debits and credits from

journal to ledger account. This

is

also

called ledgerising or

classification

Date

Explanation

Ref

Dr.

Cr.

Jul

1

1

180,000

Khizr

1

Capital

Account

No:50

Jul

1

180,000

"Ref"

is reference to the page of journal i.e.

page 1. This shows that

there is cross-reference between

journal

and ledger through "LP" and

"ref" columns in journal and ledger

respectively.

9

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS